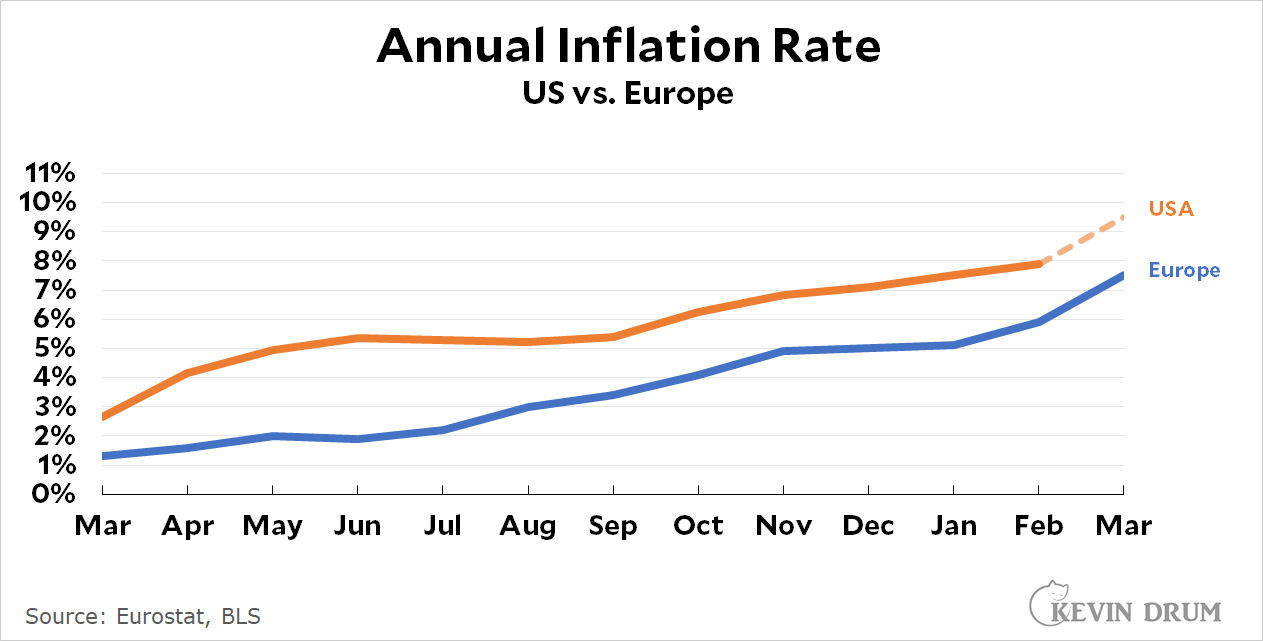

A month ago I posted a chart of European inflation vs. US inflation. The rough takeaway was that over the past year our inflation rate has been about two points higher than Europe's. Today we got the latest estimate of EU inflation, which spiked upward to 7.5% in March:

There are at least four possibilities here:

There are at least four possibilities here:

- The "two point" trend will continue and US inflation will rise about as much as EU inflation. This will produce a US inflation rate for March of nearly 10%. (The March CPI figures will be released on April 12.)

- Europe has caught up to us. From this point forward, US and EU inflation rates will be about the same.

- The spike in Europe is an artifact of the Ukraine war, which has pushed up the price of energy 45%, far more than in the US. This means that US inflation won't rise as much as EU inflation.

