Today is inflation day, and the BLS reports that CPI moved sort of sideways in February:

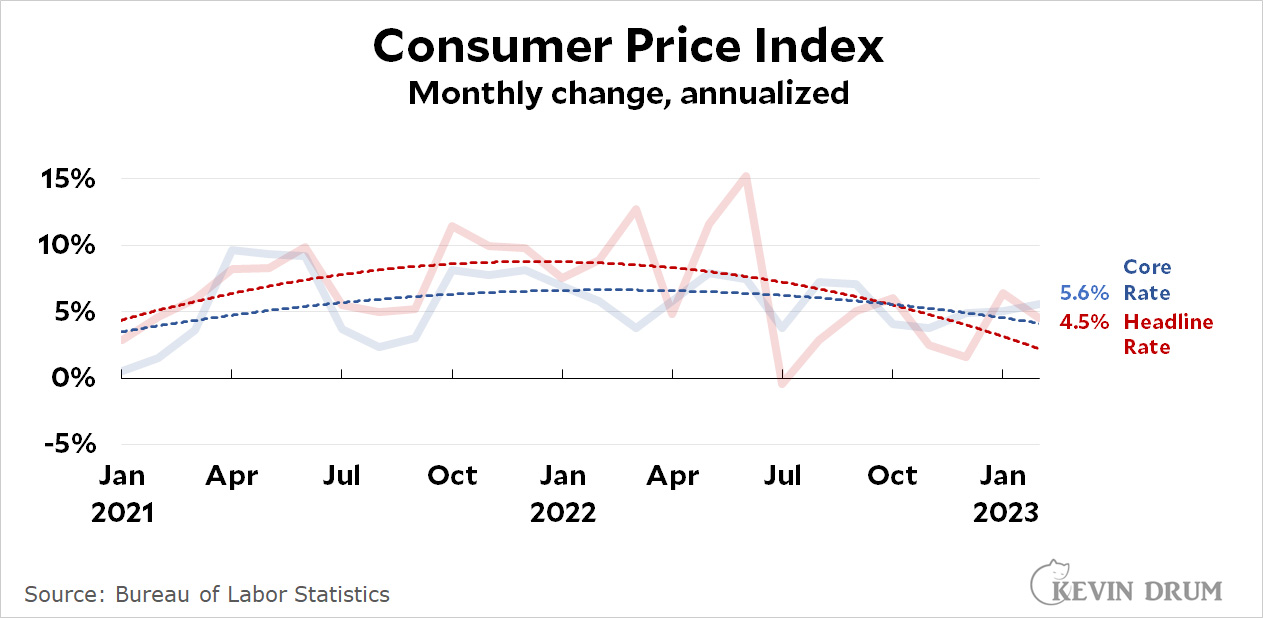

Headline CPI dropped from January's high reading, but core CPI moved up a bit. This makes three months in a row that core CPI has been creeping upward.

Headline CPI dropped from January's high reading, but core CPI moved up a bit. This makes three months in a row that core CPI has been creeping upward.

(In case you care—which you shouldn't—the year-over year rate that news outlets highlight was 6.0% for CPI and 5.5% for core CPI.)

