Jason Furman draws our attention to a new paper that analyzes the effect of the 2017 business tax cut. Long story short, the authors find that cutting taxes increased investment.

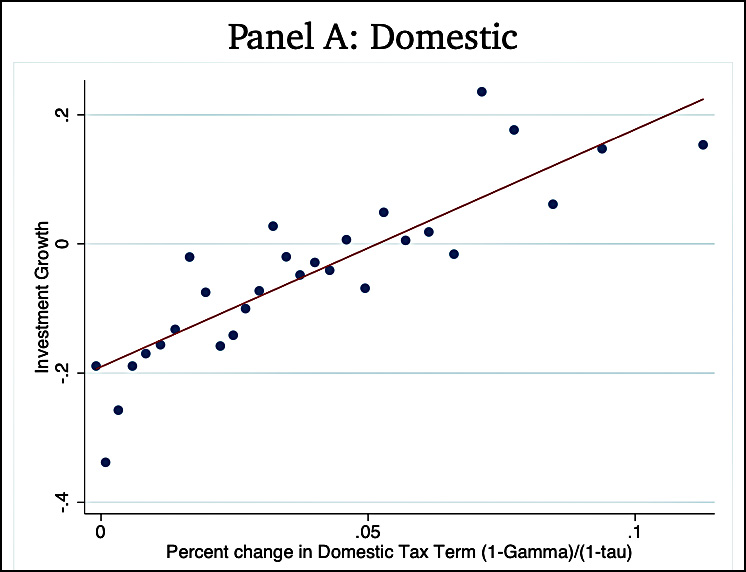

I'm skeptical of this, and I'll show you why in three charts. First up is a chart from the paper itself showing, as promised, that corporations with bigger tax cuts also invested more:

But take a closer look. Every single company got a tax cut. However, aside from four outliers on the upper right, not a single company increased investment by any significant amount. Most of them reduced investment. The trendline may indeed be up and to the right, but the overall amount of increased investment is negative.

But take a closer look. Every single company got a tax cut. However, aside from four outliers on the upper right, not a single company increased investment by any significant amount. Most of them reduced investment. The trendline may indeed be up and to the right, but the overall amount of increased investment is negative.

