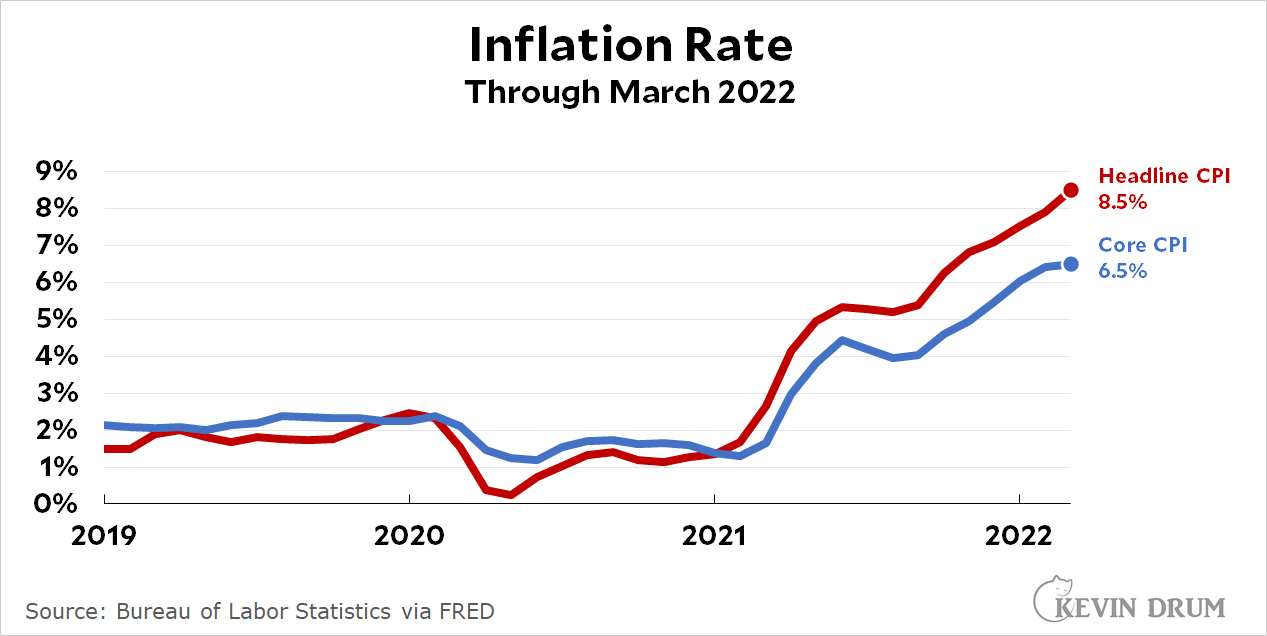

Today is inflation day, and the BLS reports that the US inflation rate rose considerably less than than the European rate jump announced a few days ago. But it still went up a lot. The headline inflation rate increased from 7.9% in February to 8.5% in March:

(Note that this chart shows headline CPI, which is measured year over year. This is the normal way of looking at inflation.)

(Note that this chart shows headline CPI, which is measured year over year. This is the normal way of looking at inflation.)

Gasoline alone was responsible for more than half of the increase in the headline rate from February to March. Among core prices, services rose at an annualized rate of 7.4% while commodities dropped -4.7%. Among non-core prices, food rose at an annualized rate of 12.7% while energy rose a whopping 250%.

On a year-over-year basis, services rose 4.7% and commodities increased 11.7%. Among non-core prices, food rose 8.8% while energy rose 32%.

Average weekly earnings, adjusted for inflation, declined -1.1% from February to March. That's an annualized rate of about -12.4%. The yearly decline was -3.6%.

Team Transitory continued to take a hit last month as headline inflation growth accelerated—though this was largely due to gasoline prices. Core inflation growth slowed down, which should work its way through to headline inflation before long.

Just how many hits will Team Transitory be permitted to take before it is KO’d or its trainer finally tosses-in the sponge?

Well, we've got a year to go until we reach the post WW2 duration of what we now know (in retrospect) was transitory inflation. So how about end of Q1 2023?

I guessed that’s as good a timeline as any.

Meanwhile, the producer price index: https://www.cnbc.com/amp/2022/04/13/producer-price-index-march-2022-.html

Well, I suppose we shouldn't give them as much time as team "the sky is falling because of inflation" had for what - the past decade ?

Ha! ++

BTW, Team Transitory(see e.g. Paul Krugman) has already admitted they misjudge this, though in fairness, no one had built in a full fledged war in Ukraine to their estimates last fall.

How much will the inflationistas wager that inflation will still be this high in 6 months ? a year ?

I'd be interested in seeing 3-year inflation rates - because inflation was artificially low in year 1 of the pandemic, so some of the current inflation rate is just catch up from that.

The year over year inflation rate will moderate over the next few months as the comparison will be to prices after the initial surge in prices. However, that will not help with chicken and egg prices (bird flu will probably last another month or two at least), fuel prices (why should companies pump more if they can charge more?), grain and food oil prices (war in Ukraine will be going on for a while), and production issues due to cases in China (as Kevin mentioned in an earlier post).

Note: If everyone now has a relatively new TV and pc and places remain open in US so people start going back out, then that my ease demand for some consumer goods. IF that's gradual enough, then supply chains can shift accordingly without too much mis-match with packaging and demand.

Now--what's the price to fill an Easter Basket nowadays?

Inflation is killing Biden's popularity on the economy. In turn, Democrats will politically burdened in the upcoming election...

I doubt it. Biden's approval rating has gone up the last 3 months.

Inflation rose .8 exing the useless Putin. Stuff. It's why core is leveling off. Indeed, inflation is stabilizing. Removing gas, it's been flat this year.

Removing used cars, it's barely over 5% in total. Maybe, the bls sucks. It is a failed organization.

Kevin forgot to mention one major factor: corporate gouging. Let's check out corporate earnings over the next month or two. If all of this inflation is just higher prices for raw materials and supply chain issues being passed on to the consumer, then it should be business as usual. If, as I suspect, we're going to see a string of orgasmic profit reports from a bunch of energy, consumer product, and food and grocery companies, well, we'll know what was really going on.

The lack of a wage/price spiral and core inflation seems to be points for team transitory.....

Or perhaps Larry Summers should be knighted for predicting the petroleum inflation and the Russian war....