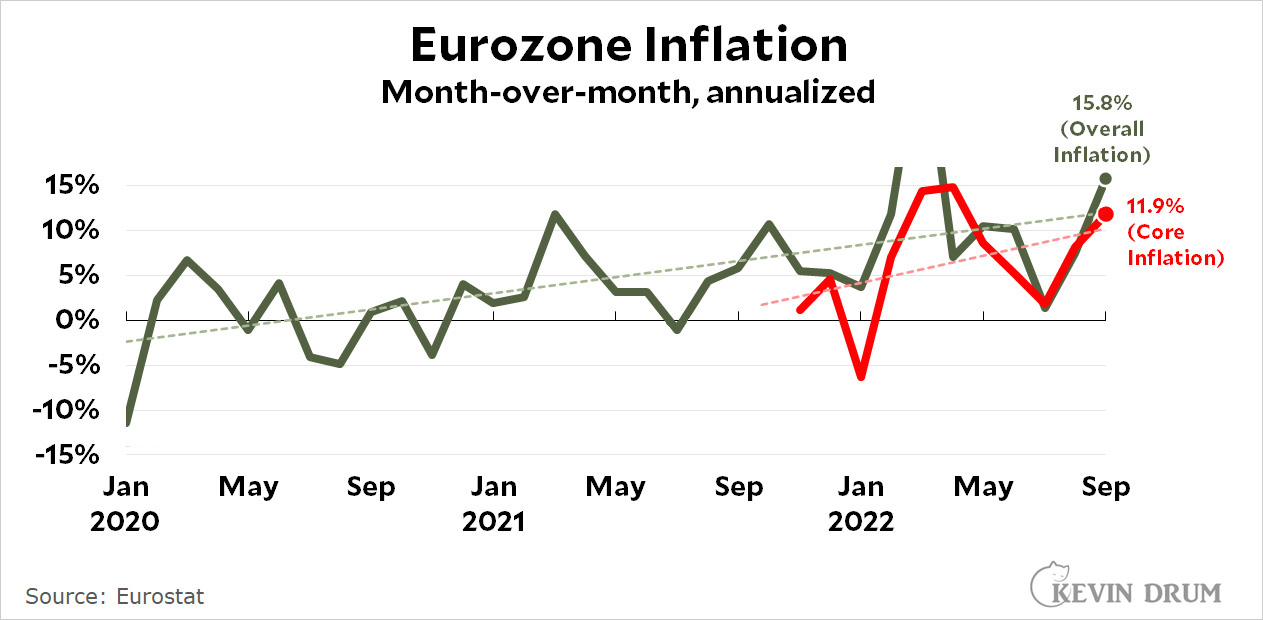

The Europeans are always ahead of us with their inflation data because they're willing to release "flash" estimates before the month is even over. For September, Eurostat reported annual inflation of 10%, which is bad enough, but that's year-over-year and doesn't capture their recent big increase. If you look instead at the monthly data, inflation for the Euro area hit a stunning 15.8%:

A lot of this increase is due to huge jumps in energy costs, but even core inflation is at 11.9% for September. Inflation is just sky high no matter how you look at it.

A lot of this increase is due to huge jumps in energy costs, but even core inflation is at 11.9% for September. Inflation is just sky high no matter how you look at it.

As usual with monthly data, though, September could be a fluke. So pay attention to the trendline. The good news is that the trendline shows "only" about 12% overall inflation and 10% core inflation right now. The bad news is that the trendlines are heading steadily up and show no signs of having peaked.

Also, Eurozone inflation is not high just because there are a few outlier countries driving up the average. The annualized September rates are high all over the place. Finland is at +8.7%. Portugal is at +16.7%. Italy is at +22.4%. Germany is at +29.8%. The Netherlands is at +40.9%.

The best performers in September were Ireland and Spain, at 0%, and France, which was down -5.9%. (Though all three still had high year-over-year inflation rates.)

NOTE: The figures for core inflation go back only 12 months because that's all Eurostat provides for core inflation. I have no idea why, but that's Eurostat for you.

Given Western Europe's gas challenge, that is likely to worsen, inflation is likely to remain high for a while.

Even though the direct cost of energy is not considered in calculating core inflation, it's the high energy costs that are driving it....

If the European central banks are going to try to tame inflation by increasing borrowing costs, they are to some extent fighting with the Americans.

Yes, but it’s only transitory…

Who knew that Biden and the Democrats' wild spending was so profligate it caused inflation on entire other continents?

Actually, major Asian countries (S Korea, Japan, Australia and New Zealand) have, while above normal, relatively low inflation despite exposure to similar global factors (price of oil, global supply chains etc).

I stopped reading at "actually." Anybody starting with that word is too pedantic to engage with.

Austin - while you may dislike my drafting, my rhetoric does not change the substance of my response. However, I will commend you to a politician like segue.

The next GOP campaign ad!

John Kerry merely forgot Poland. But Joe Brandon wants to bury it... & all of it neighbors.

+100.

😉😉😉

So, what is it about European inflation which calls for a linear trendline when a non-linear one is used for the US? …

Fitting the line to Drum's prejudices.

Pity he is normally over the years reasonably good about avoiding such habits, but this subject....

If NATO had sent it's full military might to Ukraine in April, we would own Russia by now... or it would be a nuclear wasteland. In any event, once Russia invaded Ukraine and given their energy exports, Europe was doomed. It was a colossal error to trust the Russians. Oops. I guess we pay the price either way.

Foreign exchange rates. USA is right now partially insulated from global inflationary pressures via US dollar appreciation (against literally all currencies).

Noone else is so insulated.

Ergo everyone else is fully exposed to ongoing inflationary pressure feed through both Primary - the direct impact of the energy price rises and Secondary, price rises through the value chains on intermediate goods and services as producers and servicers who have held the line under inflationary pressure, have to give in and raise prices, that is the stickier prices coming unstuck.

This in turn engenders another round of price pressures that build up.

The same stick stick and then come unstuck patterns were seen in the 1970s, meaning that a month of attenuation of price rises does not mean inflation is tamed - again the lesson of the 1970s that senior central bankers have not forgotten, a lesson that tells you not to make naive readings of singular indices (à la Drum) when there are wide statistical / econometric data indicating that price pressures are still feeding through the system.

Action now is not as Drum has most stupidly and irritatingly called "panicking" but rather is prudent Fire Break action to avoid the Stop and Pause errors of 1970s inflation response that kept pausing when inflation seemed to go sideways, only to reaccelerate as 2ndary and tertiary feed-through dislodged more and more stuck prices for another feedthrough.

Lol, 2 months of no inflation means nothing?. Even your crap with core pce means nothing after its own yry 3.5 gain the past 2 months is well below the gain of the previous 2 months.

Loud, you need your brain bashed in. Your biases are well known globalist con faggot you are.

Doesn't the expectation of permanent instability with Russia factor into it?

Who knows how long Ukraine will last, how long Putin will last, or what chaos might evolve in the wake of it.

I notice that the inflation number for Finland, while high, is on the lower end for Europe. & France is negative!

Guess joining the globalist kkkonspiracy (NATO) &/or electing a Neoliberal kkkosmopolitan president isn't the mortal error that the Putinists & Lepenists like Greenwald, Michael Tracey, the Bruenigs, Tulsi Gabbard, Jane O'Meara Sanders, etc., would have us believe.