If you're interested in details of the UAW's new contract with Ford, here's their highlight page:

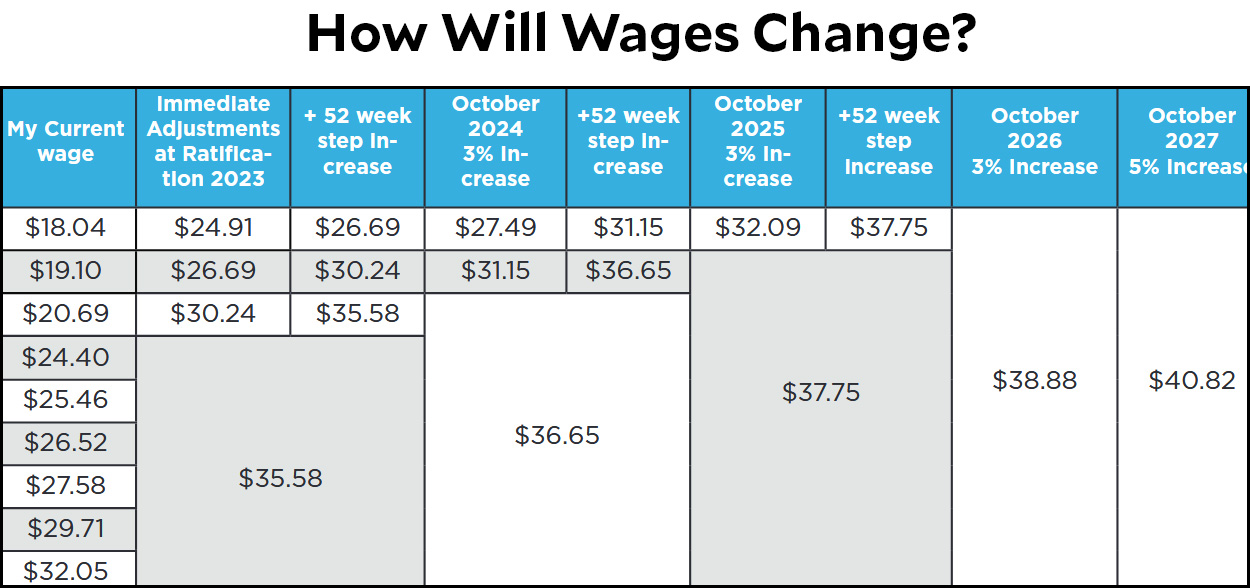

The two-tier pay system, where new hires are paid half the rate of veteran workers, has been all but eliminated, and will be gone completely in three years:

The two-tier pay system, where new hires are paid half the rate of veteran workers, has been all but eliminated, and will be gone completely in three years:

Overall wages will increase more than the 25% initially reported, although oddly, that's still the number highlighted by the UAW. The real increase is 27% by 2027 plus COLA, which is likely to add another 6% or so for a total increase of 33%.

Overall wages will increase more than the 25% initially reported, although oddly, that's still the number highlighted by the UAW. The real increase is 27% by 2027 plus COLA, which is likely to add another 6% or so for a total increase of 33%.

There are no changes to the workweek, which was part of the original negotiating demands. It's still 40 hours. Juneteenth was added as a paid holiday.

It's about damned time.

Back when the U.S. auto industry came close to going belly up, UAW members took huge wage and benefits hits to help keep the auto companies afloat. Since then, U.S. automaking is back and auto execs are getting huge salaries and bonuses and stockholders are earning tidy sums -- but damned little of the new profits, until these new contracts, has made it to the workers. Now, workers are finally gonna see some fairness.

(Meanwhile, workers in other industries: See what happens when you organize and support unions. See!!!)

Which time?

How does one demonstrate "U.S. automaking is back?" Back compared to when?

Since Ford is the company referred to in this article, going by https://www.google.com/finance/quote/F:NYSE?sa=X&ved=2ahUKEwi3tsawnZ6CAxUKlGoFHViwD-kQ3ecFegQILBAZ&window=MAX circa January 1990 Ford stock was at ~$8 a share. Circa January 2000 it was ~$27. Circa January 2010 it was ~$10. Circa January 2020 it was ~$9. I don't believe any of those are inflation-adjusted, but will be split-adjusted if there were any.