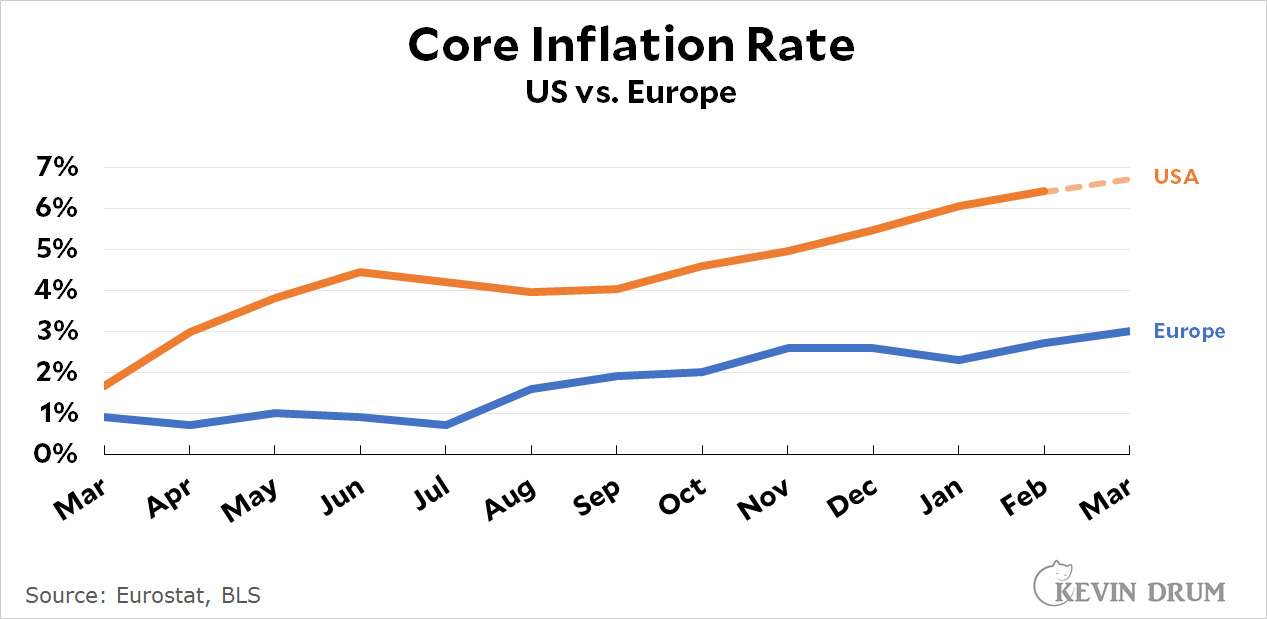

- We really ought to be more interested in core inflation anyway, since the headline inflation rate is affected by transitory and regional shortages of food and energy, neither of which affects the true underlying inflation rate. Here it is:

I really don't know what to expect, but I'm going to guess that the core inflation rate is more important right now, which suggests that the US inflation rate will rise half a point or less and end up just under 8.5% in March. Maybe.

And last month the headline inflation rate in the US was 6.4%, down be a ton from the previous month. However, Putin will have a big impact on next month's headline figure.

Whoops, that was PCE.

Grr, formatting didn’t make it…

The point of the inflation figures is not to be able to say "ZOMG! Prices are way up!" but to inform policy responses to changes in aggregate prices. If you are worried about the price of food and energy, you should pursue policies to stabilize and lower the price of food and energy. If you are worried about inflation writ large, you're worried about the relationship between aggregate demand, money supply, and aggregate supply. Food and energy prices are volatile (always have been, possibly always will), and so focusing on the frequent swings in the cost of energy and food will tend to swamp the bigger picture, and lead to bad policy choices.

This isn't to say that current high prices for energy and food are nothing to worry about or don't cause harm to people--just that they don't tell us that much about what's going on with inflation.

Yesyesyes!

Specifically, we know from historic data that demand for motor fuels declines very little when prices increase, so raising interest rates to make paying for energy even more difficult doesn't constrain demand much. Similarly for food; people will continue to eat. Raising interest rates just burdens people further without addressing the underlying problems.

Maybe, but raising interest rates raises leverage as well.

Are there actually enough people who purchase neither food nor energy and so for whom those things are a don’t care??

Not many, no.

But I think implicit in the focus on core inflation is that the "volotility" of things like food and energy means they can (and usually do) come down after a spike.

I really don't know what to expect...

I'm expecting Republicans to win 30 seats, and then promptly begin impeachment proceeding against the president.

Oh, well, two years of sanity were better than nothing.

Because, you know, even though inflation isn't really horrible by historical standards and the job market is excellent and daily covid deaths are running 85% below what they were when Donnie left office and the US has re-emerged as a force to lead the free world against tyranny, THINGS ARE AWFUL because reasons. Plus, Yale-trained lawyer Hunter Biden commands high fees.

KD: "We really ought to be more interested in core inflation anyway, since the headline inflation rate is affected by transitory and regional shortages of food and energy, neither of which affects the true underlying inflation rate. "

I'm astonished at Kevin's refusal to accept that inflation is here. It's big. It's not transitory. It's not regional. And it hurts poor people the most.

When voters experience substantial inflation for several months, they are completely turned off by Pollyannaish statements telling them it's not so bad.

Please read aldoushickman's comment.

I am amazed at the inflation hawks who are certain that we are in for a long stretch of high inflation. The situation now is fundamentally different from the one in the seventies: We now have a positive price spiral combined with wages going down by means of not compensating workers for inflation. In other words the extra pennies earned from higher prices are going to employers and do not get recycled through wages. How long such a spiral is sustainable is I believe a question without a valid answer.

As of now it seems to me the inflation optimists have at least as good arguments as the inflation pessimists--as evidenced here: No argument is presented, just assertions of faith.

