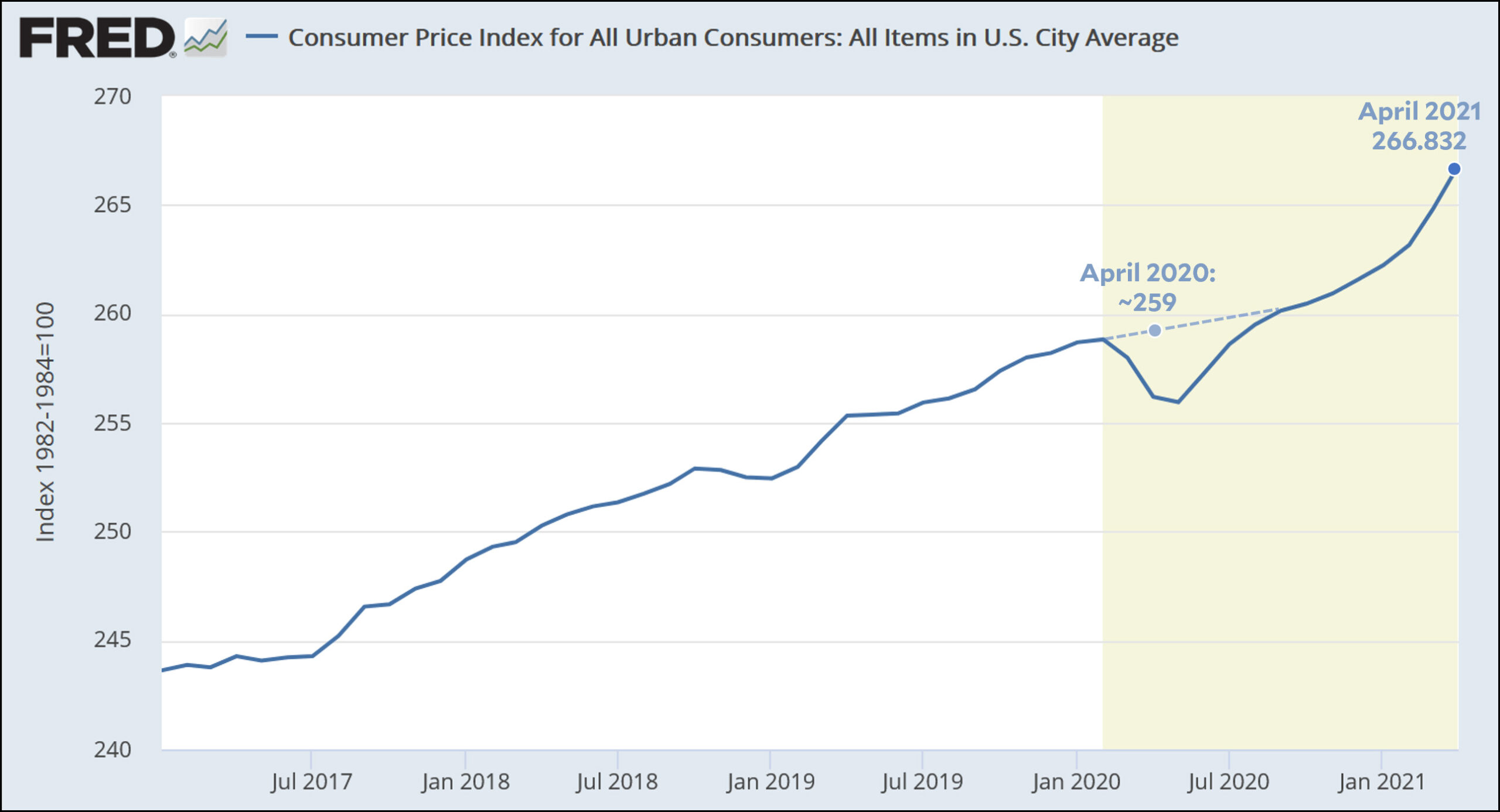

As expected, the headline inflation rate rose 4.2% in April. My best guess for the real rate of inflation, based on ignoring the artificial drop a year ago, is 266.832 ÷ 259, or about 3%:

For all you inflation worriers out there, 3% is still high too! But hardly unexpected. We've pumped enough money into the economy that everyone expects a temporary bout of elevated inflation. The only real disagreement is over how long this will last. Is it just for a few months, and therefore no big deal? Or is this a harbinger of high inflation for years to come?

My vote is on "temporary bout," but only time will tell.

We're seeing some interesting goal-post shifting from the MMT crowd on this. Initially it was all about spending to fill the output gap. Then it became about the output gap since the last recession. Now that we've got rising inflation (3% is definitely above the usual target), they've shifted again to claim that the rising prices are good, because it will create the capacity to absorb it. Almost like supply side economics.

I think if the real rate gets to 4%, we've gone too high and need to tamper it down a bit.

Why 4%? You can't just say "we've gone too high". That's being obtuse about an arbitrary level.

