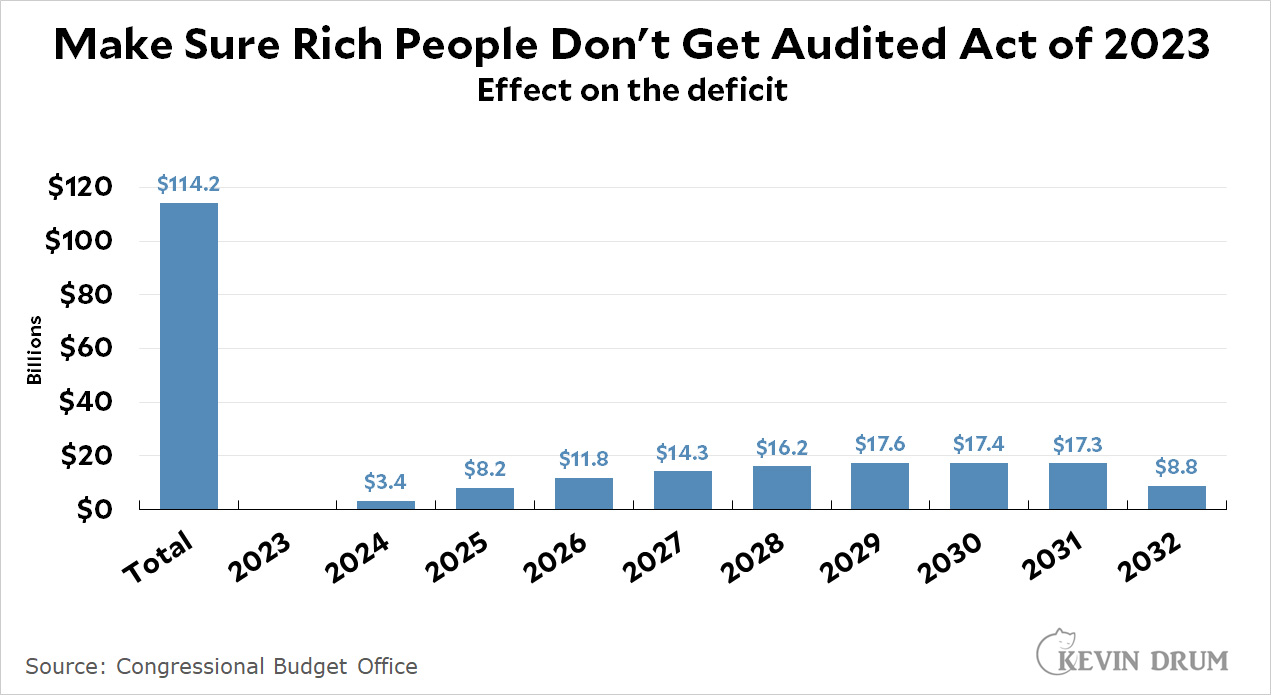

Here's the impact of the first bill that Republicans passed today:

I'm just kidding, of course. The real name of the bill is the Family and Small Business Taxpayer Protection Act. Because why not? Republicans can call it anything they want regardless of what it actually does.

I'm just kidding, of course. The real name of the bill is the Family and Small Business Taxpayer Protection Act. Because why not? Republicans can call it anything they want regardless of what it actually does.

And what it does is simple: It repeals the Democratic bill from last year that gives the IRS more money for taxpayer services and high-income audits. By defunding taxpayer services it will keep people mad at the IRS. By defunding the IRS, audits on the rich will continue to go down and that will be a boon for wealthy Republican donors.

Luckily this is entirely symbolic. It won't pass the Senate and it will never even reach President Biden's desk. But it tells everyone where the Republican Party stands.

Not totally wrong, since a lot of the beneficiaries of this are going to be local rich Republicans as well. The big guys who benefit from unenforced taxes, but also your local Republican business guy who has been cheating on his taxes from his rental properties and taking all kinds of dubious deductions and "business expenses".

By the way, I'm sure this demand won't go away, either. It'll pop up when it's time to do a budget again for 2023. Hopefully Senate Democrats and Biden stick to their guns and tell them to pound sand if they try it again (I don't why Obama didn't veto budgets that heavily slashed into IRS funding when he was President).

Start making more money weekly. This is valuable part time work for everyone. The best part ,work from the comfort of your house and get paid from $10k-$20k each week . Start today and have your first cash at the end of this week.

