One of the (many) downsides of the debt ceiling debacle is the possibility that it undermined faith in US treasury bonds. If that happened, interest rates on treasuries would increase, potentially costing the government billions in higher funding rates.

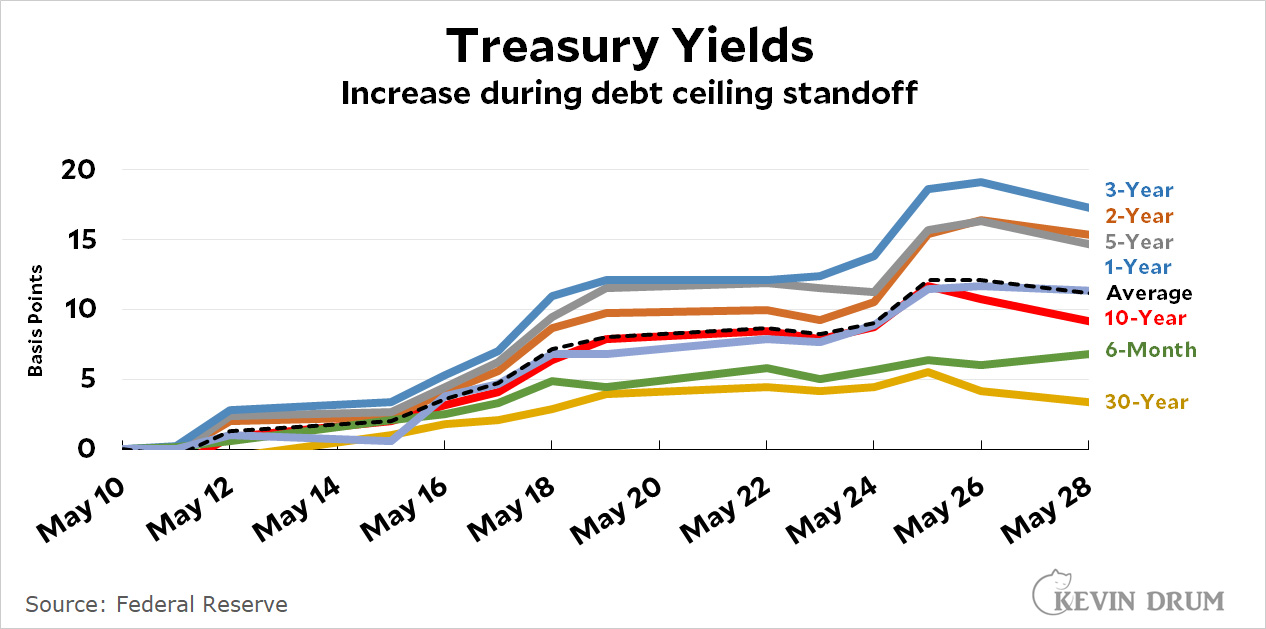

So did this happen? A very rough back-of-the-envelope look at treasury yields suggests it did—a little bit, anyway:

Starting in early May, when concerns peaked that no agreement would be reached before a government default, yields increased by about 10-15 basis points (0.1%-0.15%). There's no sure way to know if this was caused by debt ceiling worries, but the timing is consistent.

Starting in early May, when concerns peaked that no agreement would be reached before a government default, yields increased by about 10-15 basis points (0.1%-0.15%). There's no sure way to know if this was caused by debt ceiling worries, but the timing is consistent.

How much did this cost us? Probably not much. A 2011 report by the General Accounting Office estimated that that year's debt ceiling crisis raised yields by about 25 basis points and cost the government $1.3 billion. If the dynamic is similar this time around, the cost of this year's debt ceiling crisis cost about half a billion dollars—possibly a few times that amount over the course of the next few years.

That's not much. The early resolution of the crisis probably helped us dodge this particular bullet.

So, do billions count anymore? Or do you have to get to trillions before you are talking about real money?

“A billion here, a billion there, and pretty soon you are talking real money” - Everett Dirksen (reportedly) in the sixties.

One could read this post and believe the REASON for the change in the price was the risk of default.

However, the yield on US Treasury's (bonds and bills) moves for many reasons (inflation, supply and demand, world events such as wars etc). Certainty, the risk of default (commonly called the financial health of the issuer) impacts the valuation of a bond.

I suspect, with a large set of data, one can estimate the impact of financial risk of the issuer/estimate the cost of negotiations over the debt ceiling. However, the chart provided is for a much too short time period for any type of valid analysis. Basically, in my opinion, the chart is misleading...

One could map and correlate to default insurance (to speak loosely) of the CDS. CDS contracts on US paper rather than rates on US paper should be essentially purely tracking the default risk, and there have a metric.

You are missing some of the other costs of the debt ceiling fiasco.

One example is that we couldn't replenish the SPR which pissed off Saudi Arabia.

If we bought the oil then it would have brought us closer to default. So we didn't buy it.

I don't think the dollar cost was very big but most foreigners couldn't understand how stupid our law was and thought we were just making excuses.

(Again) the historical reason for selling Government bonds was to protect the Treasury's gold supply. (Money used to buy bonds could not be presented for conversion to gold, and the interest was motivation and reward for taking the risk that the Government would run out of gold before the bonds mature.) Absent convertible currency, there is no public purpose for issuing bonds in the first place. It's just giving money to people because they already have money.

The idea that anyone could identify the cause of variations in Treasury yields on the order of 0.1% is absurd. There are variations this large on a daily basis for unknown reasons. There are variations above 0.25% within a week. Look at recent variations in the 10-year bond here:

https://fred.stlouisfed.org/graph/?g=15SWO

Can you explain what caused all the variation? The conclusion is that any effects on interest rates from the crisis are well below noise. This is basically what Kevin says, but there is no need to attribute mythical powers to the GAO or any economists.

It's nice that we can dick around with "only" $500M when it comes to putting on kabuki dances to entertain politicians from West Virginia and pundits on Fox News.

But of course, when we need $500M to build a new highway interchange or subway station or elementary school or homes for 5,000 people at $100K a pop or whatever, the money is *never* there. Cause that's $500M that we can't afford to dick around with.

Reason #791 why We Can't Have Nice Things in this country, only Shit Sandwiches As Far As The Eye Can See.

The only way to measure the impact would be to compare Treasury Bond rates to the interest rates of other similar Sovereign debt obligations, though needing to adjust for currency risk would likely make it difficult to calculate meaningful results.

The risk is that continued brinksmanship on the debt ceiling, caused by the MAGA morons, could actually trigger a ratings agency downgrade, resulting in a material cost the the US Treasury (and us).

In modeling rates of return for all US dollar based investments (using the CAPM), the US T Bond rates have always been used as risk free rate of return. If and when that is no longer the case will be a really, really bad day for the good old US of A.