MMT would suggest that, simply, the Feds would tighten supply to combat high core CPI. But, with the Feds formally adopting the policy of average inflation targeting, it's pretty clear they're going to allow inflation to remain above 2% for a while.

You have to pick some level, and I'd rather it be in the low single digits than 10% or something like that. Besides, you might not perfectly hit the target - you might aim for 4%, but still end up at 5% inflation.

Having to "pick some level" isn't very sound policy.

If you were in charge of policy, is this how you'd explain to the nation why you pulled the trigger to control the money supply?

I'd rather have someone explain that the decision is based on a series of triggers:

-- Exogenous shock has been cleared, and

-- NAIRU exceeds the nominal unemployment rate, and

-- GDP growth is above the long-term average, and

-- Inflation has remained persistently above 50% of the average inflation target of 2%, and

-- Inflation is increasing, then

Pull the trigger and raise the central rate.

Having to 'pick some level' is the biggest reason no one takes Libertarian Bayesians seriously.

Having to "pick some level" is an appeal to solipsism.

If the correct answer to the question is "I don't really know," use it.

"You have to pick some level" is a perfectly sound statement about a lot of things. There tends to be a range that makes sense. For instance, in the US the legal drinking age is 21; it used to be determined state by state until the federal government coerced the states with highway funds. In the UK it's 16; in the various Canadian provinces; it's either 18 or 19. The same applies to voting ages; democratic governments tend to set the voting age at what they perceive to be the age of adulthood, and it varies in the range of 16 to 21.

That also applies to inflation. For instance, why set the acceptable maximum at 3% rather than 2.5%? Economists generally agree that there has to be a little inflation to allow the economy to function efficiently, but that too much inflation is a bad thing. Attaching numbers to "a little" and "too much" is to a certain extent arbitrary; you have to pick some level and experts may disagree, within a fairly narrow range, what the exact right level is.

It's interesting. When I enlisted you could get a beer on base at 18...after all, if you can die or kill for your country, you should be able to handle an adult beverage or two. Heck, at my A school there were even some Charlie Whiskey hold overs (retraining or instructing) that told of the days when they would go out and get a beer *at lunch*.

Now apparently throughout most if not all of the US the young men men men men men men (three more men) and women that are going to face or deal out death for our 'national security' can't drink until 21. It's rather strange...our society trusts young peoples' judgement to help select the 'leader of the free world' and the local county sheriff, but doesn't trust them to have a pint.

There's a reason #OurRevolution is appropriately called a Tea Party of the Left.

Now, the Tea Party turned into Q. What will #OurRevolution & #TheSquad convert into?

The Squad doesn't equate to either the Tea Party or QAnon at all.

Yeah, the Tea Party folks don't hate their country and its history. And most of the Tea Party's folks grandparents were born here.

Then why is their purpose to cause as much harm and disaster as they can, while pretending where their grandparents were born is an arguable defense in court?

Eh, real rates are negative right now.

Think how much out of control inflation led to a spike in the price of Jeff Bezos's new yacht.

It is no wonder the Post keeps harping on El Pepe Maximo's failing economy.

Assuming the original price on Jeff's yacht was around $500,000,000, then 4.2% inflation is going to cost him $21,000,000 this year. This only includes the primary yacht, not the escort yacht that carries the helicopter.

That's Ryan Tannehill's cap hit!

Inflation is worth one NFL league average quarterback.

Where's the "Block" button, Kevin? It's not often I'm on the side of cobras.

Two points:

1) Not very long ago, the Fed and other economists were concerned about being unable to bring inflation UP to 2%. This remained the case from around 2009 until quite recently. Given that, the notion that we should be terrified of one month's figures (especially based on Kevin's correct reasoning about last year) is more than a tad absurd.

2) In all the discussions I've seen, including Kevin's, there is no mention of supply chain interruptions caused by the pandemic, yet they are the obvious cause of at least some, if not all of the price increases we're seeing. If this were true only in a few areas of the economy, it would be subsumed in the broader numbers, but that's not the case. Pretty much everywhere you look in the economy, demand is exceeding supply because supply has been held below normal capacity by the virus. We see the same result in the labor market.

Before we even begin to discuss inflation in the (hopefully) post-Covid economy, let's see what happens when we get back to something resembling "normal" -- that is, workers back in their jobs, suppliers able to fill orders normally, etc. My bet? Much of the so-called "inflation" will vanish.

Until supply is no longer constrained by the pandemic, I expect "inflation" to remain somewhat higher than we're used to.

And here is the month/month rate on a yearly basis:

https://fred.stlouisfed.org/graph/?g=DX5W

That rate of 9.2% is the actual rate for April/May 2021 (insofar as the monthly numbers are accurate). This is a real rate: it is not an average and it is not dependent on the drop of a year ago. Kevin's claim that he can supply the only "real" rate by taking an arbitrary average over some period other than a year is nonsense.

