Conor Sen suggests that lots of people view the economy poorly because interest rates have gone up for things like credit card debt and car payments:

Food and energy as a % of disposable personal income is around where it was in the mid-2010’s. Personal interest payments as a % of income are skyrocketing: pic.twitter.com/LpVZMMUTIg

— Conor Sen (@conorsen) October 28, 2023

How soon we forget! Remember all the pre-2022 whining about how it was impossible for ordinary schmoes to increase their savings because banks were paying interest rates of 1% or less? At least those days are over.

So let's add together personal interest payments and personal interest income:

It's been sliding downward for a long time, but nothing extraordinary has happened over the past year or two. It's been a wash.

It's been sliding downward for a long time, but nothing extraordinary has happened over the past year or two. It's been a wash.

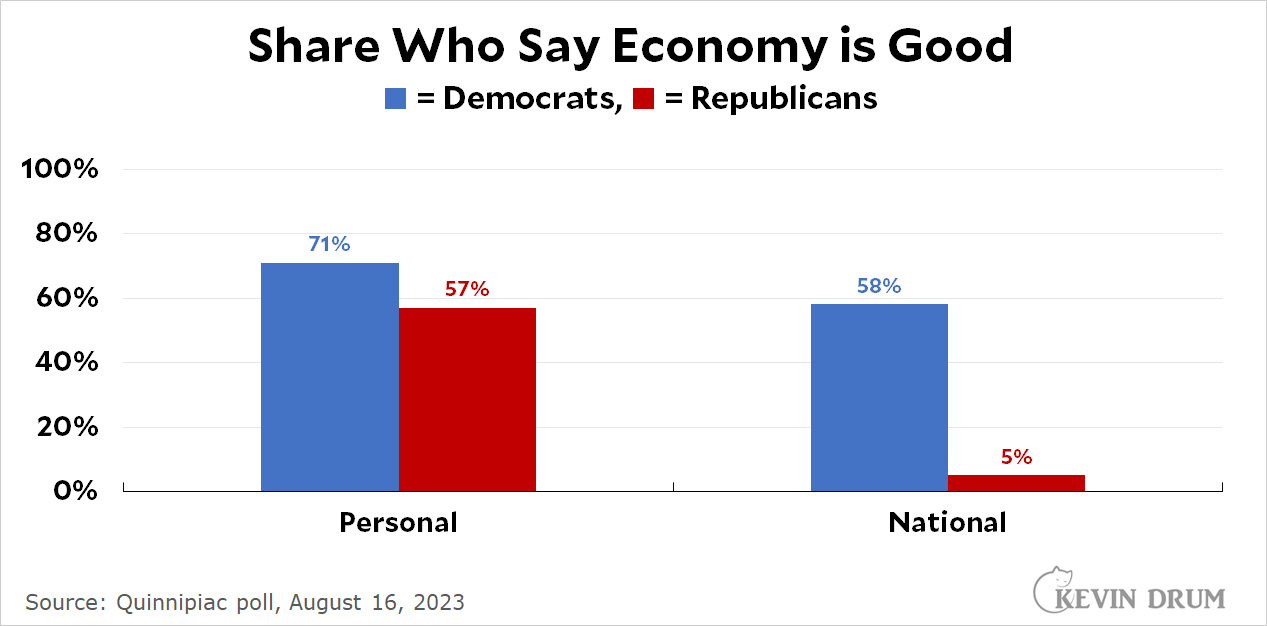

Now, it's quite possible that the interest payers are more annoyed than the interest earners are happy. Who knows? But honestly, it's not worth looking into. The reason people are unhappy with the economy is obvious:

It's not "people" who are unhappy about the economy. It's Republicans. And it's not because they're personally doing poorly. It's because Fox News and Donald Trump keep telling them the economy is lousy. Compared to the massive effect of this, everything else fades into irrelevance.

It's not "people" who are unhappy about the economy. It's Republicans. And it's not because they're personally doing poorly. It's because Fox News and Donald Trump keep telling them the economy is lousy. Compared to the massive effect of this, everything else fades into irrelevance.

What's the most uninformed group in America? Republicans! Of course. They win that sweepstakes every time.

The rush to "explain" why people have every right to complain about the state of the economy when almost all economic indicators are showing robust growth and employment is a quirk of media and would-be pundits that only compounds the problem.

The alternative would be: tell the pubic the good news. But that would be bad for the (journo) business.

On top of that, major media has lost its role as the gatekeeper of what news people get to see. Once upon a time, it was the morning paper and Walter Cronkite at night. Now, many people get their "news" from crackpots and info-warlords with a political ax to grind. It's a real challenge for our democracy.

