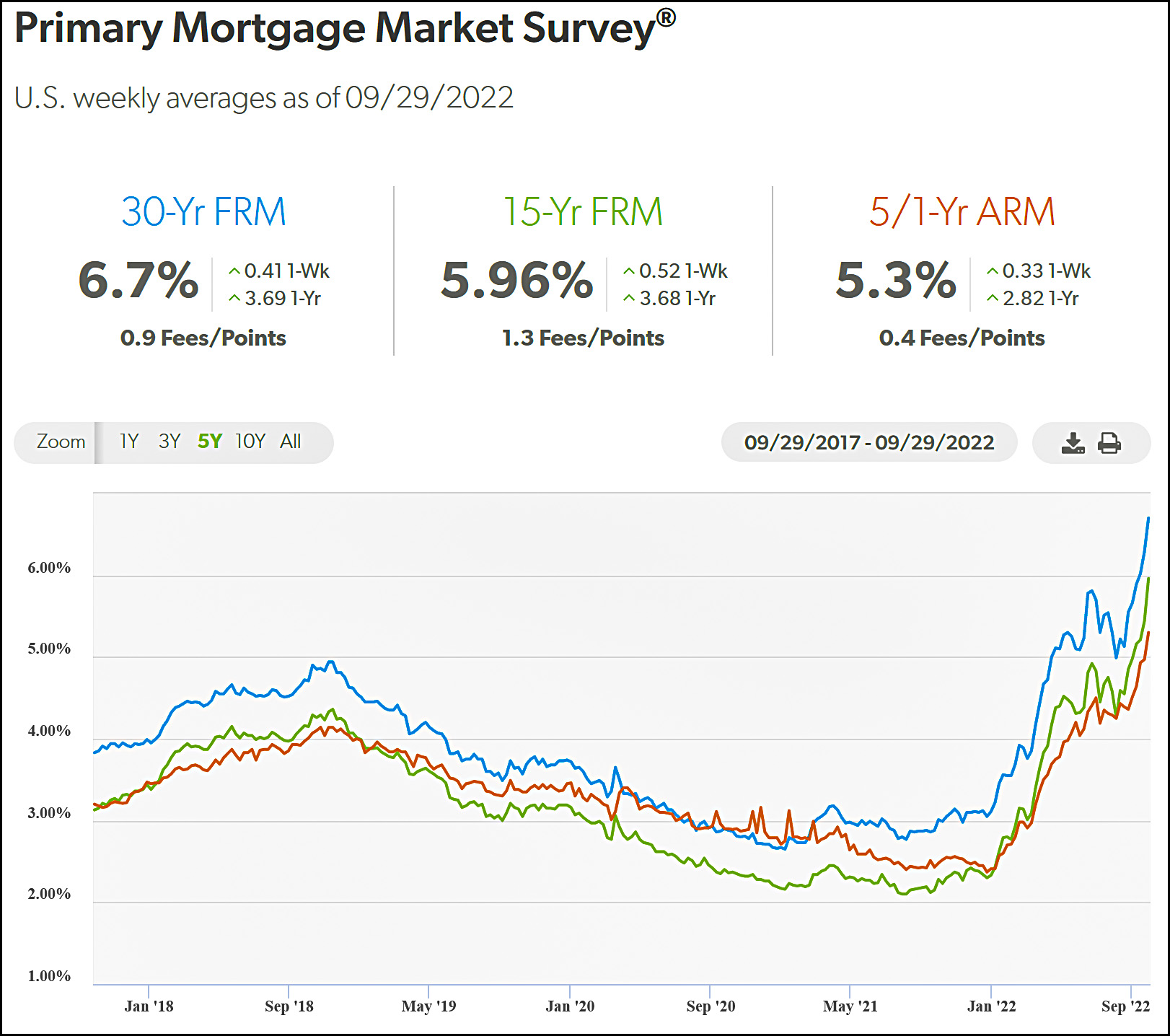

Here's the latest on mortgage rates:

For a while, when rates skyrocket like this, people rush to buy houses before they go up even more. But eventually rates get too high and mortgages simply become unaffordable for many people.

For a while, when rates skyrocket like this, people rush to buy houses before they go up even more. But eventually rates get too high and mortgages simply become unaffordable for many people.

But it takes a while. Back in the bad old days of 1981 mortgage rates rose to nearly 20% and there were still people buying houses. I should know: I rented out a room from a couple who were ponying up that much. Eventually, of course, rates went down and they refinanced at a more reasonable rate.

How long do people think rates will be this high? KD seems to think the Fed is being overzealous, which would suggest that a recession is coming soon along with lower rates. It may make sense to buy now, with a high likelihood that you can refinance in a year or two.

Also, how many people are close to paying off their mortgage? Maybe I run with a very frugal crowd, but a lot of people I know took advantage of the low rates over the last decade to refinance to shorter loans. Some who refinanced when rates dipped in 2012 may be nearly paid off now.

