The Wall Street Journal says the Fed is likely to react harshly to recent news about price levels:

A string of troubling inflation reports in recent days is likely to lead Federal Reserve officials to consider surprising markets with a larger-than-expected 0.75-percentage-point interest-rate increase at their meeting this week.

Before officials began their premeeting quiet period on June 4, they had signaled they were prepared to raise interest rates by a half percentage point this week and again at their meeting in July.

I hope they don't do this. First, these "surprise" moves are never surprises because they're always telegraphed in advance. Second, the latest inflation report wasn't that bad. It showed a plateau in headline CPI, not a new resurgence of rising prices, along with a continuing decline in core CPI.

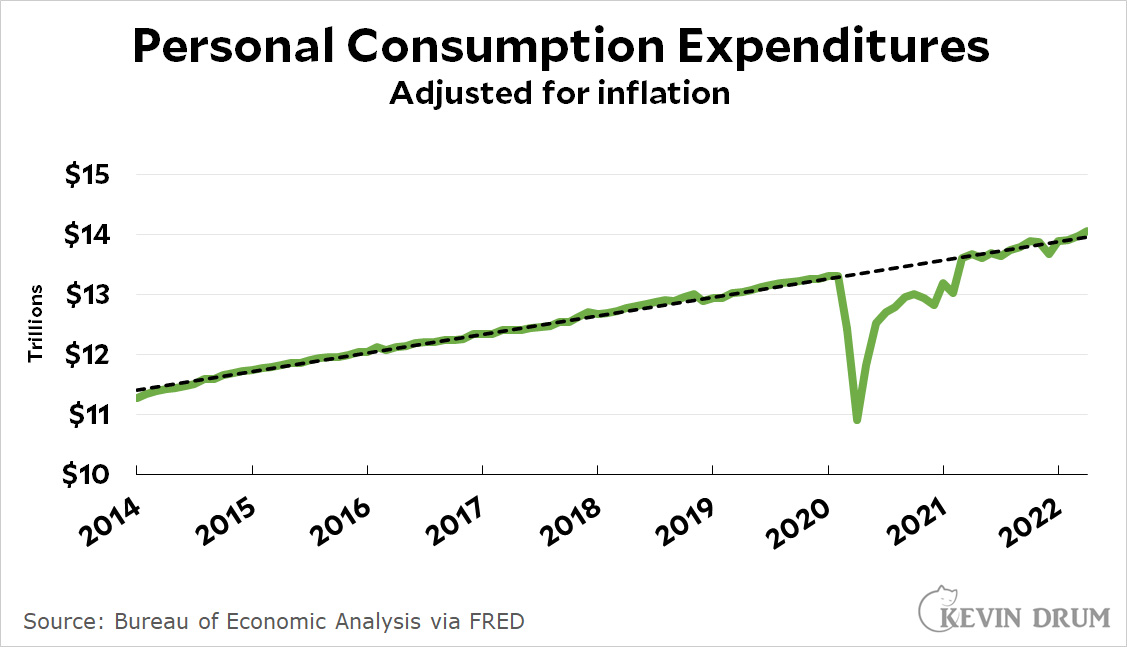

What's more, there are several good reasons to think the economy is going to slow down without any extra help: (1) the Fed is already raising interest rates and slowing asset purchases, (2) the Biden stimulus will fade out in the second half of the year, (3) the housing market is likely to pop thanks to mortgage rates above 5%, (4) personal savings have dropped back to pre-pandemic levels, (5) consumer debt has increased to nearly its historical average, (6) real consumer spending hit its pre-pandemic level in early 2021 and has been rising at normal historical rates ever since, and (7) supply chain problems are easing and will probably continue to ease.

And there's one more thing: Milton Friedman's famous long and variable lags. For fiscal policy, like Biden's stimulus, it takes time for the money to get spent and then a while longer for the spending to affect the economy. In other words, we should expect its peak effects right about now, followed by a steady decline. Monetary policy also takes a while to affect inflation and economic growth. The bright side of this is that Fed action probably won't dampen growth right away. The dark side is that it will dampen growth in 2023—and are we sure we're going to want that when 2023 finally rolls around?