The fundamental difference is that back then (World War II) it was a fight between two totalitarian regimes. Now there is one totalitarian regime fighting with a country aspiring to be independent. Back then, the big countries like the U.S. and the U.K. also participated in the war. But today, the majority of the countries who have the potential to stop this war have chosen this immoral position of an onlooker, of noninterference. And the politicians of these countries have put their citizens in this situation of immorality, because the only choice the citizens have is to observe online, in real time, how city after city of Ukraine is destroyed.

You could say that Putin is winning at the moment internationally, because the policies of world leaders are based on fear. They’re not even capable of taking a rather neutral step of introducing a no-fly zone over Ukraine.

They’re not even capable of taking a rather neutral step of introducing a no-fly zone over Ukraine.

There's absolutely nothing "neutral" about going to war with a country that possesses 6,000 nuclear weapons, especially for a non-vital interest*. And yes, "imposing a no-fly zone" is a euphemism for going to war with Russia. Full stop.

Plus, you know, what we're doing now might well be working! It would certainly appear Putin is losing. Why snatch defeat (and boy what a defeat!) from the jaws of victory. It makes no sense.

*I want Russia to lose, and lose badly (hopefully culminating in regime change) as much as the next person. Heck, we'd possibly be getting a nice geopolitical win at China's expense, to boot! But the reality is the United States of America did perfectly fine for many, many decades (really, almost all its existence)—during which time the country grew to be history's mightiest and richest power)—when Ukraine was part of the Russian Empire.

PS—Do you really not understand the concept of tail risk? No, said concept doesn't mean "take no risks." It means, rather, balance the probability of failure with the consequences of the failure in question. A nuclear war would be the mother of all failures.

"The fundamental difference is that back then (World War II) it was a fight between two totalitarian regimes. Now there is one totalitarian regime fighting with a country aspiring to be independent. Back then, the big countries like the U.S. and the U.K. also participated in the war."

This is not an accurate characterization of the situation in WWII, so I don't think your analogy works.

Do you need some fingers snapped???? Where have you been since last fall retard???

Dana

It's interesting how political orientation lens understanding the statistics and how Left is making essentially the same arguments of the early 1970s... (as was interesting how the Right spent 2 or 3 decades inappropriately obsessed with non-existant inflation). Essentially mirroring their errors.

While the Left desperately doesn't want it's punch bowl taken away, the ongoing pretence that there is not a structural up-shift in inflation to dangerous levels is just a willful blind - rather in a similar fashion to the way the Right was willfully blind the structural changes that for a long time quashed inflation.

One typically strips out Energy and Food as transient factors tend to render these two categories extremely volatile - up and down. However what we are seeing in Energy and Food now do not look transient in the normal sense, particularly energy where structural changes (of which lack of investment in hydrocarbons while RE and Nuclear lag times are catching short availability) are arriving at the same time as more transient factors.

Denialism is just going to get Left governments in a mid to late 1970s bind.

There are several possible futures for price indexes:

1) Prices on goods that showed sharp increases, decline to or near to long-term trend;

2) Prices on goods that showed sharp increases stabilize in the near future, remaining at a permanent higher level;

3) Prices on goods that showed sharp increases continue to increase at a 'permanently' higher rate.

Outcome 1 brings relief to consumers soonest, their current income once again pays for the lifestyle they had previously, whatever that was. Outcome 2 brings relief to most consumers later, when their incomes increase (seniority, COLAs, increased skills ...). Outcome 3 is the most worrisome. But persistently rising prices don't just happen, they must be driven by some persistent cause. All that we skeptics are asking is, please tell us what that cause is, because we don't see it. We see causes that are self-limiting, like pent-up demand from the pandemic and the boost in spending power from economic-impact payments which have ended. Another cause is supply problems also ascribable to the pandemic; these are slowly abating as vaccines and improved treatments are reducing the impact of Covid-19 on the general health of the populace. At worst, these factors seem likely to lead to an outcome somewhere between 1 and 2 - prices decline from their peak, but stabilize at a higher level than the <2% trend line.

Kevin, if it were possible to predict the consumer price index from core inflation nobody would have bothered to introduce core inflation to begin with.

The point is that this prediction is impossible. Wars, famines, droughts etc, are almost be definition unpredictable.

The PCE index excluding food and energy increased by 5.4% from twelve months ago, and its increase for the month of February was 0.35%, which annualized to 4.3%. Next month's figures for the 12-month increase are likely to be lower, because March 2021 gave us a fairly large one-month jump. The month after that could well be lower still. Maybe the Federal Reserve's open market committee will see enough of a downturn in the inflation rate to agree on just another 0.25% for their May interest rate hike.