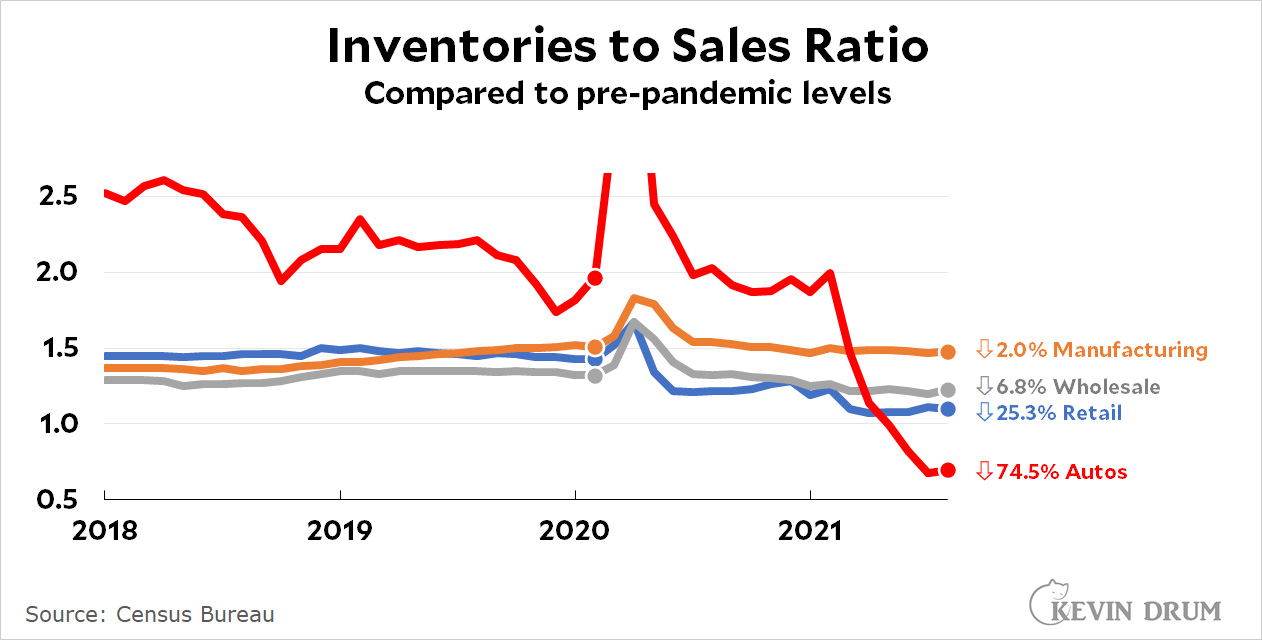

A big component of inflation is consumer demand outstripping supply. One way this shows up is in a low level of inventories compared to sales volume. Here it is for four categories of goods:

As you can see, manufacturing is in good shape, and inventories of durable goods are especially strong. However, retail inventories are down substantially and auto inventories have fallen off a cliff. Overall, business inventories are down about 11%.

As you can see, manufacturing is in good shape, and inventories of durable goods are especially strong. However, retail inventories are down substantially and auto inventories have fallen off a cliff. Overall, business inventories are down about 11%.

If anything, inventories ought to be rising at least a little bit during an economic expansion as corporations get increasingly confident about their business. But that isn't happening this time around due to supply constraints. Combine that with a big slug of money pumped into the economy at the beginning of the year and you get a big slug of inflation. When inventories catch up to demand and all that money has been spent—both of which are certain to happen—inflation will settle down.

Of course this is exacerbated by the recent "just in time inventory" fad. Stupid is as stupid gets or something...

Hey! "JIT" works just great.... when it works. No warehouse needed! Get your component parts from all over the world! Keep costs low! Stock prices and executive compensation high! Which, after all, is what business is all about: maximizing the reward to the "suits."

The fact that little economic, weather-related, or other glitches can cause the whole system to crash down in flames -- well, it probably will never happen.

So, just how much of what (component) inventory should be kept on hand at all times? Two weeks? Two months? Two quarters? Great if you've predicted what will sell accurately, otherwise, it ends-up being a waste of resources, money and emissions.

Rick-

Big ticket items - washers, dryers, fridges, stoves along with autos are kinda hard.

Smaller items are easier.

But JIT refers to parts that go INTO that finished product doesn't it?

Looks like meat producers are playing shenanigans

https://www.reuters.com/business/meat-packers-profit-margins-jumped-300-during-pandemic-white-house-economics-2021-12-10/

You know, the same fine folks that management took bets on which employees would catch covid.

because they can....

Inflation will drop, but don't expect prices to actually drop. The price increases will be sticky...

Someone on another blog posted that business profits were way up too.

But with the exception of gasoline golack is right prices will NOT come down. Our businesses have learned to price what the market can bear.

Businesses ALWAYS charge what the market will bear, during times of falling prices just as much as during times of rising prices. At the moment, demand is high enough that the market will bear somewhat higher prices than it would have a year ago. If demand slows "what the market will bear" will begin to decline.

Looks like inventories to sales was already dropping in automotive prior to the pandemic. Recognition of the cost of having too much inventory, or has the industry been cyclic in that regard going back before 2018?