And again, the point is to predict future inflation. You can't predict the future by taking any single number from past data. Is the 9.2% monthly rate going to persist for years into the future? That is very unlikely but inflation could be fairly high for a while until supplies build up again. The reason we are not likely to have an "overheated" economy which could cause inflation spikes like those of the past is that we will probably not be seeing either a major war or huge increases in oil price, which was what was mainly responsible for the inflation of the 70's (Or will we? Will hackers strike again to disrupt gasoline supplies?). Such predictions are not made by juggling the inflation averages.

Sorry, the latest number is March/April. But note that month/month inflation has been over 3% for the last four months, and generally increasing.

Not impressed. Inflation hasn't risen much over the last 3 months.

If you stretch out the FRED chart, you'll see the the spike of recent months is still not as high as spikes we've had in every decade since the end of WWII, with the exception of the 2010s. We've had high spikes even in periods of low inflation.

The two postwar periods of high inflation were the immediate postwar years (1946-48) and the 1970s. The first of them was short-lived. The second, the one that people today remember (including policy-makers), was persistent and took a Fed-induced double-dip recession to tame. I don't see how the conditions today would lead us into a period of 1970s-type inflation.

Today we seeing demand rebound from a year of suppression and some cases of supply shortages. That probably gets worked out in the next few months or year or two. It's not what happened in the '70s.

There was really no inflation in the 70's either. Just producers raising prices on fear of shortages. Which created embedded inflation.

Adventures in historical gaslighting.

9.2% is not a real rate; it's the computed rate if inflation at that rate continues for 12 months. The real rate is 0.8% for the month.

You can’t predict future inflation even with lots of numbers, unless you understand (i.e. can model) the causative mechanisms. I don’t see any candidate mechanisms today.Real wages have been nearly stagnant for four decades, as unions have weakened, so a wage-price spiral isn’t going to happen. The economy is considerably more energy-efficient, and less dependent on oil for energy, than in the 70’s (We have whole sectors powered by caffeinated soft drinks and pizza, allegedly). Is there another ubiquitous factor of production that is likely to see prices rise persistently?

For all you inflation worriers out there, 3% is still high too!

That's only true if your expectations are anchored to recent history. The average for the past two decades was sub-2%. But the long-term average for annual inflation, from 1913 to 2020, was 3.1%.

We're never going to get back to a normal, functioning economy if we slam on the brakes every time inflation hits 3% or more. If inflation ran 4% or 5% for the next five years, that might be a problem. But if it goes there for a few quarters, it's probably no big deal.

Inflationistas have been consistently wrong since sometime last century. No reason to listen to them now.

Strangely, as far as messaging goes, Jay Powell seems better-suited for this moment than Janet Yellen.

Pat Buchanan says, "Aloha!"

It would be nice to start earning interest on my savings accounts again. Maybe CDs will return.

That's up the banks. Don't hold your breath.

Cassettes are already making a comeback. Several indie label startups are tape sales only.

CD can't be far behind.

Cassettes no, vinyl yes.

Real inflation is about at 2.9%, driven by shortages from the pandemic and a booming economy which caught producers off guard. Lazy lazy. This was not 2009 people, for a variety of different reasons.

By next year, the shortages will be gone, stimulus will be faded, reducing consumption. Might have a disinflation.

As Krgthulu pointed out, 1/3 of the increase in the index can be chalked up to the price of used cars.

https://twitter.com/paulkrugman/status/1392458554578247685

Somehow I can't get all that worked up about this.

Well, that's something. The reason used car prices jumped 10% is the same reason car rentals in Hawaii are now $700 to $1000 per day. Rental companies cut back their fleets last year. A textbook econ case, but not really a big worry for the rest of us.

Pretty much the thing. I had to rent a Nissan Sentra for a week while my car was in the body shop in late March. Cost me $850 for a week. The other thing WRT used car prices is that right now new cars are very expensive and have limited availability, which limits the supply of trade ins. There are pinch points all over the automotive economy right now.

Pinch points, floods, fires, pipeline hacks.

It's all inflation guys. Stuff like this happens all the time in non-pandemic times. The reason demand is high now is Biden-zeit printers on overtime.

Good democrats will take note and stop spending unnecessarily until supply catches up. Don't spend money!

I think that's happening. I'm deferring a home reno project until the price of lumber comes back down.

Why is that dotted line so flat? If the dotted line were drawn with the same slope as the preceding curve, it would just about intersect the point we are at right now. Ie, prices are about exactly where they should be relative to pre-Covid trends.

My memory, probably faulty, is that for a long time the inflation target was 2-4%. It has recently been a struggle to achieve even 2% inflation. So finally getting to 3% seems like definitionally a victory, in fact hitting the center of the target precisely. What is the argument that it is "too high"?

Look at that inflection point!

Oh, btw, 'real' inflation shouldn't include on the cheap electric geegaws we get. Yeah, a $2000 computer in 1995 costs about $500 now, but you can't eat or live in a computer.