Housing is 3% of gdp......give me a break. Mortgage rates should go higher and normalize around 7.5%, or its historical average.

Powell already signaled a target of 4% Fed effective rate by end of year. It's currently at 3.08%. Rate should keep increasing through the end of the year so it seems quite likely that mortgage rates will continue to go up.

Maybe, but rates are lagging the 30 year.

I'm thinking a lot about this. Planning on leaving the Big City in the next couple of years. Depending on timing, buying would just be dumb.

But since a my hobby is sort of industrial, renting commercial might be the thing to do if CRE keeps failing to force people back to the veal pens.

This seems to be a fairly authoritative index of mortgaging volumes:

https://www.mortgagenewsdaily.com/data/mortgage-applications

The volume of refinancing is highly sensitive to mortgage rate, but purchases not so much. If you expand the Purchase Index diagram to the Max time scale, it will be clear that purchase mortgages are often more dependent on other things than mortgage rate, such as regulations. Of course the Fed was a major instigator of the 2006 bubble in various ways other than interest rates.

The recent buying frenzy may have been due partly to FOMO (fear of missing out) according to economist Robert Shiller:

https://www.nytimes.com/2022/09/28/opinion/housing-prices-pandemic.html?searchResultPosition=1

Interesting that money going from government bonds to investment yields supports acceleration in capex. Basically the counter recession sign. It looks like low interest rates in the 2010's indeed lowered growth. The Fed kept on waiting for money to leave the bond market to raise rates, but the Boomers never budged. Old losers.

when I bought my first house the interest rate was 9.8 or something like that and people were talking about how great it was they were finally below 10% again

I listened to Loretta Messier this morning, (she is Cleveland Fed head), and the determination to destroy the world economy was...shocking to me.

I suppose that I am good with .75 basis points x 3 where we are now....it is the .75. .50, .50 that is in the pipeline that I object to.

The Fed wants workers to be Afraid of losing their jobs and their homes...Labor simply has too much power now and the Fed will crush this happy development....and crash the world economy as other countries must adjust to the US and often devalue their currency.

I will say again...the Black Plague that rightfully destroyed feudalism and ushered in capitalism by giving labor actual power...this dynamic is in play again, though of course Covid is nothing like the Medieval plagues, but Covid also has changed people's consciousness....and the Fed is bound and determined to make people fearful again.

As they destroy the world and force a worldwide recession...as a final note, we want things made, assembled and manufactured here in the USA...this premise is automatically very inflationary. I don't disagree with it, but at least I am not being stupid and refusing to recognize that things are going to cost more in that US workers are always paid better than Chinese....so people should stop whining.

Best Wishes, Traveller

There is no .75 .50 .50 in the pipeline. Inflation is dead.

You say, Mr Spade, but the Fed Respectfully disagrees and will crush you.

Best Wishes, Traveller

Incorrect. The fed's been out of touch for awhile. Lagging behind trends. Doves are good where rates are at. As each month comes in with no inflation, political will will be gone. Your listening to words idiot.

From the 21st:

“ Applications to refinance a home loan, which are usually very sensitive to big rate swings, actually rose 10% for the week, although they were still 83% lower than the same week one year ago.

Mortgage applications to purchase a home increased 1% for the week, but were 30% lower than the same week one year ago.”

https://www.cnbc.com/amp/2022/09/21/mortgage-demand-rises-for-the-first-time-in-six-weeks.html

Investors have been buying up trailer parks, then hiking the fees....because they can. There has also been a lot of investors buying homes--not to flip, but to rent, and have been out competing first time buyers.

https://www.npr.org/2022/02/18/1081751190/first-time-homebuyers-are-getting-squeezed-out-by-investors

This is good news I think. Absolutely nothing good comes from "global M&A".

https://www.reuters.com/markets/europe/global-dealmaking-plunges-financing-market-hits-rock-bottom-2022-09-30/

NEW YORK/LONDON, Sept 30 (Reuters) - Global M&A shrank for the third consecutive quarter as rising interest rates forced lenders to pull back from financing large deals and the soaring dollar failed to spur U.S. companies into snapping up foreign targets amid persisting geopolitical tensions.

A steep fall in large private-equity buyouts contributed to the slowdown in global dealmaking, with third-quarter activity dropping 54% to $716.62 billion from $1.56 trillion in the same period last year, according to Dealogic data.

Yes, a strong dollar is financially protectionist. Invest within.

I want to believe there is some grand strategy behind all of this. But as a non-economist this doesn't seem very well thought out at all. It becomes easier and easier to understand why some people believe in whackadoo conspiracy theories.

We used to price our 30 mortgage rates as a spread over 10 year Treasuries.

I have been out of the business for a couple of years. It seems mortgage rates have gone up more than the 10 year Treasury.

I can get data for the Treasury yield but does anyone have the data for average mortgage rates. The link appears to just give me a chart when I really want the granular data.