Social Security is back in the news. The word on the street is that MAGA Republicans—unlike Donald Trump himself—want to "reform" Social Security so it doesn't go "bankrupt" and cut off our kids from their rightful pensions.

I'm willing to go toe-to-toe on the gritty details of Social Security with anyone, but not today. Instead, I'll just give you a taste of the Social Security doomsaying we're likely to get. Courtesy of the Wall Street Journal, here is Travis Nix telling us that raising the payroll tax cap is a bad idea:

The Social Security administration forecasts that without benefit cuts or structural reforms the entitlement program will run out of money in 2035. In response, lawmakers in both parties are mulling the idea of lifting the payroll tax cap.

....[This] wouldn’t fix the structural issues with Social Security. Like a ponzi scheme, the program relies on the contributions of a shrinking young population to pay off an increasing elderly population.

....These programs need serious structural reforms—more tax revenue won’t save them....Lawmakers need to think bigger to offer real solutions. By raising the retirement age, letting workers put their tax in personal accounts instead of Social Security, and shifting Social Security to a flat benefit to make it a true antipoverty program, lawmakers could begin to address the crisis.

First off, Social Security will not "run out of money" in 2035. Current estimates say it will run about 25% short in 2035. That's a big difference, but conservatives can never bring themselves to say it.

Second, it's not a Ponzi scheme. If you cut off all the babble surrounding it, Social Security is just a standard social welfare program: Taxes go in and pensions go out. This can keep up forever, just like it can for Medicaid or the military or anything else.

Third, raising the retirement age saves money but does so mainly on the backs of the poor. Personal accounts are risky, which is why Social Security doesn't use them. And a flat, small benefit for the few would destroy public support for Social Security. Nix surely knows all this.

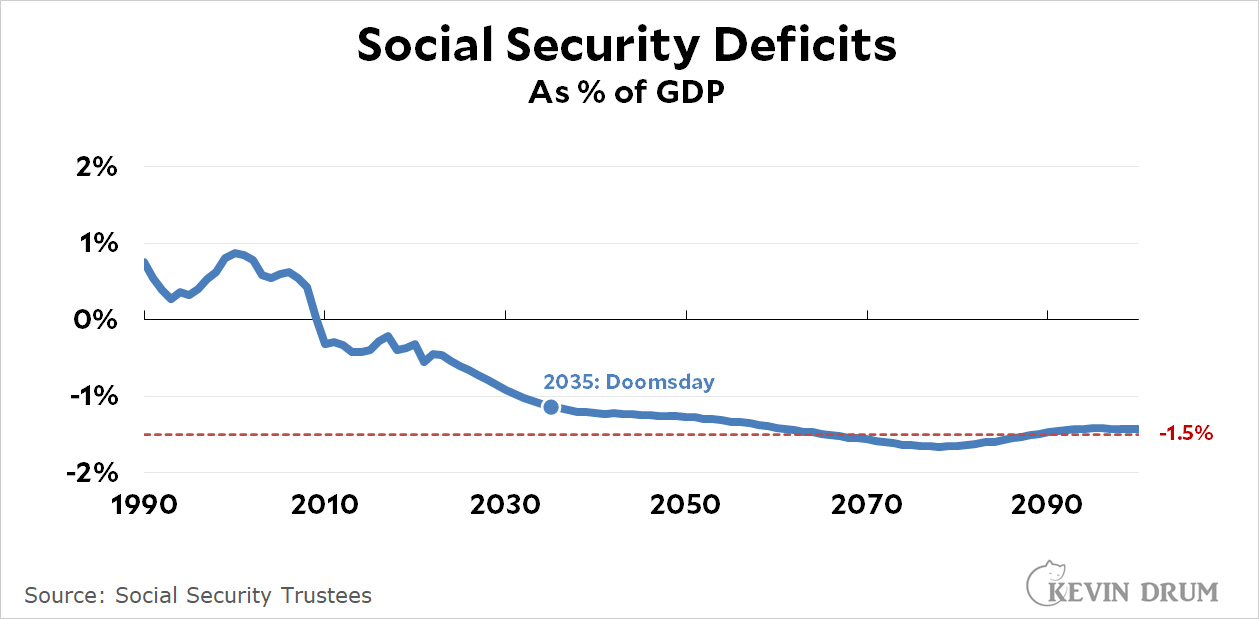

Fourth, literally everything Nix implies is baloney. I'm excited to report that the Social Security Trustees now include Excel data in their annual report, which means I can recreate their charts on my own. Here's the most basic, most important single chart you will ever see about Social Security:

That's it. That's all you need to know. Forget about high and low estimates or bend points or the accuracy of the Trustees' actuarial assumptions or any of that. Those are trivial. What this chart tells you is that Social Security is not doomed to an endless spiral of death. It's projected to eventually run annual deficits of about 1.5% of GDP forever.

