Do we have a housing shortage? How is that possible if the number of housing units per capita is at an all-time high—which it is?

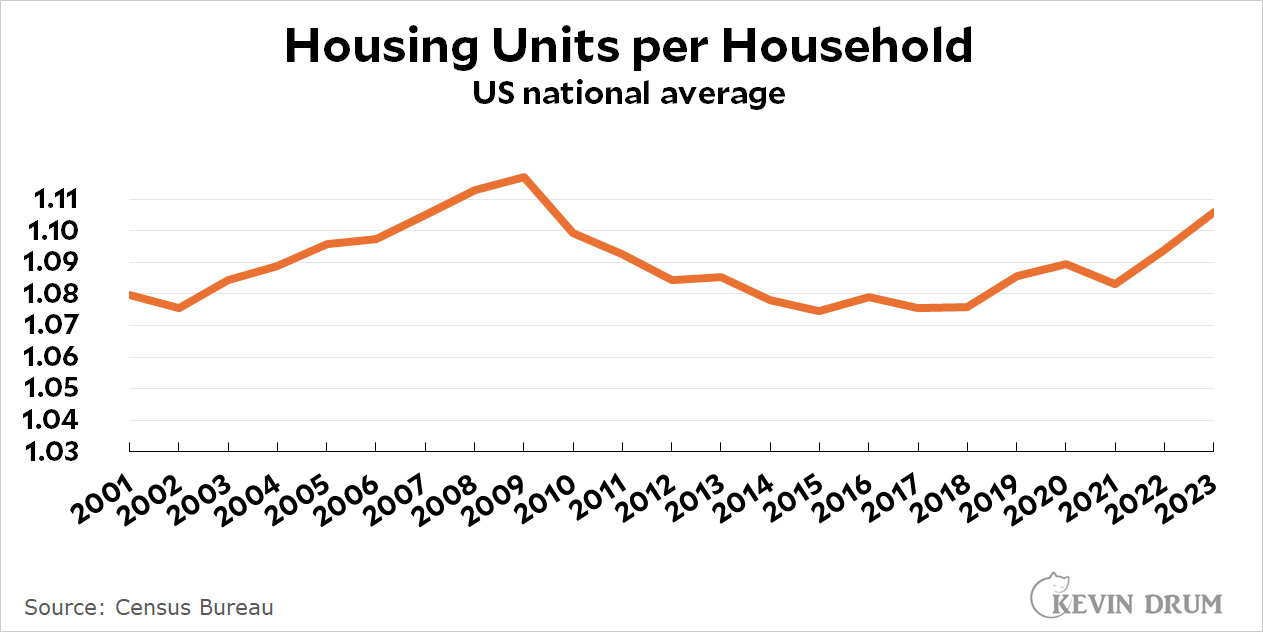

Kevin Erdmann has a long, complicated post explaining that this is all about families having fewer children, but he never takes this to its logical conclusion. To recap: we don't really care about housing per capita—i.e., housing per individual person. More kids, for example, doesn't mean we need more housing. Instead we want to look at housing units per household. Here it is:

The number of housing units per household is higher than it was in 2001. It still doesn't look like there's a housing shortage.

The number of housing units per household is higher than it was in 2001. It still doesn't look like there's a housing shortage.

