The Washington Post informs us that Millennials are screwed:

Homeownership — the main driver of wealth for most Americans — is out of reach for large swaths of the population. But the pinch is most pronounced for millennials, who are buying homes at a slower pace than those before them.

....Those born between 1981 to 1996 have been called the “unluckiest generation.” Since entering the workforce, they’ve experienced the slowest economic growth of any age group. They’ve also been weighed down by student debt and child-care costs, Lautz said.

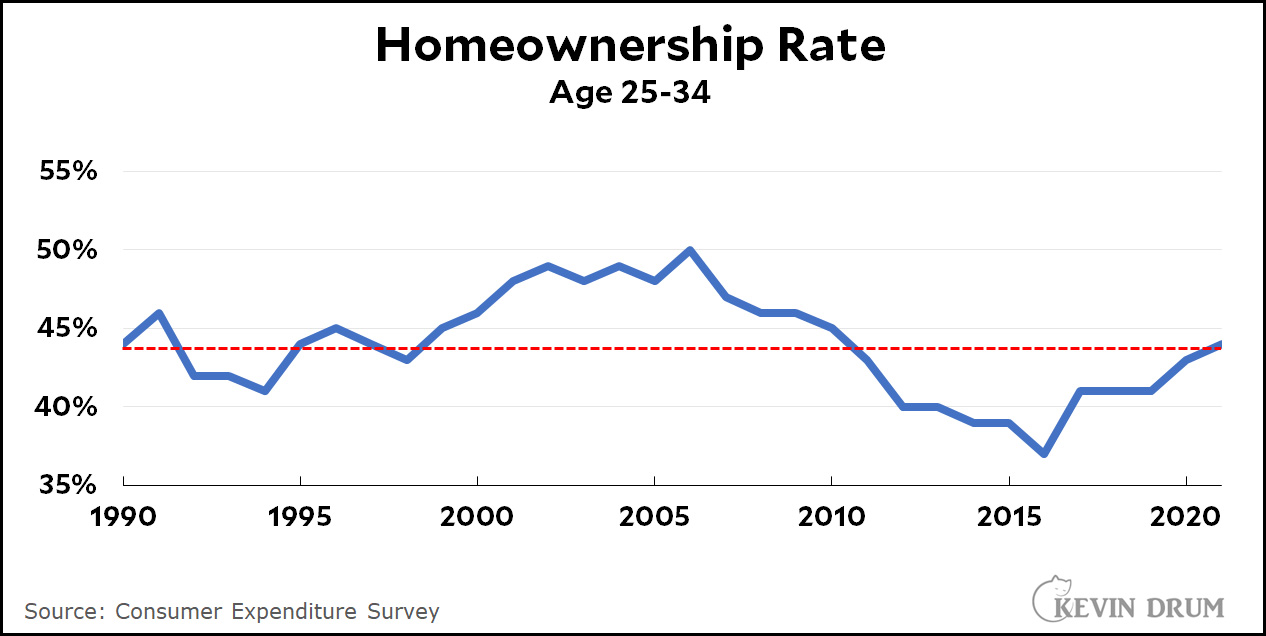

I'll spare you the usual rant about this. Instead I'll just show you a few simple charts. For 30-somethings here is homeownership:

