I have had my mind blown. Over at National Affairs, Dan Currell says that college tuition hasn't actually gone up over the past few decades:

In the late 1980s and early 1990s, colleges discovered that the appearance of high tuition was good for marketing. Positioning one's school as "almost as expensive as Harvard" created a sense of exclusivity and, somewhat contrary to economic theory, resulted in increased applications.

....Of course, almost nobody was willing to pay Harvard-level tuition for a middling college education. Colleges resolved this problem by canceling out their high sticker prices with "institutional scholarships" that had no money behind them; they were simply the discounts a school had to offer to convince students to enroll....Throughout the 1980s, colleges kept publishing ever-higher tuition numbers. Meanwhile, the tuition students actually paid rose only slightly.

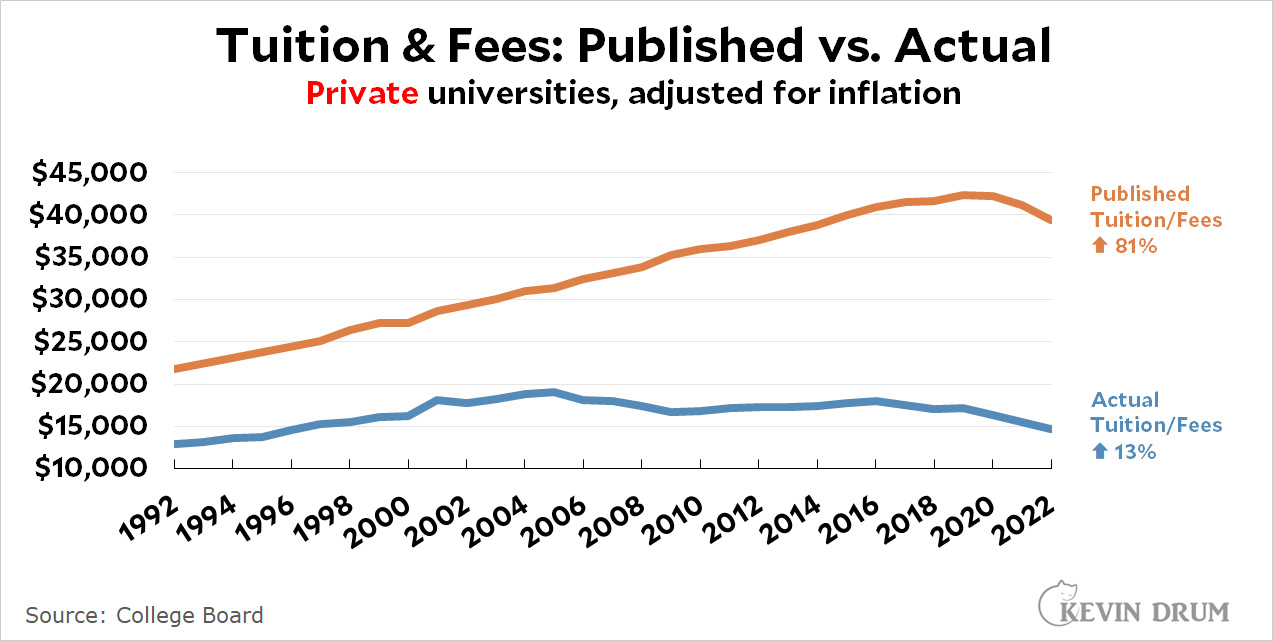

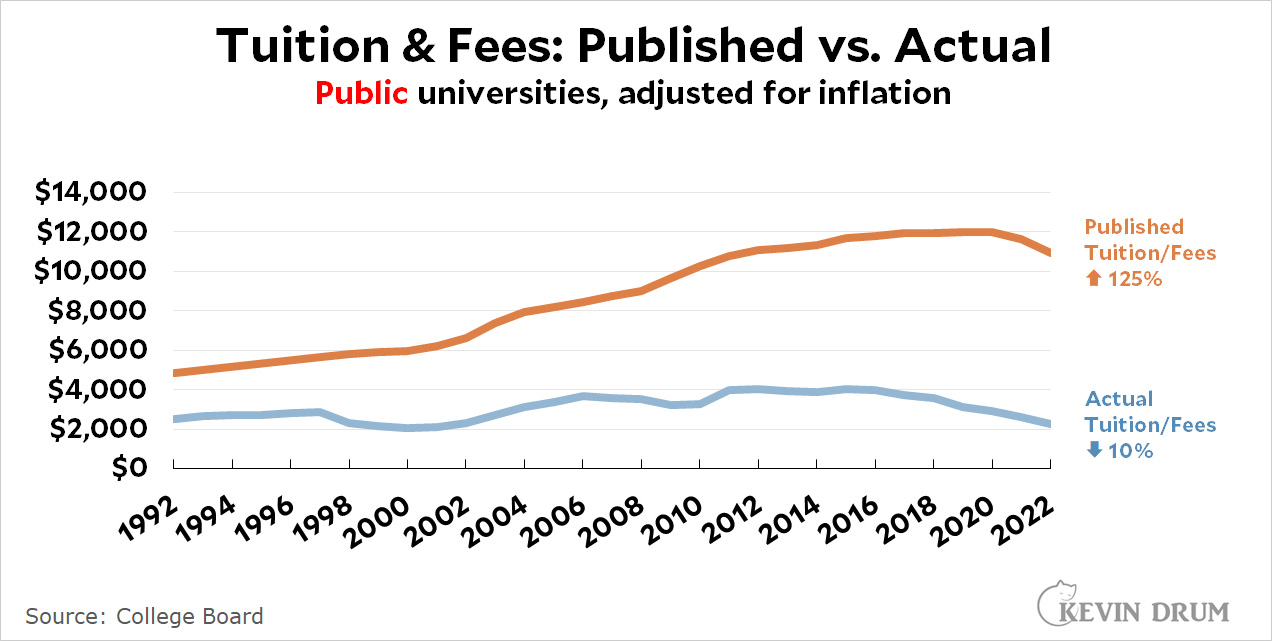

Naturally I was skeptical. But sure enough, every year the College Board publishes a report called "Trends in College Pricing," and right out there in the open it lists both the sticker price as well as the actual tuition that the average student pays. Here it is for public and private schools:¹

Now, some students do pay the full list price, but this is mostly limited to affluent kids going to the very top schools (Harvard, Yale, etc.). The vast majority of students pay far less than the published price thanks to "grants" and "scholarships" that are actually just routine discounts from the list price.

