Earlier today we were on the subject of corporations raising their prices and profits far beyond anything justified by inflation. So I thought you might be interested in a different way of looking at this for the economy as a whole.

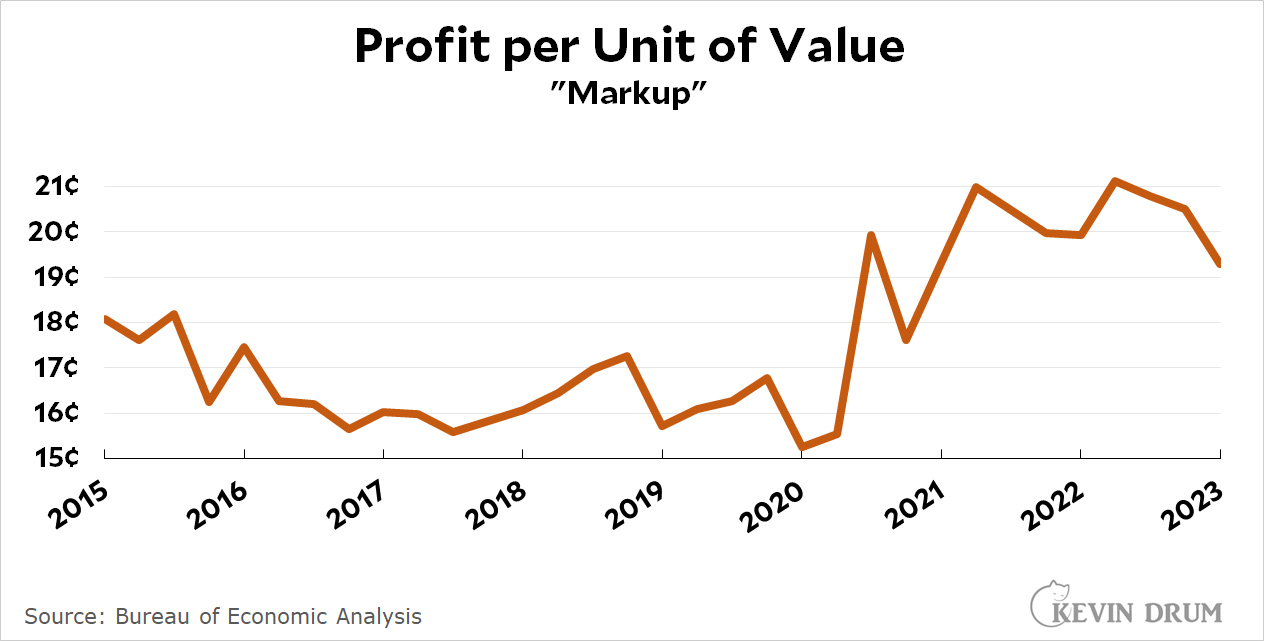

Roughly speaking, this chart shows how much profit corporations make for each dollar of value they add to their products:

This measure bounces up and down over time, but as you can see there's a dramatic increase right around the start of the pandemic. For several years profits had hovered around 16¢ per dollar, but by 2021 profits were around 21¢—an increase of 30% in only a year. And this was well before inflation started to kick in.

This measure bounces up and down over time, but as you can see there's a dramatic increase right around the start of the pandemic. For several years profits had hovered around 16¢ per dollar, but by 2021 profits were around 21¢—an increase of 30% in only a year. And this was well before inflation started to kick in.

So yes, corporate profits are up thanks to widespread price markups. The pandemic may have been bad for you and me, but all those shortages and supply chain problems were a godsend for C-suite managers trying to hit their bonus targets.

At the height of inflation rates last year, so too were net profit margins of many grocers. I was researching the lag effect between producer prices of certain raw materials and that of CPI food, when this concurrent net profit margin and inflation increase caught my eye.

And how high did the net profit margins of these many grocers get? Looking at Kroger's annual reports, their net margins were 2% for 2022 and 2021. And 2020. 2.5% in 2019, 1.5% in 2018, 1.7% in 2017, and 1.8% in 2016. While higher "today" than "yesterday" it still doesn't seem like they've been really raking it in.

