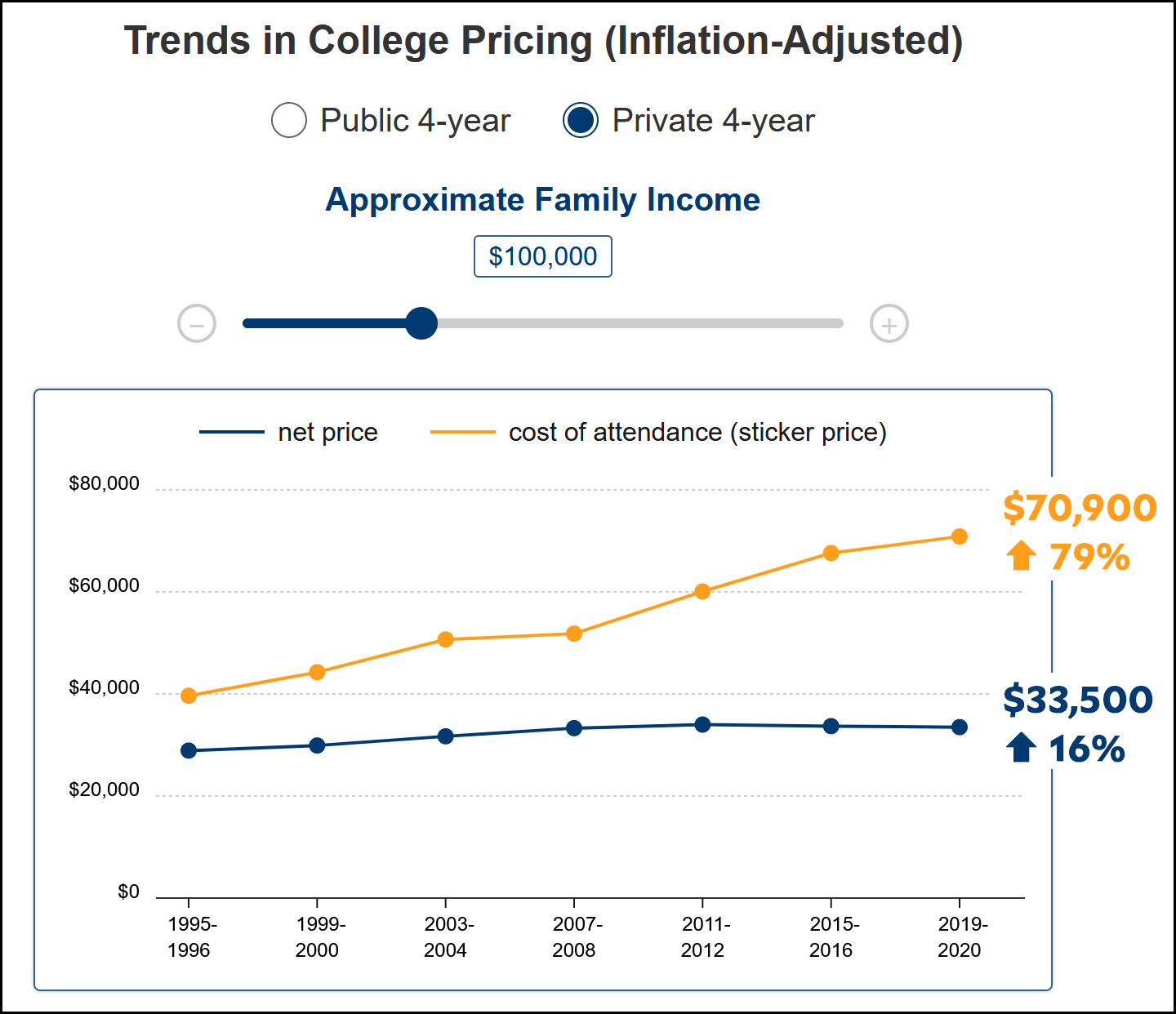

Those of you who are faithful readers already know this, but today Brookings released a report confirming that college costs haven't really gone up that much. They include a handy graphing tool that shows the actual cost of college at various income levels:

In the scenario I chose to illustrate this, the actual cost of college for a family with an income of $100,000 has increased 16% since 1995 and hasn't increased at all since 2007. That doesn't change until your income exceeds $150,000. (All of this is adjusted for inflation.)

