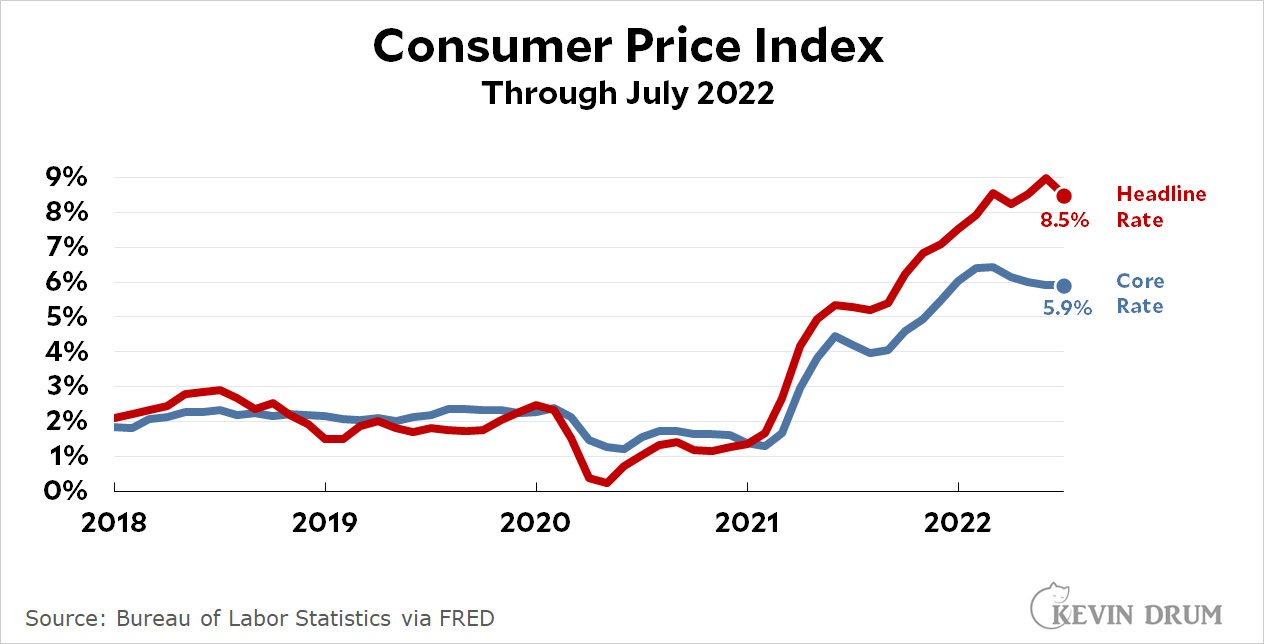

We have broken the back of inflation!

OK, not really, but the news is good this month. The headline rate of inflation dropped from 9% to 8.5% while the core rate of inflation stayed steady at 5.9%. Given the underlying state of the economy, which is pretty strong, this probably finally represents that we've passed the peak of our latest round of inflation.

OK, not really, but the news is good this month. The headline rate of inflation dropped from 9% to 8.5% while the core rate of inflation stayed steady at 5.9%. Given the underlying state of the economy, which is pretty strong, this probably finally represents that we've passed the peak of our latest round of inflation.

If that's true, it lasted about 12-18 months depending on how you measure things, and that's certainly as long as it should have lasted. With stimulus money long gone and housing prices starting to ease after a torrid 2021, the core rate started declining earlier this year. And with energy prices finally coming down from their June peaks, headline inflation is coming down too. In fact, it should be declining more, if you ask me. But food is still a problem, rising at a 10.9% annualized rate in July.

On the wage front, the news was good or bad depending on what you were hoping for. On a monthly basis, hourly wages were up 0.46% and weekly wages were up 0.49%. Since monthly inflation was down .02%, this means that hourly and weekly wages were up 0.48% and 0.51% respectively after adjusting for inflation. On an annualized basis that comes to 7.6% and 8.2%.

On a year-over-year basis, hourly wages were up 5.2%, which comes to -3.3% adjusted for inflation. Weekly wages were up 4.6%, which comes to -3.9% adjusted for inflation.

So wages were way up for the month but still negative for the year. Also remember that up is good if you're a worker, but down is good if you're worried about a wage-price inflation spiral. So you may decide for yourself if you think the July numbers were good or bad.