That's it. That's all you need to know. Forget about high and low estimates or bend points or the accuracy of the Trustees' actuarial assumptions or any of that. Those are trivial. What this chart tells you is that Social Security is not doomed to an endless spiral of death. It's projected to eventually run annual deficits of about 1.5% of GDP forever.

So to fix it, all we need is reform that eventually adds up to 1.5% of GDP. That's it. Some combination of tax hikes and benefit cuts that come to 1.5% of GDP. That will keep Social Security properly financed forever.

Now, having said that, I should let everyone know that I've changed my mind about all this. In the past, I was in favor of some kind of sensible compromise that could be put in place now. But it's obvious that Republicans won't negotiate anything of the sort. They won't raise taxes, period, and they don't really want to give up doom mongering about Social Security either. It's a good brand for them: They can yell loudly about how Social Security is fatally broken and then quote surveys showing that young people don't believe Social Security will be around when they retire. It's a nice gig.

So even though sensible is sort of bred in my bones, I'm on Team Atrios these days: There's no point in—what? Cutting now so we don't have to cut later? What's the point of that? We might as well wait until later, when we'll know for sure what we need to do.

In reality, no one is going to cut a deal until the very last moment, just like we did in 1984. So when 2035 rolls around, our hair will suddenly be on fire and everyone will finally come to the table. And we'll find our 1.5% of GDP without too much effort.

Let's also tell the truth about Reagan's "fix" for Social Security way back in the 1980s. Reagan, with cooperation from Congress, dramatically raised payroll taxes, supposed;u tp fimd tje sirge om Spcoa; Secirotu wotjdrawa;s we're experiencing today. By design, the excess of tax collections would go into the 'trust fund," a collection of special treasury notes that would act as the store of value ofr the trust fund. Like any other treasury note, the proceeds from issuing the notes would go into the government's coffers--eliminating the need to raise income taxes. At least for a while.

Short version: every working American has paid more in payroll taxes for years. The government "borrowed" that money to avoid raising taxes on rich people. Now it's time to repay the moeny and republicans don't want to do it.

This exactly. We have the surplus we have now on the backs of the past generation's working and middle classes, who essentially overpaid. Future solutions need to be mostly on the backs of the richest Americans who "borrowed" from everyone else for the last 40 years.

+10 !

It was mainly boomers who paid in the excess to swell the Trust Fund. This was because of their excess population. That money is going to be paid back to boomers and the Trust Fund is going to shrink, although it should have some money in it as a buffer.

The projections take account of this payout. In order to project future SS benefits it was necessary to project future wages and salaries, and wages have not grown as fast as expected.

I’m overpaying on my federal taxes right now, while boomers still get to deduct the full mortgage interest on the homes they bought decades ago. Same as how I overpaid for my state university tuition, while boomers got to attend university for the cost of a summer of working part time.

Fck the boomers. They made out well as a class. They can afford to eat it when it comes to not getting every dime back that they allegedly overpaid into SS.

How many boomers do you know that still have mortgages to pay off?

So the 1% says to you:

“Look at their crumbs! So much bigger than yours! Why do they get those huge crumbs while you get small ones? You should make sure their crumbs aren’t bigger than yours!” “Now excuse me while I eat my cake, which I deserve so I can provide a few more crumbs your way. Be sure ‘They’ only get the smaller crumbs. You are so deserving of bigger crumbs than them!”

And you agree. “ F those big crumb getters!” And the 1% go back to their cake.

"Fck the boomers."

Grow up junior. Adults know you aren't supposed to attack and disparage any large demographic group.

If they bought their houses "decades ago" it;s unlikely they are paying much, if any interest, now.

I think you're on the mark, Skeptonomist.

I am now about to start getting the benefits that I supported with those hefty payroll taxes since 1984. I'm satisfied that this was fair to me, and I want it to stay fair. And for the many over the decades who said, "It won't be there to me," you needn't have been so defeatist. I used to say that when I was young, but when George W. Bush gestured toward undermining the program, I changed my tune to "It better be there for me." And that's always been a politically powerful position.

