I've long been puzzled by something related to remote work. There's a big gap between two different metrics:

- Based on a variety of estimates, the number of office workers who actually work in the office (i.e., not remotely) has declined from 90% to about 70% today.

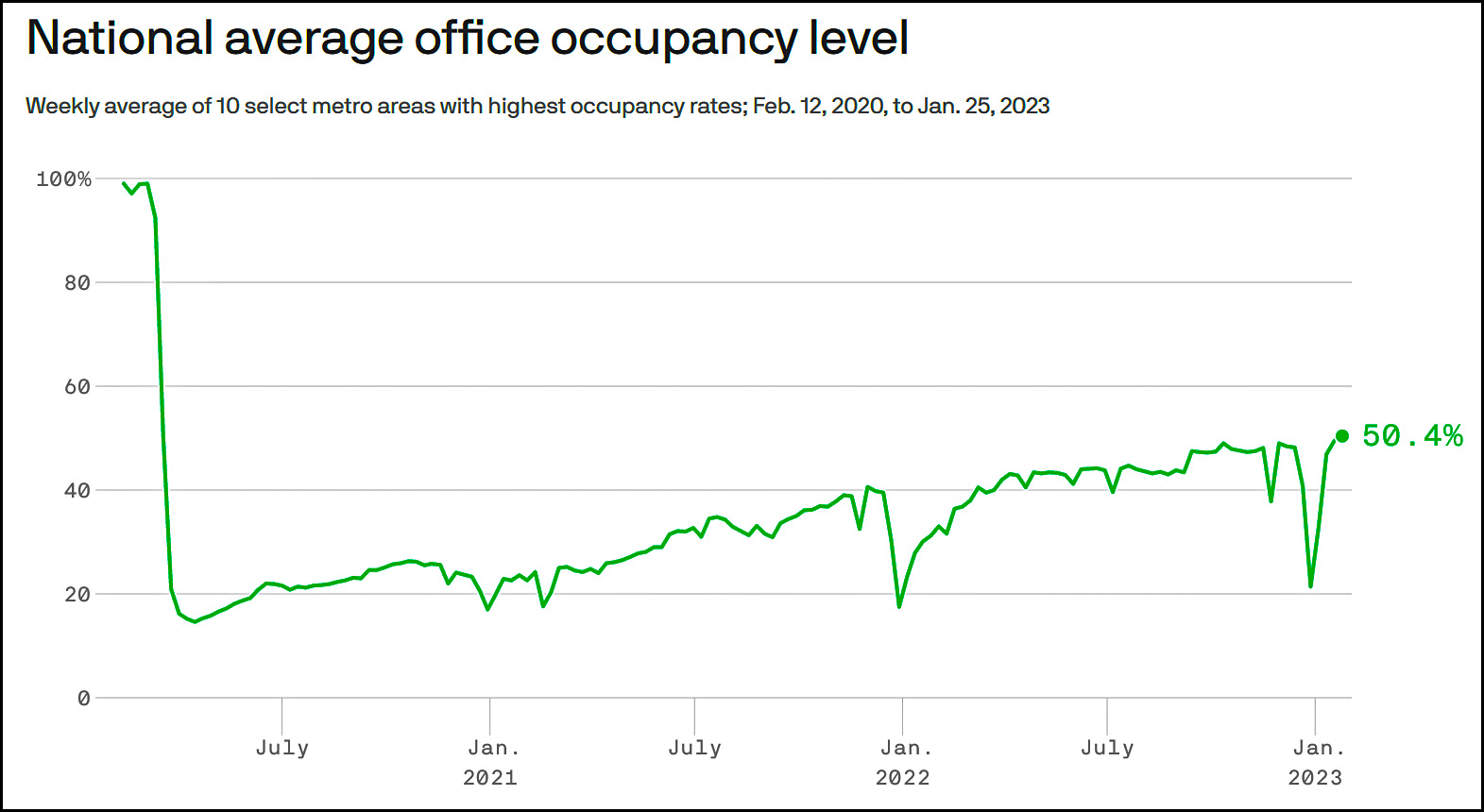

- But every estimate of office occupancy in big cities suggests that it's declined from 95% to 50%.