Supermarkets are low margin businesses that make money on volume. You spend $100 on groceries at a store, the store initially invested $98 to get that $100. You buy groceries every week, and the store re-invests some of the money you spent. So for that initially $98 investment, the store makes $2 every week. By the end of the month, that initial investment makes them $8. By the end of the year, it's $96 for an initial $98 investment. Not bad.

But the low margins can bounce around a bit. Consolidation of the food industry means limited vendors and suppliers--each of which can squeeze you. Or in a bad for consumer contracts insist their products must always meet the lowest price for a given product line.

Um, that's not how these statistics are nomrally calculated . . .

So, averaging 1.7% for 2016 - 2018, and 2.1% for 2019 - 2022. That’s an increase of 23% across periods.

But consumers are just LeTtInG tHeM dO iT.

Surely this calls for one of Kevin's curvy trendlines?-)

Why back only to 2015 though? It looks like the net profit margins were on their way down from the 2015 starting point until the pandemic. How much higher were they in say 2010 or 2000? Are the margins of "today" unprecedented or is this a back to the future moment?

“Why back only to 2015 though?”

My guess is that each data point has to be individually queried from BEA and so Kevin only queried the last 32 quarters worth. Going back to 2010 would be another 20 queries and back to 2000 would be another 40 queries on top of that.

You’re welcome to do the legwork yourself if you have a counterpoint to make to Kevin’s free research and chart making that he’s provided.

I’m happy to transcribe if pointed at the source. My initial attempt at a search on their site was not successful.

It would help a lot if you provided links back to sources. For example, how do you measure "unit of value added to product"?

I invest in private Internet marketplace companies and one of our biggest red flags is when a founder tells us that a successful offline middleman adds no value. Such people get rapidly disintermediated without needing Internet.

There is a lot of value in providing financing, warehousing, in maintaining inventory stores, especially for long tail items that people need to buy with shorter lead times or smaller quantities than manufacturing MOQ and lead times, in aggregating product from large numbers of suppliers and making it available from a single source in a single order with a single delivery.

Does your source measure these kinds of values?

The Bureau of Economic Analysis is identified as the source and their website is here: https://www.bea.gov/

Do your own research if you don’t trust Kevin’s. That’s a lot harder to do though than squirting a lot of squid ink everywhere in an attempt to discredit the hard work Kevin put in to compile this chart you apparently don’t like.

There is no excuse for not providing a link back to the page.

FOAD, you MF_ing troll.

Did all of these super valuable things just magically appear in 2020?

If you add value by holding inventory and taking inventory risk then you expect to be paid for that value add when there is a supply shock and you can sell at much higher prices.

There was a supply shock in 2020 and there is continuing disruption of global supply chains due to decoupling with China.

"A little truth is a truth in which the opposite is false. A great truth is a truth in which the opposite is also true." David Bohm

Why corporations are benefiting at the expense of the economy is one of those things that is incredibly complex and incredibly simple.

The simple explanation is that a part of the social system is benefitting in a small way at the expense of the whole, in which case all the parts will pay a large price in the long term, or the social system is benefitting at the expense of its parts, in which case all the parts will benefit in the long term.

Why does it seem like everyone loves a "the system is to blame" conversation? And why does it seem like, when the "What is the system?" question is asked, everyone suddenly wants to change the subject?

It seems to me that there is a system that isn't understood because most people reflexively assume it can't be understood. With all due respect, is that true? Or is it a lie that most people actively want to believe because there would otherwise be a relatively small short-term sacrifice involved?

Maybe this just seems self-evident to me. Maybe there's something I've overlooked.

Some bottlenecks were affecting supply before the Ukraine invasion and oil and gas prices kicked up. So some prices - and profits - were going up while the oil/gas contribution to inflation was still negative.

"Greedflation" seems to be the current term for this.

If “corporate profits are up thanks to widespread price markups,” one would expect to see higher corporate profits relative to GDP, but we don't.

https://fred.stlouisfed.org/graph/?g=13c2u

Profits are up, but they aren't growing faster than GDP. I don't know how to square this with the profit per unit of value data that Kevin provides.