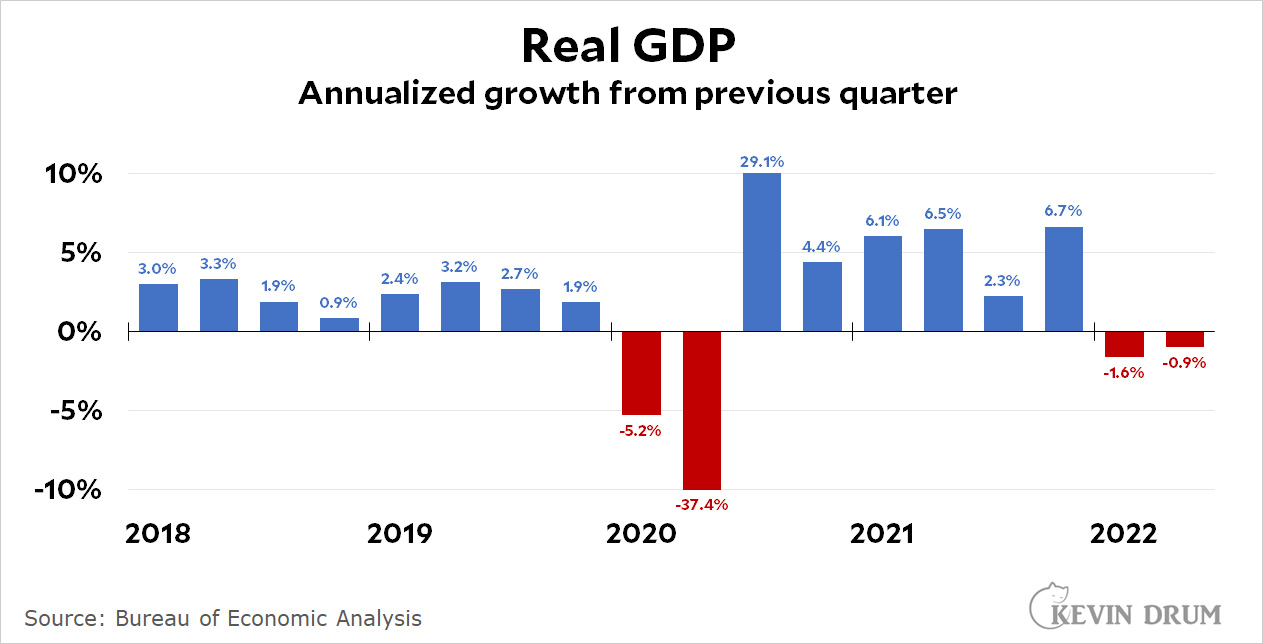

It looks like the Atlanta Fed's forecasting prowess was pretty good for second quarter GDP:

Real GDP declined 0.9% on an annualized basis, so we now have two consecutive quarters of contraction. On the bright side, real GDP was up 1.6% compared to a year earlier.

Real GDP declined 0.9% on an annualized basis, so we now have two consecutive quarters of contraction. On the bright side, real GDP was up 1.6% compared to a year earlier.

Down in the details, none of this can be blamed on the brave American consumer, who increased spending by 1% in the second quarter. At the same time, corporations cut their investment level by 13.5%, mostly due to reduced construction, and government consumption was down 1.9%, the third consecutive quarter of declining government spending.

And now let the battle begin: Are we in a recession? I still vote no.

2 quarters shrinking = recession. It's way too messy and animal spirity otherwise.

https://www.distractify.com/p/why-is-spirit-animal-offensive

"Animal Spirits" are not the same thing as "Spirit Animal" you dumb bot

He's trying to get you kicked off Fboy Island.

I think he’s trying to get you mad so you email the linked address, which may be a hapless victim

Genius trolling strategy if I’m correct on the diagnosis, gotta give it to him. 2 birds with one stone

But that's so stupid. Why would you bother to email someone to have an argument online?

The whole point is to fight in public so everyone can see the superiority of your view and your prose.