This piece gets into how the news biz has changed, with a chart from The Economist showing the great divergence in consumer sentiment since the pandemic. Though the big event in 2020, of course, was the election of Biden, and seeing the problem as a pandemic effect and not a change-leadership effect is to misdiagnose the problem.

Economy is getting better but it was hard for a year.

I’m unhappy with the economy because we’re in that awful recession which everyone from Mr. drum to Larry summers said we would have. I’m lucky I haven’t lost my job yet, but we’ve been suffering for months now!

See, Mr. Drum, you all talked us into this funk. Plus, you know, homeless and poor are suffering even more because gas prices are way up from 3 years ago.

Oh well.

Although you are being sarcastic, it seems like in my techish social circle people have been losing their jobs left and right for months* and are going through their attics finding stuff to sell on craigslist. The finance and real estate people are having the same issues. Because the issues are industry wide ones that means the new opportunities for those people are limited. That's problem with looking at headline numbers, they can average away a large number of locally concentrated issues. The industries that are being currently affected are the inverse of the ones that were in 2020. Those of us affected now don't have a clear villain to blame though. Then on top of that many people see the advances in AI and can imagine a near future where their skills are no longer needed. It's like the classic horror trope of never showing the monster clearly but just the carnage it has wrought. The nameless dread is usually the worst.

*FYI not intended as date or even anecdata because emotions are not tied to statistics

Americans are unhappy because (i) real median household declined in each of 2021 and 2022 and (ii) the stock market is down significantly in real terms since January 2021 (it's roughly flat in nominal terms, but wealthy people and middle-class retirees have to pay bills in real dollars). So across the board, no one is happy.

Oddly, when he's not thinking about the election, Kevin admits both of these things freely (usually blaming corporate greed and the Wall Street Journal for the stagnation in real wages).

Real median household income fell while real median personal earnings were up. This is a bit of a puzzle, but we have 2 pieces of data that explain the fall in median household income:

1. Almost all of the decline was due to the end of stimulus payments which occurred in 2020 and 2021, but not 2022. This doesn't impact individual earnings, but it makes a huge difference for median family income.

2. The stock market decline also caused a massive reduction in stock options being exercised/paid out in 2022. The census gives us both the median household income stat as well as household income by quintile and it was only the highest (richest) quintiles that saw a reduction. Other tax data identifies fewer stock options as the cause.

This statistical artifact (end of stimulus and fewer stock options for the wealty) is not likely to be a big driver of public opinion.

I keep seeing pieces like this and then reality sets in: I go to my local supermarket and see the price of soda, milk, beef and cereal. Additionally, since I am of an age where it would be time to downsize my housing situation, I am "trapped" by my low rate mortgage.

Before Reagan and the Supreme Court changed the rules in 1982, your mortgage would have been assumable and an asset when it comes to selling your house. (I don't know what the rules were in California then, but in most of the country a loan was assumable if the buyers had decent credit.)

Club soda has gone up 20 cents in the last 10 years. It still costs less than the whiskey though.

Good point. So, if I'm ever in South Carolina, I'd like to have a drink with you. I'll bring the whiskey.

In 2017 the CEO of the large financial institution that employs me said it was hard for the company to make money with interest rates so low.

In 2023 he said it's hard for the company to make money with interest rates so high.

+1

You know that high level managers are all BS artists, who never remember what they said a month ago. From their point of view, it's really unfair for you to have a better memory.

I would like to mark 30 years of telling everyone I can that the problem is the MEDIA. The RW media, of course, seeks only power for their oligarch owners. The mainstream media lives in 24/7 terror of being labeled "liberal" -- as if anything they do will change that -- and therefore quail at the prospect of putting anything into truthful context. Thus, they report polling results as what "people" think.

Very interesting that Republicans are happy with their personal "economy" but think the national one is awful. Of course, that's because they are proud of their ability to prosper even in Biden's hellhole due entirely to their superior personal qualities.

Yes, Republicans have a ridiculously unrealistic assessment of the national economy. But I think it is also noteworthy that only 58% of Democrats think the national economy is good.

About the topic that this post actually is about: There is a difference between the interest a debtor pays and the one that the banks pay a saver (sorry, investor). In other words the benefit to the income receiver is far less than the damage to the interest payer.

This difference has actually been growing slowly (and steadily) as the graph in the post shows. Which only demonstrates the still growing power of the financial industry.

The chart shows that interest received is greater than interest paid, doesnt it? The opposite of what you are claiming?

Also the chart shows this as a %of total disposible income. Downward movement may be a result of Americans having higher disposible incomes.

Pingback: No, wages aren’t down recently – Kevin Drum