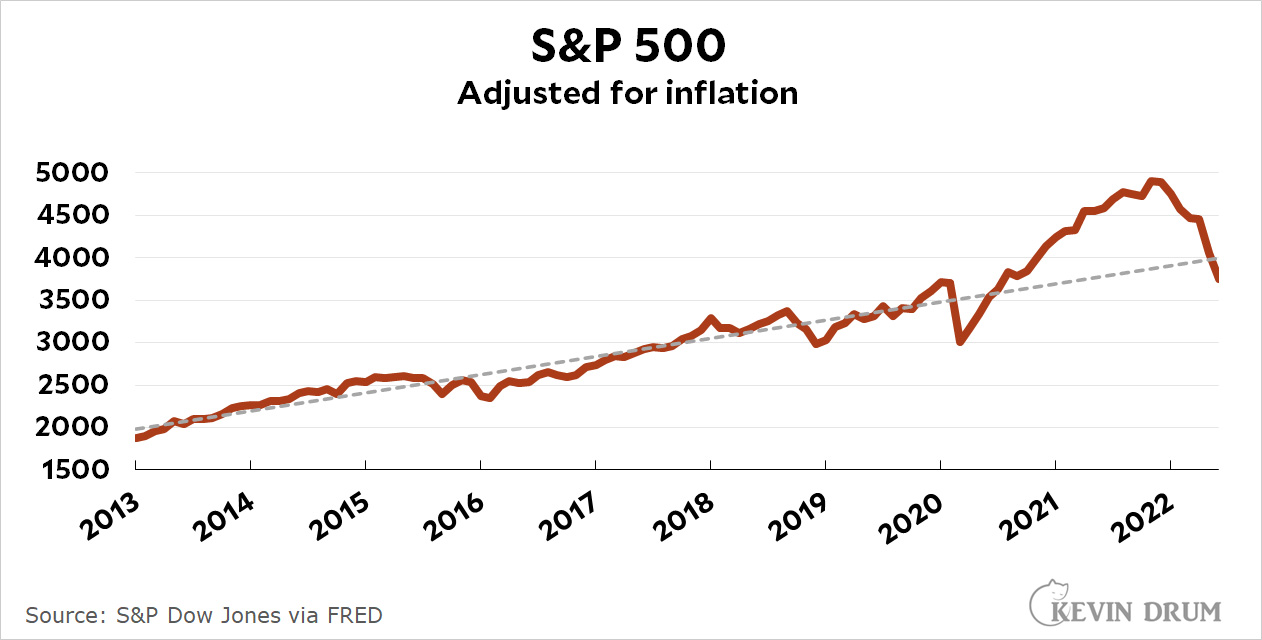

We are officially in a bear market now. However, I'd like to show you something:

There are two things about this chart that are different from most of the ones you see. First, I adjusted the S&P index for inflation. This doesn't usually make a huge difference, but if you're looking at price levels over a long period of time—or during a period of high inflation—it's best to go ahead and adjust.

There are two things about this chart that are different from most of the ones you see. First, I adjusted the S&P index for inflation. This doesn't usually make a huge difference, but if you're looking at price levels over a long period of time—or during a period of high inflation—it's best to go ahead and adjust.

Second, I ran my favorite trendline through the raw numbers. As usual, it's based on data only through February 2020 and then extended to the present. It shows you where the S&P 500 would be if there had been no pandemic and the market had just kept rising at its post-recession rate.

The answer is that it would be about where it is now. It's corrected for the weird boom of 2021 and nothing more. So far.

That may change, especially if the Fed overreacts to inflation. For now, though, it doesn't look all that scary except to people who bought at the peak of the 2021 bubble.

I hear news-rumors that the Fed will go for a 3/4-percent rate hike this time, and that seems like an overreaction to me, although as soon as a recession starts, they might just slash the rates again.

The Fed is irrelevant. If you can't parse a fraud driven inflation report, your number than I thought.

Objectively the stock market has been the third best place to invest excess capital for decades. Only bettered by real estate and fine art. But considering the work involved in handling investment property, and the training/education for art, Stocks clearly are the optimum choice.

And in my experience, most investors are quite aware that the markets periodically go down, but mostly - over years and decades - go up. And at a rate greater than inflation.