Inflation is likely to subside over the rest of the year and the Fed really shouldn't panic over it. All that does is panic everyone else in a time when the Fed should be demonstrating stability and restraint. Beyond that, we certainly don't need to throw the economy into a recession just because that's what Paul Volcker did in 1980. Today's economy is nothing close to what Volcker faced.

Nah, the housing market isn't likely to pop.

It's just gonna be less insane for a short period of time.

It'll get right back to its two-decade-long trend of rising way faster than inflation really soon.

So let's see, Russia is sending more oil to southeat Asia freeing up barrells. Yet another failed market prediction. They were warned in March but did not listen. Time to meet your maker Weds. Bye inflation.

The US' (headline) inflation rate is not only within a half point of the Euro Area, but it is also tracking with the inflation rate changes across most of the world's economies.

In normal times, the technical response is to raise rates when inflation is high and climbing. Yet, these are not normal times. Inflation is being driven by two specific exogenous events causing shocks in (most) countries around the world. There was a time when economists would explain that we can't all slow down our over-heating economies -- one has to take the blow of the other, after all, otherwise it's all counter-productive.

And, if the rising cost of gasoline doesn't naturally curb consumption, then the Fed raising rates in a growing economy may end up ironically exacerbating inflation.

Which all points to the need to solve for exogenous shocks, not for the inflationary effects of the shocks.

+1

High interest rates cant solve worldwide petroleum, food and worker shortages. But it can turn these shortages into greater suffering.

Whats exactly is the goal?

+1

High interest rates cant solve worldwide petroleum, food and worker shortages.

I see this line of reasoning brought up frequently. But it seems quite self-evidently false. It is true that raising interest rates will not increase supply. But nonetheless, if demand is reduced because of sufficiently tight money, the currently inadqueate supplies of certain goods will no longer be inadequate. Which means lower inflation.

I think a more valid way to state the issue is: if restrictive monetary policy is the tool used to reduce painful inflation, the use of that tool will itself (obviously) not be pain-free.

The challenge with rising inflation is people/businesses change their behavior in anticipation of future price rises. Further, there is a long lead time between Fed actions and changes in market behavior.

I am not qualified to create Fed policy: rather, I believe the Fed must do enough to ensure that folks don’t embed significant inflation expectations into their decisions.

Precisely.

Drum (and many or most Left) is essentially arguing to make the mistakes of the 1970s. It is better to slam some brakes and break the cycle with rebound that to keep trying "oh it is really moderating shortly" self-deception.

What evidence is there that expecting price increases to moderate is self-deception? There is plenty of evidence that exogenous factors are driving prices, and that the solution is to address supply and distribution issues.

How do you solve a problem that is global, by slamming the brakes on the local?

The presumed mechanism by which inflation expectations drive price increases is advancing purchases of durable goods in time, i.e. buying sooner. Please provide evidence that this is occurring. I can Google up any number of reports on supply problems affecting autos, white goods, building materials, etc. It’s inadequacy of supply, not excess of demand. Trying to fix that with interest-rate increases is pounding nails with a toothbrush.

Re Kevin's: "the latest inflation report wasn't that bad" (link to an earlier post he made)

"wasn't that bad" = consistently 6% for 12 months with a slight trendline decline from April 2021 peak (nearly 10%). That looks like cherry picking to me.

Re Kevin's: "there are several good reasons to think the economy is going to slow down"

That's a variant of his inflation denial throughout 2021.

I don't understand Kevin's persistent dismissal of inflation concerns. What's more puzzling is his non-acknowledgement that inflation hits the poor the hardest and those with real assets the least.

And the high-interest rate triggering an economic slow down hits those groups just as hard, if not harder...

Thanks, Kevin. I couldn't agree more. If the Fed goes with higher hikes now, it tells me they've given up on a soft landing and really think it's time to go Paul Volcker again. A certain class of rich people will love them for it.

The stock market has popped a bit.

The Atlantic notes that the venture capital subsidy of millennials is ending (what, I have to pay real prices for ride sharing???)

https://www.theatlantic.com/newsletters/archive/2022/06/uber-ride-share-prices-high-inflation/661250/

and Tesla stock is now only up ca. 7% from a year ago, so ca. 1/2 of it's high value.

Pingback: Trump und Johnson diskutieren linken Aktivismus im Tafelladen, der von der NATO verteidigt wird - Vermischtes 15.06.2022 - Deliberation Daily