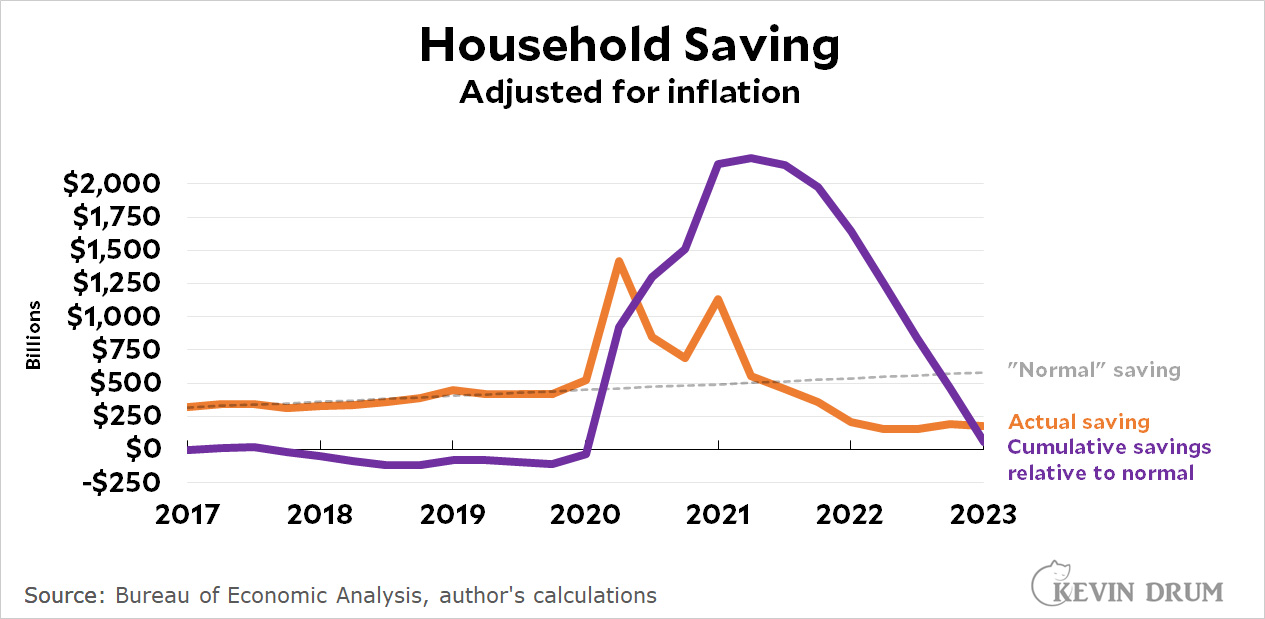

If you want to project the state of the economy, one of the key metrics is personal saving. But this is harder to estimate than it seems. Here's one crack at it:

The dashed line is the "normal" quarterly saving rate and the orange line is the actual saving rate. As you can see, it spiked when the government mailed out checks at the start of the pandemic and then again when Joe Biden's rescue plan passed. Then it went down as the government programs ended and consumers started drawing down their savings accounts. Around mid-2021, actual quarterly saving dropped below the historical trend.

The dashed line is the "normal" quarterly saving rate and the orange line is the actual saving rate. As you can see, it spiked when the government mailed out checks at the start of the pandemic and then again when Joe Biden's rescue plan passed. Then it went down as the government programs ended and consumers started drawing down their savings accounts. Around mid-2021, actual quarterly saving dropped below the historical trend.

The purple line is just arithmetic: it shows the total amount of savings above normal. This peaks after Biden's bill, and then declines as people spend their savings. All this extra government money is now gone.