And as I type this, mid-day for the market it is at about $9.80. Down from about $11.50 the day before the agreement was announced.

Perhaps the other US automaker, GM, has done better over that time. I'd be happy to be shown that it has.

And somehow Ford won’t go bankrupt. It’s almost like they can share the profits with the people who do the work

"Share the profits with the people who do the work"?

That's crazy talk.

(Sarcasm, if you can't tell.)

What was Ford’s net profit in 2022 anyway?

2022 net income of -$1.98 billion, so that's not great. But they did have net income of +$17.94 billion in 2021, so we'll see how 2023 goes.

I wonder how much in absolute terms another 33% in wages is.

Workers going from a range of $36K to $64K a year to $80K, not bad. Getting all their wages above the average selling price of a new car is a good thing. And expect a knock on effect at non-union places too.

I expect employment levels in the automotive sector to drop a bit with automation and shift to EV's, but communities won't be devastated with more money flowing into them from the increased salaries.

And the companies? They've given up on the car market and do SUV's and crossovers. Not sure if their R&D has been focused on the future--we'll have to se how their batteries will do.

A cost of living increase is not a wage increase. Saying that the REAL increase is 27% and then including the COLA is a mistake. COLA increases keep up with inflation. When Drum calculates real wages, he adjusts for inflation, thus indicating he understands the distinction. So it seems unfair today to inflate the settlement by including a COLA which is designed to keep workers even with inflation.

You're right, of course. But a lot of large employers announce their wage/salary/compensation increases -- whether publicly or more likely just to their employees -- without adjusting for inflation, and without any COLA in the plan. So for comparison purposes, many people may find it more useful to find out about the projected increase in nominal dollars.

US automakers have a lot going on/face some meaningful risk.

1) significant shift from gas powered to battery driven cars.

2) changing to more on shore or friend shoring in terms of procurement

3) new, much more expensive, labor agreements.

4) A strong competitor, Tesla, who is non union in the EV space

I hope this all works out well...

On the flip side, the owner of Tesla is a toxic Nazi, and many decent people will refuse to buy from him ever, which gives the other companies a boost.

Its funny (sad funny?) how investing in your workforce is portrayed as a risk similar to shifts in consumer demand, supplier changes and competition.

We would never see the failure to invest in people assets presented as a risk.

Odd huh?

jdubs - depends by what you mean by investing.

1. ) investing in better training or tools, likely increases productivity.

2.) investing as in paying more for the same job, probably decreases productivity

"paying more for the same job, probably decreases productivity"

Two responses:

1) I do love the Republican belief system re: productivity. When the subject is taxes they *always* say that if rich people make more money then they will work harder and productivity will increase. But does that principle apply to ordinary working folks? Haha, no.

2) When a job pays more it attracts a higher caliber of applicants. The current workers may or may not work harder than before, but the next hire likely will.

Supply-side economics: The odd notion that the poor aren't working because they have too much money, and the rich aren't working because they don't have enough. (Paraphrasing from memory, quote often attributed to J.K. Galbraith)

U.S. car makers will raise their prices. Beneficiaries will be Hyundai, Toyota, Mazda, et al, who have factories in the U.S. but are not unionized. The Big Three will plant stories here and there suggesting it's the fault of the unions, but they won't make any direct public statements to that effect. Many will believe it. The U.S. price increases will go to line the pockets of executives and investors. Rich peoples' hundred-year vendetta against labor will continue, now with "proof" that god is on their side.

Oh well, keep a good thought.

So that's, what, about eight percent a year?

A bit on the high side until you look at the shellacking they took back during the Great Recession, and then it's downright reasonable, low even.

The old Detroit story goes that during a break in negotiations, a Chrysler exec told Walter Reuther that automation was going to make unions obsolete. "I can't wait to see you try to sign up a robot."

Reuther answered "Right after I see you try to sell one a Chrysler."

All those Ford people who got raises are going to go out and buy a new, loaded F-150.

When they should be buying at worst a hybrid sedan if not a full EV.