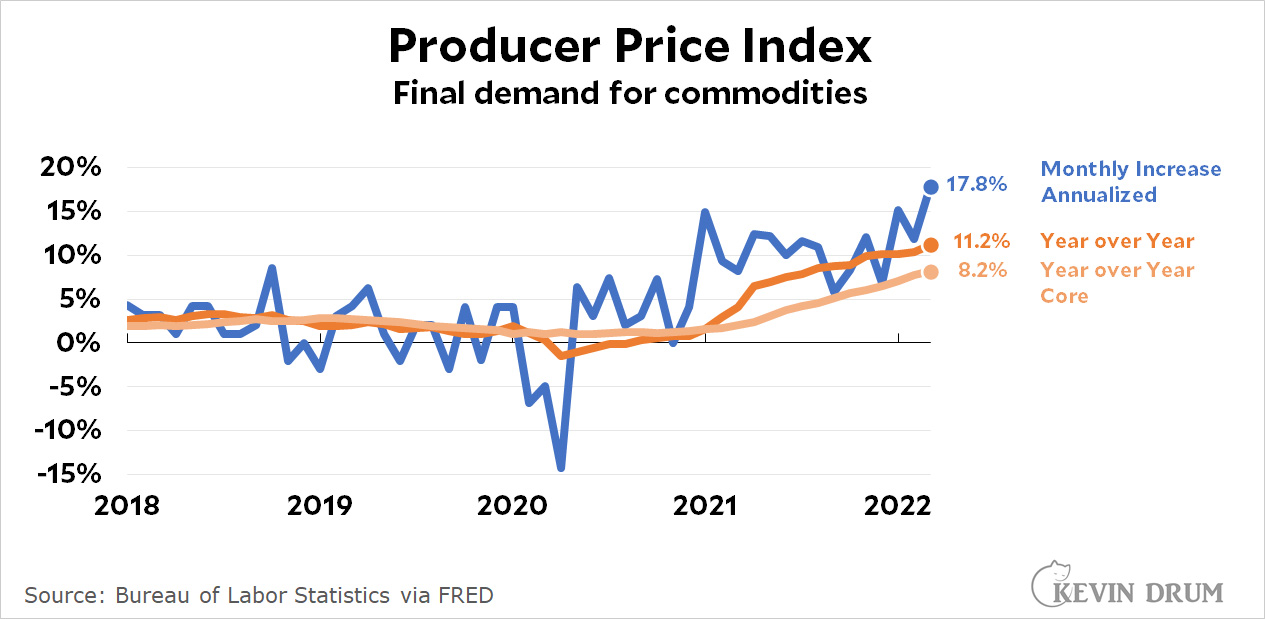

I don't normally bother posting the producer price index, but since inflation is on everyone's mind these days let's take a look at the latest numbers:

Not good! The PPI for goods was up 11.2% from last year and the monthly increase from February came to 17.8% on an annualized basis. In both cases they seem to have accelerated a bit.

Not good! The PPI for goods was up 11.2% from last year and the monthly increase from February came to 17.8% on an annualized basis. In both cases they seem to have accelerated a bit.

The large monthly increase in the PPI for goods is way, way different from yesterday's CPI number, which clocked in with a drop of -4.7%. That's a difference of more than 22 points. However, on a year-over-year basis, which is generally less volatile, the PPI increase is only a few points higher than the CPI increase (11.2% vs. 8.5%).

As with the CPI, a good deal of these big increases is due to large rises in energy prices. The core PPI was up 8.2%, which is better than the overall number but still a couple of points higher than core CPI (8.2% vs. 6.5%).