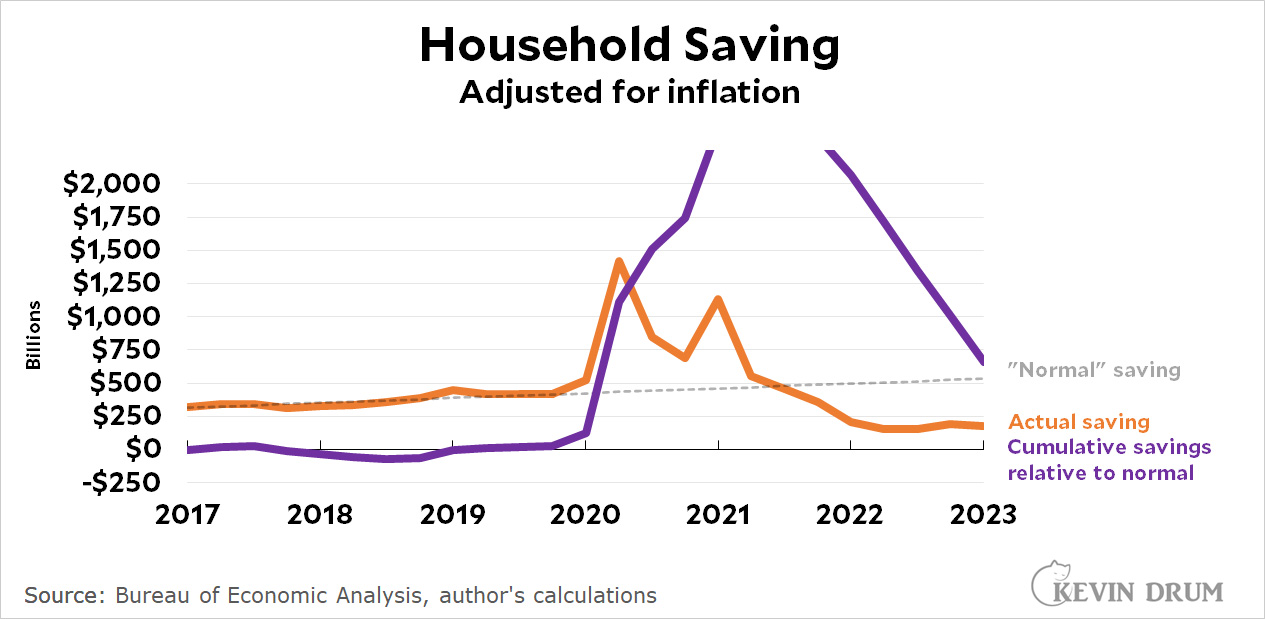

Or is it? Here's the same chart, but this time it suggests that total savings are still above normal by about $700 billion. Can you tell what the difference is?

In the bottom chart I changed the normal saving line slightly. That's all. But that slight change was enough to change the amount of excess saving by quite a bit.

In the bottom chart I changed the normal saving line slightly. That's all. But that slight change was enough to change the amount of excess saving by quite a bit.

The top chart is my best guess because I didn't mess around with the trendline. It's just a simple least-squares fit of the pre-pandemic trend. But "normal" is nonetheless a guess, and the amount of savings still left to be spent is extremely sensitive to this guess.

This is why predictions are hard, especially about the future. I think savings are essentially gone now and this is going to start hitting the economy very soon. But I could easily be wrong enough to put off the day of reckoning for another six months.

And so could anyone else. No matter how sophisticated your technique, you're still stuck trying to predict human behavior based on a projection of "normal" over the course of three years. There's an inherent lack of precision to that, and therefore to your overall economic predictions as well.

We'll know the answer before too much longer. But only in hindsight.

Pretty sure "savings" are long gone already. And most folks don't have savings ever anyway, even with the pandemic income supplements 2020-2021. Fed remains determined to crash the economy later this year, just in time for election season and just like the last two times* they did it to prevent the re-election of a Democratic president. Fed knows how to cause inflation when they want to. Ending it? Not so much.

* 1980 Carter and 2000 Gore.

All I can say is that banks used to have a ton of deposits for which they paid very little.

Then liquidity started drying up, even before SVB.

Now banks have to pay a lot more for their deposits. One reason for this is that we have spent almost all of our savings.

I never received any Covid money. I was fully employed throughout and don’t have dependent children. But my savings is up because I paid off a car loan and I keep getting paid / promoted / bonus payouts. On the other hand, my IRA and 401(k) are down this year. My contributions offset the losses… a little.

The idea that these Covid benefits had some effect is silly. I paid off a car and stopped going to out for lunch / dinner so much. People living paycheck to paycheck don’t have savings. Upper middle class folks like me do. And we didn’t get any checks from Uncle Sam.

If you didn't receive any Covid money, it means that you didn't file your taxes correctly. I, too, have no children and was continuously employed. I still got a couple of big checks.

And if you adjust for inflation differently???

Consumers have started pulling back, and household debt is up. From your charts, the question is does spending crash now or in a couple of months.

Is this calculation using BEA data for personal savings? If so, its likely missing capital gains and painting a very misleading picture for 2021 and 2022 when capital gains were likely very high. Any income from stock sales and house sales would be missing from this calculation.

I wouldnt be surprised if there are a lot of excess savings left.