In the scenario I chose to illustrate this, the actual cost of college for a family with an income of $100,000 has increased 16% since 1995 and hasn't increased at all since 2007. That doesn't change until your income exceeds $150,000. (All of this is adjusted for inflation.)

The Brookings data shows a higher increase for public universities, but that's because they include room and board. If you look at tuition and fees, the net cost has gone down.

Remember this the next time you see one of those charts showing that the cost of college has skyrocketed over the past few decades. It hasn't. In fact, over the past 20 years it's barely changed at all.

If memory serves parents paid something like $15,000 a year for my college education. I’m paying that much a quarter for my daughter’s.

Adjustment for inflation may be indicated, but that isn’t something one’s memory does…

No, but if you Google "inflation calculator" you will come up with a bunch of them.

Tuition in California’s UC system for undergraduate residents was $3,086. In 1994

https://ucop.edu/operating-budget/_files/fees/201415/documents/Historical_Fee_Levels.pdf

CPI says $6,592.73. Current UC tuition is $14,395

In the mid-1970s, I paid $600 a year for tuition ($300) and educational fees (another $300) -- plus $66 a year for student government fees which I believe included some health insurance -- in California resident fees to attend UC Santa Barbara. Food and lodging not included. So that's 50 years ago. A UC fact sheet I just brought up says it's $14,436 for tuition now, $1,800 in campus fees, and $3,000 for health insurance. The inflation calculator at the American Institute for Economic Research (which Google coughed up; I have no idea if they're reasonable or not) says that $600 in 1975 would be $3,398 today. Just a few factoids for consideration.

Note, however, that UC students with family income under 80k pay zero tuition. https://admission.universityofcalifornia.edu/tuition-financial-aid/types-of-aid/blue-and-gold-opportunity-plan.html

I forgot to add that the school I attended was private, and the one my daughter is attending is public (out of state).

Of course, just exclude room and board. Because that doesn't impact college costs! I've got one kid in a public university, and room and board is far more expensive than tuition and fees. To "waive" that away is extremely problematic.

True, but those costs vary widely. For someone going to UCLA costs for housing are going to be much higher than someone going to UC Merced.

Not looking it up, but good point - a dorm anywhere is competing with available nearby off campus housing and land in Los Angeles or Berkeley probably costs ten times more than in Merced and off campus rents are no doubt a lot different.

You'd be paying for rent and food whether you're going to college or not.

Of course, just exclude room and board.

The Brookings numbers include dorm fees and food.

“Doesn’t change until your income exceeds $150,000” is telling. That’s the income of two teachers on Los Angeles, or a pair of nurses. Median income is $125ish, but I’d bet the median income of families sending kids to college is well over $150k. That’s the problem with these generalities. Most people sending kids to college are from well over the “danger zone” for increased college costs.

So most people are seeing much higher college costs. There’s a lot of suffering. I guess you can take the position that relatively modest families aren’t poor so they should bear these costs, but that seems overly cruel to me.

Yeah. I looked up the figure for $250K, which is about what my brother and his wife earn, combined. It's decent money even for Boston—it puts them in the upper middle class, though not by a lot (a couple of low six figure incomes is very far indeed from exceptional these days in blue metros). They're looking at about a 75% increase over where they'd be at that income in 1990 (for private unis) and about 40% for public.

I'm not suggesting we need get out our violins for people making solid six figure incomes in America. They generally live well! But college costs are a huge albatross for upper middle class (but non-rich) families, especially with more than one kid. I doubt either of my nephews will be able to attend a private university absent a lot of financial aid (unless they're crazy enough to take on a lot of debt, which I doubt), and this is despite the fact the my brother and sister-in-law are fairly aggressive savers. They're realistically looking at 400 grand for a private university...for each son...absent scholarship aid.

One of the things that makes it hard is the trajectory of parent incomes. Two teachers 20 years into their careers may well make over 150,000, but they sure didn't make that much when their kids were young. They had no way to pile up money in 529s. Almost no one can just shift 35% of income toward college costs on a dime (what affordability calculators expect), so everyone pretends those people making upper-middle-class incomes have always been upper-middle class, with giant college funds they started saving when Jr was in diapers.

Kevin do you expect the kids to live in their cars to save on room and board? What a tone deaf post this is.

The Brookings figures include dorm fees and meals.

