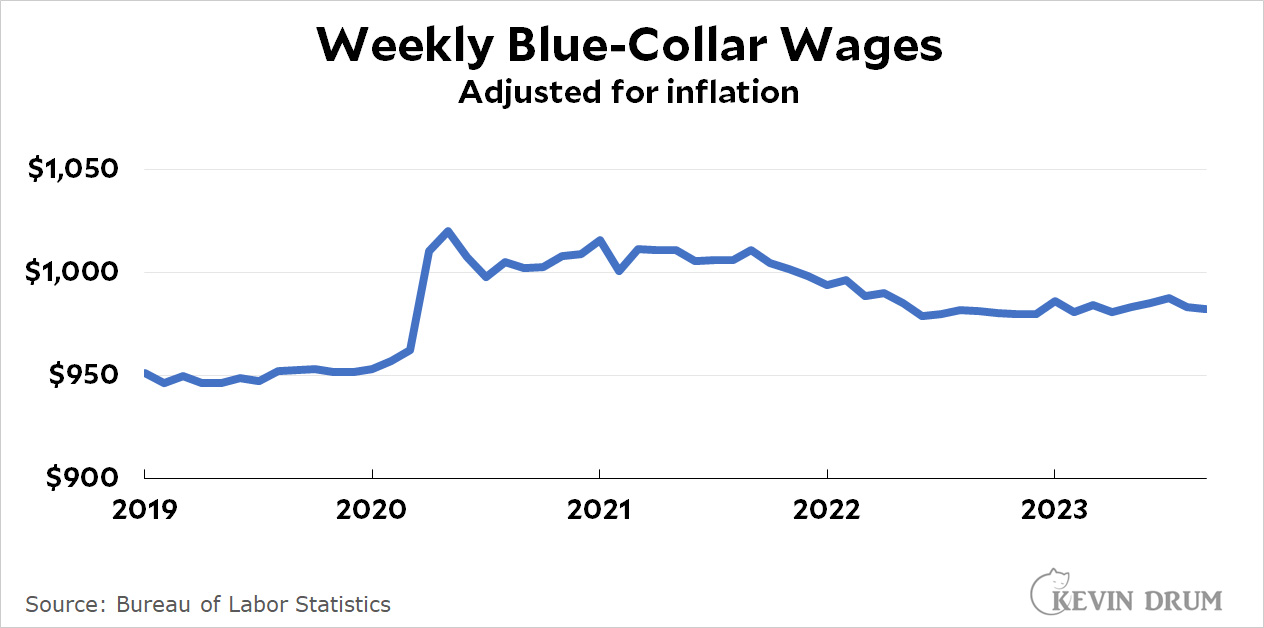

Here's the medium-term trend in blue-collar wages:¹

Wages are up slightly over the past year but have been dead flat for all of 2023. I know I bore everyone with repetition, but this is not the sign of a tight labor market.

Wages are up slightly over the past year but have been dead flat for all of 2023. I know I bore everyone with repetition, but this is not the sign of a tight labor market.

¹Using an estimate for September inflation.

So what's actually going on? Why are there so many unfilled job openings? Why is the unemployment rate close to historical lows?

I'm sincerely asking: if these things (which would normally be signs of a tight labor market) are not caused by a tight labor market, what's going on there?

What does "tight labor market" even mean to you? Is there a definition besides "wages are rising faster than inflation"?

I'm pretty sure Kevin's only definition of tight labor market is a wage-price spiral.

I don't think that's structurally possible now, in today's age of very low unionization and very high corporate concentration.

Agree!

Maybe the new normal- Corporate Utopia

If you are in a two-worker home and one has been out of work, then get a job the household income would double but the weekly wage per worker would not.

That increased participation would indicate a tighter labor market without influencing this data.

Whether the labor market is "tight" by anyone's vocabulary is ultimately irrelevant to inflation. What is supposed to affect inflation is growth in wages; if uppity workers are not getting much higher wages there is no pressure on inflation from the labor market. And if workers themselves are not getting raises that are much higher than price rises, they are not feeling better off.

Inflation started dropping off in July 2022 while unemployment was 3.6% and it hasn't gone significantly higher since. This makes nonsense of the usual assumption of most economists and the media that the Fed controls inflation by affecting unemployment or the "tightness" of the labor market. There is danger of higher unemployment, but it is from supply shortages, mostly associated with the Ukraine war and mostly from oil and gas prices (also OPEC).

Unemployment went to 4% or below at the start of 2018 and was 3.5% in February 2020. This didn't result in greatly increased wages so why should low unemployment do so now? Economists are just wrong about how these things work. There may have been more of a relation between "tightness" and wages in the past, but unions are weaker and employers can use immigrants or outsource work (not just factories - how often do you deal with an American customer service person?)

Right. Just because economists call it the labor ‘market’ doesn’t make it function the way the textbooks say markets work.

I’m not bored by repetition.

The phrase on MrDrum’s graph, Adjusted for Inflation” does a lot of work in the “Wages have not risen so it can’t be a tight labor market” story… As we’ve all seen discussed here, it can almost feel like a philosophical dispute. If inflation is 10% and wages have largely risen 10% too, they’re flat, and can’t be a cause of inflation?

If wages grow 11% and prices grew 10% is that evidence of Wage-Push inflation? Or is it a temporal dynamic - wage increases followed price increases *in time,* so can’t be causative?

I basically agree with MrDrum and Skepto above, that we’re not really seeing wage-push inflation in the classic sense, and it was mostly a result of Oil Prices (war, SA) and disruptions from supply chains that largely caused inflation, and it was not driven by wages. But it’s more of a feeling and a guess than anything.

Corporate profits have grabbed a bigger slice of the pie, so I doubt greedy workers are pushing the price increases. (Though averages can hide a lot of variation - the big 7 tech companies made huge profits early, and have continued, perhaps outside of them profits’ share was a wash with labor’s share).

Averages can also hide lot of variation in wage growth too. But all the deciles seem to be doing allright.

Static real wages are definitely not a sign of a tight labor market. On the other hand, they're also not convincing evidence of the absence of a tight labor market. Clearly, the very low unemployment rate and surprisingly high rate of job creation are signs of a tight labor market. However, wages are "sticky"; they seldom go down much even in recessions, and employers are notoriously reluctant to see them go up much even when they have positions they can't fill at the current pay rates. We may expect that the market will eventually react to the tight labor market by raising wages, but we shouldn't expect it to happen quickly. As the old saying, made in another context but still applicable, goes "the market can remain irrational longer than we can remain solvent".