Tyler Cowen takes a look at the housing market . . .

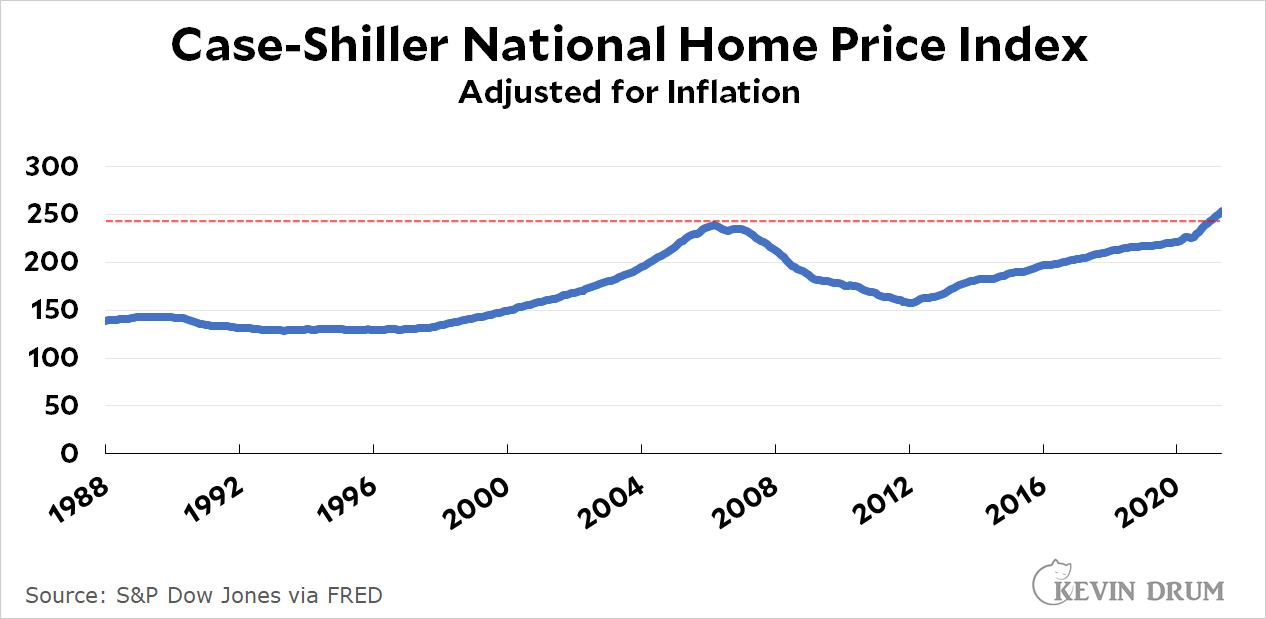

. . . and concludes that we didn't really have a housing bubble in the early aughts. Prices have now returned to their 2006 height, which suggests that the big price runup was mostly based on fundamentals with just a little bit of bubbly mixed in.

