Core PCE is the inflation measure the Fed cares the most about but nobody else cares about at all. The LA Times, Washington Post, and New York Times barely even mention it today, while the Wall Street Journal leads with data about consumer expenditures, with PCE inflation playing second fiddle.

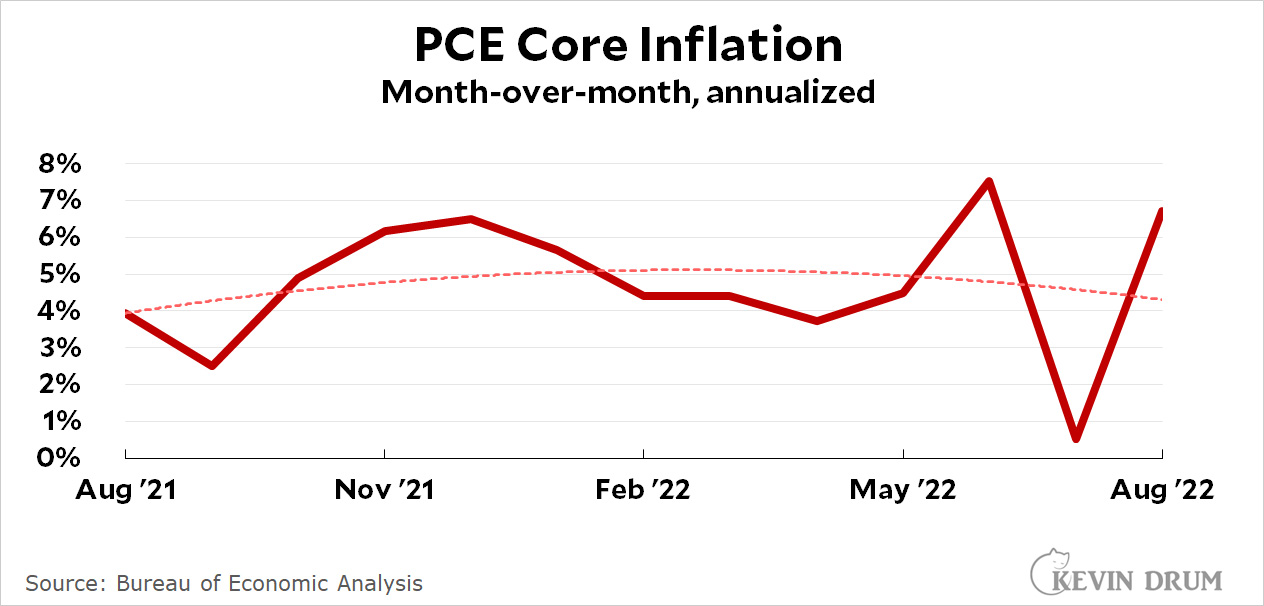

But here it gets pride of place this morning. And the news is not great:

Core PCE inflation was up 6.7% compared to last month (in annualized terms). The trendline still suggests it peaked in February, but it's basically been pretty flat all year. And remember—this is core inflation, so it doesn't get pushed around due to changes in energy or food prices. It just measures everything else.

Core PCE inflation was up 6.7% compared to last month (in annualized terms). The trendline still suggests it peaked in February, but it's basically been pretty flat all year. And remember—this is core inflation, so it doesn't get pushed around due to changes in energy or food prices. It just measures everything else.

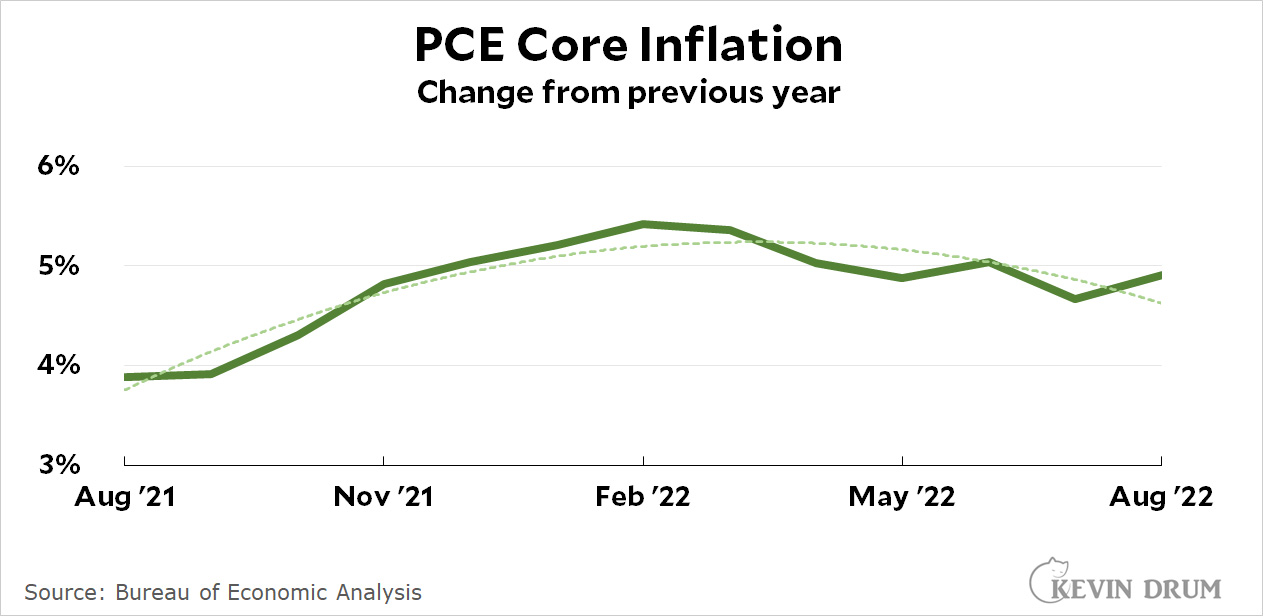

Here is core PCE measured the way most people do, as a percentage change from the same month in the previous year:

This looks a little better: the August reading is 4.9% and appears to have peaked around March.

