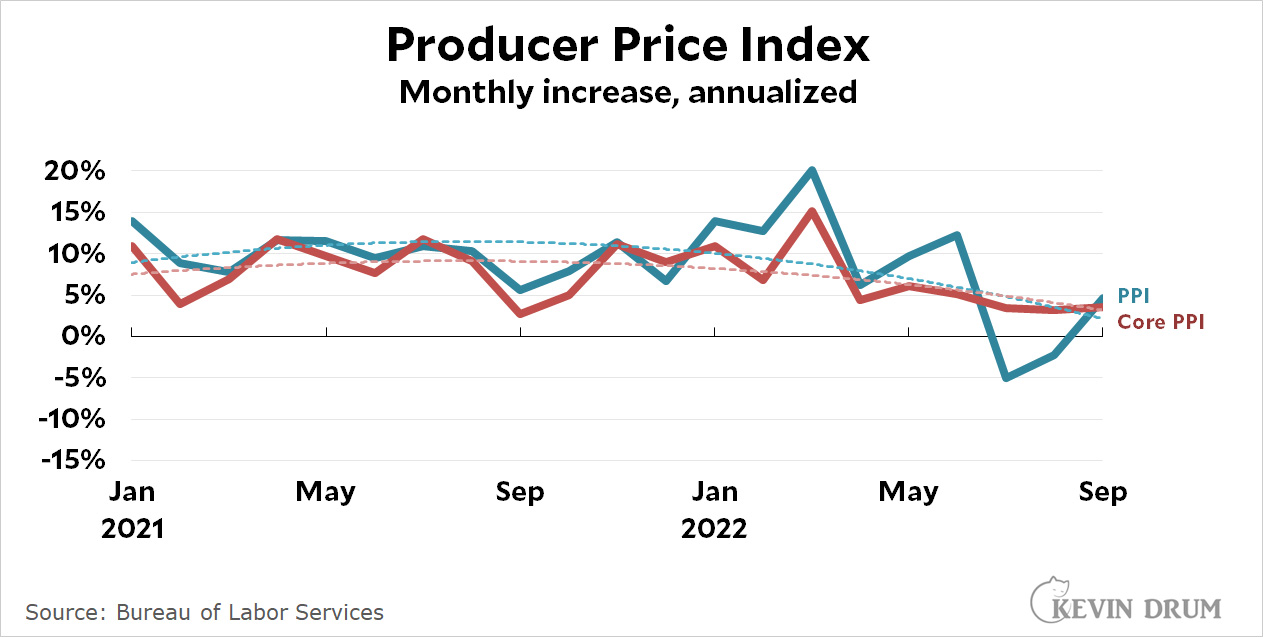

Tomorrow is inflation day! But while we all wait anxiously for the latest CPI numbers, the Bureau of Labor Statistics is teasing us today with PPI numbers. That's the producer price index, and it estimates the prices companies have to pay for their raw inputs. Here it is:

Overall PPI growth returned to positive territory in September while core PPI was basically flat. On a trended, annualized basis, PPI was around 2% and core PPI was around 3%.

Overall PPI growth returned to positive territory in September while core PPI was basically flat. On a trended, annualized basis, PPI was around 2% and core PPI was around 3%.

In theory, PPI is forward looking: the numbers we see today feed into consumer prices a few months down the road. So if PPI is trending down today, CPI will keep trending down through the end of the year. We'll see.

On the plus side, just think of how many contradictory research papers and dissertations will be written about the pandemic and post-pandemic data.

Core inflation removes food and energy: if you believe that food and energy have atypical price movement, then this index brings interesting insights. In contrast, if the movement of food and energy is not 'temporary', and both in the same direction, then there are limits to the value of this index.

The broader challenge, removing food and energy hides the true cost of living for households: these items are rising in price and consumers must still buy them....

What actions should be taken by the Fed if food costs are high ?

What should society and the Fed have done with the information that overall PPI was negative in July and August?

The rate of decrease from June to July was shocking and certainly should have spurred fast action to address the dire situation of runaway deflation. Or...not?

jdubs - while I am not an expert, let me try and respond.

1) The Fed does not directly impact items such as food (or energy) prices.