Now, some students do pay the full list price, but this is mostly limited to affluent kids going to the very top schools (Harvard, Yale, etc.). The vast majority of students pay far less than the published price thanks to "grants" and "scholarships" that are actually just routine discounts from the list price.

And once you account for that, the real-life price of college has barely changed over the past three decades. Since 1992, private school tuition has increased 13% while public school tuition has decreased 10%.²

This is so contrary to everything I've read and heard my entire life that I'm not sure I believe it. But the numbers are right there. In terms of what the vast majority of families actually pay, college costs no more today than it did in 1992.

¹The 1992-2005 figures are from the 2007 report, adjusted to 2022 dollars. The 2006-2022 figures are from the 2022 report and are also in 2022 dollars.

²Keep in mind that this is solely for tuition and fees. It doesn't count either books or room and board, both of which have increased at a higher rate.

This is bullshit. The college board has a vested interest in reporting that everything’s a-ok at the nation’s colleges, because otherwise we might start to question if all the shit colleges spend money on to get good rankings is really worth it.

Anything's possible, but these findings personally strike me as highly intuitive. And they should be check-able. College rack rate tuition isn't secret information, and the finances of such institutions are subject to disclosure via Form 990 (required by the IRS for non-profits). In any event the article, which I've just skimmed, seems credible.