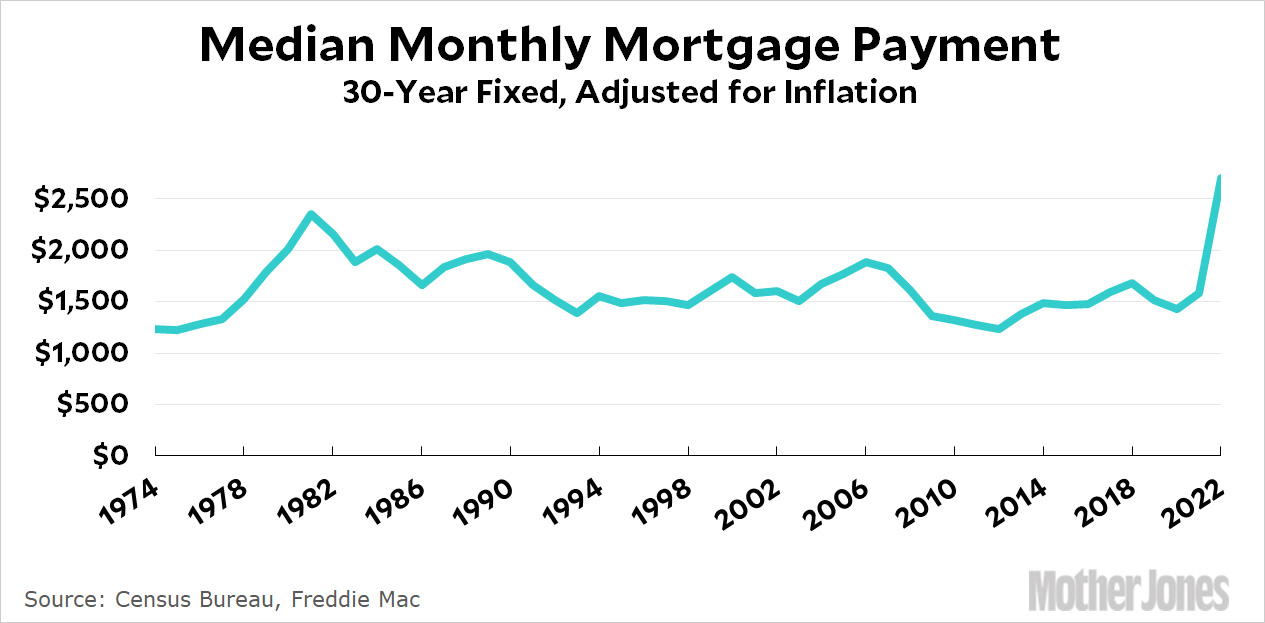

Here is the average cost of a house over the past 40 years:

Here is the average cost of a house over the past 40 years:

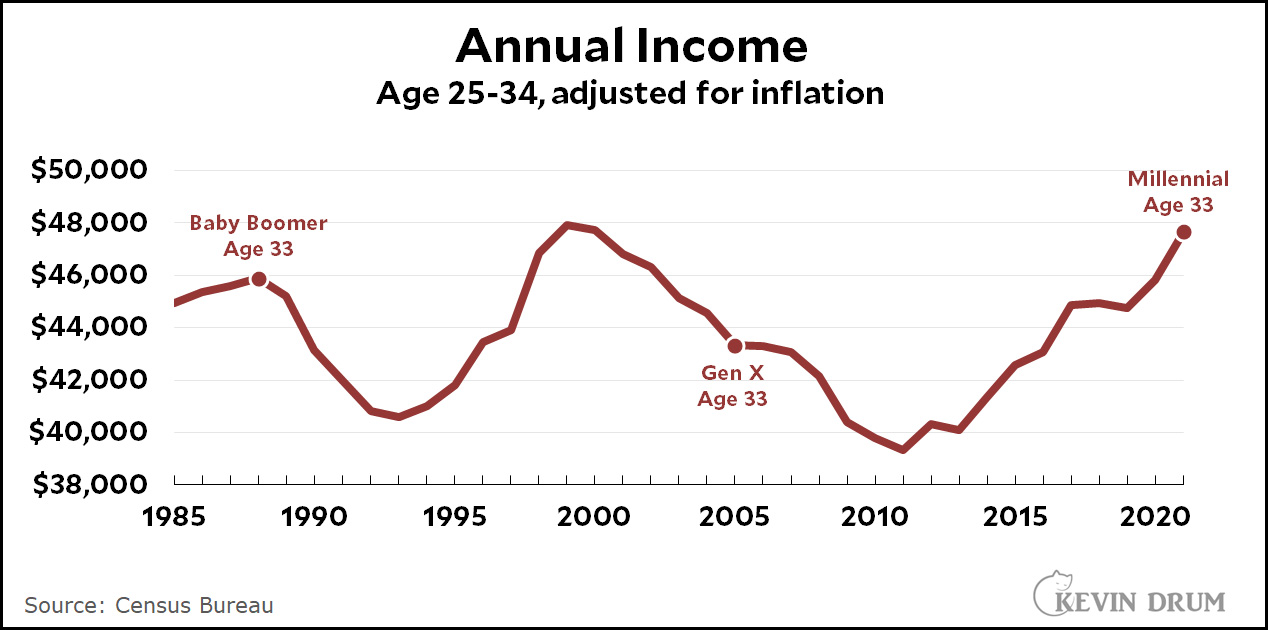

Here is income:

Here is income:

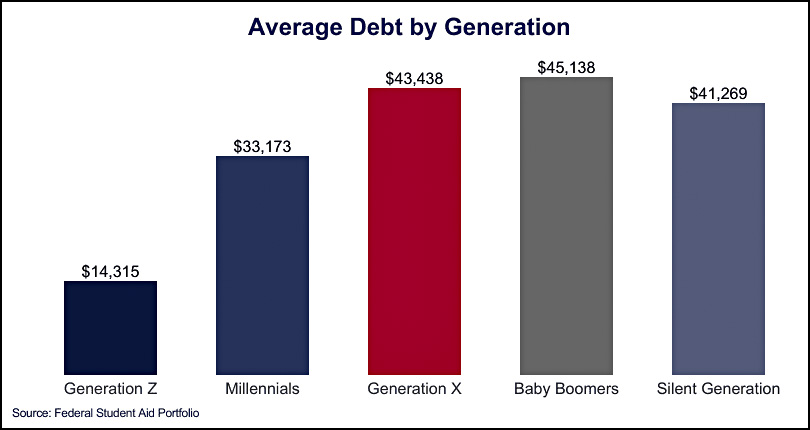

And here is student debt:

And here is student debt:

Through 2021, Millennial homeownership is at its average for the past 30 years. The average mortgage payment is the same as it was for Boomers and Gen X. Income is higher than both Gen X and Baby Boomers at the same age. And average student debt is lower than either Gen X or Baby Boomers (although only 10% of Boomers have student debt compared to 20% of Millennials).

Through 2021, Millennial homeownership is at its average for the past 30 years. The average mortgage payment is the same as it was for Boomers and Gen X. Income is higher than both Gen X and Baby Boomers at the same age. And average student debt is lower than either Gen X or Baby Boomers (although only 10% of Boomers have student debt compared to 20% of Millennials).

The average mortgage has increased and the homeownership rate has undoubtedly decreased since 2021 thanks to our recent housing boom and interest rate spike. And while it's true that this affects young families the worst, it's also (a) temporary and (b) something that every generation has gone through (Boomers got the 1981 Volcker recession and Gen X got the 2001 dotcom crash as well as the 2008 Great Recession). It's nothing unique to Millennials.

Millennials are doing fine. There's a small and vocal subset who are unhappy that they can't afford to live by themselves in a spacious apartment in Manhattan, but the vast majority are faring as well as previous generations and better than Millennials in any other country in the world. Someday a reporter from the Washington Post will read this and pass the news along to the rest of the country.

This (and similar stories) really are all about people in DC, NYC, San Francisco / the Bay Area, and LA to some extent. Go to Pittsburgh or Dallas and they'll find a different story. But not a good narrative!

So if you can go without a good-paying job (the Rust Belt) or without control over your own body (the Bible Belt), then you can easily afford a house. Assuming of course you can also scrape up the down payment, which I notice Kevin doesn’t chart for us over time possibly because as house prices go up so does the 10-20% needed to get a mortgage.

The beatings will continue until Millennials agree they have it just as easy as Boomers did with their free college tuitions and ability to raise a family off of one salary.

et voilà, the very example of the stubborn combination of innumeracy and mule-level understanding that statistics show the innumerate narrative is unfounded on like-to-like inflation adjusted numbers (although Goode Olde Days is such a stubborn mental illusion and ancient mental fallacy of humans that one should foresware any hope that any favourable development will ever occur in this area).

Down payments are not necessary. Wife and I bought a home in $2010 with no down payment. All it meant was we'd pay about $100/month extra in private mortgage insurance.

Fundamentally journalistic innumeracy and utterly outdated reliance on anectdote in an age when statistical data is generally plentiful, accessible and checkable as Drum redemostrates every week. For all his blindspots relative to his own weak mastery of inflaton econometrics leading to poor application, I am at least happy the man properlt focuses on proper numbers than anectdote....

Most of these work, but "average student debt" may not be higher per graduate/student, but it is far more widespread.

It is also, in comparison to Boomers and Gen X, at far more onerous criteria including -- until Biden just changed the rules -- that even when making the required payments the principal would increase.