So it has gone up substantially for those of us paying the sticker price. Many students are not getting scholarships or financial aid.

I bought my first new car in 1980 for $5,000, a shade more than the $4,800 it cost for a year of school (tuition, room, meals, fees) where I had graduated the year before.

The average cost for a new car now is $47,000, a shade more than the $42,000 it will cost for a year of school (tuition, room, meals, fees) where my son is headed this fall.

They're in the same ballpark.

That's anecdotal, of course. Not everyone will have the experience. But the biggest discrepancy in my example is that my son will get an education that is vastly better at a top UC school than the one I got an unremarkable private college in the Midwest.

$8000 in 1980 = $20,072 today, so both those prices doubled. But you can still buy a car for around $20K today and it will have a lot more engineering content and equipment including airbags etc. than a cheap car in 1980.

How much more do you get from college today than then? Obviously UC vs some small college someplace is not a good comparison. But most high school graduates can't get into a UC either.

How much more do you get from college today than then?

A lot. Much of the value of college cannot be measured in dollars and cents (the experience itself, plus your options in life are much greater with a degree), but in economic terms alone it's worth it. Later in life, average wealth for college grads tends to be about 4x what it is for non-college grads.

But most high school graduates can't get into a UC either.

In California, you can get a first-rate and affordable education at more than 20 CSU/Cal Poly campuses. You can go to community college FREE for two years, then transfer to a CSU or UC, where transfer acceptance rates are in the 70% range. Private schools are very generous with financial aid for students without the means to pay the sticker price. Stanford's sticker is about $82,000, but for a family with income of $100,000 the actual average cost is below $10,000 per year.

College is not cheap. But with a few exceptions (Cal public schools), it wasn't generally cheap in the old days either. Many people can still make a good living without a college degree but career options are vastly greater with a degree, and in the long run getting a degree is worth it.

The question was not "what do you get from college", but "How much MORE do you get from college today than then"

Figure 1A shows tuition increases, even after adjusting for inflation, have hit everyone, but that it has hit the hardest at the highest income levels.

What was ~$12K in 1996 is now ~$19K in 2020 for those families with under $50K in income. That's a 58% increase in real dollars. That's not a lot?

College costs are relatively progressive in that there are essentially different prices based on your income. Very few goods/services I can think of actually do that. And this chart suggests that it is getting moreso as the delta between the sticker and actual costs increase, because it indicates more aid being given, which is more typically going to the less affluent.

Of course, the counter to that is that higher education should be something of a right rather than a privilege, but that is not going to happen.

College costs are relatively progressive in that there are essentially different prices based on your income.

Basically that's it. It's arguably a good system, but the weak link is "upper middle class but not rich" families. They get hammered by college costs.

For smaller schools, there's the need based aid then there are the various "scholarships" that go out. For the latter, those go out to people with more income and less need based support and are relatively small dollar amounts--more marketing (we think you're kid is special) to bring those kids in with the hope of increased donations later.

Not sure how it is now, but back in the day, "work-study" was a significant component of aid packages. That wasn't always viable, but always counted when places calculated how much you'd have to pay.

Ok. If that's the definitive measure for actual costs over time, then why is there so much debt being carried by students? What is the difference in student debt carried now compared to the past?

A lot of reasons, I think, but a place to start is that the net cost tool shows public-college costs for 2020 in the range of 1/3 to 1/4 of family income for the lower income ranges. It shows costs plateauing at a little over 29,000, which gets under 1/4 of household income at about 120,000, and of course decreases as incomes rise (as presumably will disposable income).

The net cost for a $100,000 family is 26,000. How much of that will come from free cash flow? Depending on factors like how many other kids, basic cost of living, etc, maybe 5-10,000 for a real pinchpenny family? No real idea here, I'm spitballing, but the point is that even when you look at the net cost, there's a big gap to be covered between that cost and the family's available cash flow.

The same calculator says the net cost for an equivalent $50,000 family in 1995 would have been 12,500. About the same proportion of income, but adjusting for inflation means the number of dollars is halved, so even with the same cash flow pattern, the borrowing will be double in nominal dollars. Which is what lenders and borrowers deal in at any given time.

(Had to use futureboy.us for the adjustment because my browser won't connect to my preferred measuringworth.)

