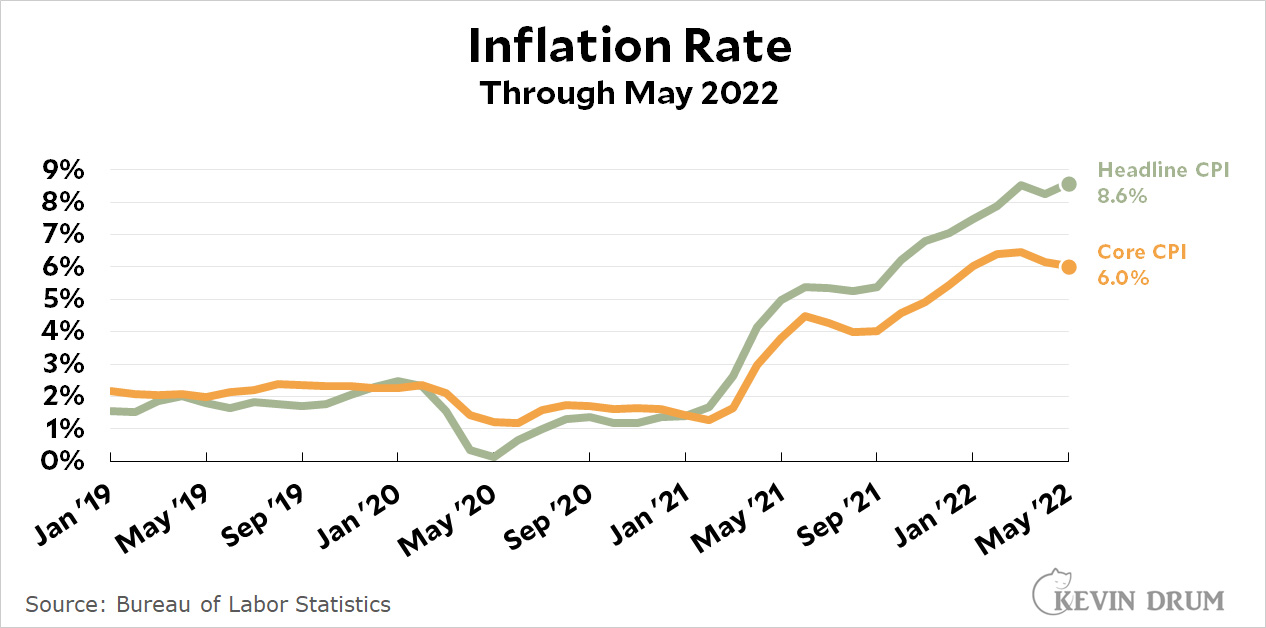

Today is inflation day, and the BLS reports that the US inflation rate has basically plateaued at above 8%. March was 8.6%; April was 8.2%; and May has clocked in 8.6%.