The room/tuition/board/books situation, I'll add, bears looking into it. I'd be surprised if these revenue sources aren't being pushed to the max.

Jasper, how can you doubt Austin? I'm sure he has all the facts, completely documented. At some future time, he will undoubtedly publish (at a minimum) the links to his sources and his data.

This is hardly a surprise to anyone who works in higher education. For decades, "sticker price" has gone up faster than inflation, and financial aid (however it is packaged or described, but in essence just a discount) has gone up right along with it, as each institution tries to keep itself attractive and affordable to the same cohort of prospective students that it attracted in the past. The hard part for those who market the colleges has been to get prospective students and their parents to focus on the net, not the list price.

I can not dispute the data presented, but I do not believe this information presents the full picture.

'

1. The price of ancillary services (rooms, food, books etc) is not included (I THINK). This has increased rapidly.

2. The 'discounting' is hidden at the point of application. The up front, sticker price, can change decisions to apply.

3. The majority of the 'discounting' flows to the lower third of folks on the income ladder. Meaning, the chart appears to use averages. The real cost of college for many middle income and moderate upper income families is much closer to/or at the published price....IE college is very expensive for many middle income, and some upper income, families.

The 'discounting' is hidden at the point of application. The up front, sticker price, can change decisions to apply.

Yes, the discounted price isn't revealed pre-application, because they don't offer the same amount to everyone. You generally can't get a discount (aka "a scholarship") unless you first apply. What's your point?

IE college is very expensive for many middle income, and some upper income, families.

I'm not seeing the claim that college isn't expensive—only that tuition inflation hasn't been as pernicious as often cited because the figure quoted doesn't reflect widespread discounting. But the view that "college is eye-wateringly expensive" was nigh universal in the early 90s, when Kevin's charts begin. So, even if tuition inflation has been exaggerated by the failure to reference discounted prices, this wouldn't itself mean college isn't pricey—only that college hasn't gone up in price quite as much as we feared.

And yes, of course, given the fact that there are something like 20 million college students in the United States, clearly not all of them are getting a nice discount. Inevitably the number who are paying full fare is substantial in absolute terms (even if a sizeable majority aren't receive a discount).

That seems unlikely. You can't get to a factor of 5 difference even if the lowest one third are getting in free!

I agree that an organization concerned about transparency would be providing histograms, not just averages; but the difference is so striking there has to be something real to it.

(And don't get me wrong; I'm absolutely not defending it. I will laugh myself sick the next time a college requests help from anyone and doesn't get it because they've been trying so hard to present the image that they are richer than Croesus...)

I can only say anecdotally what I have seen. I went to a UC in the 1980s. The cost was about $1300 per year for tuition, and another $3500 per year for the dorms. My parents paid for me, thankfully. I went to law school afterwards to a private law school in the early 1990s. The cost was $16k per year. My parents were well enough off that there was zero aid, so I had full tuition.

Fast forward to now, when my kids are in college (or graduated). I am paying back the gift my parents gave me by paying for their college, even though I don’t make as much money as my parents did. But as a professional living in Los Angeles, my salary isn’t small, but I’m a public sector lawyer, so I’m not exactly killing it with the cost of living in Los Angeles. Trust me, zero complaints, life is good. However, I, and all of my friends in my position, fall into that area where we basically pay full fare for college.

Cost of UC now? $32k per year (that’s up from $5k when I went in the 80s). Cost of a private law school now? $70k (that’s up from $16k when I went in the 90s). Pretty much all of my friends are in the same position - there is no assistance at our level. I’m very happy to pay it forward, and to ensure that people who struggle don’t have to bankrupt themselves for college. But even had I not been fortunate enough to have my parents pay for me, I would have been fine. My 4 years of undergrad and 3 years of law school would have cost a total of about $75k, which means I could still have been a public sector lawyer. Today? This would cost my son $330k to replicate? What chance would he have of working in the public sector or doing something that doesn’t require a huge paycheck? It pushes people to have to choose something in finance or the like rather than having options like I had. And having a huge anchor around his leg getting started that he may never get rid of. Imagine having a huge mortgage to pay when you start life without even having a home!