Visit this article for more details.. http://incomebyus.blogspot.com/

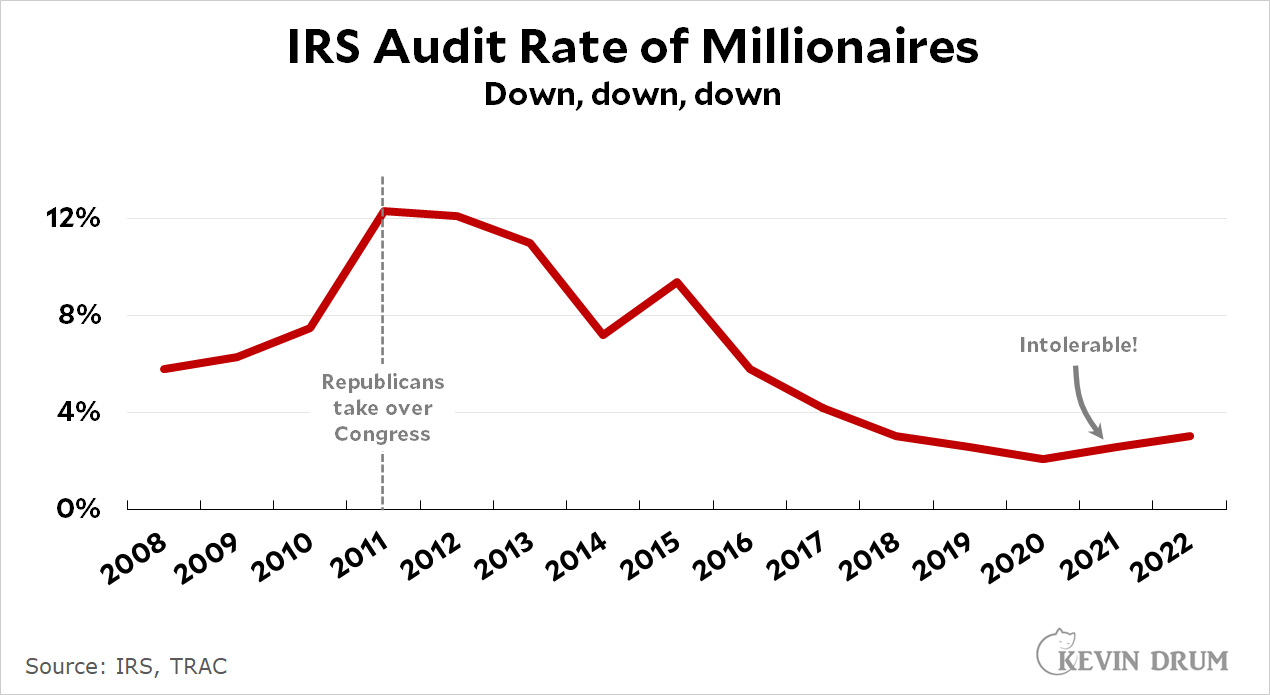

What was behind the doubling of the audit rate of “millionaires” between 2008 and 2011, and what were the additional audits finding?

Democratic control of the House, Senate and Presidency! Well the Presidency in 2009-2012, Democrats took over congress in 2006 held control until 2012 midterm shellacking.

GOP = The pro crime party!

Since it is essentially a time series of money, would those millionaires be in 2008 dollars or 2022 dollars?

