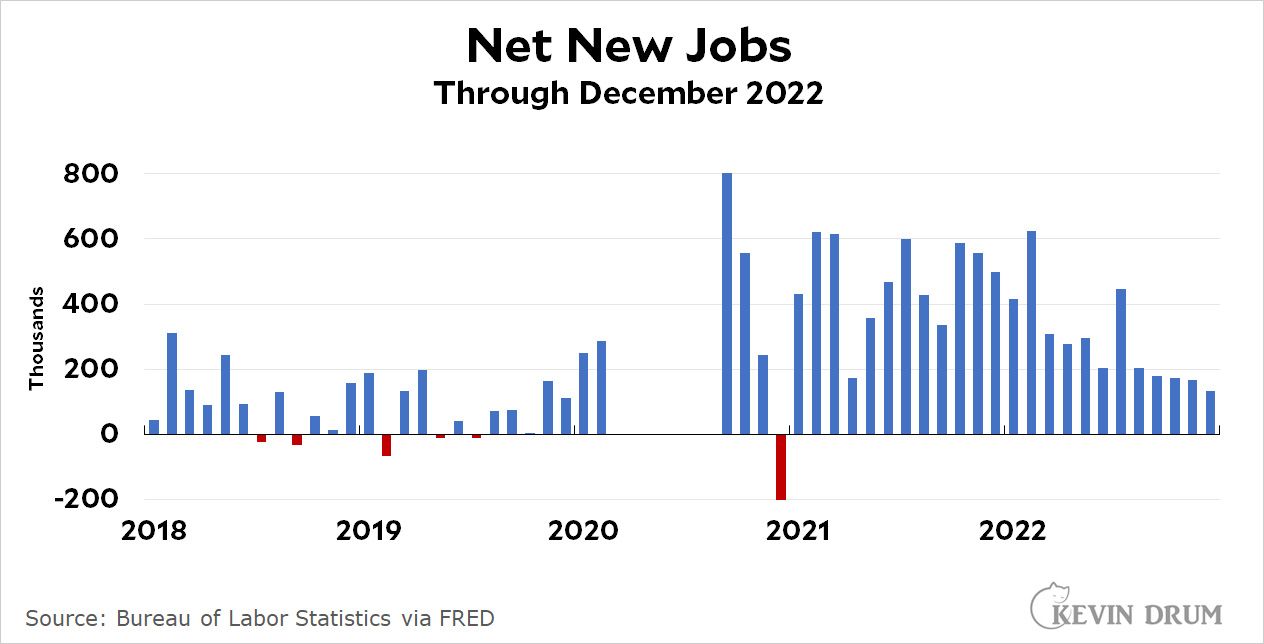

The American economy gained 223,000 jobs last month. We need 90,000 new jobs just to keep up with population growth, which means that net job growth clocked in at 133,000 jobs. The headline unemployment rate declined to 3.5%.

This is a pretty good jobs report. The topline number is only so-so, but the number of employed people went up 717,000 while the number of unemployed people went down 278,000. The labor force attracted 303,000 new workers and the headline unemployment rate was down two-tenths to 3.47%, its lowest rate in the past half century. Another tenth and it will be the lowest rate since before I was born.

This is a pretty good jobs report. The topline number is only so-so, but the number of employed people went up 717,000 while the number of unemployed people went down 278,000. The labor force attracted 303,000 new workers and the headline unemployment rate was down two-tenths to 3.47%, its lowest rate in the past half century. Another tenth and it will be the lowest rate since before I was born.

Unfortunately, there's good news and bad news in all this. The headline number of 223,000 is pretty much perfect. It shows moderate growth, which is good, but not so good that the Fed has to panic over it. But when you add in the record low unemployment number, the rising labor participation rate (62.2% to 62.3%), and the excellent underling numbers, the Fed is highly likely to conclude that the labor force is too tight and it needs to push us even further into a recession next year.

On the other hand, weekly wages were down -0.2%, which comes to -1.6% after adjusting for inflation. That's pretty good evidence that the labor market isn't as hot as the unemployment figures suggest.

Leisure and health care were the biggest gainers. Temp services were the biggest loser.

More proof that the Fed's interest rate hikes have not had any impact on the economy yet but will definitely cause a "we are so fucked" recession sometime soon.

