The Office of Management and Budget issued a new set of guidelines for regulatory analysis a couple of weeks ago, and it's surprisingly important. It's also pretty technical, so hang on.

The rules are set out in Circular A-4, one of OMB's 136 circulars, and the first thing it addresses is the discount rate that agencies should use. This is a measure of how important the future is. A high discount rate means you're discounting the future and mostly focusing on immediate effects. A low discount rate means you consider future effects important.

To some extent, the value you should use is a matter of opinion. But there is a quantitative method of approximating it: take a look at financial markets and figure out the actual discount rate that's predominant when investors buy things like long-term bonds. The OMB did that, and decided that the discount rate had dropped over the past couple of decades from 3% to 2%.

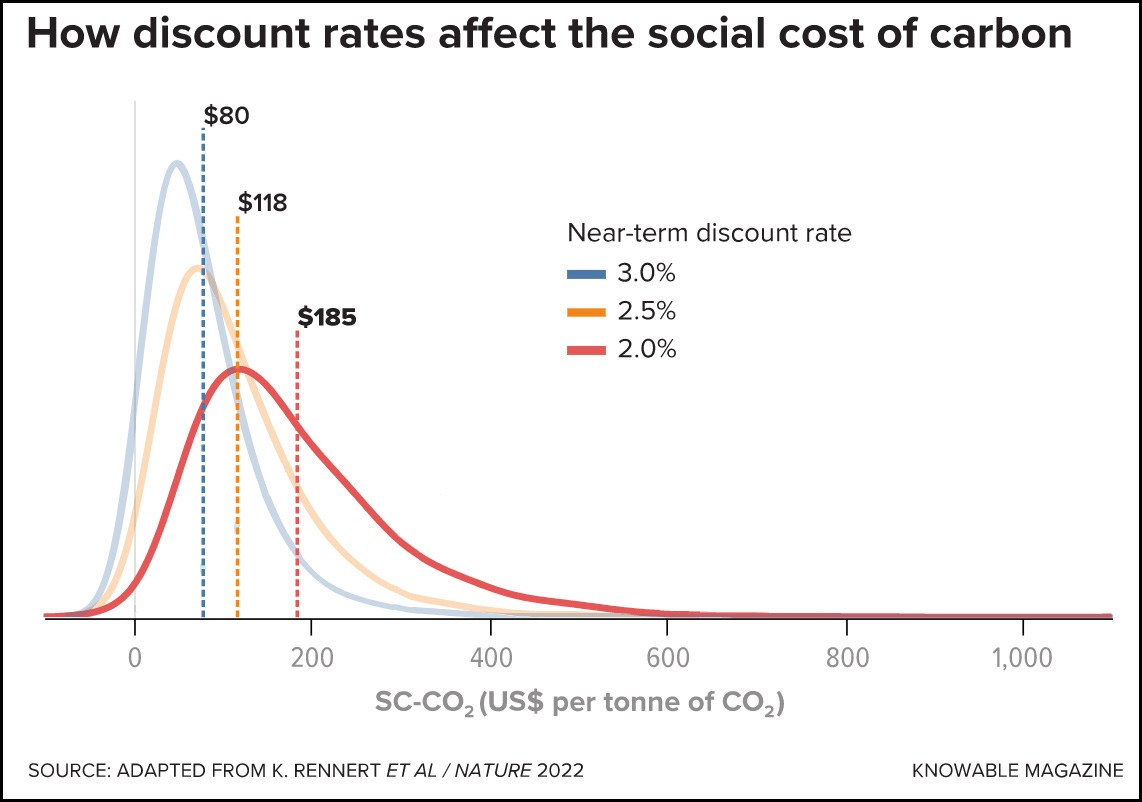

Why is this important? Because small changes in the discount rate can have big effects on regulation. In the area of climate change, for example, a lower discount rate means we're taking future effects more seriously, and that in turn means that regulations now (which have present-day costs) should be stiffer. Here, for example, is an estimate of how much we should tax carbon based on the future effects of global warming:

A discount rate of 3% implies that the social cost of carbon is only $80 per ton. A discount rate of 2% implies a cost of $185. The OMB's new 2% default rate means that cost-benefit analysis is more likely to come out positive for regulations on things like carbon and pollution, which have effects mostly in the future.

A discount rate of 3% implies that the social cost of carbon is only $80 per ton. A discount rate of 2% implies a cost of $185. The OMB's new 2% default rate means that cost-benefit analysis is more likely to come out positive for regulations on things like carbon and pollution, which have effects mostly in the future.