.

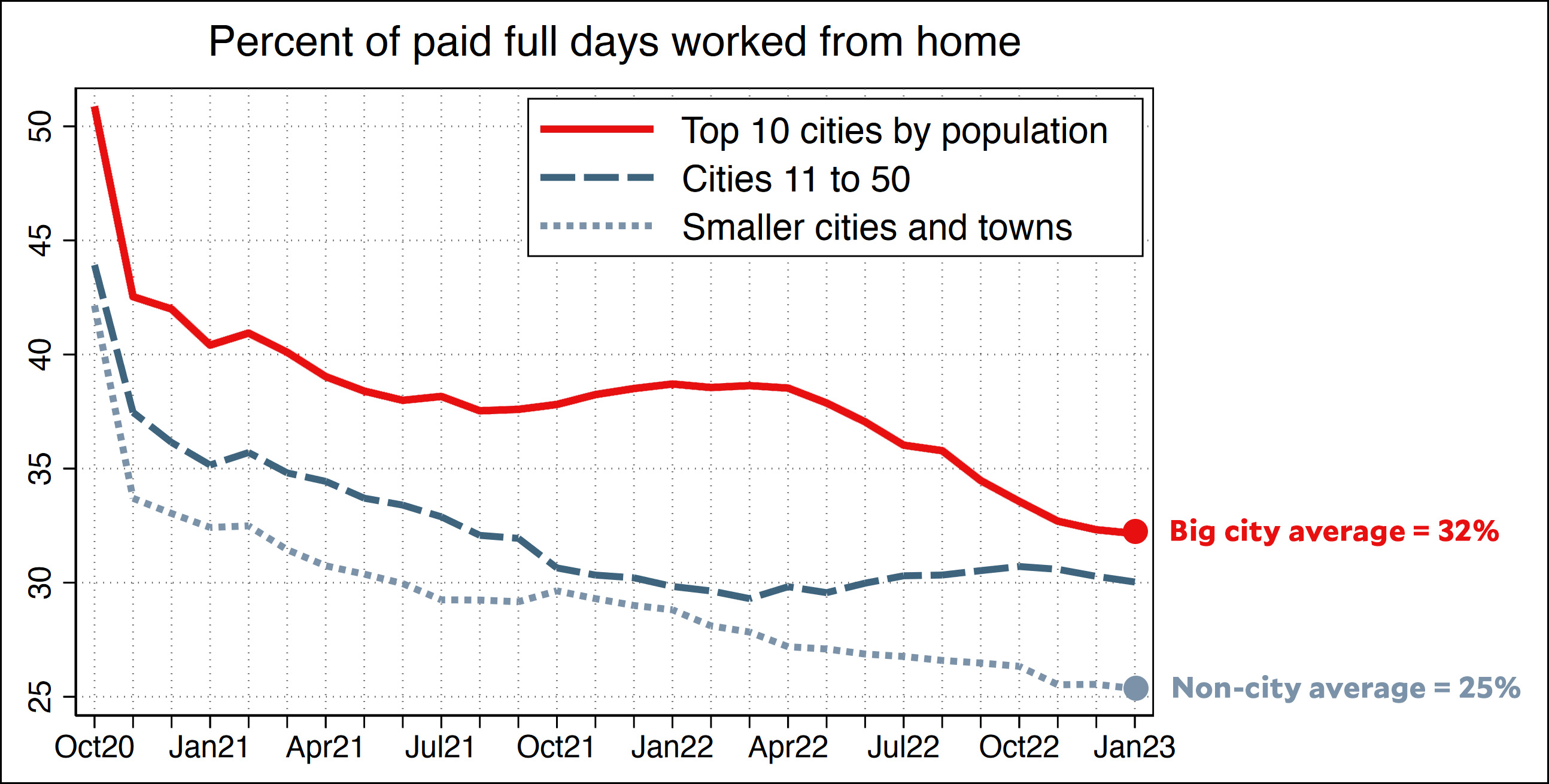

Why is the office occupancy rate so much worse than the actual work rate? One possibility is that the occupancy rate is for big cities, and remote work is more widespread among workers in big cities compared to smaller towns and cities. Today I ran across the Stanford Work From Home project, which confirms that this is indeed the case:

These numbers are hugely overstated because of a flaw in WFH's methodology. But the flaw is consistent across the survey, so it's OK to compare remote work in big cities vs. non-cities. As you can see, there is a difference, but it's pretty small. It doesn't come close to accounting for the difference between in-office work, which has dropped 20 percentage points, and office occupancy, which has dropped 45 points.