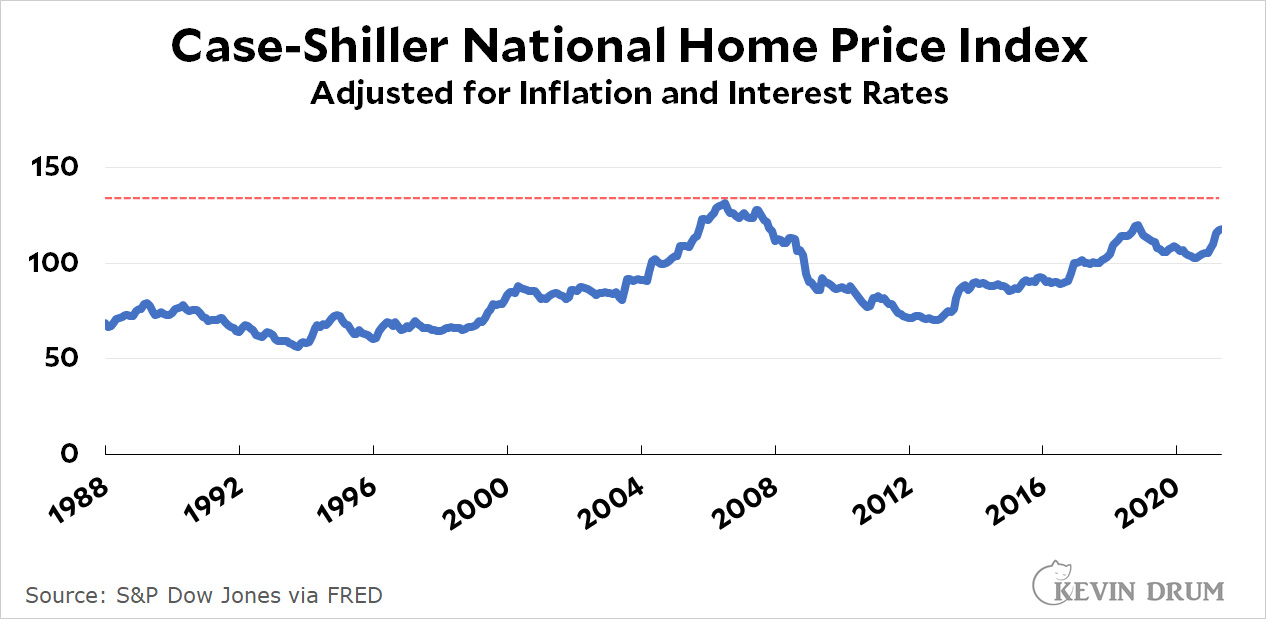

Maybe! Let's take a look at two other things before we decide. First, here's the home price index adjusted for mortgage interest rates, which have declined steadily for the past 20 years:

On average, this represents what people actually have to pay each month, which is more important than the raw house price. As you can see, we aren't yet at the level of 2006.

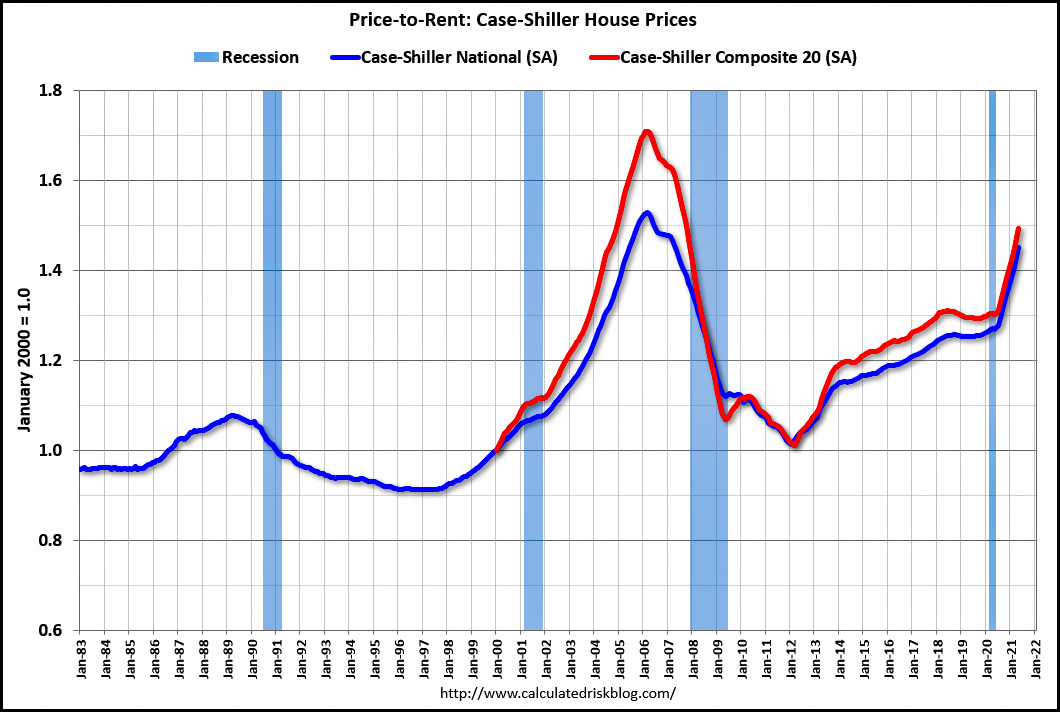

Second, I've always been sort of addicted to the price-rent ratio as one of the best signs of a housing bubble. Via Calculated Risk, here it is through May of this year:

We're getting close to the 2006 peak, but we're not there yet. (Not through May, anyway.) Still, a price-to-rent ratio this high sure seems kind of bubbly to me, and I wouldn't be surprised if the big spike starting in 2020 is COVID related, not fundamentals related.