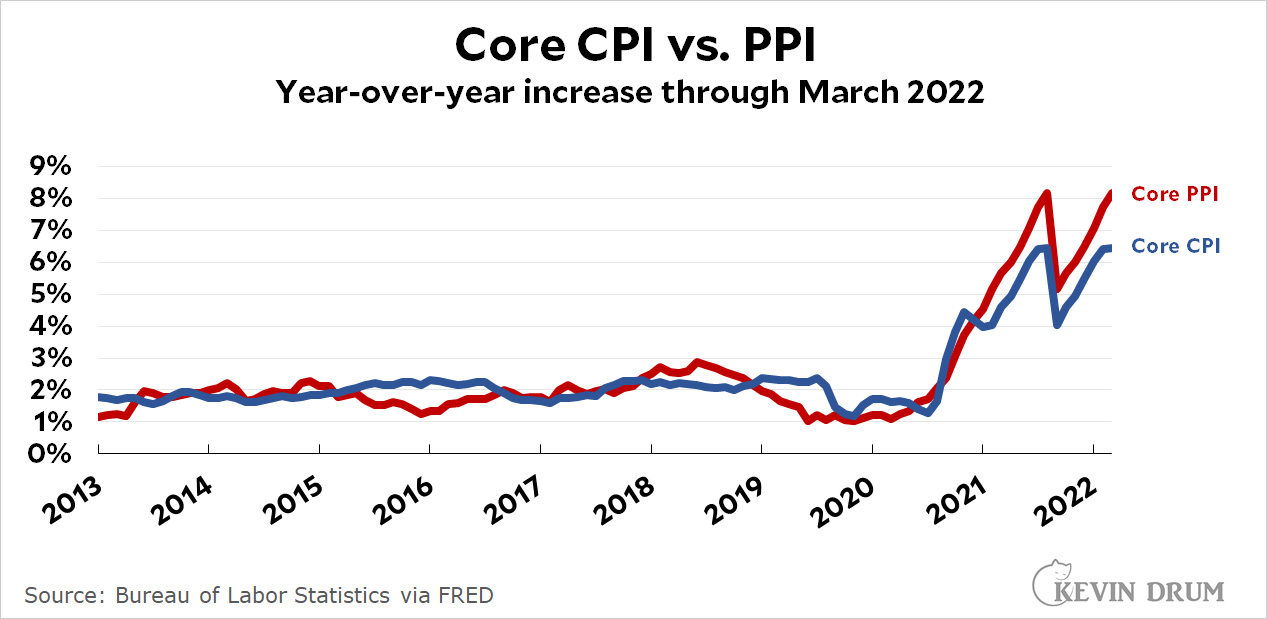

The difference in core CPI and core PPI is not new. Before the pandemic, core CPI and core PPI for goods followed each other closely with only brief divergences. On average they were identical. But starting in 2021 they diverged and stayed diverged:

Since 2021, core PPI has averaged 1.2% higher than core CPI, and in March it was 1.7% higher.

Since 2021, core PPI has averaged 1.2% higher than core CPI, and in March it was 1.7% higher.

The divergence in the price level of services has been even more dramatic. Before the pandemic the growth of the overall PPI averaged a little lower than the growth in CPI. But since 2021 the divergence has exploded: PPI has averaged 2.7% higher than CPI and rose to 3.6% in March.

Sorry for this number-ific post. There's just a lot to see here. So far, this divergence in pretty much all forms of CPI and PPI (overall, core, goods, services) hasn't shrunk, which means it's not passing through to consumer prices. Or something. It's a little hard to parse, actually, which means it's hard to say if the March increase in PPI is bad news for future CPI growth. We'll just have to wait and see.

Menzie Chinn at Econbrowser has been good explaining the co-movement of various price indices. He also suggests that as of right now, the biggest upward driver of prices is oil, and that core inflation (which eliminates the most volatile prices, like oil) is actually fading a bit. He is in no way suggesting complacency, though (that's my take of his recent posts). In any case you're in good company.

.4% inflation in April???

We're in for a bumpy ride, I'm afraid. What's going to make the next couple of months ugly is the Covid situation in China. Just as all the shipping backlogs start to clear up, we're going to be looking at massive supply chain disruptions coming out of some of the their largest manufacturing centers due to lockdowns. And then there are the assholes like Greg Abbot down in Texas holding up thousands of trucks at the border because he claims they're all full of fentanyl and illegal migrants.

While Abbott allows illegals and fentanyl over the border. Kill him.

The trucks should detour west to Nogales or Agua Prieta in AZ. It's a 6-hour 550-mile drive, but that's nothing compared to a 30 hour wait.

Blaming Vladimir Putin isn't going to work for most people.

Blaming the oil companies for price gouging is going to work.

You have to blame them, keep blaming them and threaten to nationalize them, and when conservatives rush to their defense you can blame them as well.