There was the rise of the scam "universities" and "technical schools". With the great recession (2008), a lot of people went back to school and got loans--and a fair amount got stuck with loans and worthless degrees--even the ones who recognized the problem early and quit. That led to a lot of low income people stuck with relatively low dollar loans, but loans that were onerous to them, without any improvement in their financial prospects. The Obama administration went after those places and some of the federal loans were forgiven--but the situation was large enough to affect statistics and hurt a lot of people.

Another generation, another set of Veruca Salts.

What a precious opinion.

This Silent, on his way out, is wondering if the debt is adjusted for inflation? I went to Cow Pilely SLO on $140 per quarter and lived on the $100 per month dad bailed to me. Had a car too. Most of my friends were on the GI bill or from similar low status families.

This is a huge problem in the DC area. Highly educated idealistic young folks come to DC "to make a difference" but entry level salaries are low compared to housing costs and student loan payments. Unless there's family money it's hard to launch your career in DC.

I must confess I ended up living with my parents to super save money in my first years out of college.

I think that's right. So much of this narrative is being driven by college-educated millennials (= high debt load) in tech and media industries (= trying to launch their careers in really expensive areas), so of course it looks like everything sucks. I can't imagine being a college grad today and landing a dream job at, say, Blizzard/Activision in Santa Monica and, even with a low six-figure starting salary, being able to live reasonably within 25 miles of that job site, especially if you also have to deal with monthly payments on 50-100k or more of student loan debt coming due. I recommend the yooths check out Rochester, NY -- beautiful city, nice parks, good university, culture and arts, burgeoning tech industry, etc. (building on the ruins of Eastman Kodak). Avg. home price: about 150-200K. And that's for a really nice 3-br home, too, in a historic neighborhood.

But I do question Kevin's "student loan debt" chart. *Of course* Boomers and Gen-Xers have more debt now -- they own homes and cars and stuff. The Silent Generation had never even heard of student debt. What would be more useful to see is how much debt SGs or Boomers or Gen-Xers *started out with* at a comparable age. I suspect then we'd understand why it was so much easier then to buy a starter home, build equity and wealth, etc.

I know for sure that college costs in the 1980s were higher than the golden days of the 1960s & 1970s but my middle class family was able to send me to college after my mom went back to work. By the 1990s tuition at Virginia state schools skyrocketed as the state refused to kick in enough funding to keep tuition low. It just keeps getting higher and higher as the years ago by.

Beat you like king cold winters. What day is true but….

Charts don't say what Kevin says they do, part XXV.

Granted, this one isn't quite as bad as some others, but they're still misleading at several points.

Homeownership rate: completely ignores that as older millennials entered homebuying age, the rate cratered. Also this isn't an apples to apples comparison with the other charts, with the exception of the income one.

Income chart: includes COVID stimulus, presumably. If you take that out, they're doing no better than previous generations. When you consider that we DO have a housing shortage and what is actually happening with housing prices (they've risen far faster than inflation, and given that they're 1/3 of the inflation calculation it also says something about the inflation calculation itself...), having roughly the same income while home prices are 250% of what they were is not "the kids are doing alright."

Median mortgage payment: just an artifact of the lower interest rates and ignores the fact that home prices (and therefore the barrier to entry) skyrocketed.

Debt: is this adjusted for inflation? Where do these figures come from? Also, you can't just drop it in here and not adjust for per capita within each cohort if you're talking about the cohort in its entirety. You need to compare the total debt for each cohort.

Also, what these charts invariably show is that in some ways, Gen X got fucked even harder. That tracks with personal anecdotes that I've read.

America is still the best place to be. Things can change quickly, though. Of course, for whatever odd wacko psychological reason, I have seen civilizational collapse since I was a teenager in the late 70s. In the '70s, we had four channels, ABC, NBC, CBS, and PBS. Sometimes, I would notice a pause that was longer than usual between commercials or programs and think that they would announce the economy collapsing. I am a freak.

I work hard to develop a grateful attitude. Can you imagine living somewhere where you are so desperate that you travel thousands of dangerous miles and face the possibility of death, rape, or kidnapping to try to get to the United States and other Western countries?

Au contraire. Green Acres is the place to be.

