The Wall Street Journal has an update for us. A month ago they reported that average pay for CEOs of large companies had increased to $14.2 million last year. But now we have final figures:

The median pay package for chief executives of the biggest U.S. companies reached $14.7 million in 2021, setting a sixth-straight annual record as strong profits and robust markets boosted performance measures.

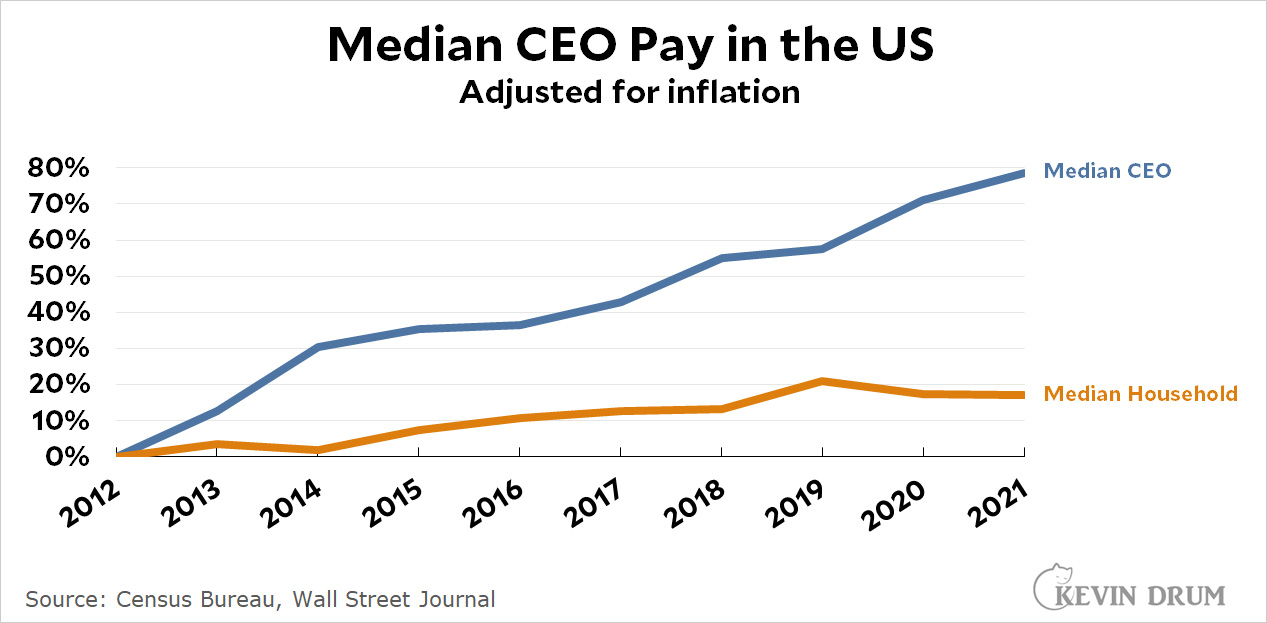

That's a mind-boggling increase of 110% over the past decade measured in nominal terms. As you all know, however, I'm dedicated to fairness in all things, even CEOs. This means adjusting their pay for inflation:

Adjusted for the ravages of inflation, CEO pay has gone up only 78% in real terms. So, you know, not really all that much. And I'm sure every one of them deserved it for coasting along with a long economic expansion they had nothing to do with.

Adjusted for the ravages of inflation, CEO pay has gone up only 78% in real terms. So, you know, not really all that much. And I'm sure every one of them deserved it for coasting along with a long economic expansion they had nothing to do with.

I asked myself what top line revenue growth is over the same period. A very quick search said about 6 percent per year, and a quick calculation shows this to be about 80%. So CEO pay is roughly the same as that. Earnings growth has been wildly erratic over the last 10 years, but is a bit higher.

So, shareholders and CEOs are sharing in this. There is no structural reason that employees can't too, but that's not what these guys are doing. A fundamental competitive attitude drives them to make more than most people and to surround themselves with the trappings of this.

But if they shared the wealth with the workers, they'd have less money...