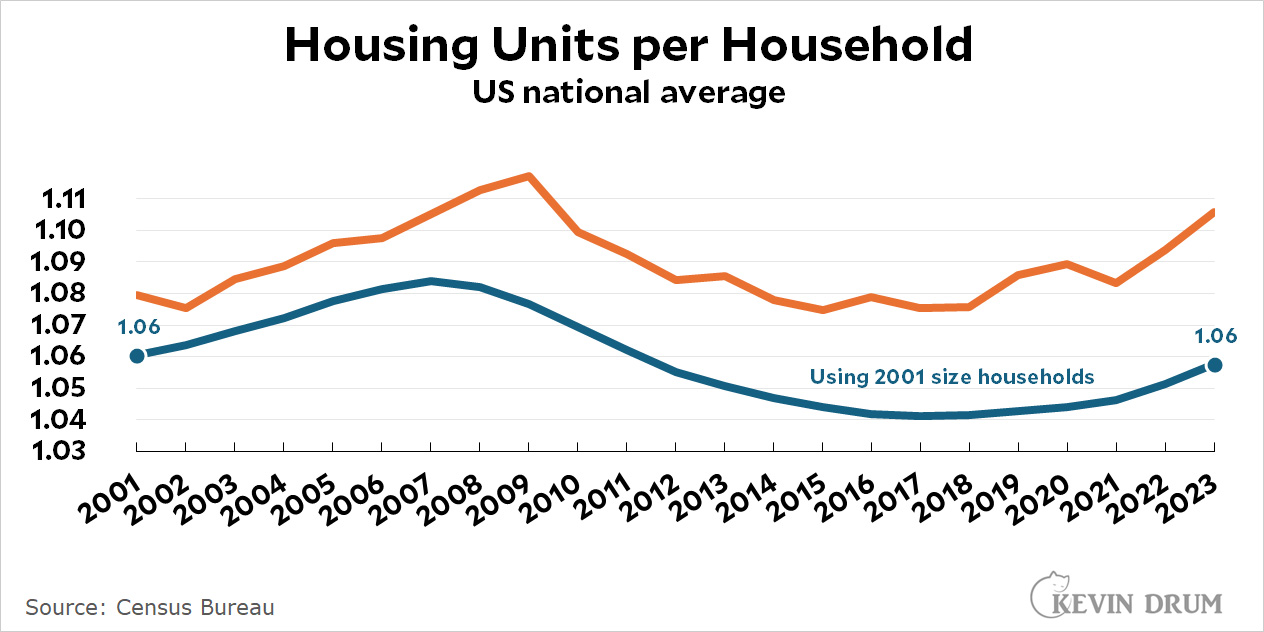

But wait. This is circular reasoning. If housing is in short supply, it depresses household formation (more kids remain living at home, etc.). But the depressed number of households will then make it look like the housing-per-household ratio is still high.

That sounds complicated, and it's about to get worse. As it happens, the number of adults per household has, in fact, been going up. Is this by choice, or because it's been forced on people by housing shortages? One way to get a handle on this is to look at the housing-per-household ratio, but use the 2001 figure for household size throughout. Here's that:

Even using this measure, the ratio of housing to households is the same as it was in 2001. In other words, even if household size had stayed the same, housing would be about as abundant now as it was two decades ago.

Even using this measure, the ratio of housing to households is the same as it was in 2001. In other words, even if household size had stayed the same, housing would be about as abundant now as it was two decades ago.

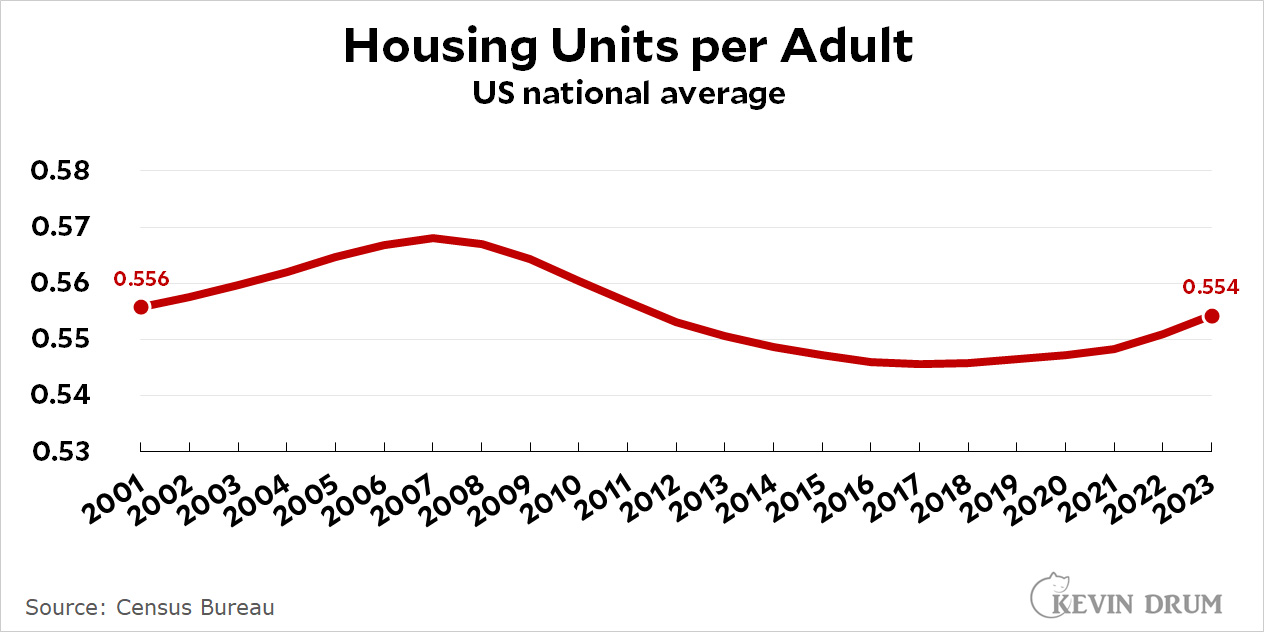

Here's yet another way of looking at this:

Forget households and forget kids. Just look at raw housing per adult. As you can see, it's precisely the same today as it was in 2001.