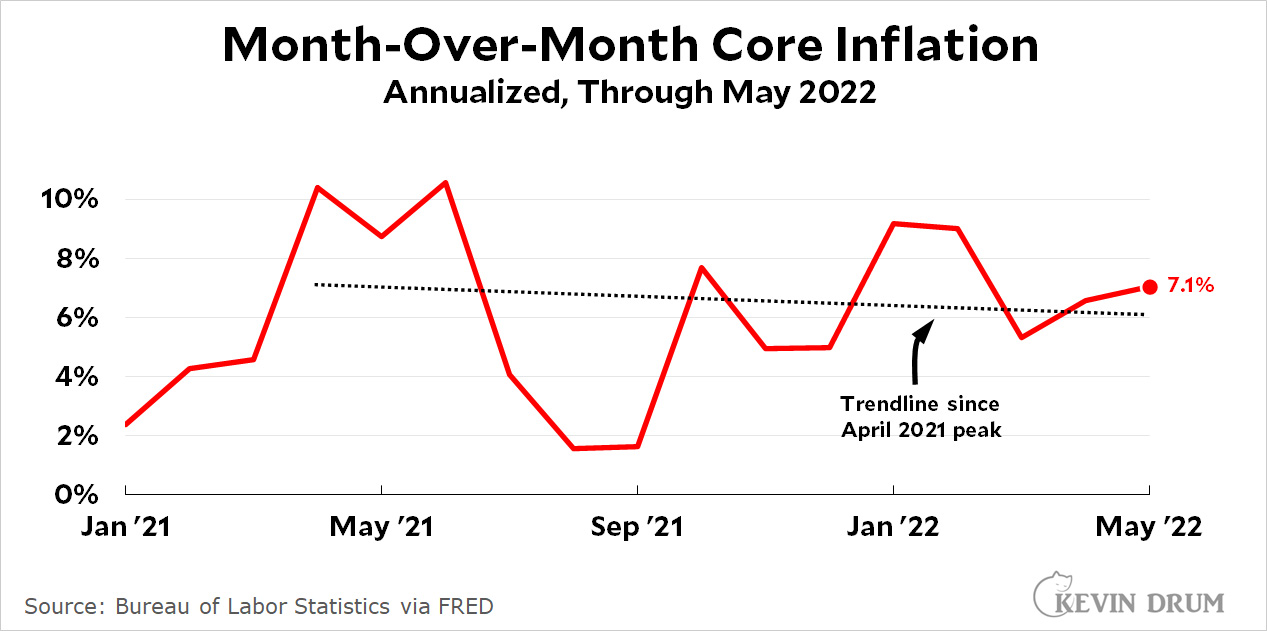

Core CPI has actually declined for the past few months. Note that these are the standard year-over-year figures, which compare May 2022 with May 2021. However, if you want a sense of how inflation is running this month, your best bet is to extract month-over-month figures and then look at the trend. Here's an updated version of my chart from yesterday, which does exactly that:

Core CPI has actually declined for the past few months. Note that these are the standard year-over-year figures, which compare May 2022 with May 2021. However, if you want a sense of how inflation is running this month, your best bet is to extract month-over-month figures and then look at the trend. Here's an updated version of my chart from yesterday, which does exactly that:

This is CPI core inflation, not PCE core, because that's all we have available today. However, the difference between the two is small and the trendline is still down from last year.

This is CPI core inflation, not PCE core, because that's all we have available today. However, the difference between the two is small and the trendline is still down from last year.

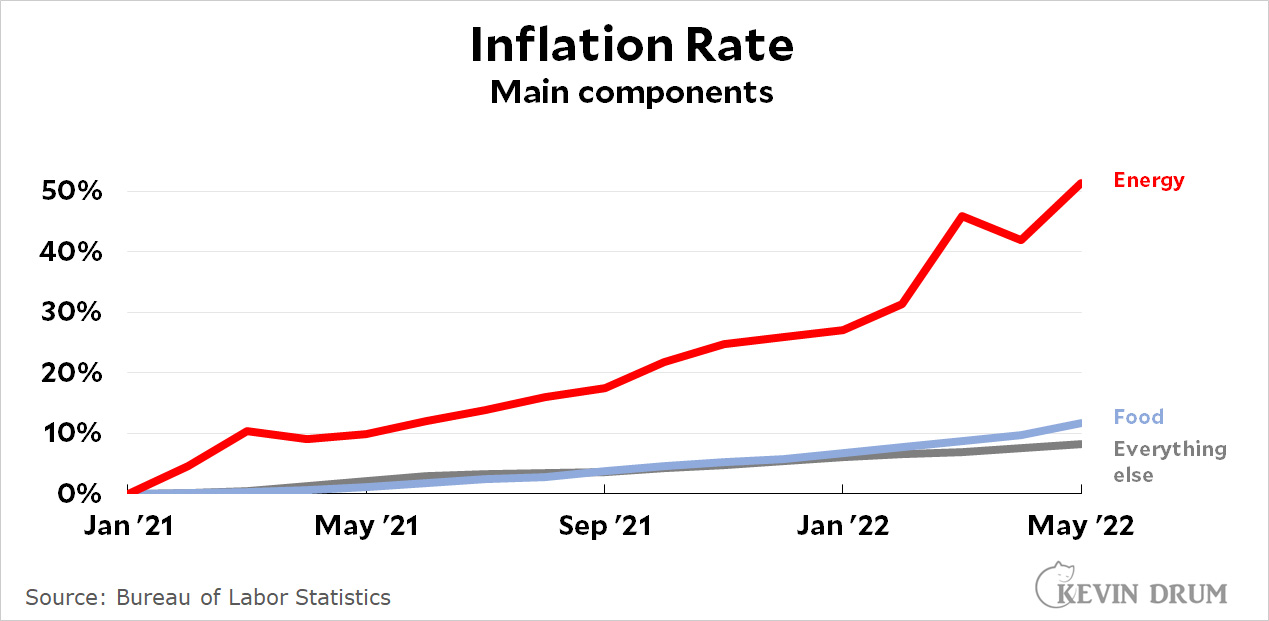

Finally, if you want to see what's driving inflation, here it is. There are no surprises:

Energy has been skyrocketing since the beginning of 2021, while food began outpacing general inflation in early 2022. Core inflation, by contrast, has been rising too fast, but only by a moderate amount. Once again, my horseback guess for the components of inflation right now are:

Energy has been skyrocketing since the beginning of 2021, while food began outpacing general inflation in early 2022. Core inflation, by contrast, has been rising too fast, but only by a moderate amount. Once again, my horseback guess for the components of inflation right now are:

- 2% from underlying inflation

- 2% from stimulus spending

- 2% from supply chain problems

- 2.5% from food and, especially, energy

I expect the middle two to wane over time, assuming that COVID-19 remains under control and delivery of goods and services gets back on track. As for the extra inflation generated by food and energy, who knows? That depends on global issues, and there's really no way to predict how those are going to unfold.

