Here it is. In nominal terms—which is what people see at the pump—this week's price of $4.33 is a 30-year high, breaking March's recent high by a penny. So far.

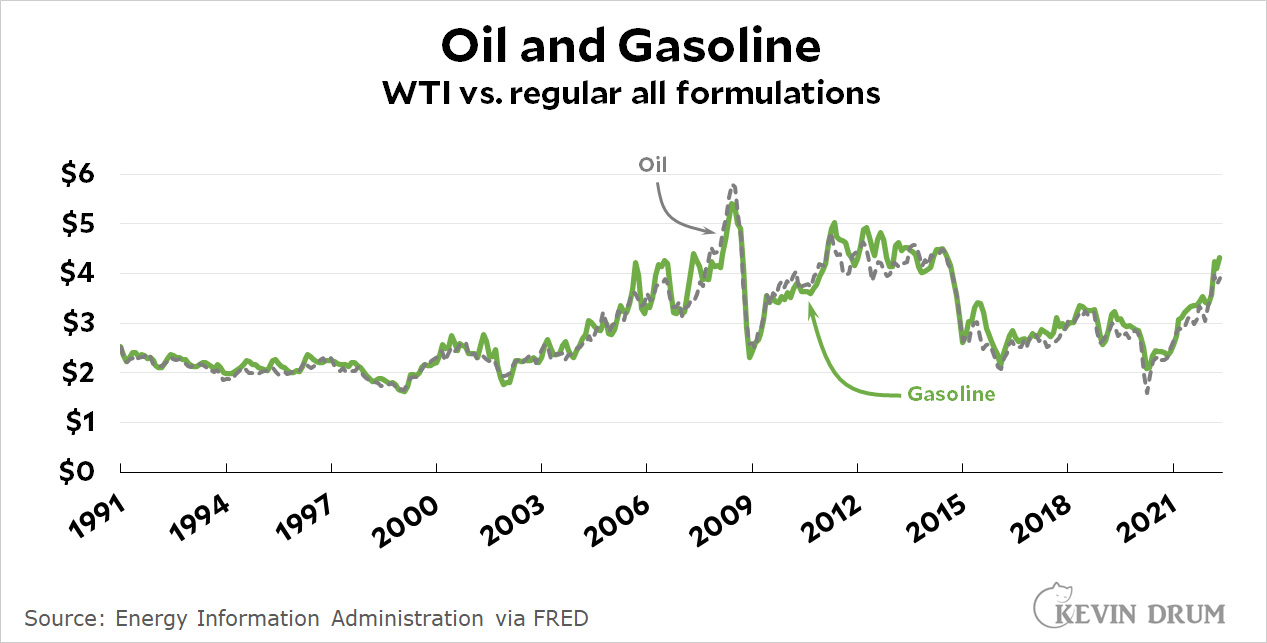

UPDATE: Here's an update of my chart showing gasoline prices along with a trendline based on the price of WTI oil:

UPDATE: Here's an update of my chart showing gasoline prices along with a trendline based on the price of WTI oil:

A month ago I predicted that gasoline prices should drop about 40 cents within a couple of weeks. But even though the price of WTI oil has dropped $2 in the past couple of months, the price of gasoline has gone up ten cents. For some reason, gasoline is not returning to its historical relationship with the price of oil. It's still selling for about 40 cents a gallon more than it should be. I don't know why.

A month ago I predicted that gasoline prices should drop about 40 cents within a couple of weeks. But even though the price of WTI oil has dropped $2 in the past couple of months, the price of gasoline has gone up ten cents. For some reason, gasoline is not returning to its historical relationship with the price of oil. It's still selling for about 40 cents a gallon more than it should be. I don't know why.

More people working, record low unemployment, price of gas goes up.

What a surprise!!

(Maybe they are driving to work. Or traveling if not working)

And then toss in a war interrupting the energy markets.

(But look at record profits for the oil companies. They love high prices. Shareholder value and all that!)

But recovery from a a pandemic recession is JBrandon's fault!

Yes, most mass transit is only back up to 50% per-pandemic ridership.

But there are still significant numbers of people working remotely. I'm one of them and will be doing so indefinitely. Traffic where I live has rebounded a lot, but rush hour congestion is still well short of pre-Pandemic gridlock.

By how much have they managed to increase their net margins?

And I just read how we're looking at possible shortages of diesel in the eastern U.S.this summer due to reduced refinery capacity and increased demand.

How many refineries will go down for unscheduled maintenance?

Point taken. And there's this; in my own work over the past couple years I've seen the Philly Energy refinery closed following the explosion and fire, Paulsboro NJ refinery shuttered during the pandemic, Belle Chasse LA shut down thanks to Hurricane Ida. Also currently have a customer in Montana down until June due to a fire. It adds up.