Forget households and forget kids. Just look at raw housing per adult. As you can see, it's precisely the same today as it was in 2001.

It was surprisingly hard to get the data for this chart thanks to the Census Bureau's remarkably crappy collection of data about population—the thing that's supposed to be its prime purpose in life. I'd like to do this same chart for California, but it fills me with fatigue just to think about trying to wrestle out of the Census Bureau the adult population of California for the past 20 years. I'm sure it can be done, but God knows how.

If I had this data, I'm pretty sure it would tell us that California has a housing shortage but the rest of the country doesn't. That's what I usually seem to find. For now, aside from California, I continue to believe that the US doesn't really have a housing shortage. Maybe in a few hot cities here and there, but that's about it.

We keep getting richer and richer so we have a lot more people with multiple homes. This used to be something only the rich did, but now the middle class all expect to have cottages.

Also another conclusion, we used to have a shortage but it's gotten better since Joe got into office, but there is always a long time delay between improving a problem and people noticing the improvement. True about crime, drug overdoses, etc. etc. Moral of the story, never be a president after a complete disaster. It took a while before Reagan wasn't considered an absolute disaster as president. During his first two years in office, he was way behind Biden's worst approval number.

No, things have not gotten better since Biden took office, house affordability has gotten much worse because mortgage rates went up (see my comment below). But this was not Biden's fault - unless you believe Trump who claims that he and only he can control inflation.

It's not a factor everywhere but here in Denver (and other big places I'd wager), over the last couple of years investment firms have also been competing for houses in the market; they've bought around one of out five or six houses as they go up for sale and have turned them into rentals for the time being. That has real knock-on effects for people trying to buy in those markets and could be expected to bleed out elsewhere as well ("sell my house and retire to Kansas, it's cheaper there, and now I'm loaded enough to bid for and buy a house there!").

Inordinate, if not obscene, wealth in more than one sphere is warping the market.

How about the number of homes that are secomd homes, airbnbs, etc.?

Yeah, I wonder about the impact of short-term rentals. In my own neighborhood, I see apartment houses with dozens of key lockboxes lined up outside--a sure sign of short-term rentals. Still, I find it hard to imagine that there are enough of them to make a measurable dent in the number of available units.

Location, location, location...

There are certain areas where short term rentals have take off and taken over a fair amount of those local markets. And there's the secondary issue of Wall Street buying up housing to rent out.

It depends on where you are. I live in a small city of 20,000 near a national park, so we have a lot of short term rentals. Housing prices have soared. A lot of people who were scraping by are now homeless or borderline homeless. (e.g. living in an RV in a friend's driveway) The city has started cracking down on short term rentals, but they've had to do it slowly since there is a constituency for them.

We used to have relatively cheap real estate here, but COVID and AirBnB have ended that era. One good sign, though, is that a few outdated motels have been turned into apartment buildings.

If they weren't short term rentals, they'd be second homes. Apartment buildings would be boutique hotels instead of apartments.

It still represents unmet demand.

So there are only housing shortages in the places where people want to live. How reassuring.

Yeah national numbers are borderline meaningless. "Well there's plenty of available housing in Bismarck, North Dakota, so ..."

North Dakota was one of the places with a shortage: No one wanted to build any there, and the weather loves to destroy them.

But you can't say "I will never ever be able to afford a house!" Let's be honest and say "I can't afford a house at this moment exactly where I want to live."

Affording a house requires having the money to pay for it. There are places with cheap houses, but they tend to be places where money is hard to come by.