So while the cost may have gone up only marginally for the AVERAGE person, it has gone up exponentially for the MEDIAN person. And it’s outrageous.

So while the cost may have gone up only marginally for the AVERAGE person, it has gone up exponentially for the MEDIAN person. And it’s outrageous.

This is a really important point, I think. Back in the day, upper middle-class and affluent households also paid full sticker price for college, but it wasn't insurmountable and lower-income folks got financial aid for the rest. Now lower-income students still get financial aid, but the amount wealthier families have to pay has gone way up. Add to that a growing overall wealth gap esp in the US and you have, yes, an "average" group for whom tutition hasn't gone up all that much, a small group of ever-wealthier people who can pay cash and don't care, and that upper middle class group who can't just pay up front anymore, but also get little or no financial aid/tuition discount.

I'll also add that tuition/fees generally only comprise about 1/2 of what it costs to send a student to college. There's also room and board, aka living expenses. That's one thing at Iowa State, and a whole 'nother at UCLA or NYU. Even if you get a tuition discount, nothing covers room and board. Except for student loans, natch. And *this* is where most people get in to debt.

From experience this sounds very accurate. My tuition was 900 and room and board 3000 at SUNY Albany. The experience of friends tells a different story. SUNY still a great deal but not one as good as mine.

At the UCs and Cal States, tuition is less than half of the cost. At UCLA (for which I have been paying tuition), tuition is about $15k, and dorms are $17k. You’re right, there is a lot of aid for a lot of people that really cannot afford it, but when you look at the percentage of my present income my tuition would’ve cost back then vs. the percentage of my present income I pay for my kids now, it’s just a huge difference. Same thing, even more, for people going to private schools. A bunch of my friends that I work with, who make the same as me, get zero aid for sending their kids to expensive private schools with zero aid. Even public schools outside of California cost them $55k per year all in.

I'll echo this as I have basically the same story - went to a state public university in the 90's & tuition was ~2k a semester, for my kids going to the same university today it cost ~8k a semester. Housing is outrageous, books now are exponentially more expensive with much less return when & if they can be sold back, and there's a whole new slew of fees that didn't exist when I was there.

Your numbers mean nothing because they are not corrected for inflation or income. Using the CPI numbers from FRED (for example) inflation correction is simple arithmetic, but there are calculators that will do it for you:

https://www.usinflationcalculator.com/

Correcting using median, average or percentile incomes (same type of calculation) might be more pertinent than using prices. But if you can't do these calculations you probably should not be making claims about national trends.

Fair enough. I paid $260/q in '75 for UCLA (adj. $1400 today) from a middle class home, I did NOT get (or could qualify for) Cal State scholarship (as my brother did, who went to LMU.) My father remarked that it was cheaper than my private, prep school high school - Loyola Los Angeles (Go Cubs!)

It was specifically NOT tuition but fees - I hear that tuition was introduced by (the GOP anointed) Saint (then Governor) Reagan right after me (BA '79) and we were off to the races. IMO CA should work very very hard to get back to no-tuition Unis or at least what was the Cal State Colleges (I hear they are all UC now?)

I also question the charts esp. with all these claims of vast student loans - who are taking them? Middle class kids squeezed as noted above?

Reagan’s term as Governor ended in 1975. You can’t really compare your experience because the time period Kevin is using begins in the 90’s.

I went to State University in the early 70’s and there was tuition, but it was very low. Less than $100.00 per semester. I suspect you also paid tuition if you went to UCLA.

We all have our anecdotes, and here is mine... I have 2 kids, one just graduated and one still in. It turns out that except for the elite schools, by and large, college Tuition prices are like SHOPPING AT KOHL's. Not a single school my kids got admitted to did not offer discounts of some kind. And we did not need discounts.

