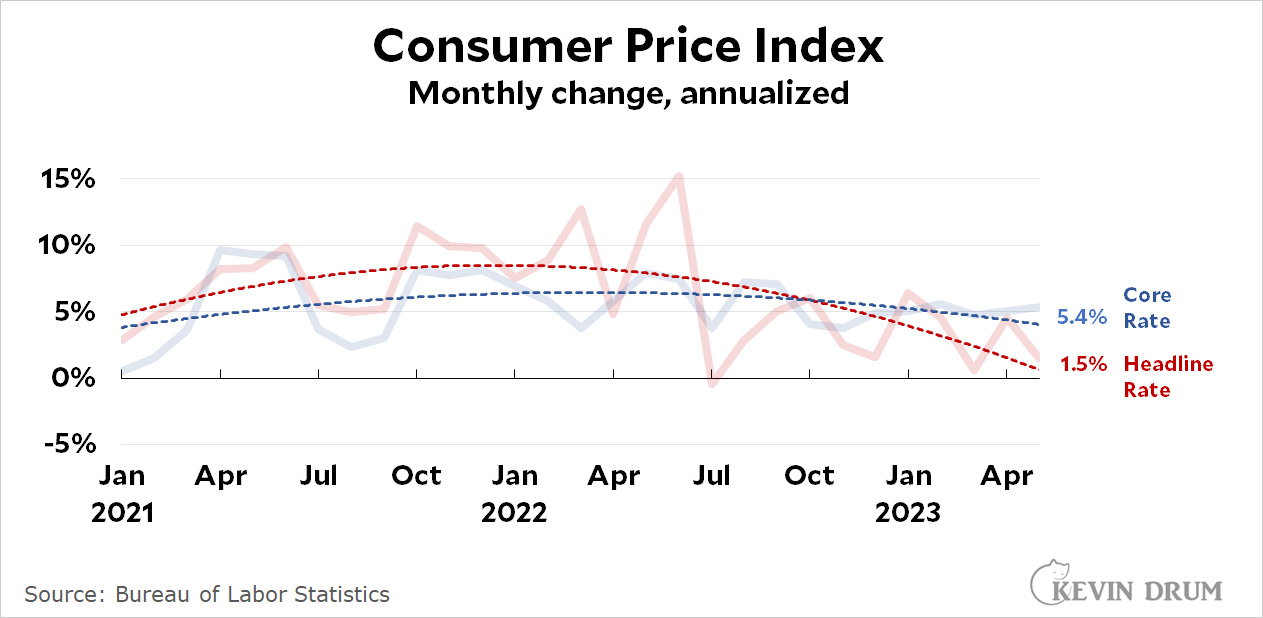

The CPI inflation report for May was released this morning, and it's the same story as it's been for the past few months: headline inflation is down but core inflation is stubbornly steady:

On a trend basis, headline inflation is almost down to zero, but core inflation is around 5%, the same as it's been since October of last year. This is mostly because energy prices are down substantially, which affects headline inflation but not core.

On a trend basis, headline inflation is almost down to zero, but core inflation is around 5%, the same as it's been since October of last year. This is mostly because energy prices are down substantially, which affects headline inflation but not core.

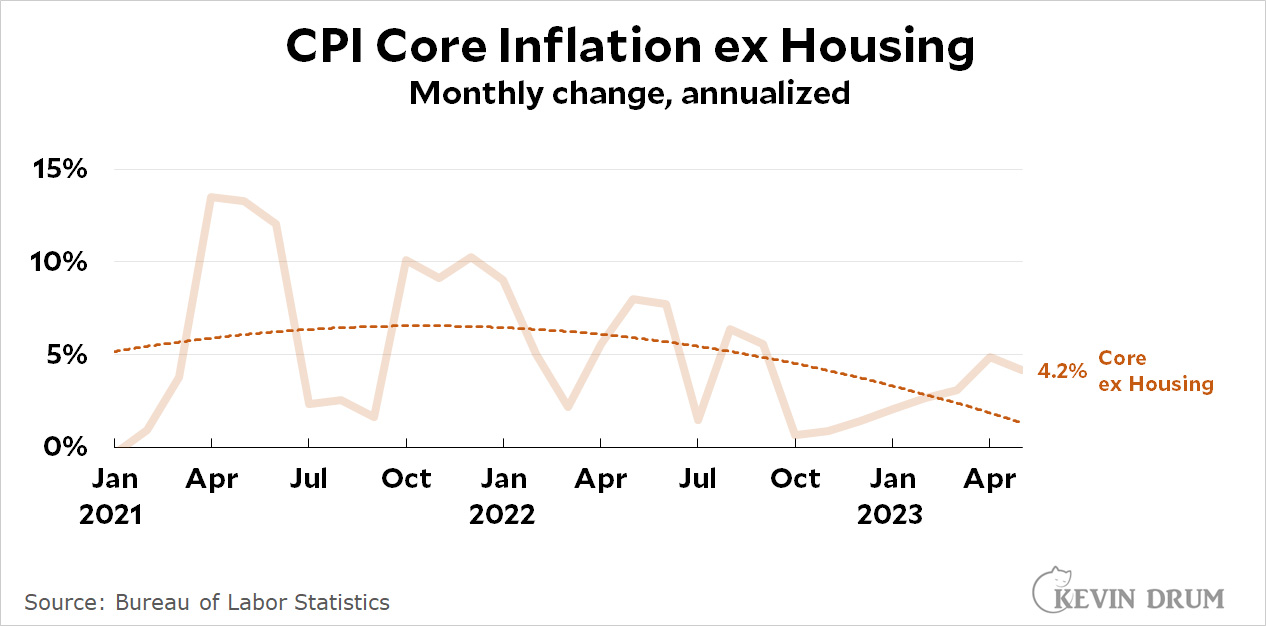

However, the story is a little different if we take out housing, which has been artificially raising the core rate for many months:

Core CPI without housing has risen since October, but is down to 4.2% in May. This is likely a more accurate measure of core inflation.

Core CPI without housing has risen since October, but is down to 4.2% in May. This is likely a more accurate measure of core inflation.

So in other words twenty-five more basis points coming soon.