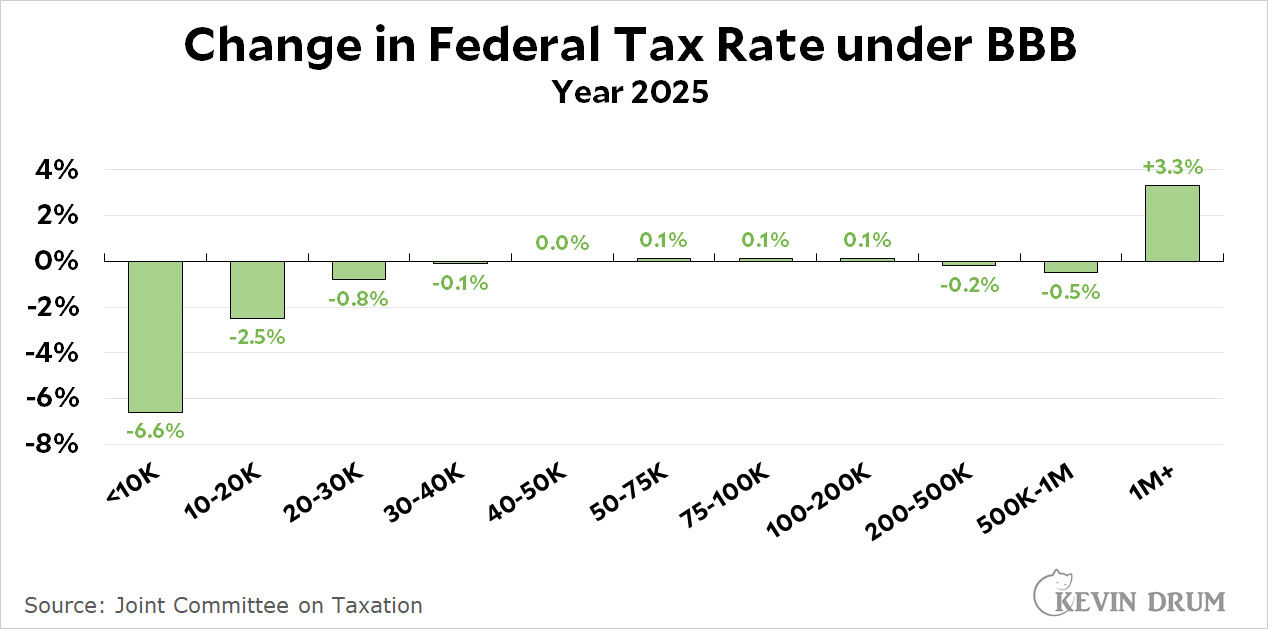

Will you pay higher or lower taxes under Joe Biden's Build Back Better bill? The Joint Tax Committee has the answer:

This is in 2025, when the tax provisions have pretty much all kicked in. It's not clear to me why we want to lower taxes on the $500K crowd, but this is all of a piece with the rest of the bill. It's well intentioned but generally seems to be kind of sloppy in execution.

This is in 2025, when the tax provisions have pretty much all kicked in. It's not clear to me why we want to lower taxes on the $500K crowd, but this is all of a piece with the rest of the bill. It's well intentioned but generally seems to be kind of sloppy in execution.

I'm with Kevin, why on earth are we going to decrease taxes on those who make $200,000 to a million? While raising taxes on those who make $50,000-$200,000? Who paid who off for this to happen?

Does anyone have any idea how this calculated? Biden promised not to raise taxes on anyone making under $400,000. Is this a straightforward broken promise, or are they counting non-taxes as "taxes"?

I am thinking there might be a phaseout of or changes to the child credit that started this spring.

Not really a tax increase, but maybe hits middle earners harder (as raw number) if more parents are in that 50-200 thousand group.