So . . . who knows? When you adjust for both inflation and interest rates, we're still below the 2006 bubble peak. On the other hand, over the past 18 months there's been a spike that does look kind of bubbly. If I had to guess, I'd say (a) 2006 was a bubble, though perhaps more driven by fundamentals than we thought at the time; and (b) we weren't in a bubble up through 2020, but we might be in one now.

Of course, the pandemic will end eventually and—presumably—housing pressure will continue to grow until it reaches a point that we start building enough houses to serve the market again. If we do, then house prices will either go down or stabilize. This will depend a lot on whether young buyers continue to lust after houses in urban markets that are likely to stay tight or if they finally give up and start looking at mid-size cities that have more scope for home building.

I suspect that it’s time the bubble will deflate rather than burst. Back during the housing loan crash I was an Investigator with the California Department of Real Estate. I had a front row seat and saw it all happen in real time. I reviewed many hundreds of the loans involved. This is something I posted a while back but I’ll post it again because I think it is relevant. It’s kind of long, sorry:

I’m sure most here are aware of Paul Krugman’s column back in 2005 predicting the housing bubble coming to an end (“That Hissing Sound” http://www.nytimes.com/2005/08/08/opinion/08krugman.html). Krugman was largely correct in predicting the end of the bubble, but he was wrong in one part: “So the news that the U.S. housing bubble is over won't come in the form of plunging prices; it will come in the form of falling sales and rising inventory, as sellers try to get prices that buyers are no longer willing to pay.” But, as we know prices did plunge a couple of years latter.

Why didn’t the bubble deflate rather than burst? It’s my opinion that a big reason was S&P’s bogus ratings which spurred a fraudulent real estate scheme known as an “Inflated Price Transaction”.

In early 2006 I received a letter from a real-estate agent outlining what he believed were fraudulent transactions. He provided a list of homes that had recently sold in his area. All were listed for several months and failed to sell at the original listing price. The listing price was decreased, and almost immediately after the decrease the home sold at the original listing price. This made no sense to him. Shortly after receiving his letter I got a call from another agent. She had been offered to participate in a scheme in which her client, legitimately selling their house and lowering the price after receiving no offers at the original listing price, would sell the house at the full original asking price, but with the difference between the original price and the lowered price kicked back to the agent using a “secret addendum” to the contract. She refused. She said she was tempted but she thought it illegal and asked if it was. I assured her it was and she told me that she knew other agents were doing it, and actually holding meetings to train each other how to do it. She provided a copy of the contract that had been provided to her from the proposed buyer, and I used the name to see if that “buyer” had later purchased a house. He did. In fact he “bought” 5. All in the same area, and all closed escrow on the same day. All were stated income 100% financed pay option ARM loans. All had been houses that fit the description outlined above. The buyer had, of course, been a straw buyer, likely paid a flat fee. I figured the broker, between his commission for selling the house, making the loan, YSP, and other fees made several hundred thousand dollars on the transactions. When contacted, the bank refused to cooperate (“Ha, ha, ha, why do you think they call them liar loans”). What I found out was that these transactions were rampant throughout the sate and at least some other states. I heard from an FBI agent that almost an entire condo development in San Diego was so “sold”. Of course, the loans defaulted very quickly. The agent indicated that he too had been laughed at when he asked banks to cooperate with investigations. This was really shocking to him because in the past it was always banks that had contacted the FBI to report suspected fraud.