"supposed;u tp fimd tje sirge om Spcoa; Secirotu wotjdrawa;s "

I've done that... too often.

I'm on that team, although I will say it's worth making the easiest and most popular tweaks (like removing/adjusting the cap) between now and 2035 whenever Democrats hold both houses of Congress and the Presidency. It'll push out the date where the trust fund runs out and push the eventual changes in a progressive direction.

I'm 70, and back when I was young, the doomsayers were saying that Social Security wouldn't be around by the time I retired. Guess what - it's still here. Raise the salary cap, tax the bejesus out of the 1%, and quitcher bellyachin'.

I was about to post the same thing, only I'm only in my mid-50s. In the early 90s I regularly read this exact same doomsday stuff. Young people will never get Social Security. Need to give people private accounts and raise the retirement age. These libertarian/republican guys need a new songbook.

And once again:

1) Social Security is not going to "run out of money" any more than say the military is. There is no good reason for it to have a separate budget that must never go into the red. This fake requirement could be changed at any time by Congress. Why is it taboo for SS to contribute to deficits (it has not done so yet) when nothing else is held to this requirement?

2) At the moment it is about $2.7 trillion in the black. This is mostly money that boomers paid in and they should get it back. It belongs to them and not to post-boomer generations. When that money is gone, SS will be back to pay-as-you-go - it is not primarily a funded program.

3) How many people know that interest, dividends, rent and capital gains are not taxed for SS? There is no good reason that these types of income couldn't be taxed as well as raising the cap on wages and salaries. Why don't Democrats inform the public about this?

4) Increasing productivity should counteract any effect of an aging population - see Dean Baker:

https://cepr.net/the-nonsense-about-a-demographic-crisis/

You can't predict that robots will take all the jobs and also predict that there won't be enough workers to support retirees. With normal productivity increase there will be enough for working people and retirees.

5) The real reason that a shortfall is projected is that wages have not been increasing as fast as they were formerly. It is not a generational problem, it is a class problem. Since the rich have been getting more of economic gains, they should be taxed more.

Hogwash.

People have brain worms when it comes to social security. The taxes boomers paid to fund social security are not "theirs" any more than the taxes they paid to build a B-1 bomber or an interstate highway makes those things "theirs."

Yet another brain-wormed idiot who thinks "You didn't say your words right" is a crushing argument.

+1 to #1

Liberals need to stop buying into the premise that SS is different than other gov programs.

At the moment it is about $2.7 trillion in the black. This is mostly money that boomers paid in and they should get it back. It belongs to them and not to post-boomer generations.

Fck this. Boomers also get tons of spending on Medicare and Medicaid that they either underpaid for over their working life or never paid a dime in for, especially that Part D coverage that Bush II added with no additional revenue coming from anybody to pay for it. I’m fine with Medicare and Medicaid spending, but the boomers can fck themselves if they also claim to want a rebate on SS funds they “overpaid.”

I've been reading our host for 15 years or so, and after all these years, it is this comment that has pissed me off enough to create an account to comment. Point two is bullshit. Boomers have only paid a the post Reagan rates for a portion of their working lives, but will be enjoying the benefits of the trust fund for the entirety of their retirements. Meanwhile, GenXers like me saw the rates go up just before we entered the workforce and will see the trust fund that we've been paying into since our first day of work run out just as we are preparing to retire. You can stick your "Boomers earned it and everyone else can suck it" where the sun don't shine.

Your argument sounds a lot like: "I overpaid even more than those boomers, so we should just abandon the whole thing, because I feel insulted."

Gen Xers probably do have it worse. But what are you supporting as regards paying back the Trust Fund or not?

I have no idea how you got "we should abandon the whole thing" out of my comment. I was reacting strongly to skeptonomist's "This is mostly money that boomers paid in and they should get it back. It belongs to them and not to post-boomer generations." I think that argument is both factually wrong and morally repugnant. My own position is that we should lift the income cap on SS/Medicare taxes to fund the current level of benefits past 2035, while also looking for ways to expand those benefits. Is that plain enough?

Engaging in intergenerational finger pointing is a waste of time . That said you are off base here. I was born smack dab in the middle of the boomer years and the vast majority of my working life - at his point over 38 years - has been since the 1984 revisions. But as I said this is a waste of energy . Social Security has been a tremendously successful social program. It deserves our continued support. There's no reason you will not get your turn unless you buy into the nonsense the GOP (and many in our media) is promulgating. "Fixing" it - as Kevin implies - is not a complicated problem.

Amen!