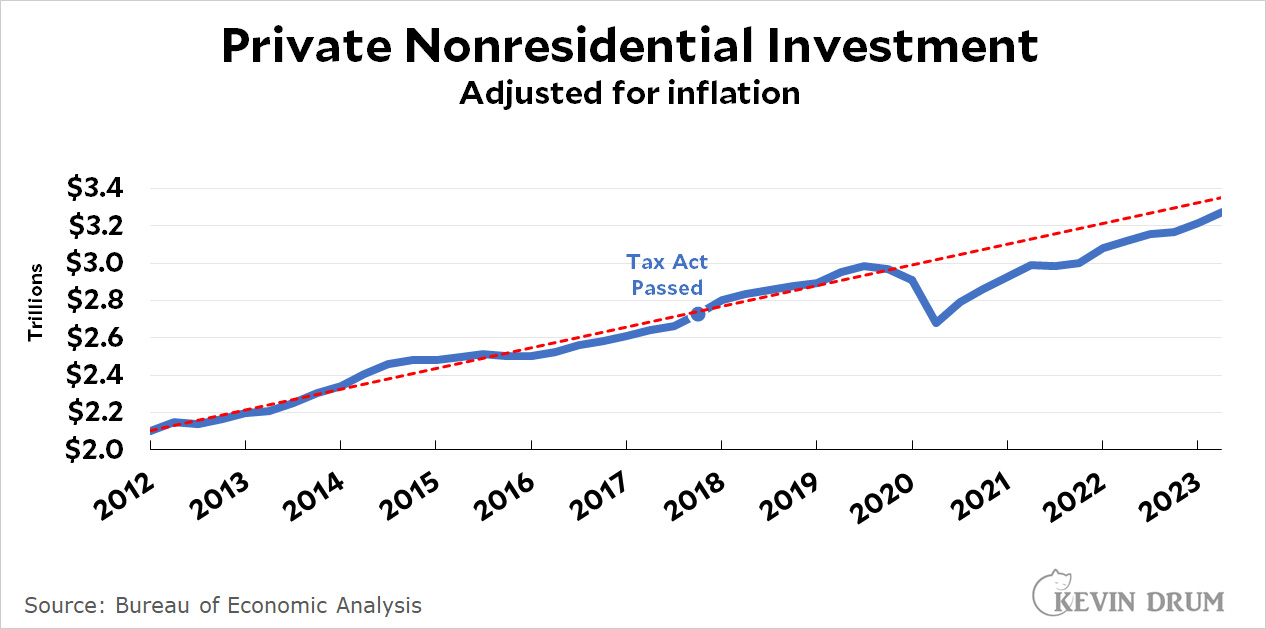

Next up is business investment since the end of the Great Recession:

This is a broad look, so you might not expect to see a big impact from the tax cut. But in fact you see no impact from the tax cut. Surely there ought to be something, even if it's small?

This is a broad look, so you might not expect to see a big impact from the tax cut. But in fact you see no impact from the tax cut. Surely there ought to be something, even if it's small?

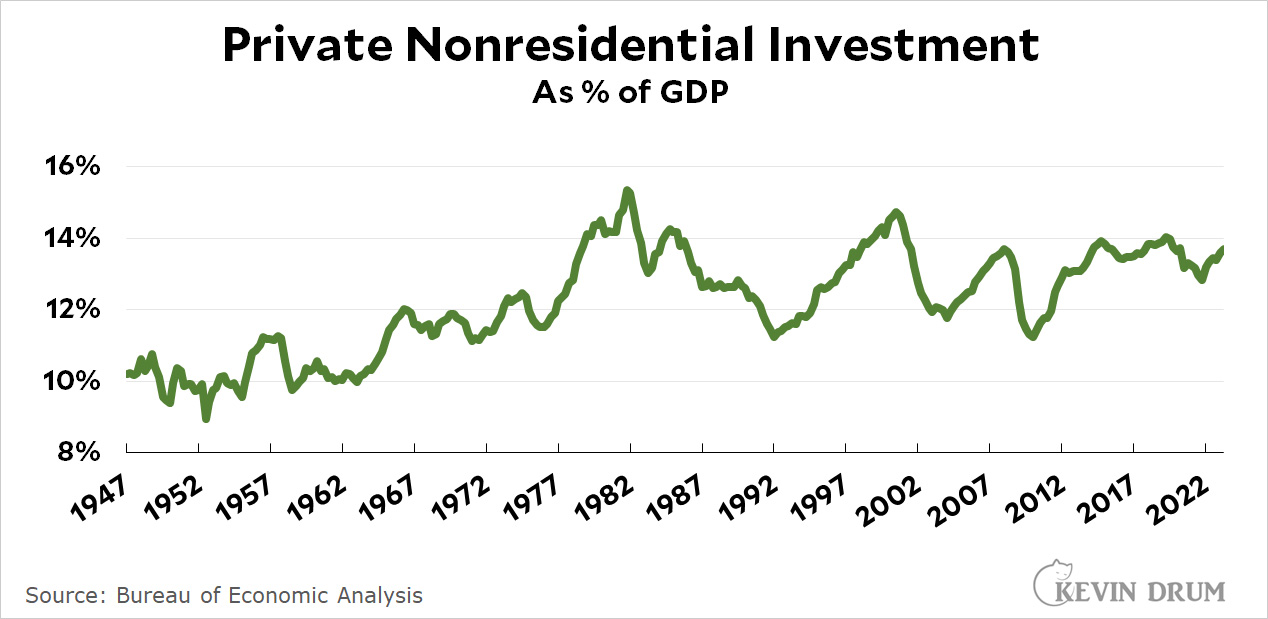

Finally, here's a long-term chart showing business investment since 1947:

The amount of business investment varies enormously from year to year, and this plainly has nothing to do with taxes. Even if tax cuts do have an effect, they are surely minimal compared to the normal ebb and flow of investment.

The amount of business investment varies enormously from year to year, and this plainly has nothing to do with taxes. Even if tax cuts do have an effect, they are surely minimal compared to the normal ebb and flow of investment.