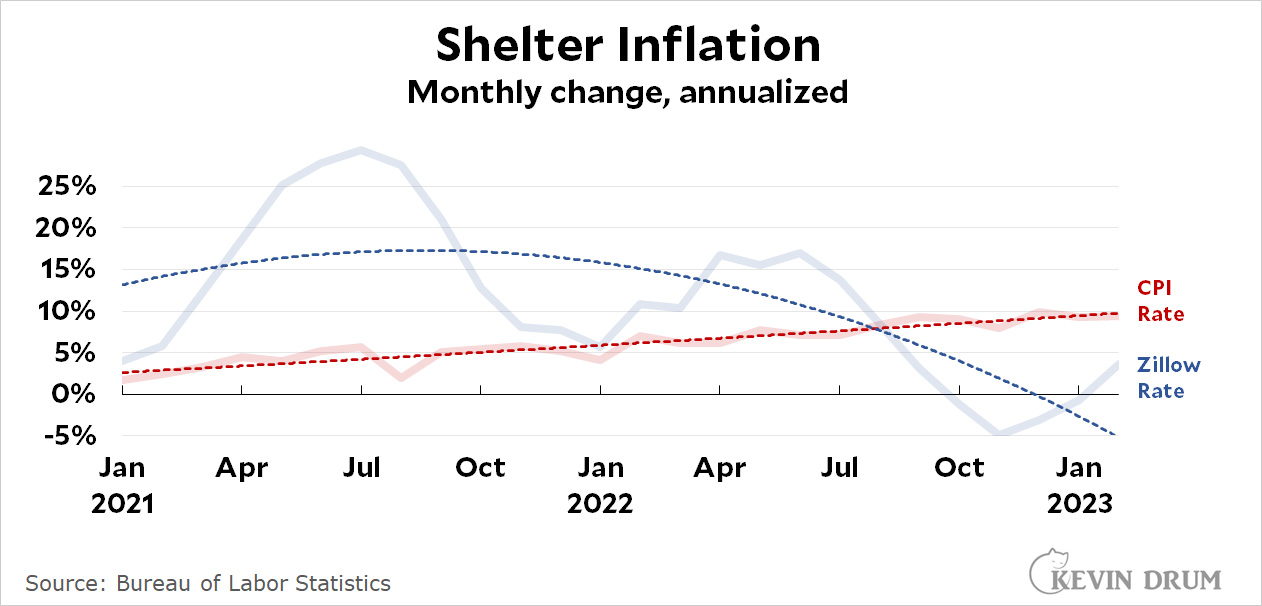

But inflation is actually not as bad as it looks. According to the BLS, shelter accounted for more than 70% of the increase in the headline rate. This is kind of crazy. We all know that shelter CPI lags the actual market, but is it ever going to catch up?

Shelter inflation measured by CPI is still rising steadily and clocked in at 9.5% in February. Zillow, by contrast, shows rents falling since last June. Their figure for February is 3.7%. Here's what core CPI looks like if you remove shelter:

Shelter inflation measured by CPI is still rising steadily and clocked in at 9.5% in February. Zillow, by contrast, shows rents falling since last June. Their figure for February is 3.7%. Here's what core CPI looks like if you remove shelter:

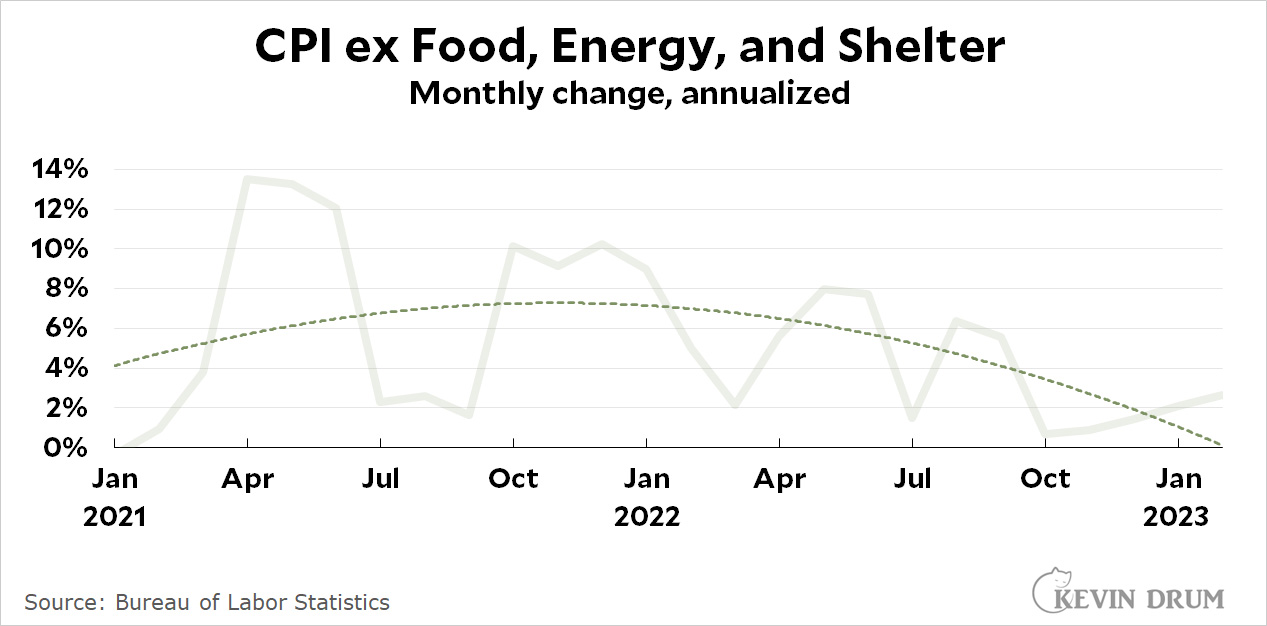

That's . . . not bad. It's disconcerting that it's increased for four consecutive months, but it's still at only 2.7%.