Fuck.

Nobody cares about overhead inflation in monetary policy. Artificially rising oil prices makes it worthless. Real inflation is falling and will fall again next month.

I still have to find a way to pay for energy and food you dolt.

Inflation in May '20 was low, so year to year comparison made May '21 look a little higher even though there was a month to month dip for May '21. Next month will show a dip barring some huge event in Ukraine.

Note: climate change fueled heat and drought effects are coming to the fore. There's now a shortage of Sriracha due to lack of hot peppers. Will probably trigger and soybean and grain (and alfalfa) shortfalls in US production--affecting fall prices.

No, soybean levels look high.

Supply chain inflation is over. The rest is Putin's inflation. If energy prices had stayed at estimated yry levels, inflation would be at 5.8% right now. Simple truth.

Until gas prices start coming down all you will read and hear in the media is "inflation" is destroying family budgets. You can understand why--most people have to stare at those gas prices at least once a week or more as they fill up.

Bearish report coming on the 15th for oil.

Yep. Vacationing with extended family this week.....a couple small business owners whose businesses are booming like never before....but they can only talk about how much it cost to fill up the tank today. I think I heard seven different stories about filling up the gas tank. They are also pretty panicked about gas in California, even though nobody lives in California.

Spades got me to thinking of El Toro sailboats. The sail emblem is a spade. Used to pick up the droppings from the bull.

.6% monthly inflation from "energy" nuff said. Killing you is a option. You sound foreign.

.7%

You ever have to realize, core inflation is impacted by energy. .4 of the May total.

Follow "Transportation" component. .7% was energy with overhead .4% with core.

Yogi Berra is the patron anti-saint of pundits and prognosticators.

Drawing trendlines is not a reliable method of prediction, no matter what time you average over. In order to predict future inflation you would have to know how the specific influences are going to develop. Some things that have been involved, such as pandemic stimulus and supply-chain problems, will probably fade, unless the pandemic gets worse. On the other hand the oil/gas situation may get worse, depending on how the war in Ukraine goes and whether the Russian supplies are cut off, also on whether Saudi Arabia and some others increase production (no, switching to non-fossil energy will not reduce inflation in the short term, although as I have been saying for a long time dependence on oil in particular can lead to instant inflation whenever there is disruption in producing countries). Wages are not increasing as fast at inflation, which was also the case in the 70's and 80's - real wages fell even faster then. Wage growth is not causing inflation and there is no prospect of it doing so.

If you can predict how the specific factors will develop you might be able to predict inflation, but nobody can do this.

Well of course it is better to have a model of underlying mechanisms, but if the time constants of those mechanisms are long enough to span a number of measurement intervals, a trend line can predict short-term fairly well. There’s definitely a need for the best forecast we can make that is better than a coin toss.

Given the Biden administration's stated goal of destroying the fossil fuel industry, it is likely that energy prices will continue to skyrocket.

Nope. You gonna learn the hard way.

Then why has oil rig count surged under Biden??? Do you need a eye gouged out????

Yeah, we need to destroy the planet so the fossil fuel industry can survive. How does that work, again?

The way it works is that energy prices skyrocket, people protest, and rulers in democratic countries (and often even in authoritarian ones) back down. That is why global carbon emissions are steadily rising. If the Biden administration doesn't take measures to expand oil and coal production, its successor will.

“…… administration doesn't take measures to expand oil and coal production…”

“Expanding production” takes decades (not weeks or months) and in the United States expansion is not done by X administration, but by private enterprise. Note: granting leases on federal property is not “expanding” production. The easily gotten oil is gone, which makes future development by private enterprise costlier and by extension riskier. Coal is already dying out as a competitive energy source.

Oil and coal are finite resources in an a world whose 7 billion and growing human inhabitants are increasingly demanding more of everything.

The other day, El-Erian explained the need to respond to technical signals (of inflation) in response to what he understood to be exogenous events. And all I could think of, was that a lot of economists are so accustomed to their training and experience re technicals that they've already forgotten the long-term threat of the ZLB due to global demographic changes and that exogenous events are exogenous.

A technocrat will read music and call it jazz because it sounds jazzy, but when asked to improvise, they will fail.

Pingback: The Fed needs to avoid panicking over inflation – Kevin Drum