To summarize: (a) most companies reduced investment following the 2017 tax cut, (b) overall business investment didn't budge from its trendline following the cut, and (c) business investment varies so strongly from year-to-year that a small tax effect would be unnoticeable even if there were one.

It may be that, technically, the 2017 tax cuts increased investment compared to a baseline of some kind. But even if that's so, the effect is tiny and completely washed out by normal noise.¹ Anyway you cut it, we gave up $1.5 trillion in tax revenue and increased the federal deficit by $1.8 trillion for nothing.

¹This is what the CBO projected five years ago: total increased business investment would be on the order of $20-50 billion per year, an amount too small to measure.

Where a trendline is conspicuously absent. Still, it is almost 40% higher (~14 versus 10) as a percentage of GDP.

Jimmy really got things going.

Nah, I like Ike.

You'd think an organized political party could run on this kind of thing.

In 2008, Larry Beinhart wrote, "The raw truth is that the economy has grown faster when taxes were higher, but how can we explain that phenomenon? "

You can find his explanation here: https://www.alternet.org/amp/why_the_economy_grows_like_crazy_amid_high_taxes-2647193811

I run a small business, and Beinhart's explanation is spot-on as it applies to me. I live it every day.

For this same reason, most people don't understand those year-end bonuses.

thanks for that

Good read, spot on.

Republican tax cuts aren't meant to encourage investment of any sort, unless by "investment" you mean "CEO gets to add second helipad to his 200-food yacht."

I doubt that the corporate tax rate cut stimulated investment instead of boosting returns (dividends) to investors. I think their observation of increased investment is actually based on the accelerated expensing of investment in the law.

In their context of foreign (vs domestic), the difference seems very modest.

Rather than find an answer to the question (of what effect the law had on investments), they should look to which part of the law contributed most to an increase in investment, IMO.

This debate reminds me of the, so called, Bush tax cuts. Democrats went on and on: the tax cuts were a total waste and did nothing for the economy. Then Obama made the majority, I believe it was 84%, of the Bush tax cuts permanent.

We will see what happens at the ten year mark, with the 'wasteful' Trump tax cuts....

What it did for the economy is unclear. What is clear is that tax cuts once enacted are politically real hard to eliminate, especially if they benefit a broad spectrum of potential voters. Remember how George H got pounded after he raised taxes in 1990. After the midterm shellacking by the GOP (Tea Party) in 2010, there was no real chance of any further elimination of tax cuts.

I simply can't stand the so called "deficit hawks" who scream about the deficit when they are not in the majority and then enact $ trillions of unfunded tax cuts (mostly for the wealthy) when in control of the government. The tax cut I got from that Orange Menace was about a $2K increase, since they shit canned the SALT deductions. At least the George W and Reagan tax cuts actually lowered my taxes.

Just another example of the Repubs making a mess and expecting the Dems to clean up after them and take the heat for it.

Tax cuts increase investment in lobbying - for more tax cuts.

I've an evidence free thought about why the level of investment would have been relatively low from the late 1940s to the late 1960s. It would seem like the massive industrial effort of WWII would have left us awash in machine tools and factory buildings. We'd have had more than enough box cars and merchant ships. The airlines were using surplus DC-3s.

What businesses were short of were employees of all sorts. Especially those with college education, but also blue collar workers. The great depression had hollowed out the workforce and then WWII compelled businesses to get and keep old codgers and women to make the tools of war. With the war's end the young men were back, but about 400k had been killed and many crippled. Probably a lot of the old codgers were ready to call it a day and probably a lot of the women as well.

I think it is possible that a lot of business spending during that time period was dedicated to hiring and keeping a much larger workforce than they had prior to the war. This involved sweetening all kinds of compensation.

This may be completely wrong, but it is my impression that this period was a kind of golden age for corporate research and engineering departments. I entered the workforce at the early stages of the great take-back where real compensation was shrinking. At the same time the resources going to R&D was shrinking fast. Most other departments were shrinking as well.

In special cases some sort of tax breaks might help investments. Rebates for solar power or EV cars seem to boost those businesses.

In recent years, however, businesses were awash in cash. Interest rates were at record lows. Businesses did not need tax cuts in order to invest. This was just a bit of PR to help sell the tax cuts.