That's . . . not bad. It's disconcerting that it's increased for four consecutive months, but it's still at only 2.7%.

Policywise, none of this may matter. Given the wobbliness in the banking sector right now, the Fed is unlikely to want to raise interest rates much, if at all. The latest CPI numbers could be better, but they're good enough to allow a pause.

Google paid 99 dollars an hour on the internet. Everything I did was basic Οnline w0rk from comfort at hΟme for 5-7 hours per day that I g0t from this office I f0und over the web and they paid me 100 dollars each hour. For more details visit this article... https://createmaxwealth.blogspot.com

Kevin - for the last couple of years, you consistently have held that inflation is some combination of 1) transitory 2) over stated 3) not really a problem.

Over time, I find decreasing merit to your point of view, on this topic. At root, is a desire to have the Fed stopping raising the Fed Funds rate, driving your perspective?

A lot depends on how you define "transitory." The prevailing narrative in the media is that we need to worry about "persistent" inflation because that's what people remember today. I side with "transitory." Just because inflation isn't down to 2% right now doesn't mean that's wrong.

For a historical look:

https://www.minneapolisfed.org/about-us/monetary-policy/inflation-calculator/consumer-price-index-1913-

"Transitory":

1916-1920 (all years north of 7%; peak annual rate of 17.8%)

1946-1948 (all years north of 7%; peak annual rate of 14.4%)

1951 (7.9% for the year; peak monthly rate of 9.4%; 14 months of inflation above 4%)

"Persistent":

1968-1991 (all but 4 years north of 4%, peak annual rate of 13.5%)

The current spike (average monthly reading):

2021 4.7% (first month above 4%: 4.2% in April)

2022 8.0% (monthly peak of 9.1% in June)

2023 6.0% as of Feb

We're in the 23rd consecutive month of inflation above 4% and the 9th consecutive month of inflation trending down.

I think inflation in our time looks far more like a transitory event than the persistent one that everyone fears.

"9th consecutive month of inflation trending down"

should read

"8th consecutive month..."

The monthly numbers, btw, are annualized rates.

I love it when Kevin writes "But inflation is actually not as bad as it looks."

That chart of CPI ex Food, Energy, and Shelter with Kevin's favorite 2nd order curve (that's always an inverted parabola) is pretty much what I've come to expect.

I want to see a chart of CPI ex Food, Energy, Shelter, Clothing, Internet, Office supplies, Jewelry, Haircuts, Lottery tickets, Vacuum cleaner bags, and Sunglasses.

Another thing. When the BLS has numbers that disappoint, don't worry. There's always some other metric - in this case Zillow - that will back up your claims.

The "trend" lines have become increasingly amusing.

Given the difference in how housing costs are calculated as compared to other items in the index, its useful to dig into the data a bit.

Why do you object to the data? Or is the narrative that you dont like so any supporting data has gotta go?

Luckily I can just cut and paste

“It’s transitory”

I lean toward transitory, But I think that the important question is: Is bringing inflation down from the current level worth the increase in unemployment? 6% inflation and 4% unemployment seems like a decent set of numbers to me. In my opinion, unemployment causes much more existential pain for people than higher prices do. Additionally, price inflation is outpacing wage inflation so eventually it will have to slow down.

Given the complete lack of data showing that the current level of inflation is harmful, that is an important question. But it isnt one that decision makers really want to grapple with.

Inflation is harmful to people who have savings in bonds or savings accounts paying less interest than inflation - their money buys less. But then if the Fed causes interest rates to go up, those who have their money in long-term bonds lose even more. The real question is whether the Fed does more harm than inflation. There is no question whatsoever that the Fed's intention is to increase unemployment and decrease the rate of growth of wages, even though wages have been growing more slowly than prices. The Fed takes no direct action against the increase of profits that has gone along with inflation, although if there is a bad recession as in 1981 the profits will drop also.

So first we were to ignore the headline rate and focus instead on core.

Now we are supposed to ignore core and look at “supercore?”

Exclusions will continue until the data matches the message?