Apropos of nothing, regular gasoline has now clocked in at $3.21.9 a gallon along my normal morning route. And speaking of which, the Corolla is running on fumes...

Still hovering around $4.50 where I am. Fortunately I don't need to drive much, so it's not a big deal and when I do it's in a Prius.

Food prices:

Bird flu affects eggs and chicken

Drought/fires out west: beef, and eventually veggies from the Central Valley.

Drought (and dust storms?) in the plains and prairies: beef, corn, soybean, grains in general.

War in Ukraine: grain prices, vegetable oil, sunflowers

High energy prices and labor costs play a role too--but this is a global warming issue hitting home. And will be the new normal at best for the next few generations--if we get our act together. Otherwise much worse.

I'd forgotten about the bird flu this year. Yeah, that's got to have put massive pressure on poultry and egg prices. And the drought in TX and OK is killing beef cattle right and left and forcing ranchers to liquidate herds because there is no pasture or water left to raise them on. Somehow, I imagine they still find a way to blame Biden for that.

Bird flu is over.

Dark Brandon bringing light to the 2022 midterms.

As i saw on Twitter, Bill Climpton's wanger, 9/11/01, & Dark Brandon are the only things powerful enough to subvert the tendency of midterms to be a beating for the party in the White House.

Good. Hopefully Jay and Company give us another 100 basis points and get this shit over with once and for all. I'm serious, Dems: whether it's a mere slowdown/soft landing (preferred) or an actual recession (hopefully a mild one), inflation's not going to get below 3% when 500,000 jobs are being created on a monthly basis.

I like jobs as much as the next person. All things equal they beat widespread unemployment. But all things aren't equal: MAGA is seeking a comeback, and if the aforementioned slowdown doesn't arrive pretty soon, it's going to mean bad things for Joe Biden's 2024 campaign. Better 5.9% unemployment soon—and four more years of a Democrat in the White House—then a lingering boom that finally ushers in a 2024 slowdown, and a Trump restoration.

I'll add: if they get very lucky Democrats could possibly enjoy exquisite business cycle timing: the current ultra-hot job market enables them to significantly beat expectations in the midterms, but with the slowdown that delivers low inflation being palpable very shortly thereafter—and then mostly having lifted by the winter of 2024 (with an obvious, strong recovery in place by the summer of 2024). Not even Saint Ronnie enjoyed that (he suffered fairly sharp losses in 1982, IRRC).

Funny that you and the Fed don’t see a problem when wages lag productivity and remain stagnant (in real terms) for four decades, but can’t yank away the punchbowl fast enough when workers get a real one-month raise …

Yes Kevin, I ran a marathon in 2 hours

Well actually it just took me 2 hours to get halfway there but the marathon was done at that point apparently

There’s no reason to think inflation won’t settle at a much higher level than it was, in which case it won’t be “done” for some time. Rising inflation is bad due to the promise of continued higher inflation, but stable inflation at a high level is also bad. Agreed that hopefully this will shut down the doomposters warning of an inflationary spiral, but we’re not really out of the woods if we’re still sitting at 5-8% inflation

We are not "sitting at 5-8% inflation". The 8% is a number than comes from taking the average over the last year. This month's CPI is the same as last month's, so the current rate of inflation - over the last month - is about zero. If this continues, then high inflation is over. I'm surprised that Kevin didn't emphasize the month/month number. As I keep saying, you can't just look at one number - especially year/year inflation - and predict what is going to happen, or even understand what has happened.

Of course it's not as simple as expecting this month's result to continue. This month gasoline and other energy prices went down, while some other sectors went up. Some of the several things which were causing inflation especially stimulus money and supply-chain problems are going to get better, but oil price could go up again at any time. Wage increases are not a primary cause of inflation as long as they are less than price inflation.

+1!

Stop telling me true things so I can grouse over inflation!

Just kidding of course, you’re right. Thanks for pointing that out, my inner Fox viewer came out for a minute. Apologies to Kevin, I see the trade offs of using noisy month-by-month numbers vs the nicer but misleading year-over-year numbers. I guess we’ll have to see how things settle out

That’s backwards. Inflation needs a mechanism to keep it going, such as the notorious wage-price spiral, or expectations-driven advancing purchases. Absent such a positive-feedback loop, inflation abates. Unless you can identify such a mechanism, there’s no reason to think it won’t decline, in accordance with Stein’s Law.

Pingback: Team USA | Glenn Melancon