The Wall Street Journal says today that the US economy is "sticking" its soft landing:

Parts of the economy are cooling, just as the Federal Reserve would like to see to combat inflation. Freight railroads, for instance, are seeing shipping volumes decline. Construction firms are cutting back on equipment purchases. A vending-machine company’s customers are negotiating prices downward.

Yet the key to a measured, inflation-busting slowdown that doesn’t sink the economy lies in whether companies hold on to workers or lay them off. And the answer, in an economy that otherwise can send repeated mixed signals, is clear: They are making a priority of keeping workers. Apple, for one, is avoiding layoffs despite economic uncertainty.

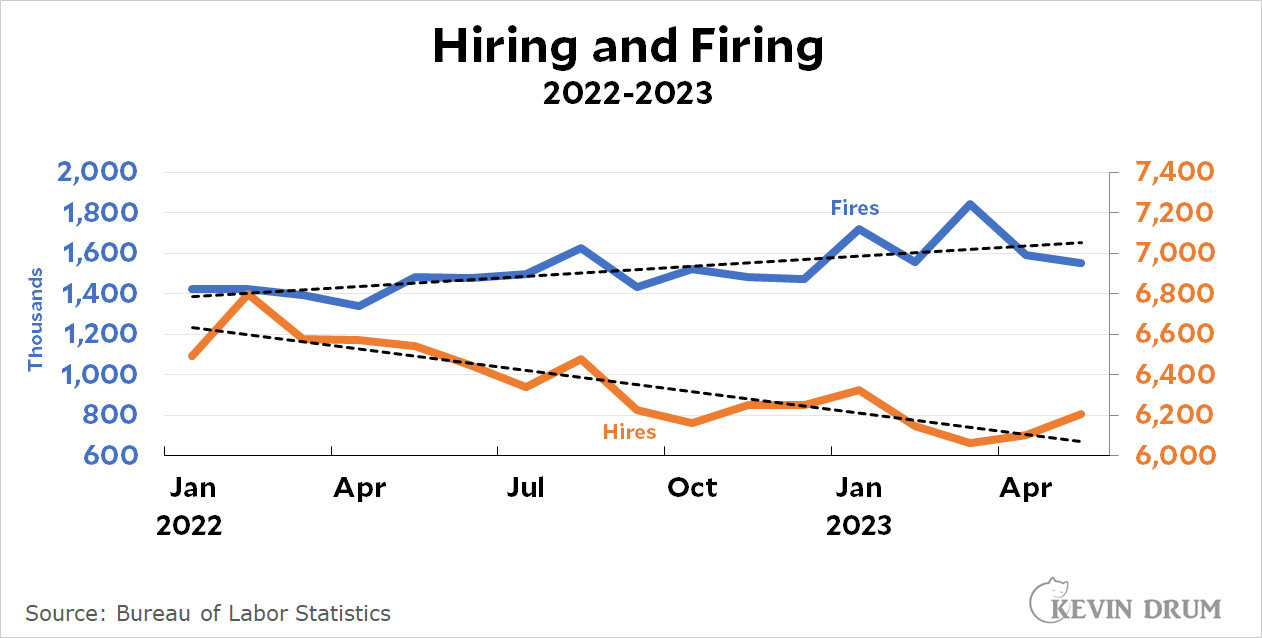

Hmmm. Here's hiring and firing over the past 18 months:

Hiring is down by more than 400,000 and discharges are up by more than 200,000. The last time this happened was in 2006-07, and we all remember what happened after that, don't we? The hardest of hard landings in 2008.

Hiring is down by more than 400,000 and discharges are up by more than 200,000. The last time this happened was in 2006-07, and we all remember what happened after that, don't we? The hardest of hard landings in 2008.

That might not be what happens this time. But American companies are very decidedly not holding onto workers. A 30-second look at actual statistics is all it would have taken to change the Journal's mind. Why are they so consistently unwilling to do that?

Um, looking at the axis numbers I see that hires are still 4x higher than fires. So yes, companies are holding on to workers, albeit a little less than last year.