This looks a little better: the August reading is 4.9% and appears to have peaked around March.

By chance, the average of PCE core over the past four months is 5.0%, exactly the same as the change over the past year. It's probably safe to say that 5% is roughly where we're at with PCE core inflation right now. That's too high and it's not declining fast enough.

Same as cpi's OER. Rent distorted all core measurements. There was no growth in pce. With rent collapsing, say goodbye to high core measurements.

2 months, no inflation.

Lovely. I need to find a new job next week just as the economy begins to collapse.

Nope.

My company is still hiring. Move to Michigan!

If you disagree with your interview, please refrain from telling him to FOAD. haha.

Seriously, good luck on the job search, Internet nemesis.

Maybe someone could explain to me why we don’t raise taxes on the top, some percent?

Those Teslas and Lightnings aren’t being bought by fast food workers, but we double whammy them with higher interest rates and a slowing economy.

I know R’s cry a million mile river but that could help the water crisis in the West.

Actually the economy returned to growth in August. A lot of confusion going on now in data.

We should, as soon as the election is over. But we won't. Because Democrats are afraid.

How would raising your taxes help you?

Raising taxes would help me by making it more likely Republicans lose in 2024.

I thought inflation was supposed to be over, and the Fed overreacting and doing so late…

No pce inflation for 2 months. Do you need a finger snapped??? What happens when that core redeclines next month??? What happens when the Oct-June pop starts coming off????

"No pce inflation for 2 months"

Aug 3.8

Sep 3

Oct 5.5

Nov 5.8

Dec 6

Jan 5.5

Feb 3.5

Mar 4

Apr 4

May 4

Jun 7.2

Jul 0.5

Aug 6.7

In short, Drum and inflation is over-denialism was wrong

Your in denial to no inflation. 2 months, nope, no inflation. Beating brain dead would be fun.

Well that settles it. I'm going to vote for those evil republicans because, gosh darn it, they will surely fuck up the world even more to punish the nasty democrats.

https://nypost.com/2022/09/29/policymakers-caused-the-coming-recession-dont-let-them-blame-covid-and-ukraine/

Who you gonna blame?

I guess you all didn't get the message yet. Stop buying junk. Stop going out for dinner. Stop going on vacations. Just... stop everything.

Ok - I guess some did get the message. Have you?

https://www.reuters.com/markets/us/us-consumers-spurn-cars-couches-cruises-results-show-2022-09-30/

Caution is even creeping into spending on travel, a red-hot sector that has benefited from the easing of COVID restrictions.

Cruise line operator Carnival Corp (CCL.N) saw its shares plummet more than 20% on Friday after reporting third-quarter results that fell well short of analyst estimates.

Carnival has been heavily discounting and ramping up advertisements to attract passengers after a long pandemic-led interval. It also has a higher exposure to the mass-market category that has been more affected by inflation.

Lol, the war in Ukraine was a like worth .3-5% of March-June inflation. Kill this journalist.

5% Core inflation does not signal inflation being 'under control' or no actions needed by the Fed.

We're going to need 200 basis points by year's end.

"Here is core PCE measured the way most people do, as a percentage change from the same month in the previous year:"

That's not how most people measure any inflation metric. That's how economists measure it.

At a minimum, most people measure inflation from one presidential election cycle to the next, because most people believe the president is responsible for it. And yes, I know, the president isn't responsible for much of it, but I'm not normal. Normal people go by feelings, not facts; "Biden is in charge, my food/gas bills are outrageous ever since he moved into the White House, so Biden Will Pay!"

Therefore, it's not enough that inflation is being tamed. We too should be looking at inflation from Jan 2021 to present.

My dad - a smart guy - would blame the inflation (and the subsequent sky high interest rates) of the late 70’s/early 80’s on Carter, and the Democrats, at every opportunity. Even 30 years later, he’d still blame Democrats and their spending on poor people for wrecking the economy.

Republican/conservative/free-market propaganda was pretty effective.

There was a time when the common wisdom would say that 5% PCE was slightly higher than optimal.

Today the common wisdom says 5% PCE is a catastrophe that must be 'fixed' by throwing millions out of work.

Funny isn't it?

5% is too high and it needs to come down. I think that's correct.

I even agree with Kevin Drum that the Federal Reserve's interest rate moves so far might be enough, and it will take some time for them to show their full effect. But I also think Jay Powell has set the course and won't change it until that inflation rate comes down a bit more.

If things do tip into recession, we'll come out of it okay. If it happens after the elections, even better. And if we bring an end to the economic wars with Russia and China, that would be best.