A lot of schools admit most reasonable applicants but make their REAL decisions based on how much financial aid they give out to the various students, with no small part of that geared towards improving their standings in US News rankings. Parents often have the option of sending their kids to higher status schools for more money or lower status schools for less. A lot of us parents literally see it in those terms and make our choices accordingly.

+1

In America getting a number for your college tuition or understanding how much you should pay for medical care (if uninsured) is worse than buying a used car. (Apologies to used car salespeople)

I recently had an ultrasound was billed $3900 insurer paid $900 with a $50 copay. If uninsured I would have had to start negotiating (if I was aware of the need) at $3900.

Similarly in sending a kid to college. We were in the in between group not wealthy but two people with good jobs. We stretched, borrowed and paid the full fare for Stanford and Vassar (in the 80’s) unaware that we should have negotiated.

I had a better experience buying my Subaru.

I'm a first gen college graduate. Since there was no one there to tell me better, there were a lot of financial lessons I learned along the way. Given the cost of those lessons, believe you me, they stuck. But my daughter was second gen and learned from my mistakes. Call this the hidden cost of entering the educated class.

We stretched, borrowed and paid the full fare for Stanford and Vassar (in the 80’s) unaware that we should have negotiated.

Can one actually negotiate with many schools? I doubt with Stanford that's an option. You hope they give you a nice discount, sure. But if you don't like the price post-discount, there are a hundred other families willing to take your slot.

The government has tried to make this reality more transparent, but people still refuse to believe there is steep discounting going on.

Pick a college, any college, and Google "cost of attendance name of school." You'll see just how huge the difference is. For example, if you pick little Beloit College in southern Wisconsin you can see that the billed price (tuition plus room/board/books/etc) is $67,000, but the average cost after aid is $17,000. For families earning above $110,000, the average cost is $24,000. This is not at all unusual for private colleges.

For public schools you have a bit of bifurcation: flagship universities are often a bit more expensive, but lower tier universities are less pricey, and community college has seen its prices slashed (of course, there is state-by- state variation).

The move toward more for-profit universities may also play a role in people's perceptions. They often have lower sticker prices, but few discounts. They also tend to have lower income, first-gen students. That means their students are likely to be paying more than they would at another institution, and the higher costs are rolled right into student debt.

Graduate school does seem to have had pretty big price hikes, and those generally aren't softened by scholarships. Housing is also more expensive for college students, along with everyone else.

If your parents are earning less than $150,000 and willing to go to a school just a smidge below the top school you qualify for, you can get a pretty good deal. Especially if you live at home or pack into a tiny apartment with lots of friends. If you have really well-off parents, go to the most exclusive school you can, and live in a fancy new private dorm, it'll be expensive.

Adjusted for inflation, average student debt at graduation in 2000 is basically the same as in 2020. Undergrad hasn't really gotten more expensive for most, it's just that wages for average people suck more now than in the past, and college grads tend to live in cities with expensive housing.

Of course there is also the media, which loves to highlight sticker prices and the giant debt loads of people who went for a "dream school" that wasn't going to offer them any scholarships. Add on the people who also borrowed for grad school and you've got your story about ballooning debt and high prices.

Tell that to those with over $100,000 in college debt. They are there and are real.

Of course there are people with high debt loads. Those people existed in the past, as well.

I know someone who took on a lot of debt to get a Masters degree from Harvard in Education. Others have gone to very expensive law schools. It's hard to find someone leaving medical school with less than a hundred grand in debt.

Someone else I know took out loans to go to a for-profit college, dropped out, and then refused to pay back her loans because she was angry at them. Her debt ballooned.

It isnt hard to end up with over 100,000 in student debt. It is very easy if you go to grad school. You can also choose to pay extra for an elite institution. But there are much cheaper options for undergrad that the vast majority of people can utilize, leaving most graduating students with far lower balances.