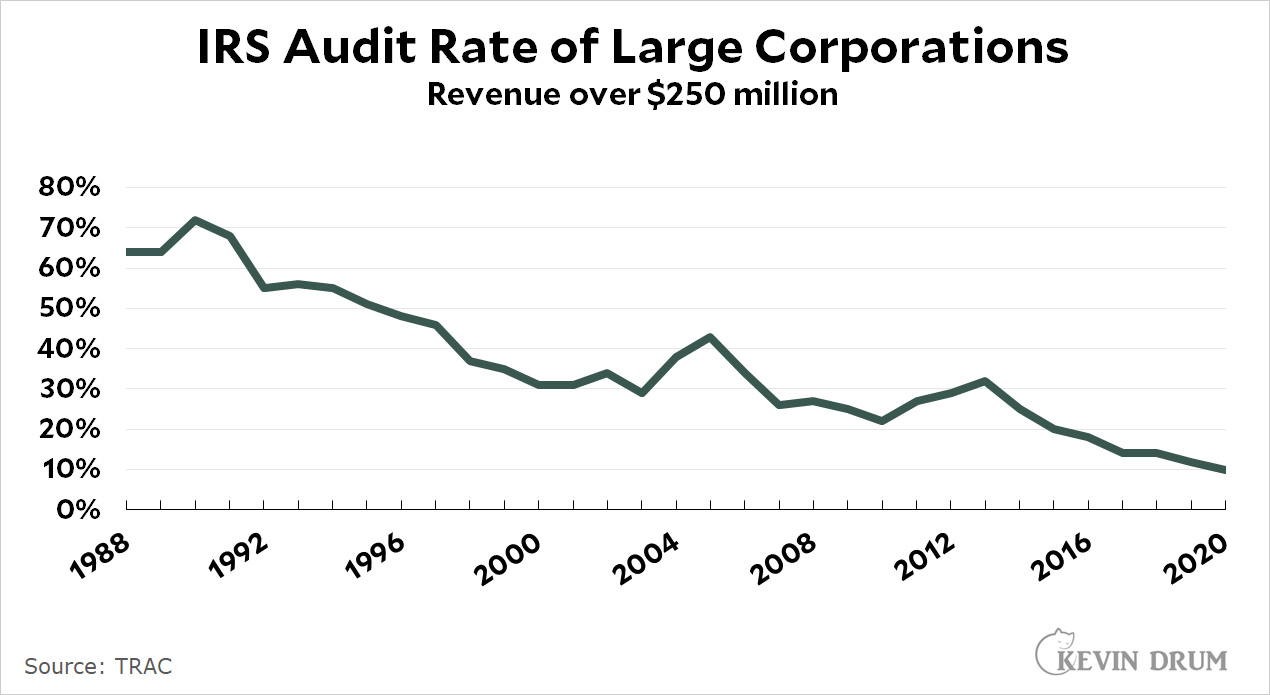

Are the corporate audit rates for businesses with revenue over $250M in constant dollars? 250m is a lot less today than it was in 1988. If the chart shows nominal dollars, one would expect the rate decline over time if the IRS is focused on bigger fish, and increase if they shifted to smaller fish (though still over the 250m nominal revenue threshold). Or if it's showing real dollars, the opposite would be true: if they focus on big fish it would go up or be flat, while if they shifted to smaller fish the rate would decline.

Serious question. How could the tax system be changed to make cheating difficult and collection so easy it doesn't require legions of tax enforcers?

VAT. But that will never happen here.

Too regressive. Shaft the middle class and poors to get a few shekels out of the wealthy.

Although a flat tax is regressive, I think that may be the only solution to get the rich to pay anything. Maybe a flat tax over a certain income? No deductions, just a flat tax of income.

A flat wealth tax: Assets - liabilities * tax rate. the first $150,000 tax free.

Almost no one would pay any taxes, other than the wealthy.

It'll never happen.

From https://www.motherjones.com/politics/2023/01/donald-trump-tax-returns-cheating-audit-irs-fraud-losses/

Yet here Kevin is showing a nearly 75% reduction in audits of “millionaires” leaving one wondering how a 26% reduction in enforcement resources leads to a 75% reduction in auditing.

When resources were reduced the IRS kept their numbers up by going for the low-hanging fruit. The truly rich are well equipped to overpower the scanty resources of the IRS—big-gun tax lawyers and accountants are mostly in private practice.

To conduct a meaningful and fruitful audit of a billionaire would take LOTS of time and money. Two things the IRS just doesn’t have.

Perhaps, but Kevin’s chart is for “millionaires” not “billionaires.”

A better name for this would be the "Bob Mercer Boot Kiss & Donation Assurance Act."

While this bill is all about political messaging, it really appeals to the small and medium sized business who could benefit. For those folks, hiding income by funneling part of their personal lifestyle as business expenses is a time honored tradition.

The big boys, like Koch Industries, financial institutions, oil companies, silicone valley, etc. do their dirty work with the help of K Street lobbyists and money hungry congress and senate members (all of them). The robbery is in plain site, or built right into the fine print of tax legislation. I have personally been on numerous conference calls with an industry group and our lobbyists, looking to influence legislation that would benefit that industry at the expense of the US taxpayer.