Sales of both new and existing homes have fallen over the past year, but that doesn't capture the magnitude of the impact on the mortgage industry. Many of the houses still on the market are being sold for cash, and even refis are scarce because so many existing mortgages were refinanced years ago at ultra-low rates. The result is grim:

The mortgage industry is notoriously boom or bust, but this bust is especially bad—and it’s only getting started. Unlike previous housing downturns, there’s no obvious way out. If the economy keeps chugging along, then the Federal Reserve will continue to keep rates high—which would in turn keep the housing market in the dumps. If the economy sinks, the Fed may loosen rates—but a recession wouldn’t do the housing market much good either.

....Some former regulators and industry officials say the current period is worse than the 2008 financial crisis, when at least falling rates spurred a large refinancing wave. Because so many borrowers already locked in ultralow-rate mortgages during the pandemic, there’s no big refinancing rescue on the way. “I’ve been in this business 40 years and I don’t remember a correction like this,” said David Stevens, a former housing-finance regulator who now consults for the industry.

Before the pandemic big banks were writing about $150 billion worth of mortgages each quarter. That rose during the recent housing boom but has since plummeted by more than half from its normal level:

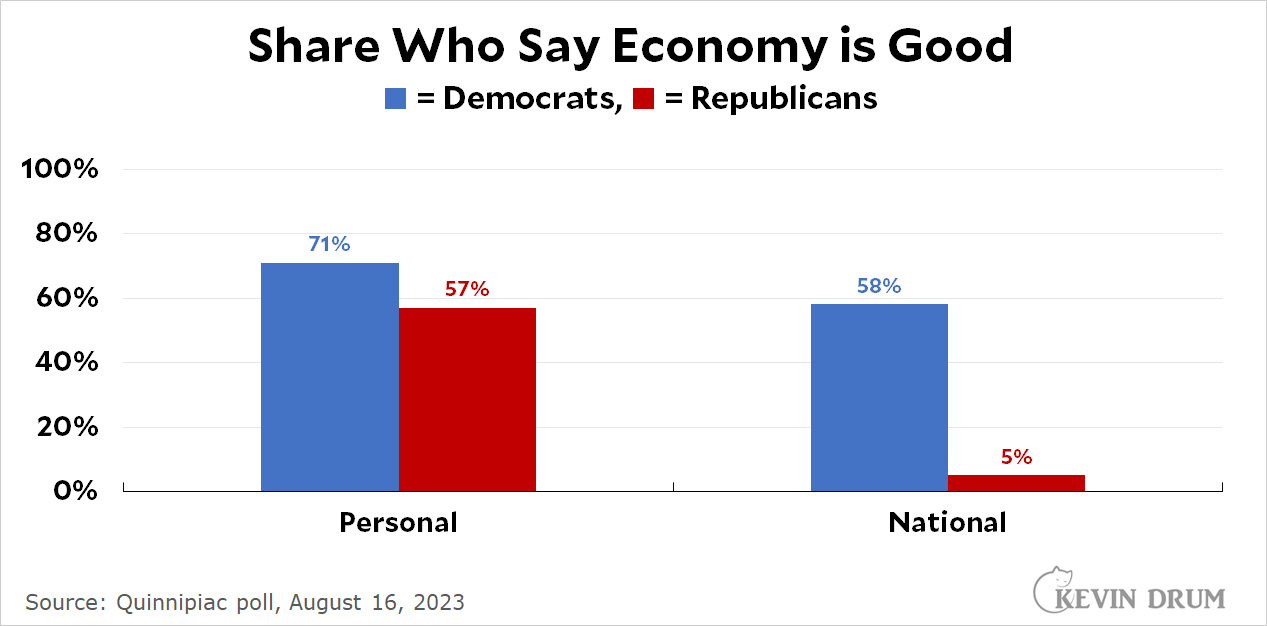

If you're in the real estate biz, the economy seems terrible no matter which party you belong to.

If you're in the real estate biz, the economy seems terrible no matter which party you belong to.