Just discovered this on Prime,

Trump Vs The Illuminati

https://www.amazon.com/gp/video/detail/B08LQXY864/ref=atv_me_inc_c_OBb2b0f9_brws_12_2

Cannot bring myself to look at it.

“…the vast majority are faring … better than Millennials in any other country in the world.”

This is basically true for every demographic imaginable. Blacks, whites, Latinos, Asians, youngs, olds, men, women, everybody in America is faring as well or better than everybody else in their same demographic in the rest of the world. This isn’t going to earn any politician or political party a cookie though, mostly because feeling socioeconomically secure is all relative. It doesn’t matter if 6B other people in the world live on $1 a day or whatever, if you live in this country at this particular time and can’t afford to live on $50 a day. ($50x365 = $18250. That’s about what minimum wage pays. Try living off of that in even the cheapest parts of the US.)

People don’t want to just barely survive and get by, they want to prosper and be comfortable. In democracies, just promising the people “you won’t die today” isn’t going to inspire a lot of support… it’s far more likely to spur support for someon

“Here is the average cost of a house over the past 40 years (chart showing just monthly mortgage payments).”

This is NOT the average cost of a house. It’s the average cost of ***servicing a mortgage.*** It doesn’t include:

(1) the down payment which I suspect has gotten much larger over the generations and is THE barrier keeping lots of people renting a place for $1500-2000/month instead of buying a place for $1500-2000/month. Believe it or not, “if only we had $20-100K lying around, we could buy instead of rent!” has occurred to millions of millennials. No more buying homes with just $1-5K down like boomers did.

(2) maintenance for the house, which can be highly variable even for newly built homes, and tends to hit the cheapest houses particularly hard. So for the millennials who do successfully struggle to scrape together a down payment to buy whatever they can, they’re more likely to end up with a cheaper house (it minimizes that down payment after all!) and a common reason why the house was cheap is “it’s old and has lots of issues that need fixing” which is highly correlated with “annual maintenance costs will tend to be higher than average and very unpredictable.”

Down payments have always been in the 10-20% range except for in the early 00s when mortgage lenders were underwriting all sorts of crazy zero-down loans and everything and we all know how well that ended. The difference is now that, especially on the coasts, prices are just out of control.

Compared to the 50s and 60s, even adjusting for inflation, everything related to home building and ownership just costs more. The land costs more. The materials cost more. The labor costs more. In places like CA where municipalities can't raise property taxes, developers and new homeowners also have to pay the costs of installing all the infrastructure -- power, sewer, sidewalks, schools, etc. -- that go into supporting new housing developments. Add insurance (esp in fire or flood-prone areas) and maintenance and yeah, it gives a whole new meaning to the term "money pit."

So, if the price of the house is going up, how has the mortgage payment not gone up other than with higher interest rates?

This is NOT the average cost of a house. It’s the average cost of ***servicing a mortgage.*** It doesn’t include:

Please explain to me how the average cost of servicing a mortgage is not directly tied to the average cost of a house. The only way that the cost of the mortgage goes up without the cost of the house going up is if interest rates go up, which causes the cost of the house itself, and thus the down payment, to go down.

The original post said that down payments and the cost of maintaining a house are not included in the chart. These are significant costs and should be factored in if someone is actually interested in talking about the cost of homeownership.

Your question doesn't seem to touch on what he was talking about, but is instead an unrelated line of questioning. It is not at all clear that higher interest rates cause the monthly servicing costs to go down. You seem to imply that this is a rule or law of nature.....but thats not the case.

The cost of servicing a mortgage is a function of only three things:

1) principal balance of the mortgage

2) interest rate

3) repayment term

You seem to want to simultaneously acknowledge and ignore that the sale price of a house feeds into #1.

When I last bought a house in 2015, we had a 375K mortgage. At the 3.75% interest rate, the principal + interest payment portions were around $1737. For the exact same mortgage size today, the principal + interest portions are over $1000 higher at $2752 because mortgage interest rates are more than double what they were in 2015.

Also keep in mind that house prices since then have also gone up.

The barrier to entry is rising out of reach for the median household, if it isn't already out of reach. Unless those median households have $80K+ in the bank, they can't afford to buy a home and are stuck renting in perpetuity. That's the point you're missing.

Monthly mortgage payment is the best apples-to-apples comparison for between non-homeowners and homeowners.