What this meant was that just about every mortgage loan during that time, whether for a home purchase or a refinance, was based on fraud. Loans are made based on appraisals and “comparable sales”, that is, what other houses in the area are selling for. Except the amount the houses were “selling” for was a lie. People who actually bought at that time were purchasing at artificially inflated prices. And maybe they had no neighbors because the people who purchased in their neighborhood didn’t exist.

The banks wouldn’t cooperate with investigations because they had sold the loan. The reason they were able to do this was because S&P gave packages of these crap loans high ratings. The loans were purchased, but I believe that everyone knew the ratings were bunk and it was only a matter of time before they blew up. Basically they were all playing a game of hot potato.

Very good info. We traded (financed as middleman to other banks- short term) some of that garbage. Looking at the tickets a few years later, from Countrywide, was amazing. None of the CW MBS had any value at all. They were the rare West Coast participant along with Bank of America. Never knew of the blatant thievery by real estate professionals.

Another reason prices didn't fall: they couldn't. Many of the houses were fully mortgaged, some even over-mortgaged due to cash back refis and HELOCs. While there are ways to do a short sale they aren't easy, and they leave the seller with an outstanding debt-- while Congress had acted to prevent those who lost houses in foreclosures from being required to pay any remaining debt after the foreclosure sale. So foreclosure became the preferred means of shedding properties one could not sell for what was owed, with the added benefit that the courts were so clogged that a foreclosure could take years

It is bubbly....though banks are supposed to be stressed tested now, so that's one difference. A bursting bubble will be bad, but shouldn't freeze up financial markets.

The spike is probably because rents fell hard during the pandemic while house prices boomed. House prices are still elevated, but rents are creeping back up so the ratio should stabilize or even decline this year.

Recent commentary I've been reading suggests that the market is weakening. My SWAG is that work from home had a radical impact on white collar professionals, which enabled them to flee high cost cities.

Work location is still shaking out and probably will be for a couple of years. Top talent isn't going to put up with commutes and excessive housing costs, so companies that expect top talent need to adjust their thinking. What will be interesting is the impact remote work will have on salaries, a fight still in the insult hurtling stage.

If I were a gambling woman, I'd be betting on the market having peaked.

I think what we have here is the normal ups and downs of the housing market. A steep rise followed by a decline of 5-10% and then a plateau. A “bubble” would indicate an eventual burst and I don’t think current conditions indicate that.

You're probably right, although I'd guess it's likely some metros will peak earlier than others. IIRC, in the last (ie, pre-Great Recession) cycle, some parts of suburban Boston had peaked by late 2004. While in the more desirable location closer to town (especially in hot downtown areas where inventory never really caught up to demand) the peak didn't come until as late as 2009 and even then saw virtually no downward adjustment (just a brief -- perhaps a year or so -- pause).

Anyway, greed will always be with us, so, I's expect to see some of the prices people (especially flippers, investors) are asking now to be a bit lofty even for a boom. Which means price cuts are coming (indeed have already started to arrive, if my casual observations of Zillow are any indication).

Just because prices are going up, doesn't make it a bubble. There are three things that cause the price of something to rise:

1. A drop in supply.

2. A rise in normal demand.

3. A speculative mania (i.e., a bubble).

#1 and #2 are ordinary market events, and they sort themselves out via negative feedback loops. The rise in prices brings new suppliers into the market (supply goes up), and pushes buyers out of the market (demand goes down), and prices stabilize.

#3 is the problem, because it sets off a *positive* feedback loop: Rising prices make the thing more attractive to speculators, driving up demand, and prices go up even more. That should have the lights flashing yellow. The lights go red when speculators are allowed to finance their purchases with high levels of debt.

All indications are that the current price rise is being driven by #1; the supply of lumber is bottlenecked all to hell right now. Is there any reason to believe there is a speculative mania going on?

Is there any reason to believe there is a speculative mania going on?

Human nature? (Greed will always be with us).

Let's put it this way, a speculative bubble may not have arrived yet -- and almost certainly hasn't nationally -- but at some point the crazy anecdotes (multiple offers over asking, huge over-asking-offers not even being responded to, etc) start to suggest at minimum the psychological groundwork has been laid for a bubble. I realize the plural of anecdote isn't "data" but at some point you start to suspect the sheer volume and craziness of the stories suggests the official statistics are lagging behind.

