Asking prices in the Southern California housing market are already starting to show some strain:

The share of homes listed for sale that took recent price cuts has more than doubled since last year. During the four weeks that ended June 5, 16.2% of listings in L.A. County had at least one price cut, up from 7.5% during the same period last year, Redfin data show.

In Orange, Riverside and San Bernardino counties the share of price drops rose to more than 20% of listings, up from about 7% a year earlier.

Nationwide, there haven’t been this many price cuts since 2019. Homes for sale in Los Angeles and Orange Counties haven’t seen this number of price reductions since late 2018 — the last time mortgage rates shot up. In the Inland Empire, price reductions are at an all-time high in a dataset that started in 2015.

Realtors are bravely saying that there are still plenty of eager buyers and plenty of bidding wars. And it's true that housing prices continued to rise through March—the latest data available. But this is just the start. I don't expect a housing bust on the order of 2006-2008, but I do expect a sustained moderate drop in house prices. In aggregate, this decline is likely to shave half a point or more off GDP growth—and that's in addition to all the other headwinds facing the economy.

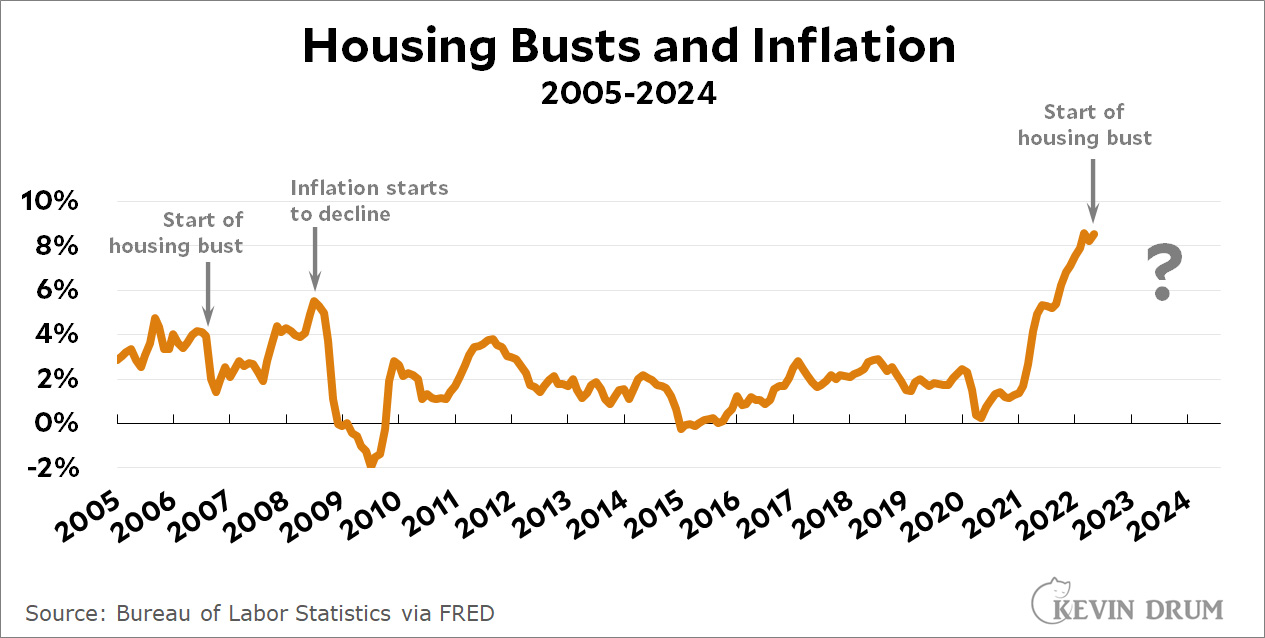

It will also bring down price levels—although judging from our experience during the Great Recession it's hard to say how long it will take for it to work its way through to lower inflation rates:

Our last housing bust was followed by a quick decline in inflation, but the decline was small and temporary. It was two years before inflation was seriously affected.

Our last housing bust was followed by a quick decline in inflation, but the decline was small and temporary. It was two years before inflation was seriously affected.

So what will it be this time around, with different circumstances and a smaller fall in housing prices? If I knew, would I still be doing this free blogging thing?

Yogi Berra - 'It's tough to make predictions, especially about the future."

Mortgage lending practices are different than the pre 2008 world: one hopes that we will not see widespread defaults....