When the wife and I bought our first house, our calculation was very explicitly. "Here's what we pay in rent for our apartment each month, and here's what we'd pay for a mortgage each month." When those numbers got within a few hundred dollars a month of each other, we decided it was time to buy a house.

The high student debts for Xers and Boomers aren't surprising. The people who still have debt are those who didn't make their full payments for undergrad (so interest piled on more debt), went to grad school, or took on parent loans for their kids.

The average debt is high for those groups, but fewer people exist in those categories. Millennials have more people in debt, but the typical borrower is just paying undergrad loans. As the cohort ages, undergrad-only folks will pay off their loans and those with big grad school debts will become the average borrower.

I think it is hard to do generational comparisons. The Boomers bought houses before globalization crashed the cost of manufactured goods (they couldnt afford to furnish a house), and the high rates of the 70s-80s means you can cherry-pick the measure you want (home prices are low, but mortgage payments are high). Meanwhile, Xers were on an economic roller coaster. Depending on the date you pick, Xers are either deeply underwater on their mortgages, with negative wealth and huge monthly costs (what happens when your only asset is a house, and its vakue drops). OR Xers are seeing the biggest rates of wealth increases (going up from negative numbers makes good returns look amazing).

Overall, I think the "poor Millenninal" narrative is heavily impacted by the reporters themselves (who are usalIy young, poorly paid, in debt, and living in expensive cities).

Just wait until Boomers start dying off. Then GenZ and even younger reporters will scream about the lucky Millennials, with their enormous inheritances!

It looks like the WP article in question, regarding the “Unluckiest Generation,” was written by Julian Mark, and this info about him is provided:

“Before joining The Post in 2021, he was a reporter for the San Francisco alternative news site Mission Local, where he wrote about housing and policing.”

So I’m inclined to think this writer really does match the profile that many commenters here suspect: fairly young, a recent graduate (who probably still has a lot of student debt), and an employee if not a resident in one or maybe two super expensive coastal cities (San Francisco and/or Washington DC).

And there’s no crime in any of that; but, I will admit my own main problem with this article: it just lacks perspective. I have to take issue with the whole idea that young people today are not just unlucky in some ways (as all generations are) but are in fact so uniquely and unfairly burdened as to be the “unluckiest” generation.

So bear with my rant for a moment, because young generations today are so phenomenally lucky in so many ways that you’d think that fact would receive a bit more acknowledgement than it does.

They live in what would have struck me and countless others as a nearly inconceivable utopia when we were kids, one where a black man is elected President twice (with a majority of the vote each time); where gay people have the right to marriage and the same federal protections against discrimination as other protected classes; where women have previously unimaginable career opportunities; where adults face no military draft nor any imminent threat of getting dragged into a war; where everyone walks around with a personal computer in their pockets and can access overwhelming amounts of online information, communication, or entertainment at the touch of a button; and where general prosperity is high while crime and similar social ills are historically low.

A guest editor for Wired Mag in 2016 declared, “Now Is the Greatest Time to Be Alive,” and proceeded to state:

“We are far better equipped to take on the challenges we face than ever before. I know that might sound at odds with what we see and hear these days in the cacophony of cable news and social media. But the next time you’re bombarded with over-the-top claims about how our country is doomed or the world is coming apart at the seams, brush off the cynics and fearmongers. Because the truth is, if you had to choose any time in the course of human history to be alive, you’d choose this one. Right here in America, right now.”

And yes, there are obviously challenges (as Obama, the author of that quote, acknowledges), but there always have been and always will be. And the 2008 crash, the 2020 pandemic, and the ongoing climate change are all issues that are similar to problems that have been faced by previous generations.

So Julian Mark needs more perspective. That’s my issue with the WP article. Younger generations today aren’t uniquely handicapped by overwhelming if not unprecedented challenges; they are instead unusually empowered to take on the kind of challenges that their ancestors dealt with in far less fortuitous circumstances.

As some others have said, Kevin is definitely lying with charts here. The funny part is that his charts dont support his conclusions, instead his argument relies on insisting the charts be mis-interpreted.

The homeownership chart is the most obvious. It shows a dramatic drop in homeownership right as milllenials begin entering the chart. The rate recovers but the chart is cutoff right when housing costs truly explode. The average that is provided as a sign of acheiving success is heavily influenced by the 10 years of far below average activity for the millenials. This 44% rate is a failure viewed from any point in the 1990-2008 stretch, but Kevin paints this failure as success.

