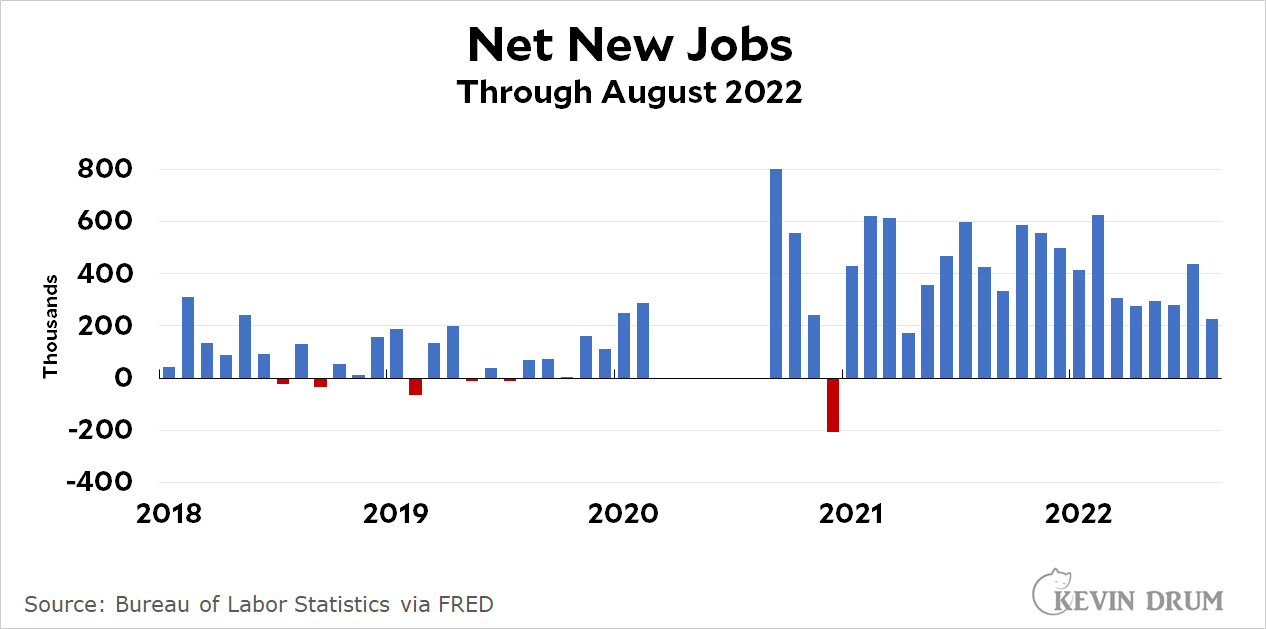

The American economy gained 315,000 jobs last month. We need 90,000 new jobs just to keep up with population growth, which means that net job growth clocked in at 225,000 jobs. The headline unemployment rate went up a bit to 3.7%.

This is an almost perfect jobs report. It's healthy enough that it means the economy continues to hum along, but it's weaker than recent jobs reports, which means the Fed doesn't have to get panicked about the economy overheating.

This is an almost perfect jobs report. It's healthy enough that it means the economy continues to hum along, but it's weaker than recent jobs reports, which means the Fed doesn't have to get panicked about the economy overheating.

