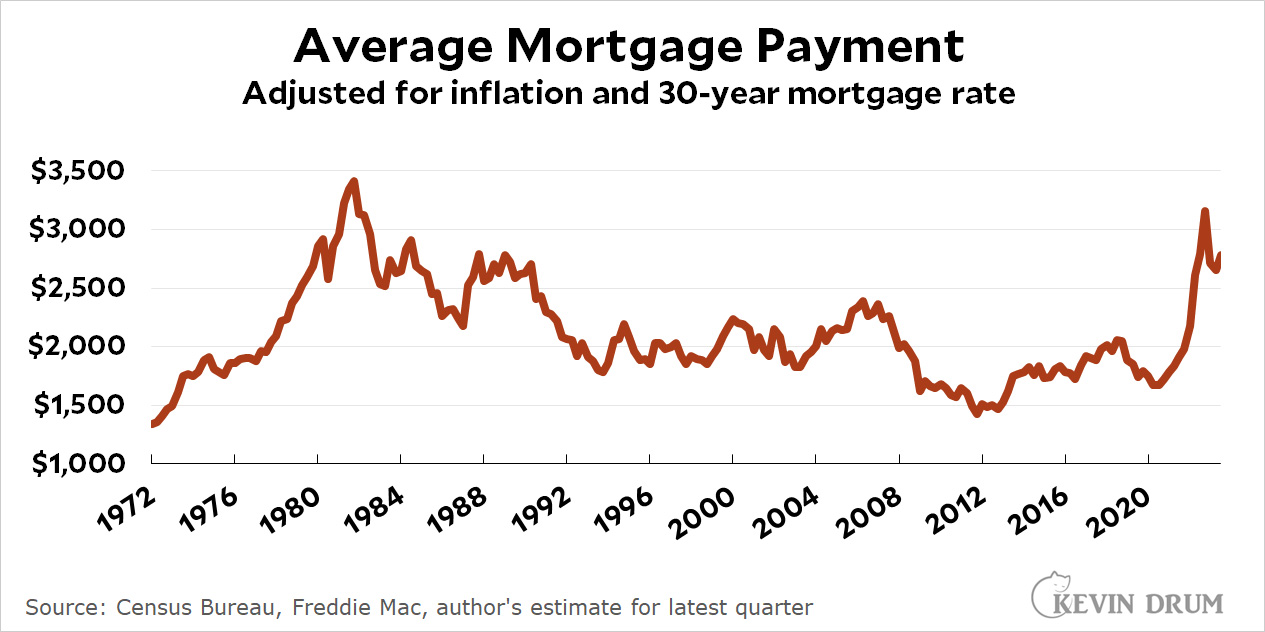

With mortgage rates continuing to climb, here's an updated chart showing the average monthly payment on a 30-year mortgage:

Monthly mortgage payments are still very high, but they've dropped since their peak thanks to falling home prices. They're about the same as they were one year ago.

Monthly mortgage payments are still very high, but they've dropped since their peak thanks to falling home prices. They're about the same as they were one year ago.

OT: Trump shared other US national secrets, this time with an Australian, back in 2021 -- https://abcnews.go.com/US/after-white-house-trump-allegedly-discussed-potentially-sensitive/story?id=103760456

No excuses. It's time to arrest him and imprison him. He's shown that he cannot be trusted.

Was completely unsurprised by this. I'm sure Trump blabbed about national secrets like this dozens of times. Remember, with Trump, it's always way worse than you can imagine. I'm sure it will eventually come out that he mentioned undercover operatives in some country like Russia or China who were later caught and killed.

So, the average mortgage is something like $2750 today. With the 30% of income rule of thumb that means the average mortgage calls for an annual income of $110,000…

A bleg for our host... In August into early September, there were multiple news reports about an uptick in covid indicators: waste water analysis, hospitalizations, etc. I have not been able to find out what has happened since. Has the uptick ticked down? plateaued? continued on its upward trajectory? How's about posting on this?

It hit peak in the US in the first week of September. Positivity rate was 3rd highest since the beginning of the pandemic but did not result in much of a surge in hospitalizations.

Thanks for this.

Northern New England seems to be lagging (or perhaps leading?) the rest of the country as measured by hospitalizations:

New Hampshire

Vermont

It has been very mild so far, so it strikes me as unlikely that this is a harbinger of winter.

"Monthly mortgage payments are still very high, but they've dropped since their peak thanks to falling home prices. They're about the same as they were one year ago."

This chart doesn't show home prices, it shows mortgage payment adjusted for inflation. This means that the real mortgage payment can go down even if home prices have remained the same in nominal terms... How much, exactly, has this payment fallen in real terms?

Don't get me wrong - I do think the market has softened a SMALL bit for particular types of houses in hot markets, or for mid/small markets, just from the interest rate increases. But there hasn't been a huge impact.

I suspect that the bulk of this real decline is simply the result of adjusting for inflation, if not the entire thing.

It would be better to look at the nominal payments in this instance since we're looking at such a short time frame since the peak. Remember that if we're talking about time scales of only a couple of years, it does not make sense to talk about home prices in real terms - only in nominal - for a number of reasons. The biggest one is that basically nobody's incomes are set to increase with inflation (duh).

I think this must be average payment on new 30-year mortgages. Most existing mortgages were taken out (some refinanced) during the long period of very low rates. Anyway Kevin should be more explicit about this.

People who bought houses before the recent run-up in prices actually gained from inflation and there are lots of such people.

I was one of those lucky duckies, in Sept 2020 I bought a house and took out a 30 year fixed rate mortgage at 2.75% with no points. In hindsight, I should have paid a point to bring it down to 2.5%.

My question is, with the Treasuries now running at 5%, and inflation still above 3%, aren't banks losing money on this? Are we going to see a repeat of the bank failures in the 1980s, which followed a bout of inflation, or did the banks sell the mortgages already? If so who is left holding the bag, and will government bail them out ?

Here's the FRED chart for 30-year fixed rate mortgages: https://fred.stlouisfed.org/series/MORTGAGE30US . For October 5, 2023, the rate was 7.49%. For October 6, 2022, one year earlier, the rate was 6.66%.

The lowest point on record is 2.66%, on December 24, 2020. The highest is 18.63%, on October 8, 1981.