IOW while college costs are inflation-adjusted, I don't see any indication that incomes are also adjusted; the author's technical note says he took the numbers from FAFSA forms. Showing inflation-adjusted costs relative to inflation-adjusted income seems like it would be a harder graphing task.

The writer states that, “All dollar values are inflation adjusted and represent the price level in 2023.” I think “all dollar values” would include income.

I missed that on a quick read, thanks. Honestly though I'm not entirely confident it applies to the income figure because that sentence ends a paragraph on how he differentiated costs of different types of colleges. His next graf discusses how he estimated income without mentioning inflation adjustments. He may have adjusted, and I think it would be better if he'd been explicit about that point.

Still, whether he adjusted or not doesn't change the fundamental effect of borrowing in nominal dollars at a given point in time (which I'm sure you appreciate but I want to be clear for anyone whose eyes haven't glazed over yet). Kevin's $100,000 family today is looking at a family cost of about 26,000; the equivalent family in 1995 was looking at about 20,000, assuming he did adjust incomes. But that's 20,000 in today's dollars. Price levels have roughly doubled since 1995, so in 1995 dollars they'd have been looking at about 10,000. So the nominal amount of whatever they ended up borrowing would be smaller than if expressed in today's dollars.

Put another way, inflation means that even though we're looking at a similar proportion in 1995 and 2020, it's calculated against a bigger number as time and inflation move on. By 2020 all the numbers, except the proportion, are about double what those same numbers were in 1995.

I think that gets to samgamgee's original question about why there seems to be so much more debt. We borrow nominal amounts that don't get inflation-adjusted for the term of the loan (if I borrow 30,000 today and pay it off over 30 years, the papers will all still say 30,000 when I'm done). So even if the proportions are identical in 1995 and 2020, inflation means the nominal debts will be about twice as big.

Pingback: The cost of college has barely changed in the past 30 years – Wesleyan Class of 1972

With what appears to be an absolutely straight face, Kevin posits that a yearly cost of college is $33K on a family income of $100k is somehow "not out of control."

Perhaps a new definition of "out of control" is needed. You can all pick your year, but when college (a) cannot possibly be afforded by working your way part time through it as a student, and (b) ......... well, how about that statistic that 50% of the population cannot afford a sudden expense of $500, and now, again, with a straight face, you are going to add $32,500 on that?

For me, by 1990 things were already slipping. It has been too expensive for a generation. Run it to 1980 and before.

Okay but surely a family income of $100,000/year puts you in the top 5% of Americans, right?

"... top 5% ..."

Top 38% actually. See here .

Okay but surely a family income of $100,000/year puts you in the top 5% of Americans, right?

Where do you live, Walton's Mountain? LOL.

What this also shows is that all the scholarship and other aid programs, government and private, implemented in the past 30 years have produced no net financial benefit to students or their families. All the benefit has been captured by the universities--meaning, since they have no shareholders, their employees.

In terms of real cost, is that after all aid, including loans, has been applied? I've never been able to tell if the cost is 'reduced' by saddling students w/ huge loans, or if it's real aid, where real aid is grants, scholarships, & discounts.

16% up is not "barely changed" (since the figure is inflation corrected!). It means that college costs have been rising above inflation, just like health care. Every year not very much but every year adding to exponential growth.

I don't actually understand the existence of "sticker prices" that allegedly nobody pays. What's the point? To put students and parents through a stressful jump-through-hoops ritual before ending up with the non-sticker price?

I haven't worked in higher ed, but people I know who do (did) tell me the "sticker price" is very real for really wealthy families, who are highly sought, and for most foreign students.

Also, private universities that don't have multi-billion-dollar endowments may be much more expensive for most students than Ivies, who can provide a lot more aid.

So, if this finding is valid, does this mean the public college presidents who claim that governments have been eviscerating education by cutting funding of their universities were ... wrong?

What a misleading post.

Kevin carefully selected the best case scenario to arrive at only a 16% increase (actually inflation + 16%) and simply declares that 16% +inflation just isn't that much, case closed.

But there's 2 problems.

Inflation + 16% is a sizeable increase, especially if your in an industry where income hasn't kept up with inflation over the years.

The increases are much higher than 16% in most of the other scenarios. Public college @$100,000 income is up 29%. Private college @ $50k is up 24%. Public @$40k is up 45%.

Kevin knows this, he's just lying. Kudos for providing the link, but the conclusion is ridiculous.