These numbers are hugely overstated because of a flaw in WFH's methodology. But the flaw is consistent across the survey, so it's OK to compare remote work in big cities vs. non-cities. As you can see, there is a difference, but it's pretty small. It doesn't come close to accounting for the difference between in-office work, which has dropped 20 percentage points, and office occupancy, which has dropped 45 points.

So what's up? What am I missing?

Perhaps you are missing new offices or office parks coming online just as Covid hit? Adding to the square footage of space available, while the number of workers is going down would make the metrics look worse.

I can make $200 an hour working on my home computer. {h42 I never thought it was possible, but my closest friend made $25,000 in just five weeks working on this historic project. convinced me to take part. For more information,

Click on the link below... https://GetDreamJobs1.blogspot.com

Hybrid work taking up less space? One of my friends is a big muckety-muck at the state and I know his office, due to going hybrid, switched to a hot desk system and shed a ton of their office space on the process.

I wouldn’t be shocked if a significant portion of other employers with hybrid work did the same and I don’t know if these stats/metrics can accurately account for set ups like that.

This is definitely a factor.

Also, who's to say that companies weren't already over-officed before?

I assume that the 'business WFH surveys' are targetting a much broader slice of the economy than the 'office occupancy' surveys.

Not every business has an office as defined by office occupancy stats. The industries most likely to work from home are the ones that rent offices. Slide 13 of the WFH survey holds the key.

This too. WFH across the whole economy includes non-office jobs or jobs that aren't feasibly remote-capable to begin with.

A worker who must come into the office every week counts among the "in office" numbers even if they come in fewer days than four years ago, right? In the aggregate, this phenomenon reduces the demand for office space, and vacancy rates have risen commensurately—but beyond what the on site vs. WFH ratio would suggest.

Also, there's probably at least some overhang in terms of new supply. Commercial development projects take a while to complete. So, I'm guessing that, with reduced demand for office space, a lot of the new inventory that's come onto the market since 2020 has remained vacant. IOW we have to reckon not only with demand but with (increased) supply. No doubt a lot of projects were cancelled after March, 2020. But probably not all of them (especially ones that were well underway).

I think this is correct. At my previous job, I was officially signed up for 3 days a week, but would have counted as "back in the office." On top of that, I actually only came in about 2 days per week, since the company didn't have per-group core hours, and so a lot of the time I came in and was the only person in my 6 person group who was there.

In my new job, I'm 100% remote, living in Pittsburgh but working only with people in Seattle and Sunnyvale. But in order to get any access to space in the Pittsburgh office, they put me down as 100% full time in Pittsburgh. So, now I'm officially back in the office, but never actually there.

+1

Hmmm... I supposedly work in Sunnyvale with people in Pittsburgh and Seattle and Bangalore.

Yeah, there's a similar thing going on where I work. We moved offices during the Covid years, downsized from ~300 desks to ~50. Nobody was let go - we expanded heavily, but hired people located anywhere, deciding that if we were going remote, we may as well shoot for quality.

Now they want people in on Mondays, but after the first few weeks, a lot of people stopped going. I'm in the office on average 1 day a month. But we're all considered "hybrid", I think it is called, because otherwise we wouldn't have office badges to get in.

I still think renting a hall once a quarter for all hands meetings would be a hell of a lot cheaper and achieve the same results, but certain types of execs like their cattle pens, I guess.

This is my intuition as well. If you had 3 employees before, and 1 was full remote with the other 2 full in-office, you had a 33% in-office ratio. But you needed 2 desks for those 2 employees. If you have 3 employees now who are each in the office 1/3 of the time, you only need 1 desk. It's not quite that simple, but writ large it is a big component of the "mystery" here.

And then there's the glut of brand new, and very empty, office space.