My guess is the $500K crowd is benefiting from the change to state and local tax deduction limit. While that was a Republican attack on blue states, I don't agree with the change. However, I'd much rather see taxes raised on $100K+ (which would include me) across the board. I understand it's a political non-starter but still.

The state and local tax exclusion limit change seems like as likely a reason as any.

Thirded.

In red states I bet there's a huge market in tactical adult diapers.

Camo-colored. Secret pockets. You'd feel naked without them.

I think the federal tax system is so complex it's almost imposible to get the exact results you want. You can call it sloppy but it may be just more difficult than you think especially with the political pressures and compromises involved in this scale and complexity of legislation. I do agree reviving the state and local tax deduction is the probable cause of the decrease in taxes for the $500k to $1m income range since many of the people in that income range live in high tax states such as NY and Ca where many of the Democratic reps are from.

30-200 essentially have no change in taxes. Most of the benefits are for small business and part time workers.

Didn't Sinema once have a demand for the 500k crowd? Or do I misremember?

BTW I'd say given the number of cooks that have been working on this project the result is rather high quality!

Kevin says 2025 when the tax provisions have pretty much all kicked in.

Well, except for the ridiculous shell game of having the salt cap drop back down to 10k , which of course is not really intended but in there as a manipulation for scoring. And are not some credits only lasting for a short period. I think the expanded insurance premium tax credit, which should mostly benefit the middle class, expires AFTER 2025 . So funny kevin picks 2025 to illustrate the tax changes for them . Maybe that is the year most changes kick in but right before they go away.

And it still shows a tax increase in large part of middle class , although a small. 1% and that is average. Obviously some will have more significant increases and others a decrease. And that is all before they lose the premium tax credit. What happened to the promise to not raise middle class taxes ?

And of course this is all coming from the joint committee on taxation, controlled by democrats, and NOT the cbo.

As usual, the middle gets pretty screwed by comparison. My taxes went up under Bush, up under Trump and now up (a little) under Biden.

What made your taxes go up under trump?

That is very hard if you are clearly middle class. But maybe if you are in a high tax state and are high enough income so that the salt cap more than offset the tax rate reductions. Was there anything in the trump bill which could increase taxes for anyone arguably middle class except salt at high income level .

And, if a 10k salt limit really was enough to offset rate reductions, then your income is almost surely high enough to only be arguably " middle class" and at a level that many would consider " rich " . Generally those at that level consider themselves middle class as they may still have to budget and cannot just spend freely . And I do not really argue much with that. But, from the perspective of someone actually at median income or below , you likely are thought of as at least monetary wealthy and not middle class .

And , from what I can remember of Bush 2 tax changes, there really was nothing there which increased taxes for anyone possibly middle class .

I assume you were not just being trite and saying your taxes increased under Bush and trump as your income increased.

But many tend to perceive how it affected them personally through a partisan lens , because their personal financial situation changed enough between years that they cannot tell exactly how the tax changes in isolation affected them. They focus on the bad things to them if president is a different party and ignore the good .

It was demonstrated that a lot of democrats had the perception that their taxes were increased under trump when it was provably not possible ( especially if salt deduction just over 10k) . And I am sure that many Republicans in middle class will be convinced their taxes went up under biden when that will not be true .

"Donald Trump, who rational thought does not support..."

Just for the record, I am NOT agreeing that the middle class always gets screwed in the USA. I actually think maybe their taxes are too low in usa compared to other income classes.

At least if you mean the more narrowly defined middle class. I might agree the " working class " which might be said to be the lower middle class , are getting screwed more .

And what is interesting is the way the actual democratic policies are changing as their political support changes. Used to be that lower middle class, white or black, was solidly democratic. But that is now a lot of the republican base . But more high income groups, especially in high tax states, which used to be republican, are now more democratic.

This has changed partisan positions in practice although often the politicians want to hide that.

Years ago, the republican party would never ever put a 10,000 salt cap. Who that affected were largely groups who used to be their base and their big contributors. And democrats would not be the ones wanting to raise the cap to 80k.