Shrunken real corporate profits. Auto inventories were at a decade record supply. Business cycle was looking weak.

From one of Kevin's favored sources - FRED - showing US Automotive inventories going back to 1993: https://fred.stlouisfed.org/series/AUINSA Suggesting a sustained, though not monotonic, downward trend back to 1993 (as far as their data go).

And FRED seems to have ratio data too: https://fred.stlouisfed.org/series/AUINSA

OT, and it is the metric no longer in favor with Kevin after he'd used it for the better part of two years, but the 51 highest 7-day trailing averages of deaths attributed to COVID-19, per-day, per-million:

Rank Population (Millions) Country Deaths/Day/Million 7-dav Avg

1 9.68 Hungary 19.28

2 1.39 Trinidad and Tobago 14.95

3 4.13 Croatia 14.53

4 5.46 Slovakia 14.14

5 7.00 Bulgaria 14.08

6 4.00 Georgia 13.33

7 10.69 Czechia 10.58

8 37.89 Poland 10.57

9 3.30 Bosnia and Herzegovina 10.00

10 43.99 Ukraine 9.72

11 10.47 Greece 8.98

12 1.91 Latvia 8.39

13 145.87 Russia 7.94

14 2.08 Slovenia 7.70

15 2.76 Lithuania 6.63

16 2.08 North Macedonia 6.45

17 8.96 Austria 6.11

18 2.96 Armenia 5.94

19 4.04 Moldova 4.98

20 19.36 Romania 4.73

21 8.77 Serbia 4.49

22 444.97 EU 4.45

23 83.52 Germany 4.38

24 11.54 Belgium 4.17

25 512.50 EU w/o Brexit 4.10

26 329.06 US 3.87

27 1.33 Estonia 3.77

28 10.10 Jordan 3.62

29 17.10 Netherlands 3.54

30 8.59 Switzerland 2.58

31 4.88 Ireland 2.37

32 83.43 Turkey 2.33

33 96.46 Vietnam 2.29

34 17.37 Ecuador 2.04

35 10.23 Portugal 1.87

36 10.05 Azerbaijan 1.79

37 67.53 United Kingdom 1.77

38 9.45 Belarus 1.74

39 5.77 Denmark 1.71

40 5.53 Finland 1.58

41 65.13 France 1.57

42 127.58 Mexico 1.44

43 6.86 Lebanon 1.44

44 32.51 Peru 1.42

45 60.55 Italy 1.40

46 31.95 Malaysia 1.31

47 108.12 Philippines 1.29

48 6.78 Libya 1.26

49 18.95 Chile 1.21

50 5.38 Norway 1.14

51 51.23 Korea, South 1.12

Question - I would think, that absent scrapping of product, the Inventory to Sales Ratio would need/want to have a long-term ratio of 1.0 no? If it stays consistently above one, doesn't that mean inventory stacking-up somewhere?

No, inventory is a stock level (#units), and sales are a rate (units/interval). It’s the production rate (how inventory gets added to) and sales rate that have to average to the same value over the long term. The other common measure is (inventory) ‘turns’, which is usually annual sales divided by average inventory. Inventory is also often measured in time units; for example, a retailer might have a ‘three-month inventory’, meaning there are as many units in stock as she expects to sell in the next three months. But it is still a count of units. In this case, turns are four.

I’m a fan of dimensional analysis (P. W. Bridgman), so I should have been careful to note that turns can be calculated as [annual number of units sold]/[average number of units in inventory], or alternatively, as [12 months]/[average inventory expressed as months]. In either case, you can see that ‘turns’ is a dimensionless number, as the measurements, units or months, ‘cancel’.

Tack. (Thanks)

Here’s a question I’ve had that maybe Kevin or readers can answer. Do inflation measures like CPI include sales? I’ve noticed in addition to price increases the frequency and amount of sale prices has been effected. A lot of products just don’t go on sale anymore, or if they do with a fairly lame discount. It’s hardly worth watching for a sale price even if I don’t mind waiting months to get something.

Supply shortages means business doesn't have to have sales to move inventory- they can sell all they want at regular (or higher) prices.

The CPI is based on the average price of actual sales over a specified period. It doesn't matter whether the product sells at "regular price" or "sale price".

So if a vacuum cleaner is $100 and goes on sale for $50 for half the month, then the price of that vacuum cleaner would basically be $75 for the CPI calculation?

In other words, even if the regular price doesn't rise, a reduction in discounts offered would reflect as inflation?

I think that would make sense if so, certainly there are some products I want to carefully select and don't mind paying full price for, some where I have a specific item in mind and don't mind waiting till the next seasonal sale period, and some where I'm after the best deal without caring who makes it. Those first two categories are where I feel like I'm paying a lot more lately. There aren't many deals to be had even if I'm flexible.

What it means is that Wall St. has won. Cut everything to the bone; labor cost, inventory, factories. etc because all that matters is "shareholder value"

And the CEO stock options.

By all accounts, the computer chip shortage is likely to persist for a couple of years. Among other things, that means that inventories of automobiles will not be rebuilt any time soon, and so the demand for, and prices of, used cars will remain high.