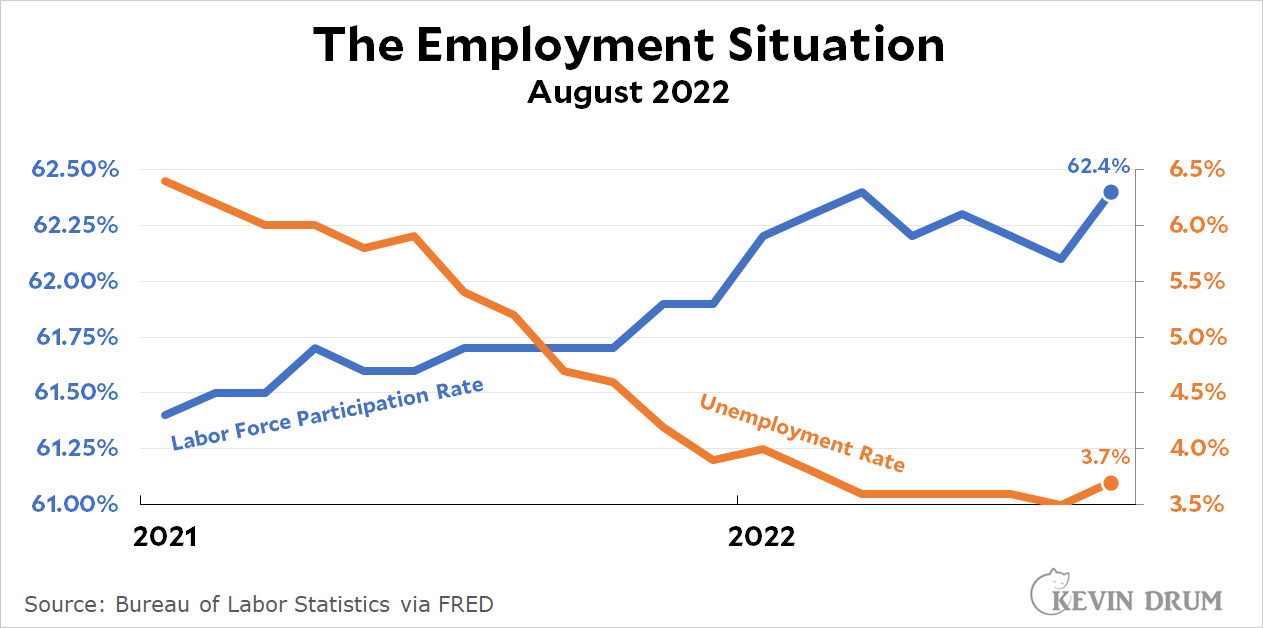

So what happened in August? In a nutshell, lots of new people entered the labor force. Some of this was due to population growth, but there were about 600,000 workers in addition to that, probably due to high school grads entering the job market. Of this total growth of nearly 800,000, about 450,000 of them were employed and 350,000 were unemployed, which is why both the unemployment rate and the labor force participation rate went up:

Wages went up 0.2% on an annualized basis. When you account for the -0.2% inflation rate in July, that means real wages went up 0.4%. Woo hoo. But it's better than going down, which is what wages have been doing lately.

Wages went up 0.2% on an annualized basis. When you account for the -0.2% inflation rate in July, that means real wages went up 0.4%. Woo hoo. But it's better than going down, which is what wages have been doing lately.

Still lots of jobs for professionals / engineers out there. Last at today for a coworker moving to NC. The economy is fine. Gas down below $3.75. Foo is pricy still, it starving the poor is a good thing in the long run. Especially Africa, South Asia, Central America etc.

"high school grads entering the job market"

Both of the measures are seasonally adjusted so ideally this should not be a factor.

Recall, the panic was in the opposite direction -- people (like you) were worried that a 150 basis point increase of the core rate would trigger a recession. Despite all fears, we're still nowhere close to the end of the expansionary side of the business cycle.

Contrary to your assertion, as I wrote before, the economy can absorb a lot more rate hikes. The Feds can see this for themselves, now. Labor tightness has barely budged.

They're going to continue to increase the Fed rate, so long as labor tightness remains and inflation remains uncomfortably elevated.

It doesn't mean that I've moved off team transitory. Rather, I believe the Feds ought to take advantage of the situation and raise rates while the economy continues to grow. Once upon a time, they used to do this, you might recall. The economy is extremely accommodative so the Feds ought to act while they can.

And all they will do is make houses more expensive. Thank goodness I refinanced in December 2021. Media hysteria aside, people will absorb the increased food costs. Gasoline is back to normal. Europeans will be destroyed by their dependence on Russian gas so that will naturally slow things down. Gonna be a cold winter in the EU? Should’ve sent troops to Ukraine. Still can! Russia is playing their last card by cutting gas supply. It’s time to blow up all the pipelines, seize the oil shipments, and sink the ships which call on Russian ports. Blockade them.