Appraisals are much more honest, "liar loans" are all but non-existent, and PMI is strictly required without exception for less than 20% down-- so no, this will not be a 2008.

I think that's right. This recent runup in housing prices has been caused by a real shortage of housing in popular cities and states around the country, not by the tissue of lies and debt that drove the previous bubble. A housing slowdown is going to hit realtors and mortgage brokers, for sure, but I don't think we'll be seeing a ton of people lose their houses because they drop 50% in value overnight.

I doubt it halves much GDP at all. It didn't add much gdp. Mostly a investor cash boom. They will just put the houses on the market and take the profit they can. I have heard 3 houses placed on the market since April that were investor bought, all sold after a modest price drop, investor made some profit. Hey the value of those homes still drop some, but like, who cares???

Nonbank and subprime commercial lending basically replaced them as credit lines after 2009.

This could not be more wrong. Housing prices pass-through directly to GDP via owners equivalent rent which is a rent metric that is calculated based on prevailing housing prices. This makes up somewhere on the order of 15% of GDP if I recall correctly, so and inflating housing market does directly feed into higher GDP numbers.

But it's not 15% anymore. Likely 6%. Catch up.

Catching up from the vacation hiatus???

The drop in the stock market, the drying up of venture capital, etc. also takes some price pressure off of the housing market.

Note, housing prices might be dropping, but mortgage payments are not. I don't think we'll see a massive foreclosure crisis, but some people will be hit.

Nope. Most will just uh, stay in their house. Real mortgage rates have been flat since late March.

In our neighborhood, a suburb of Sacramento, most homes put on the market in 2021 and early 2022 got multiple offers with 48 hours of listing. Today, our neighbor put her house on the market two weeks ago and is still waiting. A more rational market is a good thing. At the peak, our house might have got $700,000, which is absolutely idiotic for where we live.

The problem with getting a good price for your home is that you then have to move and find a home for a good price.

Nope. Why you even think that cracks me up. This ain't the oughts bud. With the decline in gas prices likely to be substantial, inflation is toast.

I want to believe you, and I more or less do. But "gas prices will go down" has been in the air for many months, and has not happened. "Inflation is almost over" likewise. Regardless of the underlying causes, these things currently seem to have sticking power than most people anticipated.

Nope, follow history of wall street generation of poor pricing. Inflation that is 75% energy prices is bogus. They blew up may gasoline futures on a lie.

Yep. I’d love to sell our overpriced home and move. But we’d have to leave the state to find something we can afford.

If we keep boosting the narrative that a housing bust is coming, maybe we can will one into existence!

/s

No, a bust isn't coming. Prices may stop skyrocketing (temporarily), but prices aren't going to drop substantially. They may drop in some locales more than in others, but in the hot markets (which are driving skyrocketing prices!), rents and housing prices are still going up. Demand is THAT inelastic.

The monthly Zillow/Redfin reports I'm getting for ZIP codes around me still show prices going up 6%+ annually, and with homes still being snapped up at 2x the median price, there are zero signs that a bust is coming to the broader DC area.

Maybe in medium-size or smaller cities there might be something of a decline, but I wouldn't bet any money on it.

Agree, I'm in NOVA and not mansion houses are getting snapped up the same week they are on the market even fixer uppers in need of a ton of work.

As I keep saying, house buying is not really very sensitive to mortgage rate (although refi's are):

https://www.mortgagenewsdaily.com/data/mortgage-applications

So what is probably happening is that the amount that a given buyer is able to offer has rapidly dropped off. This amount may be calculated by the bank or other lender, not the actual house buyer, based on income. So a price crash is likely, but not so much of a drop in volume. The huge crash in house sales after 2006 had nothing to do with mortgage rate, it was due the banks having run wild and finally being called to account. Nothing like that overexposure is obvious now.

Except that a "price crash" won't affect anything but the top of the market. All that these increased rates do is shift higher income buyers to lower purchase prices, and at the bottom end it crowds out people who would have otherwise been able to purchase 6 months ago or a year ago.

Which, as you say, is not much of a drop in volume.

In an evil sort of way we would welcome a housing bust. Palo Alto houses never "bust" they just "dip". Sold ours in 2008 and bought a foreclosure. Also bought some rentals in Reno. Wish we had bought more.

Sold my old house in San Jose last month and have cash laying dead.

Marjorie Taylor Greene blames trans men for shortage of tampons,

https://www.lgbtqnation.com/2022/06/marjorie-taylor-greene-blames-trans-men-shortage-tampons/