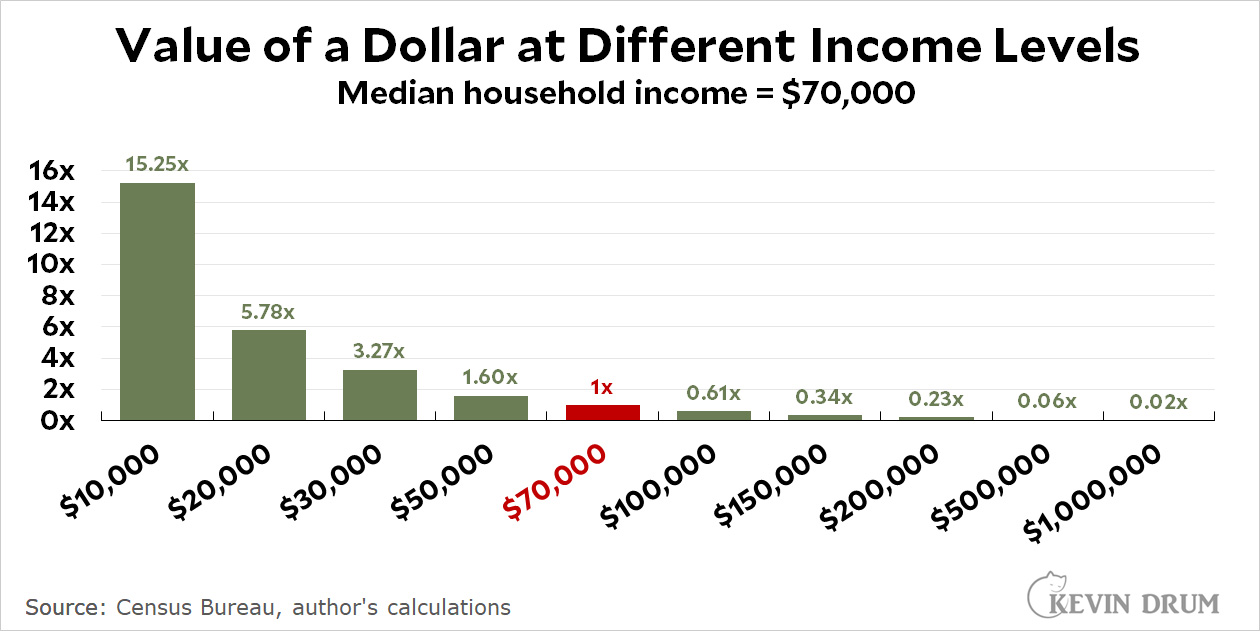

The second thing that Circular A-4 does is something I wrote about a few months ago when it was in draft form: it changes the way we treat different groups when we do cost-benefit analysis. In a nutshell, the new treatment assumes that a dollar is worth more to a poor person than a billionaire. So if some new regulation costs a rich person ten dollars but benefits a poor person ten dollars, it will now pass a cost-benefit analysis because that ten bucks means a lot more to the poor person than the rich person. Here's how much a dollar is worth to different income groups:

A dollar of benefits to the poorest group is now worth more than $700 in cost to the richest group.

A dollar of benefits to the poorest group is now worth more than $700 in cost to the richest group.

There's more to Circular A-4 (it's 93 pages long) but these are the two most important. Between them, they make it much more likely that cost-benefit analyses coming out of federal agencies will be both fairer and more reasonable.

The whole thing sounds like political BS. Long term interest rates have risen recently not fallen. And the other says it is okay to steal from the rich as long as you throw the poor a few pennies.

Taxation is NOT theft.

"Taxation is NOT theft."

This isn't taxation. This is saying it is better to cause ten thousand dollars worth of damage in a rich neighborhood than one hundred dollars worth of damage in a poor neighborhood.

In a way, yes, and that is correct, simply because the (very VERY) rich neighborhood can afford a $10K impact better than the poor(est) neighborhood can afford a $100 impact. It's called progressivity.

Don’t worry about it, James. The next Republican president will scrap all this and restore the proper order of things: namely, all policy should funnel all the money towards the rich again.

"Don’t worry about it, James. The next Republican president will scrap all this ..."

Don't expect that will be needed. Any regulation based on this nonsense will be attacked in the courts and I expect eventually thrown out. Perhaps as violating the equal protection clause.

Yes. Because when the government cuts taxes on just certain classes of people, that isn’t an equal protection case. Those people simply deserved their taxes cut. But if the government raises taxes on just certain classes of people, that’s obviously an equal protection case, especially if those classes include any rich people whatsoever.

Doubt it. Progressivity is an accepted feature of taxation; no reason it shouldn't also be one of regulation.

"...no reason ..."

The current composition of the Supreme Court.

If the Biden administration prefers to waste time and effort passing regulations that are likely to be thrown out I guess that is up to them. But hard to see why they should be applauded.

There's a lot more to determining discount rates than just nominal interest rates.

Jimmy, you have no idea how sad I am that the government failed to recognize that rich white dudes are TEH MOST IMPORTANT!

TFG will right everything for you.

https://www.mattball.org/2023/01/glibertarian-theater.html

Where does the value of a lobbying dollar get figured in? That's what will count when something actually comes to a vote in Congress.

What is the y-axis of the first chart supposed to be showing?

This is idiotic.

It suggests that a policy to tax the richest people $500, give $1 to the poor, and burn the other $499 would be a net positive. Does anyone actually believe that?

Strawman argument. Nobody believes the government would ever have a policy of just burning cash, if only because the people actually doing the burning would have very strong incentives to just keep the cash themselves and burn something else instead.

The discount rate, is the interest rate used in financial model, to determine the present value of future cash flows, for a discounted cash flow analysis. The discount rate should reflect anticipated inflation and risk over the life of the model.

The lower the discount rate the higher the near turn value. Stated differently, the use of a 2% discount rate implies inflation AND all economic uncertainty (as it relates to the items in the model) equal 2%. Basically, the use of 2% is a way to cheat/make long term investments in green technology look more favorable.

To be clear, I am not saying that green investments are bad. But I am saying, clearly, that 2% is absolutely the wrong interest rate: a more honest discount rate would be inflation (say 2%) plus risk/uncertainty (say 5%). What risk? Well the risk that a technology is effective. The risk that the computer models on global warming are accurate. Etc.

A 7% discount rate would have huge differences in these models and make lots of current green investments look unattractive....

https://www.investopedia.com/ask/answers/052715/what-difference-between-cost-capital-and-discount-rate.asp

The OMB discount rate is real rate of return (after inflation), and risk is dealt with separately (see section 11) rather than being folded into the discount rate. Your proposed 7% discount rate is what the OMB would call a 0% discount rate.

This. The OMB's rate is a real, risk-free discount rate. And as such 2% is not at all unreasonable.