As many as needed to keep the prices high.

"It's still selling for about 40 cents a gallon more than it should be. I don't know why."

Profit taking by the oil companies. Shareholder value. Have to fund those share buybacks!!!!!

"It costs refiners several cents per gallon more to make summer-grade gasoline, compared with winter-grade fuel, which is part of the reason that retail pump prices can rise in the summer." From EIA. This only explains the recent change.

It doesn't explain anything, since that formula hasn't changed in almost a decade.

The cost comes from resetting the refining from the one blending to the other. Even though each blend is well-established.

It's possible transportation costs, especially tanker trucking, have gone up considerably, adding to what service stations pay for gas. But given that oil companies are currently enjoying record-breaking profits, the simplest answer seems to be that they're gouging us.

Gasoline prices make the news more often but diesel prices are a big story. The diesel vs gasoline price spread is dramatic and at a historic high. A refinery customer of ours sourced about 20% of their crude stock from Russia crude contracts; those had to be reworked due to the ban but at increased cost. And we're just entering the busy, higher traffic season to seasonally boost demand. All the price pressures are upward and it's not simply demand; this is a tough one.

It would be interesting to see a chart of gallons consumed and miles driven.

If I recall correctly, it was the oil shocks of the 70's that really helped foreign car makers boost sales in the US--and here's a link:

https://www.toyotatoday.com/news/american-journey-gaining-traction-1970-1988.htm

The Trump administration quashed the mileage regulations, and even just pushing them back a few years will hurt US car manufacturing in the long run. When the current new car shortage ends, they'll be strong shift to better mileage/electric cars.

Who knows--in a few years, everyone might be using the iHop, you know, the Apple Branded pogo stick. 😉

There already is: as a portion of new car sales, BEVs have doubled to 5% of the total in the last year.

Whatever the market will bear…

Weirdly, Elon Musk is saying the U.S. needs to increase drilling. Why wouldn't he be cheering for ever-higher gas prices, making his own cars more cost-effective?

Such a weird dude.

Drilling is irrelevant domestically. That kind of oil is expensive to refine. It's why nobody uses it alone to generate energy. The reason foreign oil producers got mad at it is due to exports when elitist oil speculators artificially raised oil prices after 2010, cheaper than their own energy exports.

Russia, when the war ends, will have a backload of cheap sweet crude that will flood the market. Saudi's will have to cut prices to compete(which they are starting to trickle out). Prices will crash.....right for the summer.

Why wouldn't he be cheering for ever-higher gas prices, making his own cars more cost-effective?

Smart people don't publicly announce every inner wish they possess.

Considering the only remaining part of the war is the eastern breadbasket of the ukraine.

Like everybody is saying, including Dr. Krugman, Nobel-prize-winning economist, companies are taking full advantage of the (Republican-driven) media meme of "inflation, inflation, inflation!!!" to add a little more profit to their prices. Who would notice? All part of "Inflation, inflation, inflation!"

And, as another advantage, this makes President Biden look bad and by implication, ALL Democrats. Americans have even less understanding of how the economy works than the federal government, you know. With an important (gerrymandered!) mid-term election coming up in a few months, these higher prices could also ensure a strong sweep by Republicans -- an added bonus! No more regulation! No more taxes!

Sounds good in theory, but practicality nonexistent in reality. The Biden administration can set prices they see fit. If they we want lower prices and if that includes arresting and liberating the US from transnational corporations, so be it. Gitmo is waiting.

I did mention when you made that prediction that by May 1, refiners had to switch to summer blend, raising prices by 10-15 cents a gallon.

For some reason, gasoline is not returning to its historical relationship with the price of oil. It's still selling for about 40 cents a gallon more than it should be. I don't know why.

The price of oil is set globally in dollars, and the dollar has surged in value.

Gasoline prices in the US are set domestically due to factors inside the US.

I expect this, in general terms, is where the answer lies.

Lets also note, June this relationship declines a bit and late summer even further.

Who sets the prices? Not the gas station owners -- the blenders/finishers who put in ethanol and other additives and then sell the finished gasoline to the retailers. How do they decide how much profit to take on top of their costs? It should be determined by competition. But maybe . . . just maybe . . . politics plays a little role. Their industry is definitely favored by Republicans, no question of that. Planned price-fixing is, of course, illegal.

But maybe . . . just maybe . . . a little wink here, a little nod there, and several of these businesses keep the prices a little higher than they would otherwise, just ahead of a midterm election. Because we all know that the BREAKING NEWS on the TV machine almost every night is the SKYROCKETING (or, alternatively, SOARING) price of gas, followed by the latest polls showing Joe Biden's PLUMMETING approval rating.

Wink, nod.