The other charts have problems as well, but Kevin isnt operating in good faith here (his linked data for student loans makes exactly the opposite conclusion that Kevin is presenting by highlighting the info not included in the chart) and this post has gone on too long.

Dishonest post.

Yep! I wanted to gripe about the same thing with the housing chart. If you look at historical homeownership in that group prior to the lead-up to the Great Recession (where home prices started bubbling), it's far higher than the 44% average. The 44% average only looks "good" because of the absurd lows caused by the explosion in housing prices prior to the Great Recession and then the Great Recession itself having such a large impact on Millennials' economic prospects right at the start of their careers. It appears to have taken the pandemic to restore homeownership to its pre-GR trend, due to the influx of stimulus cash to consumers' savings accounts (plus pauses on student loan payments) and historically low interest rates.

Somebody please tell my kids, who can't find a house they can afford!

It seems that once a newspaper spews minutia, all the rest jump on board and spew the same. They simply don't do their homework and feel they must get a story on the front page, no matter what.

I am dropping many of my news subscriptions for this very reason. No one has anything to say but to parrot. For shame on them.

Kevin consistently takes the attitude that if people have gained a little over the last few years, or even are just staying even, they are "doing fine". If the younger generation of wage-earners has about as much of a chance as their parents of owning a house, they are "doing fine". If there has been some gain in real wages since the 90's, workers are "doing fine" - although real wages for production workers are still below the 1973 level. But shouldn't younger generations be earning higher real wages and owning more houses than their parents? Shouldn't it be cheaper in terms of median income to get a higher education, rather than more expensive? This kind of improvement actually happened for a long time, especially from about 1933 to 1973 as inequality decreased.

Kevin may feel that he is debunking the "generation war", which is something the centrist media like to play up. In practice this, like culture wars, is a thing that the Right uses to distract from the class war, which the highest-income classes are winning. The fact that projected Social Security taxes are projected not to cover future benefits is pitched as something boomers did to later generations. Actually it is a consequence of the lack of growth of real wages. The blame for the plutocratic economic policies which caused this is not a matter of generations, it is a matter of individuals or groups voting on the basis of culture wars rather than their own economic interests.

Most people who are not in the highest income groups have just not benefited proportionally from US economic growth over the last fifty years - this is the important fact, not the comparison of generations.

skept

"Most people who are not in the highest income groups have just not benefited proportionally from US economic growth over the last fifty years - this is the important fact, not the comparison of generations."

with one sentence you hit the nail on the head.

but there is, and will be a huge wealth transfer as the boomers die. The only thing that worries me is that the generations that followed us do NOT have the financial discipline that we learned from OUR depression Era parents.

it is a troubling situation. I do hope that my children (and theirs) have learned the lessons we tried to teach them.

My oldest seems to have done it. paid her home off when she turned 38. Through good management of her 401k she may be able to retire at age 55 and not collect Social Security until she is 70. Her husband is just as disciplined as she is.

watching this has been fun

As societal collapse continues on and we hear more and more about how everything is just fine, most of the people who are going to have to live through the worst parts of collapse will continue ignoring how everything is just fine.

Part infinity of an infinite series I guess.

Carry on.

The Guardian has an article--this one on greater wealth gaps in later generations:

https://www.theguardian.com/commentisfree/2023/aug/13/millennials-dont-all-suffer-alike-what-really-divides-them-is-privilege

There's a small and vocal subset who are unhappy that they can't afford to live by themselves in a spacious apartment in Manhattan...

Rather unkind way to dismiss the concerns of a lot of people, Kev, not a good look. The housing market here in Denver is driving even 50 year olds to have to work two+ jobs if they want to buy a house these days (well, OK, for people like me near the bottom of the middle class, but hey, who cares bout us?). Buying that house and being able to easily afford to are two separate issues.

The fact that the growth of rent prices is left off of this makes it incomplete.

Home ownership is roughly the same, but the price of rent for those without homes has increased by 4X (relative to 90's by inflation, it would just be 2X).

Student debt is a State issue, but argued at the national level since the Feds decided to cover the gap while not having any control over costs or funding.