I had a high school job in 1984. I'll have been paying the Reagan surcharge for 51 years if I retire in 2035. As I apparently need to make clear, I was not arguing against Social Security as a program. I think it needs to continue at at least its current level of benefits, and that we should probably make up the shortfall by lifting the income cap. I was responding to skeptonomist's claim in point 2 that "This is mostly money that boomers paid in and they should get it back. It belongs to them and not to post-boomer generations." As a post boomer who at retirement will have paid more into the program than a boomer, I strongly object to the claim that the Reagan surcharge belongs exclusively to boomers.

While I agree that the solution is likely going to be a combination of more revenues (progressive taxes) and lower benefits (perhaps primarily targeted at the wealthy) the 1.5% of GDP is a non inconsequential number.

The shortfall is approximately $345 billion or, about the total annual GDP of Pakistan ( a country with 230 million people) or Denmark (6 million people).

"The shortfall is approximately $345 billion or, about the total annual GDP of Pakistan ( a country with 230 million people) or Denmark (6 million people)."

Pakistan is a poor country with a GDP per capita of ~$1,500, or roughly 1/47 of that of the US, making it a pretty meaningless comparitor. Denmark is even worse, since while Denmark is much wealthier, the US has 55 times the population.

The US is a very, very big country, and extraordinarily wealthy on top of that, and as a result, 1.5% of *anything* describing the US leads to some very large nominal numbers. That's precisely why the PERCENTAGE is important--because otherwise you start treating something as small as a single year's worth of GDP growth as like ZOMG! Denmark/Pakistan!!!!1!

My point, in using the example, is 1.5% of US GDP is a large number. 1.5% of US GDP is about comparable to the 40th largest country (measured by GDP) in the world.

Yeah we got it, but again so what?

The US is a large country with a massive economy and the big number is still just 1.5% of it.

“The rich and the poor alike are spending 40-50% of their income on housing… the poor in their rented hovels and the rich in their 8+ homes around the world… therefore both rich and poor are equally feeling the pinch of housing costs.” -middleoftheroaddem’s logic

The middle of the road is also where idiots stand who want to get hit by cars.

The shortfall does not have to be made up in a single year.

President DeSantis will have to build a wall around The Villages if he manages to push through cuts to Social Security and Medicare or else they'll armor up their golf carts and come after him. Who exactly does the GOP think is gung ho for cuts to these programs? They are super popular, particularly among the very demographic that votes Republican.

You think they care? They do grotesquely unpopular things all the times. Doesn't seem to hurt them enough to prevent them from holding power on the regular, so unless its ever gonna do that, why stop?

And I suspect if you looked those dwellers in The Villages dead in the eye and said "Sure. I cut Social Security for your grandkids. You hate your grandkids, though. They're a bunch of lazy wastrels, they don't honor you as you should, and a lot of them are degenerate queers. So what do you care?" a lot of them will nod along.

I mean yesterday Kevin told us that Desantis already let/required The Villages to increase their property taxes by 25% in a single year to fund infrastructure for development plans for his buddies, rather than allow the county to assess impact fees.

If the Villagers are cool with being fcked over on their property taxes, they’ll probably be cool with being fcked over on their SS checks too… as long as Desantis promises them the blacks and queers have it worse of course.

Except the people currently living in the Villages won't be effected by any proposed changes. Republican politicians are just smart enough to know to exempt current and soon to be retirees and f*ck over GenX'ers like me and those even younger.

Uncapp FICA, beatches! Stop this give-away to the rich.

"Personal accounts are risky, which is why Social Security doesn't use them."

That, I suspect, is the point.

Also, current Social Security is not a savings program! Payroll taxes my employer sends the IRS this month go out in SS checks to grandpa next month.

Trying to make SS like 401k's, in addition to all the other reasons that's a bad idea, is a category error. Unless proponents want to dig up a generation's worth of benefits out of the blue to make the transition, which I kind of doubt.

It's also worth noting that there have been repeated, significant cuts to SS benefits for targeted groups*--that's a very repeatable game. Just keep the group harmed relatively small, and SS cuts are very doable.

Just from memory: I can remember my grandfather complaining about making the SS benefit taxable (1980's, probably); just last year they dramatically reduced the ability to delay taking SS payments and get a bigger annual benefit by doing so.

We'll see what Biden says about this tonight. Republicans seem pretty timid on this issue, as well as the debt limit. Maybe they fear Trump zapping them from the left, as in 2016.

