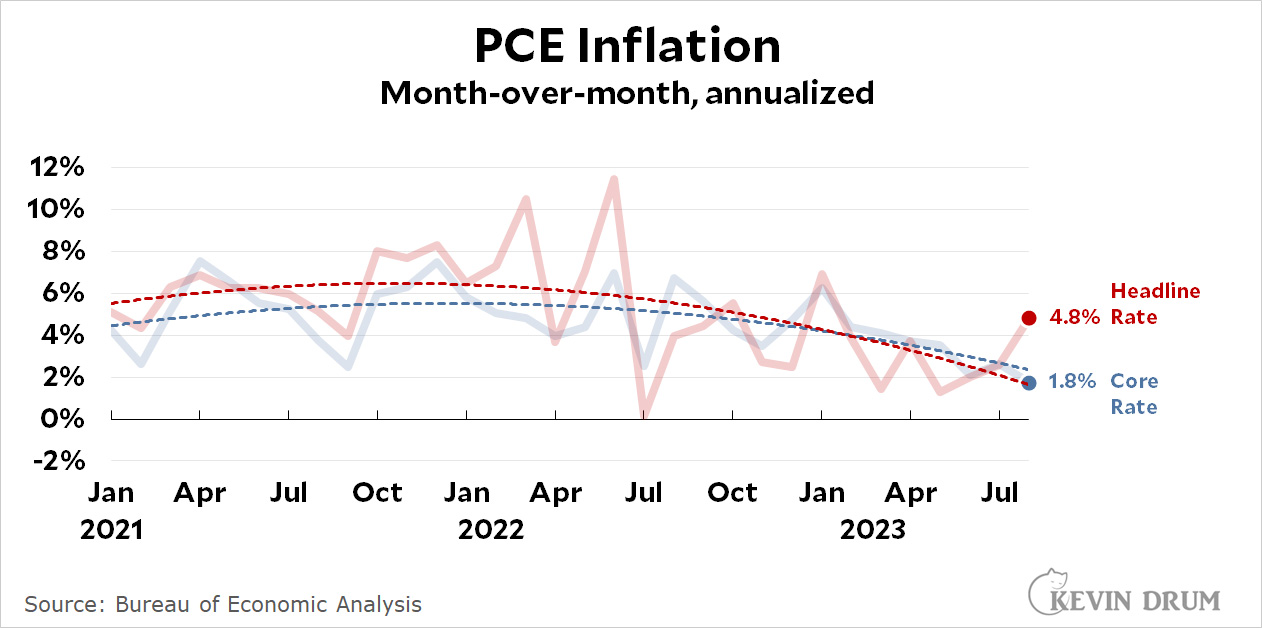

We have some pretty good news on inflation today:

The headline rate of PCE inflation spiked up to 4.8%, which was fully expected due to rising gasoline prices, but the core rate dropped to 1.8%. The core rate is (say it with me) the Fed's preferred measure of inflation, and it's no longer "heading toward 2%." It's below 2%.

The headline rate of PCE inflation spiked up to 4.8%, which was fully expected due to rising gasoline prices, but the core rate dropped to 1.8%. The core rate is (say it with me) the Fed's preferred measure of inflation, and it's no longer "heading toward 2%." It's below 2%.

On a conventional year-over-year basis, headline inflation came in at 3.5% and core inflation was 3.9%.

Great! Now they'll drop rates, right?

/s

Yeah and corporations will lower prices!

The wage data, from several surveys, show that real wages are on the same trend as before the pandemic and inflation. That is on average nominal wages and employers wage costs have gone up as much as prices. So employers do not have room to cut prices on that basis.

The control of the government and the Fed over inflation is limited - they can't force prices back down. Liberal efforts should be directed toward raising wages instead of decreasing prices.

Maybe I'm not following. If you're saying employers don't have room to cut prices, how could they have room to raise wages?

And haven't corporate profits been increasing? Meaning there IS room to cut prices?

Anyway, mostly my point is that people act like once inflation slows that means prices will go down, when slowing inflation just means prices should go up more slowly than they have been. And that is why the whole "transitory inflation" argument is silly in the real world. Even if the inflation is temporary, the price increases are permanent.