"But you can't say 'I will never ever be able to afford a house!' Let's be honest and say 'I can't afford a house at this moment exactly where I want to live.' "

My continued employment requires me living where I do. I cannot commute to my job, which requires on-site manual labor, and also live 4 hours away from it. If affordable housing only exists outside of a reasonable commute-shed of employment centers then it functionally does not exist, and saying "no, actually, you can totally afford to buy a house" remains false

The problem is a lot more complicated than just comparing numbers of people to numbers of houses. The average price of houses has been going up faster than general inflation for a long time, so does the Invisible Hand of the Market say that there is a shortage? It might be said that currently there is a shortage of affordable housing. There are various affordability indexes which mostly compare mortgage payments with income, but there other possible inputs. This one

https://dqydj.com/historical-home-affordability/

shows that houses are less affordable now than at any time since the peak of mortgage rates in 1982 although others have a bigger peak around 2006 in the bubble. But most indexes show that houses were very affordable in 2022 when mortgage rates were at record lows, despite high prices . So should the decision whether there is a shortage of houses be based on how things are now or how they were two years ago?

In addition to the number of people bidding for houses there are other factors such as the price of land - they're not making in more of it - and the size of the houses. The average size of houses seems to have increased - maybe the numerical computation should be based on square footage. There is also the fact that houses may be refinanced. Not only did a lot of people buy houses in the recent years when rates were very low but many others were able to refinance. Affordability might include the probability that mortgage rates will go down.

Maybe the decision whether there is a shortage could be based on how many people don't have any kind of housing, or who are forced to cut back on other things to make rent or mortgage payments, although Kevin's recent post shows that this is not a simple thing to determine.

And yes, and many people point out, affordability is highly variable by location. Zoning laws and other city and county policies and regulation probably have more influence now than federal government policy. Of course the influence of the Fed is somehow typically ignored when considering housing.

Kevin: You can always just move to another state if you need housing.

Also Kevin: People should return to the office where productivity is higher.

Still more Kevin: California job growth outpaces the nation.

Somehow Kevin never makes it full circle though in his logic.

Citations needed.

"California has a housing shortage but the rest of the country doesn't. "

In other words, in places people want to live in, there is a housing shortage.

I came to say that my state (Maine) has a housing shortage.

But Maine is also the fastest-growing state in the country right now.

2nd homes and airbnb units are a huge problem, removing many properties from the long-term housing market.

We cannot build our way out of this problem simply because there are not enough skilled builders available to solve it even if the funding and the land were available and ready to go.

Airbnbs only have an effect if you misunderstand their impact - they represent unmet demand as well, and removing them doesn't raise the number of housing units. Because they'll just get converted to vacation homes or empty spare units.

Short term demand is still demand.

I think that this is probably overly-simplistic and not accurate.

The "demand" for short-term rentals (airbnb and the like) -far- exceeds the demand for "vacation homes or empty spare units". Most of those renting short term rentals have neither the means nor the interest in purchasing their own vacation home. And most operators of short term rentals do not have the means to support an empty spare unit, but are using the income from the short term rentals to enable them to afford that unit.

As gby said, this is wrong. There is no reason to believe that short term rentals take the place of 2nd homes and vacant homes.

There is obviously demand for short term rentals, but there is no evidence or even logic that this demand for short rentals would create a demand for vacation homes or empty houses if regulatory hurdles limited the supply of Airbnbs.

Reducing Airbnbs would quite obviously increase the amount of housing supply and also reduce the demand for houses, so 2x the effect. It does have the opposite effect on short term spaces, but we arent facing any real national problems with hotel/short term space for business travel or vacations.

Is it Maine that has shortage or it Portland that has a shortage?

“I'm pretty sure it would tell us that California has a housing shortage but the rest of the country doesn't.”

It a good thing only 1 out of every 8 people lives in California then. It’s not a real problem until it affects 1 out of 4 of us I guess?

Never mind Chicago, Portland, New York, Boston, DC...

Related, somewhat:

A couple of days ago, Kevin posted an item about unreliable click-bait survey data. Try this on for size:

About 7 million New Yorkers plan to leave the state, a new survey revealed this month.

Source: https://www.newsweek.com/millions-new-yorkers-plan-leave-1892243

Housing is one of those subjects that cannot accurately be generalized nationally. Every market has its idiosyncrasies and the movement of the people is definitionally changeable. Cali obviously has its issues but I will say here in NoVa a house does not stay in the market more than two days. And in driving, biking, and walking around I have never seen less houses for sale (this is supposed to be the peak sale season)-and when I do, all of them say sold. It’s no wonder home prices are shooting through the roof here. I wonder if interest rates are dissuading people from selling and the answer is of course. Meaning, the Fed higher than they should be interest rates is one of the main drivers of housing inflation, at least in the DC area (currently, someone with a 2.5% rate simply is not going to sell their house).