Are you going to review the hedge fund/private equity push to buy up single-family residential units?

You might want to do so, because they're the ones generally paying well over the asking price.

Lots of speculation going on. I live outside Boston and get a phone call every single day from realtors looking to make cash offers far above my assessed value. Sometimes more than one a day. I am just one of those weirdos that likes my house (despite constant plumbing repairs) and where I live so could care less. The house also being our retirement plan means we aren't selling any time soon.

One of our neighbors jumped on such an offer and the house has been vacant since she moved out last year.

I think Pharoah finally freed the Hebrews after the culling of the first-born sons because he knew that if he held out, the plague of real-estate agents would be next.

You know there is a ton of available land in large urban metros and it can be redeveloped into nice townhomes and medium density residential. There are all kinds of global warming reasons we don't want more single family sprawl in smaller cities.

How much of that land is enough above sea level to be safe? I wouldn't purchase in Hoboken, NJ or parts of Norfolk, VA.

Considering the slowdown going on in the housing market, we will find out. My guess a protracted period of nominal flatness.

No building boom for sure, even compared to the 80's miniboom.

I Am Legend Screenwriter Forced to Tell Anti-Vaxxers His Zombie Movie Is Fake,

https://gizmodo.com/i-am-legend-screenwriter-forced-to-tell-anti-vaxxers-hi-1847454699

Price-to-rent ratio may be misleading due to the pandemic. I don't know how true that is in general, but in big cities, the pandemic has depressed rents a lot.

- co-living/roommate situations were viewed as risk prone

- university closed, so students moved back home

- remote work allowed people to work from more isolated/safe and also more desirable area (anecdote: people moving to Hawaii to work from there; but also to Tahoe in the Bay area). Some just moved to cheaper areas with more space outside of big cities.

- remote work allowed some demographics to not pay rent by moving back with their parents (my neighbors upstairs, a group of MBA 30-something who didn't want to pay SF rent when they could just shelter-in-place for free at their parents)

- no summer interns, no mobility of workers for short term rental

- no airbnb/tourism so a lot of units moved out of the short-term market onto the typical unfurnished market as it was the only one that could support any rents.

- etc...

In any case, rent *dropped* 25% in SF and have only started recovered. House prices are stickier, so I would expect the price/rent ratio to increase until the _rent_ market recovers and that wouldn't mean the _real estate_ market is bubbly.

PSA for people in Texas,

https://i.imgur.com/4EPcGp8.jpg

Ron DeSanity thinks he's running for president.

Picture it!

Hello, I'm Ron DeSanity. You know, when it comes to death, your death, and really anyone else's, it's all really some kind of big joke. That's why when I think about you and your mother suffering and dying, it just about kills me, too. It's great! And we can all laugh about it around your open grave if we all just pull together and chuckle. Vote for me, I'm Ron DeSanity.

" if they finally give up and start looking at mid-size cities that have more scope for home building."

Sure, there's plenty of low-priced homes throughout the US. But where would thir newly-enlightened occupants work?

Most remote-capable workers aren't all that worried about price. The most price-sensitive workers can't work remotely.

Re: Most remote-capable workers aren't all that worried about price.

I'm not sure that's really true. I've been working remotely for well over a year. I considered moving, but the prices where I wanted to move range from high to ionospheric and while I could afford something at the lower end, it's a practice of mine to live a bit below my means. Also, with retirement out on my horizon (maybe in 10-15 years) I do not want to saddle myself with a pricey mortgage.

I keep getting inquiries from recruiters and prospective employers in high cost areas in California and east coast. I tell them housing is too expensive and take a pass.

Seems like volume needs to be factored into the equation. Home prices rising dramatically in a low-volume market is different from home prices rising dramatically in a high-volume market.

'...will continue to grow until it reaches a point that we start building enough houses to serve the market again. If we do, then house prices will either go down or stabilize. '

Kevin's faith in simple market economics is quaint. Let's not forget American Capitalism Rule #3: nothing is so good that Speculation can't burn it to the ground.