And that is why the whole "transitory inflation" argument is silly in the real world. Even if the inflation is temporary, the price increases are permanent.

Really? I think the evidence that our recent inflation spike was transitory mounts by the day. Critically, it appears to have come down without a substantive increase in unemployment, which is what you'd expect when inflation is transitory in nature (that is, it'll come down on its own). Also, prices need not come down for an inflation uptick to be "transitory"—they merely need stop rising so rapidly.

I think seymorebeardsmore's point was that even if the inflation, in technical terms, was "transitory," the average voter doesn't perceive it that way. They see most of the supply chain issues clearing up, but everything still costing more than it did 3 or 4 years ago and they can't understand why prices aren't falling as well. That's not how it works, of course, and what hating on the sitting president is supposed do about that, I'm not sure. But as Winston Churchill was supposed to have said (apocryphally), "the best argument against democracy is a five-minute conversation with the average voter."

Yes. My point is that to the average person in day-to-day life, inflation being "transitory" isn't super comforting when the steep increase in prices compared to a few years ago remains once inflation is no longer high.

If the situation is framed as "Prices are high because inflation is high! And the inflation is temporary, don't worry!", the majority of people are going to assume prices will go back down some once inflation isn't high.

So, the many, many posts on this blog trying to minimize the inflation issue have been pretty annoying. People are supposed to feel fine about things just because prices aren't going to push them even more to the brink?

Most people would see a massive difference in

(Transitory)- a sudden, large price jump followed by stable prices, and

(Persistant/structural)- a sudden, rapid price increase followed by continuing large price increases for a long time.

There is no way that people would see no difference in these two scenarios.

I dont think anyone anywhere has argued that inflation isnt a problem.....pointing out that transitory inflation likely doesnt require creating unemployment, slowing the economy, reducing wages and reducing workers chances of finding a better job isnt the same as saying that inflation isnt annoying.

You know what else is annoying? All those other bad things I listed above and thr people insiting that those are prices they are willing and eager to impose on others to battle inflation.

I expect we'll eventually see some Fed easing, but probably not before end of winter/early spring.

They won't drop them in response to a single month's low inflation number. But a couple more months like it, or a big downturn in employment or other growth indicators, and they will.

Once again, there is no real news in the release of the PCE - it's just an alternate formulation of the data in the CPI, released two weeks later:

https://fred.stlouisfed.org/graph/fredgraph.png?g=19s0w

The PCE can usually be closely predicted from the CPI. This is true for both core and headline inflation. This may be more obvious from the year/year or 12-month average values. And yes, as Kevin says, inflation has been down for over a year.

If gasoline and food prices do rise, which is possible for various reasons, causing headline inflation to rise, the Fed may raise federal funds anyway. They don't really go by core inflation whatever they say, or by real causes of inflation for that matter.

Part of DeLong's prior post on inflation, after revisions, showed that 2021-2022 inflation was higher than reported, and as such, the decline has been steeper than realized.

I don't know what the economy would have been like if the Feds hadn't raised rates, but looking at the Beveridge Curve and the Philips Curve, we can see that their huge increases didn't have the kind of effect one would have expected based on historical data. That has to count for something.

I think the interest rate hikes certainly cooled the real estate market somewhat, and maybe delayed or slowed down some business investment, but that's probably about it. Inflation would have started coming down anyway as global supply chain issues resolved themselves.

Yeah, but what would have happened w/o the Fed hikes? That's the counterfactual I'm interested in.

It's a bit more convoluted--don't forget about ending quantitative easing.

Rates needed to come up to burst some bubbles--irrational exuberance needs to be contained. But then the Fed talked themselves into a corner, as though raising rates was a magic wand. It took a while, but supply chains worked themselves out, and inflation eased--so the Fed will claim credit.

The real problem, though, is the Trump (and Bush) tax cuts--they skew the economy, and not in a good way.

To add: I said from the start, that the economy was so robust that it would be able to handle Fed's rate increases -- because if it couldn't then it meant that our economy was strictly predicated on ZLB policy and structurally unsound.