You would have come across that Stanford WFH report from Nicholas Bloom if you read my comment last month. Just saying.

It probably comes down to four points:

- Lease rates continue to increase in the CBD, triggering a flight to suburban office spaces where rates are discounted 10-15% or more.

- WFH has shown that the economies of agglomeration are no longer that important, making the CBD less attractive, especially for smaller companies.

- Companies with open workspaces require a lot smaller footprint when sticking with partial WFH policies. Also, companies switching to open workspaces can take advantage of hybrid work and save on rent.

- A lot of space has been made redundant by coworking/shared workspaces, especially if you can share 5 desks with 10 people.

Like many above, I think hybrid working is an important part of the puzzle.

The situation of my company: I work in a medium-large (~500 people) British company that has switched to a hybrid, mostly remote, system during Covid. This new paradigm allowed them to expand from ~150 people to the current size by recruiting from all parts of the UK, without asking people to relocate. There are local offices now (three in total) that allow for a maximum total capacity of, I think, 100 people tops altogether.

We are technically required to be in the office at least twice a month, but in practice for must of us nobody cares or enforces it - especially because managers themselves are very far from the offices (we use the spotify model with three different managers per employee with discrete responsibilities: my three managers live all in different cities far from the office that I'm assigned to, so I see them in person very infrequently, maybe once or twice per year).

Before anyone jumps to conclusion, the company functions very well and its operations and structure have improved enormously since switching models. We provide exclusively the public sector, and we received renewed and expanded contracts in the past two years, with our public stakeholders expressing increasing satisfaction with our services. Our model might not be universal, but for us it functions very well.

Companies have been announcing layoffs.

And "occupancy" means rented out, not people coming in. I'd guess companies are "right sizing" their space when leases end. In good times, they'll lock in more space than needed--anticipating growth. Now, not so much.

“the number of office workers who actually work in the office” is physical occupancy. In contrast, I believe, “office occupancy in big cities” measures legal occupancy: meaning this is office space that has a paying tenant.

The difference is leased, but empty, office space.

We opened a ton of regional offices in the NY Metro area. We were centered in Manhattan with 4 floors downtown and 4 uptown. We now have occupied 2 floors downtown. Not sure about uptown. Pretty sure quite a few Companies did that. So while we are back in the office it is now a regional office.

when I returned to the office in Downtown San Francisco, many restaurants had closed, the coffee shop/bakery had closed, the Walgreens had closed, so there were lots of closed or vacant storefronts. the vacancy rate is of course not just office space.

my husband’s job at a fortune 500 is “hybrid,” technically no one is WFH, and the manager of each unit is supposed to determine the days their people come in. In reality, most people never go in- they had massive turnover when they tried to make people go back, and a lot of the remaining staff have threatened to quit if the hybrid policy is enforced. The result of this is they only need about 40% of the space they did before covid, and they’ve already cancelled leases on buildings for next year. multiply that across the whole economy…basically return to the office is a polite lie. executives say their employees are going back or going hybrid, but managers don’t enforce it because it would cause a mass exodus. the result is that a lot more people are working from home than are showing up in surveys, because they’re being marked as “hybrid,” and this is driving a reduction in office occupancy.

One thing to consider is that office occupancy was falling even before COVID. There were often articles about empty office buildings, usually older ones with higher operating costs. Most of the stories were about suburban buildings being completely empty, but there's a good chance that this was part of a long term trend and that a lot of buildings had lower occupancy levels but were not newsworthy.

Another thing to consider is that the US overbuilt office space. The US has a lot of subsidies and tax benefits for office and commercial space. We have much more retail per person than any other country, and we have been watching malls collapse for over a decade now. High level executives love new office buildings. That's one reason they're so against WFH. If you talk to corporate leaders, it's easy to overestimate demand and easy to get subsidies, loans and tax breaks.

To dig down:

Assume 400SF tiny office.

How many people can this office space accommodate, according to (IBC) building code?

4.

But, what if this space had a mandated 50% hybrid WFH policy -- now how many people can this office space accommodate?

8.

On net, a building owner is incentivized to not exceed maximum occupancy. This is how s/he would do it.

The same incentive applies to renters who would prefer to slash their rents by half.