Looks like the "Trends in College" pricing is giving average out-of-pocket expenses. The discounts include federal grants, tax credits, etc., along with in house "scholarships".

An interesting take can be found here--scroll down and they give a debt to income ratio for new grads over time (peaked in 2016, but still higher now than start of table in 2004).

https://educationdata.org/average-student-loan-debt-by-year

States are giving less aid to their universities, but federal money shot up a while ago and has been holding steady. I have come across various articles over the years, but didn't save them. One discussed how state universities admit more international (read from China) students because they pay full out of state tuition. Another discussed how colleges use "scholarships" to try to lock in admitted students from upper middle class families, i.e. ones that will be able to pay. Lower income students would require more scholarship money, else they'll drop out because the financial strain would be too high.

Admissions offices use very complex algorithms to select an incoming class that contains just the right mix of rich students paying either full fare or some kind of discounted rate and lower-income students who will need substantial financial aid. One reason colleges like legacy admissions is that they're usually from better-off families and it makes those calculations a bit easier.

From some previous discussions around an article on this topic it seemed States were giving more money overall, but less per student. As enrollments ballooned, the States weren't keeping up and it showed up with Students increasingly having to take Fed loans to cover the gap.

Based on my personal experience, this is utter bullshit. Being comfortably middle class (good job, house in suburban NY, 401K, ect) my kids were not eligible for any financial aide based on my income, and would only get scholarships (discounts) from colleges that they were somewhat overqualified based on grades/SAT. My son graduated from Penn State in 2011 and tuition plus room and board was at least $35K per year, which was materially higher than tuition for Pennsylvania residents. His options at NY State University schools would have been about $17K less per year, but we viewed that his job prospects in engineering would be better with a degree from Penn State.

We were lucky that I was well paid enough, at the time, to fund the $140K total amount without needing student loans. My experience was similar to other folks we know with a similar economic situation. We all paid through the nose to get our kids a college degree.

I suspect you badly underestimated your in-state options for engineering education. Many of the SUNY campuses have excellent STEM reputations.

One never knows for sure, but Penn State has an enormous number of engineering alumni and did significant on campus recruitment. By early spring 2011 (with the world still recovering from the great recession), he had multiple offers and his employer was specifically trying to recruit from the Big Ten schools. His first boss was a Penn State alumni.

At the end of day, SUNY would have cost about half, $70K, which is still vastly greater than the BS numbers Kevin is showing. I went to SUNY Stony Brook, because my parents did not have the money to send me elseware.

Based on my personal experience, this is utter bullshit

The data don't appear to agree with your personal experience, nor do the data deny the existence of people who are getting shafted.

What it means, though, is if you reach outside your class, you're highly penalized by the sticker.

I dropped out because without these 'discounts' I couldn't afford university. My sister made it through, though, getting a 'scholarship' which brought it down in cost.

As an aside, if a car dealer did this in California, it would be illegal. Why is it legal for schools to do this?

Car dealers don't engage in discounting? News to me.

This is good to know: College has not gotten more expensive if you manage to attend without eating, buying books or sleeping in a bed.

Hurrah!

Yep. From the University of Virginia website. For in-state students:

"The personal expenses estimates shown below reflect modest and restrained expense allowances for University of Virginia students. "

Estimated non-tuition expenses:

$18,492 (Housing $7470, Food $6470, Books/materials $1480, Personal expenses $3000, direct loan fee $72)

All the posters saying "I could afford to pay full price for my kids, so this data is false" may have missed that this statement doesn't invalidate the original information on its face, especially if you were opting to send children to more expensive places because of their reputations. I am dubious of the original claim that everyone raised tuition purely to avoid looking like the "cheap table wine" of colleges, but that doesn't mean that actual, paid tuitions may average to be much lower than the sticker prices for many students.

