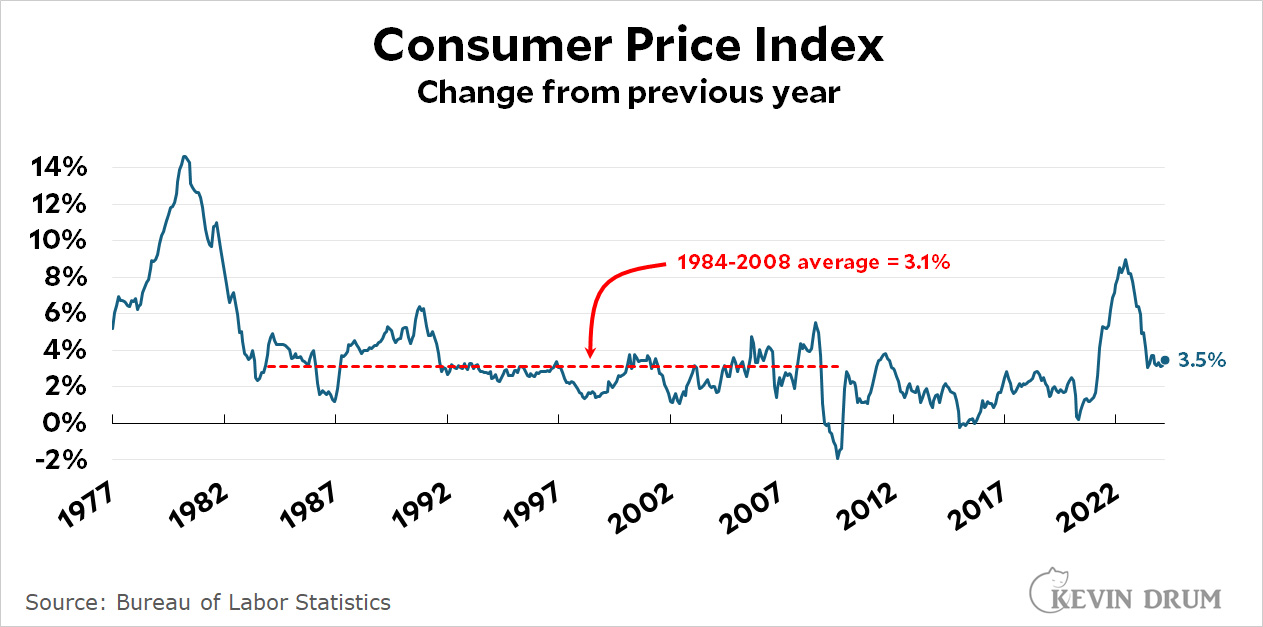

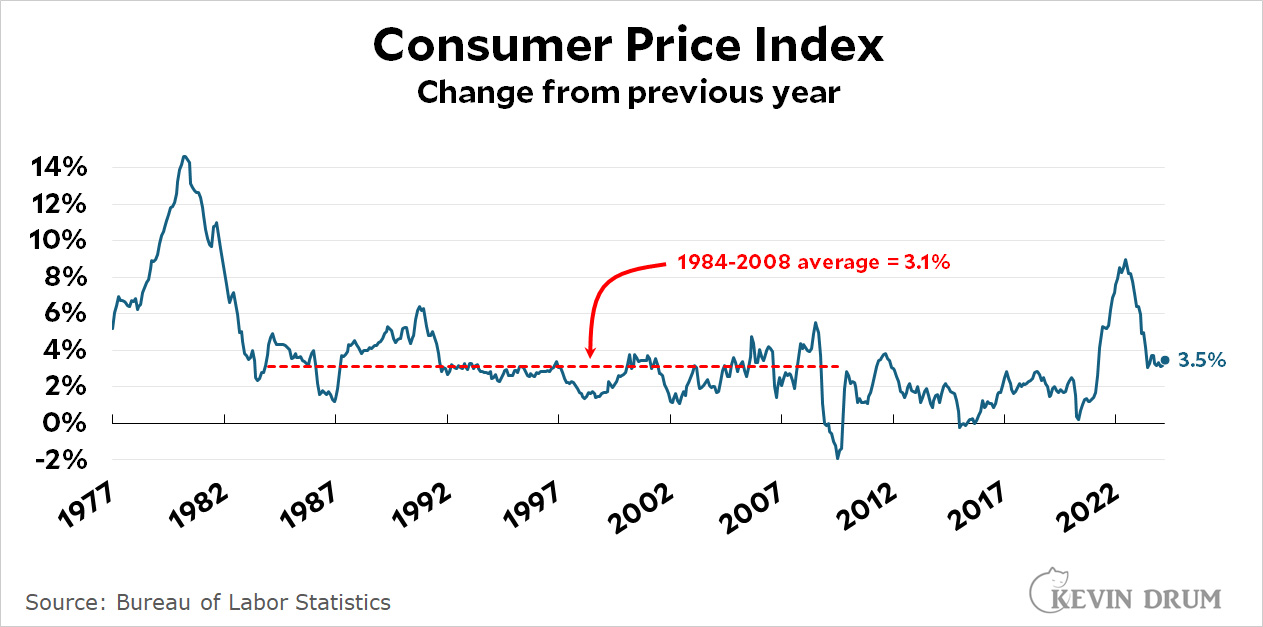

No one likes a high inflation report, but the panic over yesterday's number is a little out of hand. Here is CPI inflation since the late '70s:

There's a huge amount of noise in the monthly CPI numbers. What's more, we got used to ultra-low inflation in the decade following the financial crisis. Average CPI from the end of the '70s inflation to the start of the financial crisis was 3.1%. We're only barely above that right now. It's hardly a crisis.

There's a huge amount of noise in the monthly CPI numbers. What's more, we got used to ultra-low inflation in the decade following the financial crisis. Average CPI from the end of the '70s inflation to the start of the financial crisis was 3.1%. We're only barely above that right now. It's hardly a crisis.

Still, why the flattening over the past half year? Aside from noise, my guess is pretty simple: wages generally lag inflation, and lately they've been growing a couple of points above CPI. That pulls up the inflation rate a bit, but it will calm down before long and inflation will continue to decline.

Also housing prices, which are stubbornly staying fairly high. That can't last forever, can it?