As a stockholder I appreciate the earnings growth. As a customer I resent being treated like shit. Just got done sorting out a stupid problem with Bank of America. They could hire more representatives, but it's cheaper to just play a recording 24/7: "calls are unusually heavy, your call is important to us, please stay on the line for the next available operator".

That's why I dumped my checking account at a big bank years ago and moved all my non investment money into my employer's credit union and kept it there after I left. Not all credit unions are the same, you have to do your diligence some are as bad as big banks but the smaller ones are very good.

The shift to stock-based compensation continues to keep on giving…

Stock-market boom was very good for them.

At the end of 2012 the Dow was at 13,000 and change. It’s now north of 32,000. With the shift towards stock-based compensation it’s no wonder their take/home has thusly grown.

I've always though the real shame was that regular employees don't get some stock-based compensation, except into their retirement plans and the rare ESOP.

In Buffalo yesterday, a mass shooter recorded his rampage live on "social" media.

But according to Kevin, social media is in no way responsible for social and political dysfunction in America.

I invite Kevin to apologize for his grossly mistaken opinion, and acknowledge reality on this issue.

Let's see: Ted Kaczynski mailed his manifesto to several media outlets. Ergo, the US Postal service is responsible for social and political dysfunction in America.

Smarter trolls, please.

I also disagree with Kevin about social media. With regard to Buffalo, I don't know that one incident proves much.

And, because social media is a training device, a Skinner box that encourages people to do outlandish things for attention in the form of likes, comments and shares. It's a behavior/reward system that trains users actively. It allows actors to reward behavior (with likes or views, perhaps by bots) with zero accountability.

Fox News, by contrast is passive. It reinforces certain views, yes. It propagates new outrages, but usually they are ones that were already found on social media. It does not reward behavior other than the behavior of turning on the TV.

One incident?! I must be in a recurrent nightmare!

you do know that mass shooting occurred in the days before social media.

Exactly! And there was rape before porn.

But according to Kevin, social media is in no way responsible for social and political dysfunction in America.

Kevin's thesis is that it is primarily Fox News (and not social media) that is responsible for the intensification of political partisanship in the US. You're making a claim from your own imagination. Also, the country has been suffering regular mass murders pretty much forever—certainly long before there was an internet.

I do think the mass media ecosystem contributes heavily to shootings like this. In this case the shooter sort of circumvented that somewhat by streaming on twitch, but without help in getting it publicized I don’t think most political murderers would bother

Hell, even John Brown only went nuts at Harper’s Ferry because he knew it would get people talking. I really wish we didn’t talk about these shootings much, it’s just encouragement. The old saying “just cause you ignore your problem doesn’t mean it’ll go away” is sort of reversed in this case. If we just ignored them i don’t think people would keep doing mass shootings. Granted, this is an impossible task, but it kind of speaks to the lack of a deeper issue here

Yes, Fox news. He is right about that. But Fox news and social media do not exist independently of each other. They interact. And the interaction makes the combination even more toxic.

I have realized that Kevin has a strong libertarian streak. Libertarians are famous for treating individuals as independent atoms which do not interact with other atoms. For example, they think people should be allowed to buy guns in whatever quantity they decide is necessary for themselves. A purely individual decision. We all know what kind of society that has resulted in.

By the way, when is the last time Kevin opined in favor of gun control? The word "never" comes to mind, but I seem to remember that long ago, at MJ, he was quite critical of it. Of course, he could prove me wrong by writing about it, but as they say, I'm not holding my breath.

The managerial class essentially took complete control of corporations - outside of the high/new tech industry - a number of decades ago.

They run the companies, handpick the members of the board of directors, and make all the key decisions.

There have been a number of papers about the rise of managerial capitalism, but little interest in reforming the system.

"The managerial class essentially took complete control of corporations…"

The actual work was outsourced. I have maintained my position all along that the wrong part of corporations was outsourced.

From what I have read, the rise of the modern stock company without charters began in the late 1800s, and with it the gradual replacement of proprietary capitalism with managerial.

(Speaking of the major elements of the economy).