You've really set yourself up quite nicely, Kevin. Unfalsifiable claims and a way to spin new developments as proving you were right no matter what those new developments are.

Start making more money weekly. This is valuable part time work for everyone. The best part ,work from the comfort of your house and get paid from $10k-$20k each week . Start today and have your first cash at the end of this week.

Visit this article for more details.. http://incomebyus.blogspot.com/

Inflation has been at or near 2% since the end of June. The fed had no basis whatsoever for the last 0.5% rate increase.

Citation needed! What inflation are you talking about?

I hope you’re not referring to headline inflation - that would betray you as a fairly unserious member of this debate.

Yesterday stocks were down...because of good jobs news.

Today, stocks are up....because of the good jobs report....

Steve Bennen at MaddowBlog published yearly jobs numbers for the past decade. For every year except 2020, there were at least 2 million jobs created. In 2020, 9.3 million jobs were lost, and we've bounced back in subsequent years, 6.7+4.5=11.2 million jobs, so we have a net positive number of jobs over those three years of 1.9 million. Except, to get back on trend, we'd need a net of 6 million jobs or more.

We're still short 4 million jobs. Where'd they go? Demographics, drop in labor force participation and shut down of immigration?

I’d say the answer is yes. A combination of all 3 of those are the bulk of it, maybe a little technology too, though not that much yet.

You're ignoring that the US census said population growth slowed from the 0.7% growth per year trend prior to covid to 0.4% in 2020 and 0.1% in 2021. Given that senior citizen growth only slowed from 3% to 2% in those two years, we really didn't need more than a million new jobs due to population growth.

Also, we were catching up from losing so many jobs in ‘08-‘09. Unemployment was elevated for most of the last decade. But at some point we were bound to slow down once we actually got to full employment.

Kevin always uses 90,000 as the “break even” jobs number each month - 12 months if that would be 1.1 million. So you could claim we’re still 1.4 million jobs short, but even then I’m not sure. We’ve seen vastly lower immigration the last few years than we had previously. My guess is we can still do some “catch up” jobs growth for a bit, but at some point soon we’ll hit a fairly maximal level of employment, unless something changes.

I really wish finance reporters would contextualize what's going on in a way that normal people can understand it. You can even both-sides it!

"Reacting to the December, 2022 jobs report, the Fed decided to apply pressure to job growth that begin will take effect some time towards the next of the year, by which time the economic climate will be entirely different.

Powell believes this is necessary to support his reputation, and may even believe it is the right decision based on a theory about signaling. Others believe there is a more political motive."

Do you really think that’s a “both sides” treatment?

You understand that the majority of financial analysts think that the Fed still hasn’t done enough to whip inflation, right?

Kevin is pretty far out on the “Jay Powell is tanking the economy to hurt Joe Biden” spectrum. There are others who think he is misguided, but most financial analysts thing the Fed is too *optimistic* in their projections of inflation for 2023, not too *pessimistic.*

That doesn’t mean Kevin is wrong, for the record. I think his analysis is flawed, but he might be right, and the fact that he is way outside the norm doesn’t mean he’s incorrect.

But this comment section tends to take his views as the obvious truth that everyone knows, and acts like anyone who thinks the 50 BP rate hike was the right move either hates workers or hates Joe Biden. And that’s just not the case.

And yet, the Speaker of the House job remains unfilled...

"We need 90,000 new jobs" Kevin's been using that number for 20 years. It's time he updated it to 95k to reflect population growth. That's also the number the Fed claims.

I forget the exact year it changed, but it used to be 200,000 new jobs. I think that was the number most people used just 10 years ago. Then baby boomer retirement and steadily lower birth rates made that number unrealistic and people started to use other numbers.

90,000 seems close enough that I wouldn't bother changing.

When the jobs report comes out I always check calculatedriskblog for even more charts. Prime (25 to 54 Years Old) Participation is still below what it was before the pandemic, so I’m not sure why that would indicate the economy is running too hot.

Also, someone pointed out this tweet:

https://twitter.com/carlquintanilla/status/1611385694496358406

It points to a WSJ opinion piece titled What if Inflation Suddenly Dropped and No One Noticed?

Inflation in the second half of 2022 is “almost back down to the Federal Reserve’s 2% target. Even more astonishing, hardly anyone seems to have noticed.”

Kevin noticed 😉