"Um, looking at the axis numbers ..."

Yes, I was wondering how the graph could possibly be correct. Another extremely misleading graph from Drum.

Looking at the chart closer, there's actually nothing useful about it. Apples and oranges. This is two separate charts mushed together to encourage incorrect assumptions. There's lies, damn lies, and statistics.

Real on the web home based work to make more than $14k. Last month I made $15738 from this home job. Very simple and easy to do and procuring from this are just awesome. For more detail visit the given interface.. http://incomebyus.blogspot.com

But actually...https://fred.stlouisfed.org/graph/?g=17qzK

Yep, I knew this post reeked of cherry picking dates.

Looking at the full range of data:

https://fred.stlouisfed.org/graph/?g=17qDp

confirms what Kevin is saying:

a) hires are going down;

b) this hasn't happened since 2007 in a bad recession.

This is possible indication of impending recession, though not a strong one. There is no backing for the WSJ claim that there is a priority of keeping workers.

In response, ratio of hires to discharges: https://fred.stlouisfed.org/graph/?g=17qEs

Are there no summer and temp workers going back to school? Yeah, I know on the Right Coast, y'all don't start until after Labor Day, sometime in September. Here in NM, school gets underway at the beginning of August.

There are a lot more hires than fires, right, so some companies are holding onto their workers. Not all companies operate in lockstep with each other, obviously.

Also, don't use "X happened before 2008, so we're doomed," as an argument. 2008 was a special case, based on immense bets made by investment banks using complicated financial instruments (synthetic CDOs) issued by fools and purchased by greater fools. I'm not sure it couldn't happen again, once investment banks figure out new ways to hide potential losses, but I'm pretty sure it isn't happening right now.

Comments this time seem unfair to Kevin.

1. Is the chart misleading because it puts fires above hires even though there's more hires than fires? Perhaps a little. But using the FRED site linked above, I only see one point since the end of 2000 (the data start point on the site) where fires surpassed hires, and that's during COVID. At no point even during the 2008 recession did fires exceed hires. Kevin's chart is showing trendlines to argue that hires are trending down and fires up, contrary to the WSJ claim.

2. It is fair to question where Kevin starts the trendlines. Going back to before COVID, the firing trend since mid-09 seems flat with a slight decline; the post-COVID firing trend is noisier, but also below the pre-COVID trend for the most part, with a spike right before Kevin starts his chart. The "rise" in the firing trend looks more to me like a gradual correction toward the pre-COVID trend. Similarly, hires have been higher post-COVID, so if the decline Kevin detects is real it also looks like a gradual return to pre-COVID levels.

3. The larger question of whether the WSJ analysis has any bearing on reality has to start with the claim about a soft landing being linked to hiring and firing (hard to see evidence at all for that on the FRED site), and if so, whether the current evidence supports their claim that companies are making an effort to hold onto workers. I find it hard to see anything on the chart beyond evidence that employment is slowly recovering in the wake of COVID firings; certainly companies don't seem to be increasing wages once inflation is considered, which you'd expect to see based on the WSJ claim. Kevin's criticism of the WSJ analysis can be valid even if his own claims aren't completely solid, either.

Whatever the predictive value of the hires/fires trends, it’s too soon to score the landing — the FOMC has explicitly left open the possibility that rates will be raised further, and many economic measures have not leveled off.

The WSJ, in the interest of their prime benefactor, down plays the possibility of a sharp drop just in time for the election because they really really want R's to win and the more of a surprise the Hard Fall recession is, the more Biden and friends will take the hit, they think. The WSJ and friends have never forgotten "It's the economy, stupid!"

OT: Aren't you going to spend a hot minute talking about the impending dissolution of the PAC-

12109?A 30-second look at actual statistics is all it would have taken to change the Journal's mind. Why are they so consistently unwilling to do that?

Obviously they're "unwilling to do that" because they're in the tank for Biden.

The WSJ never lets the facts get in the way of their ideology.