For a while, the descendants of founders were able to exercise some influence, along with a smaller and more involved shareholder class. But,at least since the 1950s an insular, inbred, corporate culture firmly took control.

I wouldn't say that the work was outsourced, outside of some industrial sectors, the vast bulk of what we do and make is domestic.

Fortune magazine used to run a yearly article that reviewed large companies (Fortune 500, of course) and compared the pay of the very top executives to the returns to investors. I don't know if they still do that since I stopped getting them quite a while ago.

Basically, their investing advice back then was that you should look at an industry group and invest in the company that had the lowest paid executives in that group. They usually outperformed the rest of their peer companies. Maybe I should go to the local library and look back through the Fortune issues to see if they are still tracking that.

It’s surreal for someone like me to read an article like this

You are being robbed blind in broad daylight by your 1% with the help of their faithful Republican serfs in the Congress.

Not having a job is devastating but so is also having a job one cannot support one’s children with , a job that doesn’t come with any social status or social benefits

Being poor is a social stigma in all countries but the situation in USA is exceptional ever since the failed president Ronald Reagan managed to turn the lies of the “Welfare Queen” into a truth. Being poor is ,according to US right wingers , a choice and only lazy people are poor

It’s also become a truth among Republicans that if people are being paid livable wages will economy crash, you will lose your freedom and end up like Venezuela (or worse, as my disastrous Sweden)

It’s also a truth “over there “ that poor people should be grateful when benevolent billionaires are paying them as much as $7,50/hour

Labor markets are not about supply and demands it’s about laws and regulations. One can , in more civilized nations , find rules and customs protecting the small guy against being ruthlessly exploited by employers but such rules are nonexistent in USA and it’s unlikely such rules will be implemented in the future due to your nonfunctional political system.

Our political system has a problem in that it allows minority rule, at several levels.

Our political system has a problem in that it allows minority rule, at several levels.

It always has so, and the same can be said for virtually every country. We exist in pluralistic societies - divisions based on race, religion, education, and class.

Now the smart ruling minorities know better than to run roughshod over the rest.

Google democracy, it’s practiced elsewhere and it’s a beautiful way to run a country

<i?Google democracy, it’s practiced elsewhere and it’s a beautiful way to run a country.

Seriously? Do you believe that majority rule by popular vote, with respect to minority rights, is actually practiced?

That is no such thing as ruling elites even in the most advanced societies?

That social, economic, and political discrimination - enforced by the power of the state - doesn't exist everywhere?

A very American answer. Distrust. “The State “ (or the government, or Washington … or whatever one prefer to call some undefined amorphous structures that are scheming to suppress you)

Have a nice day

Touche'!

Hear, hear! Significant portions of the American electorate are easily misled by slogans and ranting about their "freedom", about "self-reliance", about how lazy "those people" must, absoluely MUST be, to not be comfortably well off. And racism.

Our increasingly poor educational system is partly to blame, as is the for-profit sensationalist media for which "journalism" is just an unnecessary expense. Ditto for toxic cultures in certain parts of the nation, which have endured basically since Europeans colonized the continent.

Add in jingoism, which precludes (in some minds) looking anywhere else for examples of what works and what harms. Because we're perfect! USA! USA! USA!"

By now, it's become obvious that the Constitution, with its baked-in minority rule via the Senate and Electoral College, desperately needs to be brought into the 21st century. Or even the 20th. But, because of this minority rule thing, changes can't be made. Well, change will be very difficult. Never say never.

The rules aren’t actually nonexistent; they are on the books, but the 0.1% have been successful at stalling enforcement (for example, the Senate refusing to confirm appointees to the National Labor Relations Board); and preventing the updating of the national minimum wage. There are state and local minimum-wage increases, but most still lag both productivity growth and inflation.

The US is definitely an outlier (along with the UK), but I was surprised to see that among the US, UK, France, Germany, Italy and Sweden, income inequality shows a recent, clear upward trend only in Sweden, though it starts from a low level. Very nice data explorer at https://data.oecd.org/inequality/income-inequality.htm

I keep seeing today that we should stop saying these people are mentally ill,

https://twitter.com/hugolowell/status/1525870115895627776

Yeah. if we keep doing that then we will have to contend with the fact that half the right-wing commentariat is in the same boat.