As others are saying, the use of houses as investment properties/rentals is a major concern. IMO, the proper metric here is the number of houses used as a primary residence, divided by the number of adults.

What's interesting is that if this does turn out to be the big factor driving the shortage, it suggests the problem might be addressed by cranking up taxes on houses not used as primary residences. Knock loose some of the AirBNBs and the second homes and the investment properties and get those houses back on the market.

This is especially effective because one of the obstacles to homebuying right now is that the seller needs a place to live after the sale, which means each seller turns right around and becomes a buyer elsewhere, which means giving up your sweet low-rate pre-COVID mortgage and taking on a decidedly unsweet mortgage at present rates. And nobody wants to do that. But that's not an issue with a house you weren't living in anyway. You can just sell it, pay off the old mortgage, and plunk the balance in the stock market, or spend it on hookers and blow, or whatever.

I might add that if there ain't a housing shortage, the market around here is doing a damn good impression of one. My realtor found me a house that I liked. It went on the market on Wednesday. On Thursday, the seller added a note that they'd received multiple bids and they wanted final offers by Friday. Today, I put in my bid for $45,000 over the asking price (and $40,000 over Zillow's estimate, for whatever that's worth), and lost.

And I'm in northern Indiana, not a coastal metropolis.

I'm having the opposite problem: I can't sell a house in what is supposedly a hot market, and I've even come down 10K in price (and the seventeen year old house is priced in the bottom range of the SFR market for the area). The feedback I get suggests that buyers have gotten ridiculously picky: they want brand new appliances in place, the interior to painted in their preferred color scheme, the outdoor landscaping done to their liking etc. One comment I got said almost indignantly "We shouldn't have to do all those things ourselves".

How many times do we have to tell you, houses in Detroit or Topeka are irrelevant to a housing crisis, but counted in these statistics

Isn't it fair to say that housing unavailability in such dense areas is an indication that the area has reached peak population. At least without causing further economic and social issues using our current building processes and social patterns.

Basically a sign that says you shouldn't move there unless its market has settled down and it's not so unlivable for a chunk of the population.

Continually expanding isn't an inevitability for a place like LA county or southern Cali. It's a decision, especially for transplants.

These charts appear to leave out any information as to the number of houses for available for sale and the demand for housing.

So in order to determime whether or not there is a shortage we are ignoring supply and demand for the product as well as the market rate of prices for the product.

By ignoring the only relevant data, this 'analysis' doesnt appear to try to determine if there is a shortage.

Instead, Kevin has jumped to trying to explain the shortage and is trying to make the case that the ratio of Census Housing Units to Population doesnt appear to explain the shortage. It is obviously mistaken to infer that this means there is no shortage.

Imagine analyzing a worker shortage by looking only at population and the number of registered companies instead of people who want to work and the demand for labor. Or a power shortage by only looking at national population and the maximum possible power generation capacity across the country instead of the demand for power and actual available power supply. Even if all of your data is accurate, it doesnt give you any useful information to determine whether or not there is a shortage at either local or national levels.

Intersting info here, but very bad analysis.

It seems like this is worthless information without including the distribution of locations, if most of these are in empty suburban developments near Las Vegas and Dallas, nobody in San Francisco or NYC is going to care.

One important thing to consider is not just housing units but also who has what. This article from NPR is anecdata, to be sure,

https://www.npr.org/2024/04/18/1244171720/baby-boomers-large-houses-millennials-homeownership

but it does raise an important question: how many family-sized homes are occupied by people who don’t have families while those with families have inadequate housing?

I think it’s not just a question of housing units vs households, but how those units match up. After all, if there are twenty studio apartments and ten families with children, the ratio doesn’t really help,

Easiest way to find out which places have a shortage and which don't:

Those that do will have rapidly increasing prices, outpacing inflation by astonishing margins in some cases.

Those that don't will have steady prices.

Those that *really* don't have a shortage, i.e. have a growing surplus, have declining prices. People really don't want to live there.

National housing market data like this is almost worthless. But really, we've underbuilt by so much for the last 15 years that it's created a housing price crisis in places outside of the obvious cities like NYC and LA and DC.

Homeless ppl are more likely to die right? Let’s start knocking down houses. Having fewer clowns will definitely solve this problem one way or another.