I'll also point out that the more expensive schools (I see Harvard, Penn State, and the UC system mentioned in comments) would have started out higher in 1992 and a 10% "real" increase on a $40,000 a year tuition is $4000, which is four times as much of a difference as a school which started at $10,000 a year in '92. So if you're using raw dollars and not percentages, and you're picking schools that were high to begin with, the sticker-shock will be real even if they match the charts Kevin provided.

I am suspicious of the 1992 start, also. I did find data suggesting that high school-to-college attendance leapt from 45-52% in the 60s and 70s up toward 60% starting in the mid-80s. For women in the 90s, it was more like 70%. Is comparing 92 to now doing an apples to apples comparison because the pool of students attending college is more similar? Hard to tell.

The National Center for Educational Statistics has some data, but all the dollar amounts are either not adjusted for inflation or, in one table, is all expressed in 1994 dollars. So there's no easy way to cross-reference.

It seems completely unfair to demand colleges and universities provide full aid or lower their tuitions because they are located in places where it is expensive to live: after all, that increases costs for the schools because the same is true for their employees. If someone wants to attend a school in an expensive city, that school is going to be more expensive on average. Similarly, a system where wealthier parents have to pay less than poor ones to send their kids to college might sound equitable if you're wealthy, but it isn't.

Let’s grant that this is true:

“In terms of what the vast majority of families actually pay, college costs no more today than it did in 1992.”

That would nevertheless seem to lead to another important question: was college already too expensive back in 1992?

That would nevertheless seem to lead to another important question: was college already too expensive back in 1992?

Yes. Very expensive.

So the country is suffering from a nationwide mass delusion? College isnt getting more expensive, its actually getting cheaper.....only nobody realized it.

The article doesn't claim college hasn't gotten more expensive. It claims actual tuition paid has gone up by about 13% for private universities in real terms, after accounting for discounts, (and about 10% for public universites). Thirteen percent by defnition is "more epensive."

And the cost of other fees—most importantly room and board—may have increased by more than 13% (I'd guess this is definitely the case, but I haven't looked into it).

So yes, college is more expensive than it was thirty years ago, though perhaps not by quite as big an increase as many suppose.

Three points here.

First, cost of living has skyrocketed in many/most cities where colleges and universities are located. I paid $200/month rent for a shared house when attending college in Portland in the 1980s. Try to find that today.

Second, average and median are not the same thing. And I suspect that the majority of people with really crushing college expenses and debt are from families that are above median or average income and for them, college costs have not been stable

Third, a lot of financial aid is in the form of loans, not grants. I suspect these numbers are being distorted by student loans which are just deferred payments not price discounts.

Wait a minute. The College Board considers a loan as a reduction in actual tuition cost.

This seems a very misleading. Very dishonest.

Given this, I would be pretty skeptical of the entire report.

yeah a loan is not a discount.

On the other hand my daughter graduated from my highly rated small college last year. My dad (airline pilot) paid $10k per year in the early 1980's for me. I (widower with good IT job) paid about $30k per year 2018-20 for my daughter. $10k in 2023 dollars is about $33k, so college got cheaper in our scenario. List price at the college is now $76k.

The College Board considers a loan as a reduction in actual tuition cost.

You have a cite for that?

The College Board puts out a report on this and provides some details as to what is included in their calculations. Go find the 2022 .pdf report.

All I know is that my students today pay many multiples of what I paid at Georgia Tech in 1977. I wonder what it looks like if you extend your time series backward?

It wouldn't surprise me if, say, 1977-1992 saw a bigger jump in actual tuition fees (including discounts) than the period after. This would be similar to healthcare: everybody seems to "know" healthcare costs are galloping every upwards, but in fact they've been stuck at a very high level for the better part of two decadies (about 18% of GDP).

Pingback: College tuition is about the same as 30 years ago – Kevin Drum

My daughter got $20k per year off her U Penn tuition last year just by asking, after accepting (Masters in non tech degree) You could have knocked me over with a feather.