And that genuinely needs to be addressed.

Pingback: CEO pay is up 78% over the past decade - SLRED - All The Latest News, Tips and Job Post!

https://time.com/5888024/50-trillion-income-inequality-america/

This article is pertinent to this. From the early 1940s to the early 1970s, the bottom 90% of households had between 60 and 67% of total personal income. This dropped during recessions, but the trend was upward. In 1970, you'd have expected the average to be over 65% by now. Instead, I believe in 2019 the bottom 90% had 49% of income.

Kevin,

You are incorrect that teh economic expansion is not the result of CEOs. It is 150% the result of CEOs, with "the guvmint [sic]" being responsible for -50%. It is ONLY the economic downturns that are 0% the fault of CEOs. All of this is by both self-reports and by McKinsey Consulting reports [that paid for that conclusion in advance].

" Adjusted for the ravages of inflation, CEO pay has gone up only 78% in real terms. So, you know, not really all that much. And I'm sure every one of them deserved it for coasting along with a long economic expansion they had nothing to do with."

Nice snark. But, you know, this ain't sustainable. Something's gotta give.

CEO pay for large public companies, while exorbitant, is a bit of a red herring.

- CEO is a tiny percentage of these type of company’s expenses. IF you reduced CEO pay to zero, it would not meaningfully lower the price of the company’s product or service. Or if you reallocated the CEO pay to all the workers, it would not meanfully change work wages. The Economist had an article that showed this math.

- Yes, you could make a law that ties CEO pay to a ratio of worker pay but I doubt that would have the desired impact. Companies would then just outsource more low paid functions (staffing companies etc) and create subsidiary companies (Apple retail operations would go into a separate company)

- The real issue, from my point of view, is that many workers at the lower end of the pay scale don’t achieve high levels of compensation even when working for highly profitable companies. THIS issue is not really related to CEO pay. Rather, items such as technology (replace workers with machines or software), trade policy (locate operations overseas), tax policy (no tax benefit for more domestic employment or higher wages), stock prices (higher earners equal a higher stock price) etc.

If it was just CEO pay, then your comment is correct. But there is more to it than that. First, there are a bunch of other corporate officers whose pay is exorbitant by earlier standards, but rises as CEO pay rises. So you need to multiply CEO pay by a factor or 5 or 10 to see the total effect.

Second and more importantly, since CEO compensation is so closely tied to stock prices, and those are so closely tied to quarterly reports, everything else is sacrificed to goose the stock prices. Raising wages is bad. Investment is bad. BS moves like outsourcing, headcount reduction, closing plants, and splashy high risk business moves are good since they juice the short term stock price. None of this sounds good for the wages of the people actually working.

Consequentially, CEO pay is just sort of a canary in the coal mine. The real problem is the transfer of income from wages to investment income. For CEOs to maximize their income, they must maximize what goes to the owner class. That leaves a lot less for the rest of us.

Consequentially, CEO pay is just sort of a canary in the coal mine. The real problem is the transfer of income from wages to investment income.

Maybe it's the case that US corporations are an outlier in this regard, but I doubt it. I don't recall hearing that European or Japanese firms are likewise anything but highly profitable. And America remains a country where labor is expensive.

The real problem is the country's post tax-transfer income distribution, and the effects of the inadequacy of this system on, say, the bottom 70%.

If anyone wants to take a deep dive on this topic, here's. good place to start:

https://www.oecd.org/g20/topics/employment-and-social-policy/The-Labour-Share-in-G20-Economies.pdf

The labor share of GDP is a pretty important topic. My impression from a rapid skim is that the declining trend has been present throughout the rich world, not just in in the USA. To the extent that some countries have done better on this score than America* (ie, labor share hasn't declined as much), I suspect it's because of payroll taxes (in other words, tax/transfer policy).

*And some countries have done worse.