It’s time for death panels. Once they turn 85, start reducing their SS benefit. Zero it out at 90 and offer to pay for the cremation.

What's wrong with soylent green? I hear it's tasty.

Well I agree with about 90% of the comments above. First let me point to this: https://time.com/5888024/50-trillion-income-inequality-america/

The gist is that the bottom 90% of households have seen their share of total US personal income decline from around 63% to 49% since the 1970s. Call it $22,000/household. This is despite more hours being worked per household and the decline in job benefits. You have to get to about the 98th percentile to find households that have broken even on this realignment of income distribution. The 91st or 95th percentile isn't rolling in it.

Since Social Security benefits are a function of income, it's true that this income mal-distribution has reduced Social Security benefits. However, since the distribution of SS benefits not linear with respect to income, it has reduced FICA payments more than SS benefits.

Several decades experience has proven that most people will not be able to save enough in IRA's, etc to make up the former third leg of the retirement income stool. The second leg, pensions, are now gone except for government workers. Many government pensioners are cut off from receiving SS benefits anyway.

So, we should limit future contributions to IRAs (etc.) and increase SS benefits for the lowest income current retirees and all future retirees. FICA taxes shouldn't be raised. Maybe they should be lowered. Every nickel of the cost should be paid for by taxes on the highest income households and the wealthiest. It would be good for society anyway to tax billionaires out of existence.

I think this a hugely important point. The great increase in income (and wealth) inequality over the past 40-50 years is a major driver behind almost all of the biggest problems we face in this country.

FICA taxes most certainly should be raised. On the affluent.

Pingback: Fixing Social Security forever requires only 1.5% of GDP | Later On

Personal accounts aren’t just risky, they’re quite useless in this situation: personal accounts are not currently illegal, so folks are perfectly welcome to have them on their own. In order for people who are too old to work to live, we need to transfer resources from those who are still working. We certainly *could* use Wall Street as a mediator to do this if we wanted, but it’s simply more expensive and inefficient to do so. This is just another in a never-ending series of scams on the GOP wish list.

But WHY do we have to transfer resources from the young to take care of the old?

Surely we are smart enough to create a self funding system that doesn't impose this burden on younger workers?

There is no such system. Resources have to be given to retired people so they can live comfortably. This inevitably means reducing the consumption of non-retired people whether we use a cheap and efficient method (checks from the government) or a pricey, system rife with deadweight loss that subsidizes Fidelity and Morgan-Chase.

"Surely we are smart enough to create a self funding system that doesn't impose this burden on younger workers?"

Surely if so, you could suggest one?

Get rid of the cap. According to the SSA Trustees that should put SS in good shape until the late 2050's. By that time I will be well and truly dead and don't give a fuck about what happens!

What's the point of that? We might as well wait until later, when we'll know for sure what we need to do.

I've been saying this for years. Also, we might as well wait until later because it's possible when the time comes to deal with a Social Security shortfall (18 years from now?) maybe our politics will be less corrosive or maybe Democrats will have a trifecta. That's certainly not the case now. Any changes to Social Security at this juncture will be a GOP-engineered shit sandwich that exacerbates economic inequality.

One and a half, one and a half, that’s the percent onward…

Democrats need to respond to this crap by proposing a constitutional amendment that bans cuts to Social Security and bans its privatization. Force Republicans to publicly kill or vote it down.

This is a bit misleading. 1.5% of GDP sounds like not a lot, but taxes are 25% of GDP (or so). So to make up the gap, you would need an extra 6% of taxes. It's not the end of the world, but it's not nothing.

1. Lower the rate on salaries.

2. Remove the cap on salaries.

3. Add a 2% FICA tax on other forms of income.

I don't know the numbers but this would likely give millions a tax cut and shift the burden of SS to wealthier Americans. Get some good economist to work out the details.

In my view the easiest way to "fix" Social Security would be for Congress to pass a one line enactment. Something to the effect of "The United States Treasury shall pay all scheduled Social Security benefits out of general revenue in the event payroll tax revenue is insufficient."

That's already the status quo: according to Kevin's chart, payroll tax revenue is currently falling short to the tune of about a half point of GDP, or a bit over $100 billion annually. Under current law we're apparently set for another decade plus, because intergovernmental IOUs mechanically create the required infusion of general revenue funds to make good the gap. But sometime in the next decade those IOUs will be depleted. So, once you have the votes, obviate said depletion by law. Don't worry about the extra revenue needed unless inflation is getting ugly. Who knows what the macro picture will look like in the 2020s?