How do you spell “price gouging”? The invisible hand is picking our pockets. Actually not my own so much; we plug in our Bolt EV every night and by morning it is full of $0.095 kw-hr energy. That’s $6.19 worth of electricity which corresponds to 220 to 300 miles depending on the weather.

We upgraded our 3 year old Leaf (150 mile EPA range rating) to the extended range model (226 mile EPA). Regular gas up here in the NW corner of WA is running between $4.49 and $5.59 per gallon. Diesel is between $5.19 and $6.09.

Electricity is running 9.1 cents per KwH up here and the cost per mile in our Leaf is less than 20% of the cost per mile of our Prius - which is 11 years old and still delivering a good 50-55 mpg. So we only take the Prius out for really long distance driving. (Have to remember to take a short trip every couple of weeks to keep the secondary battery in good health.)

Coup to remove cancer-stricken Putin underway in Russia, Ukrainian intelligence chief says,

https://fortune.com/2022/05/14/does-putin-have-cancer-coup-underway-blood-cancer-ukraine-war/

That may be a bit overexcited. According to a commenter at the Daily Kos web site the Ukrainian intel guy made it conditional on Ukraine winning decisively THEN Putin would be removed. On the other hand, Ukraine has mobilized a lot of equipment up towards Izyum - something is afoot.

If the Donbas offensive goes pear-shaped that whole army could pull back really quickly just because it's the only half-way organized thing they can do that wouldn't leave them sitting ducks, and then what happens in Moscow?

Putin tries to hang someone with the responsibility, but that person is strong enough to resist --and then what?

What I see in the second graph, particularly starting from 2012, is that when oil prices rise, gasoline prices rise in tandem. When they decline, gasoline prices only decline some time later. Price gouging, as another commenter put it. This presumably is when companies make the biggest profits.

Bottom line: price volatility is very good for oil companies, so expect them to promote it.

Another possibility would be the reduction of Russian crude. My understanding that oil was used to produce diesel since it is a heavier oil. Since we have also sanctioned Iran and Venezuela which produce heavier crude we have no choice but to use oil normally needed for gasoline production to be used for diesel.

The affect may not be so great now but will increase as time goes by.

Somebody somewhere said recently that it has to do with the complexities of oil trading from the ground to the gas tank and how hard it is for analysts to figure out. Which is why oil and energy in general should be nationalized, or at least under very strict national restrictions everywhere. US could say, 'you want to sell gas here, this is what you can charge.' Period. They don't want to play, fuck 'em. Let them try to find a more reliable market anywhere. $1.50 a gallon. Period. That's all you get. End of story. Or go drown in your remaining puddles of oil and we'll ride on dreams, like we always have.

There already are countries that guarantee a certain price for gas, and generally doing so doesn’t result in positive outcomes all or even most of the time. Partly because they set the price too low so when production costs rise above the price, the government ends up having to pay the difference to the producers and/or the country experiences shortages. And partly because, once a low price is guaranteed, consumers lose the incentive to buy fuel efficient cars and end up consuming more gas than they would if they had to plan for price unpredictability.

It's still selling for about 40 cents a gallon more than it should be. I don't know why.

It's because lots of companies at all ends of the "awl" business - retail, production, refinement - got slammed during the pandemic and are now extracting their pound of flesh from higher prices. Because is does not make any sense when prices are continuing to go up (especially where live) well beyond what the current market price of oil says they should be. But it makes a certain amount of sense when you think how debt leveraged many of these companies were after the expensive fracking years only to see their main source of income dry up due to a disease and to have the banks and financial companies demand they pay them back. So they have no interest in producing more oil even with the leases they currently own and do nothing with (although they'll whine when the Biden Administrations cancels sales on leases they have absolutely no desire to do anything with). Right now they've got high prices they're using to pay down debt and make a profit again, why would they want to stop the gravy train? Why pay the expensive costs of drilling with fewer people wanting to become roughnecks? Just because they're oil companies?

And then of course we have the Saudis who now control OPEC and are holding back production because they want to see Trump in again (the Kushner donation should have been an obvious signal) and are doing so with higher oil prices. In the past OPEC members were notorious for cheating on their production quotas but the Saudis have figured out a way to stop them: flood the market with so much oil prices collapse and the ability for another member state to take advantage of higher prices with more production by cheating is negated.

All I'm going to say is, the longer this situation lasts, the more electric vehicles are going to look like a better long term deal.

The reason for the price hike is for the same reason why prices of many things are outstripping actual inflation: greed.

And, the government won’t do anything about it.

Leave it to Democrats to not take advantage of the rise in gas prices by pushing massive electric vehicle subsidies and investments in electric charging infrastructure, so as to motivate ppl to get off the oil barge.