I disagree emphatically. So should most economists, but they don’t. Relying on government taxes and transfers to redress inequality imposes an economic inefficiency termed ‘externality’ in economics. An externality occurs when a third party (neither buyer nor seller) bears some of the cost of a good or service. That makes the good or service cheaper than it would otherwise be, and therefore more will be produced and sold than would otherwise be the case, a distortion of the market. A living wage is the cost of providing a full-time worker, and the externality of forcing the government, or family or friends, to partially support workers who are paid less than a living wage, is the same economically as if the government subsidized the cost of rent, or power, or fuel for an employer - employers would have less incentive to use those factors of production efficiently.

And I emphatically disagree with your emphatic disagreement! We actually have real world examples of the kinds of countries that, broadly speaking, do a good job (best in world, and best in human history, really) at ensuring broad-based prosperity and a high standard of living at the median. And they all engage in robust levels of income redistribution (possible exception: Japan). It's just a more efficient way to go about things.

I should add: I support minimum wage laws, and I also favor government laws that ensure the collective bargaining rights of workers: strong unions are desirable, because high wages and safe, agreeable working conditions are good!

But these things are unlikely to be enough. You need a strong safety net.

Yes, most OECD. countries have stronger and more broadly-empowered unions, and better safety nets - and I support all of the measures that enable and sustain those. I think all we disagree on is: I want the minimum wage to be a living wage. The safety net then is society’s way of providing a decent life to those for whom full-time employment is not feasible. Every viable business has to price its products at least as much as their production cost; the price of labor should at least equal the cost to furnish it, the cost of living.

You are correct, the compensation of the CEO drives the pay for the other executives. However, its not clear to me that a reduction in CEO and executive pay would meaningfully change the average worker's compensation.

It is a Clinton era rule that resulted in CEO pay being primarily in the form of stock option compensation: recall, he applied a special tax rate on CEO salaries...

You state "For CEOs to maximize their income, they must maximize what goes to the owner class." I THINK its broader: for a CEO to retain their job, they must maximize shareholder returns...

You would think so, but it’s hard to see that in actual data. The structure of many executive compensation plans rewards execs when the market goes up, even if they lag vs. competitors. https://hbr.org/1999/03/new-thinking-on-how-to-link-executive-pay-with-performance

Final thought.

People- unless they are very poor or very desperate - by and large don't resent the rich.

They envy them.

We have to give rich people all of the money or they won't give the rest of us jobs.

Semi-relatedly, Bill Gates just sat for an interview/question session with the Guardian. Some pretty hard-hitting questions, including about his relationship with the late Jeffrey Epstein.

What caught my eye in particular, though, was his claim that "Europe" doesn't tax estates. I'd never heard that before. Anyone else? Gates says:

https://www.theguardian.com/culture/2022/may/15/bill-gates-vaccines-readers-questions-how-to-prevent-next-pandemic-interview

Anyway, it's an interesting read.

Financing capitalism. The problem is technology can't finance debt anymore. It's not growing at the exponential rate the same industrial revolution provided. A ponzi scheme collapsing.

I just stopped by to see whether our host had mentioned the local shooting, and it just so happened that the photo at the top of the page was the Geneva Presbyterian Church, where it happened.

CEO pay level is so high that inflation is irrelevant -- you know this.

The top 10% has no idea what the cost of eggs or bread is. The top 2% hasn't stepped into a grocery store in decades.

The bulk of their income goes into investments that are unavailable to most everyone else and has significantly higher rates of return that make up for inflation in a matter of months.

Every one of them only cares about nominal income. They'll routinely remind you of their nominal net worth to prove the point that real income is irrelevant.

Just saying.

Inflation may be largely irrelevant to them personally, but nonetheless you have to make the adjustment when doing time comparison for stuff like this, or else you're getting data based on nominal change, which for most purposes paints a distorted picture of what's actually happening.

(°ロ°)☝ -- "But sir, the pace of our move towards an economic caste system is not nearly as fast as you assert!"*

* Except of course, if we considered capital gains, of which the top 1% earns more annually from capital gains than from labor, and with exclusive access to entire investment vehicles with guaranteed RoR double that of most stock funds.

Do you get the bigger picture of why counting inflation on incomes of the 1% is a waste of time, or nah?

Now do it since 1980.