Keep up this one point and only this one point.

Why do you Lefties in USA land keep thinking that threats of nationalisation are electoral winners (outside geographies where you will win virtually no matter what).

The price gouging play may work but really you need to learn to calibrate to USA not a pseudo-Europe you dream of.

Your a small mind. Arrest corporate globalist morons, torture them. My guess when we start going down "family" line. They will start talking. The end of capitalism it will be.

And....Covid is back...

Cases going up in almost 1/2 the states; falling in just over 1/3.

Always a bit of a wild card--don't expect lockdowns, but some mask mandates are back.

Nope. Covid is not back. Enough of these lame retarded posts.

I really don't know how to think about this stuff carefully, but I do think that the extended shutdown and the chaos that it produced for companies is likely as fractal as the size and distribution of companies themselves. how many small businesses held on during pandemic with some PPP loans that were less than enough to make them whole, and there is a need or pressure to backfill some revenue/profits and that is working its way though the entire system as inflation now.

This round of inflation doesn't really affect most people. Furniture, appliances, airfare, hotels, cars... It's all very easy to avoid. I'm not buying any of that stuff this year. Probably not next year either. Gasoline is already off the peak. But yes... those on the margins will fall off the edge just like they do every day.

The best solution to this inflation problem is to skip the purchase of stuff you don't need. Otherwise, food and gas will cost me at most another $100 a month and that is easily mitigated by changing my spending habits.

But the media needs to make this appear devastating to the entire country. Nonsense. The wildcard is the war. IF we had any guts, we'd have a full embargo on Russia and blockade all shipping. It's time to starve the fuckers. It's disgusting that the Europeans made themselves dependent on these awful evil Russians.

Uh, no. A naval blockade would be an act of war. We do not want to start a shooting war with a thermonuclear power. It's disgusting that people want to sacrifice hundreds of millions of innocent lives just to pretend they have "guts."

I see plenty of guts on TV splattered around. But sure… they can kill 100 or 1000 or 1000000 people in Ukraine and we can’t stop them because, well, they can always kill more! So really… there is nothing they can do which will elicit a response from the US capable of stopping them from killing. As long as they do it in small numbers over time… it’s ok. Good to know.

It was god that made natural gas the best fuel source adone tht can be transported at reasonable costs except by pipeline. It was God that put most of europe's supply of it in Russia. Europeans aren't stupid enough to cut off their nose to spite their face like Trump keeps telling them to do.

This is the classic definition of appeasement. But that’s ok. Just so we all admit it. Can’t cut off our nose for some silly people like those in Ukraine.

Overstated inflation seems to be the norm. Maybe it's time to bring new bean counters in and double check???

The government re-weights the CPI and PPI components every couple years, right?

If the price of cars spike because there are no cars available, the inflation stats assume that the count of car purchases are humming along like normal, only at much higher prices.

Is that a correct understanding? Or is the reweighting processor more dynamic?

This probably isn't a big deal most of the time, but we've seen pretty dramatic changes in buying patterns, prices and product availability. Could it be a few years before we actually understand how all of the guesstimate stats are actually impacting peoples lives?

"It's a little hard to parse, actually, which means it's hard to say if the March increase in PPI is bad news for future CPI growth. We'll just have to wait and see." Actually it's easy to parse. produces, largely manufacturers are wining a greter share of revenue from retailers. Which really isn;t that surprising given howbadly retailers took it in the neck with covid. Even amazon lost a bit of it's massive strength to dictate terms to it's suppliers.

Ukraine sends a message,

https://twitter.com/TheRickWilson/status/1514057557194817538

There was a segment on the NewsHour yesterday, and the person from WSJ said with respect to rising prices--"It's because they can".

Increases in profit margins are adding a few points to the inflation we see. That my end up hurting the economy, and companies, in the long run--but for now, they'll take the profits.

A lot of sectors behave effectively like cartels. In this case, one announces a price hike, and other follow. Why aren't the others keeping prices low to increase market share? Simple--they'd have to spend money to do that--and they really don't have the capacity to increase output by much. And there's also game theory--if they go for market share, their competitor will just lower prices. So--go along with price increases until you drive people to a completely different product line.