2) The task of the Fed is stable, target is 2%, long term inflation and employment. There is often a balance between the aforementioned two items.

3) Inflation is materially higher than the target 2%. I did not use terms such as dire or runaway. Rather, my point is the core inflation index, at times is very meaningful: imagine a refinery fire that spikes gas prices in the US. In contrast, its not clear to me that the rise in food and energy prices are about to dissipate: therefore, the Core Index fails to account for a meaningful consumer expense.

Thanks.

I don't believe that anyone asserts Core inflation to be a truer or more accurate measure of the consumer experience.

It is only another piece of data that can give additional insight when used along with the more complete measures of inflation.

The point of inflation data (and most data of any kind) is to understand what has happened in the past and what should be done to impact the future. The latter is easier if Core measures are taken into account.

Core does factor food and energy prices but it does so indirectly which is why it is more stable and more attuned to the long term effects of inflation on the economy. As energy prices goes up a manufacturer will compute that into the cost of goods. Such long term adjustments and other type of adjustments are seen throughout the economy while the cost of food and prices are processed.

Oil prices are high because of the Russia-Ukraine war and OPEC wanting to be a dick. Food prices are high because of weather (esp. drought in the Midwest and West), disease (bird flu) and labor shortages. The Fed can't do a damn thing about any of that, and starting a recession in other sectors of the economy to drive down those core prices is absolutely insane. People still got to eat and put gas in the car regardless if credit card and mortgage interest rates are killing them.

I believe the Fed chairman said the inflation fight was going to be painful. Not for him per se, or the wealthy really....but painful it must be to show the world how serious we are about fighting inflation!!!

Inflation may have slowed, but we are still seeing decent leverage for workers and gains for large segments of the working population. The latter has been identified as a problem that the Fed needs to address and the Fed is taking action.

Workers gaining leverage is a danger that left unchecked might cost the US economy untold number of new yachts, 3rd houses and private jets.

Trended… Has Kevin ever picked and published a trendline which contradicted his desired narrative?

https://www.bls.gov/news.release/archives/ppi_10122022.htm Is I believe the root source.

Yeah, I kinda disagree with Mr Drum’s characterization. I *think* he has been consistent though (a moving average of 1 year of month-to-month changes? I’m not sure!). And he’s given his rationale for choice.

But, there are lots of ways to arrange the stats. Some more common ways of looking at it give different conclusions.

Month to month, it was .4% increase in Sept, after a slight decrease for August. So it went up (noisy, I know).

…”The producer price index rose by 0.4% in September, beating a Dow Jones forecast for a 0.2% gain. Year over year, PPI rose 8.5%, a slight deceleration from the 8.7% increase in August.

Excluding food, energy and trade services, the index increased 0.4% for the month and 5.6% from a year ago, the latter matching the August increase.

Food prices helped boost the increase in goods inflation, with a 1.2% monthly increase. Energy rose 0.7% after posting massive gains the previous two months.”…

PPI was released at 8:30 eastern, the stock market (futures) declined immediate, and interest rates rose, so the market thought it wasn’t exactly good news (deemed it more likely that inflation was stubborn, the Fed might go higher/not decrease soon). Was a small effect though, the bigger CPI report is tomorrow.

Mr Drum has been on Team Transitory for a while. His instincts seem to be towards “why should the Fed slow the US economy and hurt labor and wage growth, for conditions beyond the Fed’s control, and which we do all think *should be* transitory, exogenous:

Ukraine War -> energy prices

supply chain management problems

quickly shifting consumer preferences/habits

US pandemic fiscal/social spending

IMO: Mr Drum’s biases are ones I basically agree with though - in the tradeoff between labor and capital preservation, would be nice to weigh labor more heavily than in previous eras, given the way the costs are distributed (utilitarianism-style).

I am not an expert on the topic: however, for professional reasons, I have more than a passing knowledge around Fed policy.

Based on a recent communication Fed Reserve Board Member (Philip Jefferson), he implies its either some pain now or a lot more pain latter. Perhaps the Fed is wrong: however, it sure seems the Fed does not buy the transitory / do nothing approach to inflation.

Have they factored in the Saudi's vote on the future of inflation?