@cld I see what you did there >:[

Back when Rational Expectations was just being introduced, the AEA was meeting in the city I lived in at the time, and it made the front page of the local newspaper. One of the quotes from a dissenter went something like, ‘if we accept this theory, economics will be nothing more than a branch of psychology.’ My immediate thought was, ‘whoever thought it was anything else?’

C'mon Musk, start mining asteroids!

And CERN start solving fusion!

Let's just get to post scarcity economy and then we can ignore all this shit

Anyone who argues we're in a recession has to show that we already hit peak in the business cycle, per NBER. Otherwise, it's just an uninformed guess and anyone can do that, even the folks on CNBC.

We had a jobless recovery after Obama took over for Bush & further bungled the Great Recession, so we can have a full employment recession after Biden took over for Trump & bungled the supply chain.

You mean the gov't stopped buying all those PPE's?

Our recovery from Covid has gone better than most--and we don't have a war on our doorstop....so our trade deficit is high. Spiked in March, and is still high, >100 billion a month

https://www.census.gov/foreign-trade/balance/c0004.html

> Are we in a recession? I still vote no.

Right now? I agree. But we just got another .75% bump just yesterday, by November, we will be.

All according to plan.

Then it's revised away.

Over estimated inflation, missing exports, inventory. I smell a BEA/BLS scandal.

OT: Apparently, Larry Summers played a critical part in convincing Manchin to support the Inflation Reduction Act.

Inflation was Never that high. They lied.

So great that recessions are determined now by the vibes of a panel of bureaucrats rather than by objective measures.

Ouch!!!!

The problem with GDP is it isn't objective.

Nobel Laureate Dr Paul Krugman, who you may have heard of, is skeptical. The "two quarters and you're out" rule, he notes, isn't How It's Done. Moreover, looking at that graph, the "real" GDP was down less than it was down in the previous quarter, which in a sane world would signal an improvement.

Oh, and gasoline was down to $3.49.9 this morning.

The NBER hasn't followed that "rule" for some time.

As Dr. K noted.

GDP grew 1.1 ex private inventories. What???? How could that be???? Oh that's right, they aren't counting product stuck in ports. What a mess the BEA has.

Not in a recession yet, My guess: October 2022 through August 2023 is how it'll end up being dated, Unemployment peaks at 6.7%. We'll have at least four more rounds of tightening but this was the last round where we see a full 750 basis points. V-shape recovery thereafter.

By March of 2024 there'll be undeniable signs the economy has entered a solid, low-inflation expansion. Four more years.

Unlikely. There is no recession. I have unemployment down to 3% by 2024.

The term recession has become a political football with nary any economic meaning. The real question is whether we are having a real economic downturn as evidence by the data. More to the point is how significant is the downturn and that’s what really should matter. As the economy ebbs and flows there will always points of negative economic data, but a measured contraction of .225 sounds like a rounding error for large economy (its like a gas tank for the average earner).

Unemployment is the only truly meaningful definition of a recession.

FRED says the number of employed persons has been rising throughout the year so far: https://fred.stlouisfed.org/series/PAYEMS

Ask yourself: is it reasonable to think that an economy with more employed persons has been producing fewer goods and services? That companies are hiring people to stand around with their hands in their pockets? Or is it more reasonable to think that maybe our measures are flawed, or subject to more noise than we imagine?

Recession occurs when there are fewer goods and services being produced to be divvied up among the populace. Where is the evidence for that?

The Alanis Morrissette Principle of HR Practices

https://youtu.be/aLnsjWijfUI

Over at Vox they have all the details.

To put it more plainly, the idea is to tamp down consumer spending and slow business expansion by increasing costs in other areas (namely, borrowing and loans). The Fed is trying to get you, for now, to stop buying so much stuff.

Really… what wrong with all of you?

This is especially helpful.

One thing consumers can do to navigate the moment is to reduce some spending. Maybe put off the summer trip that hasn’t been booked yet, or save that home purchase for a later date, if possible. Walk instead of driving to your destination. “That’s something that will put them in a better position going forward, but also they’ll do their part in contributing to reducing demand,” Sinclair said.

https://www.vox.com/the-goods/23169673/fed-interest-rate-hike-inflation-recession-stock-market-debt

The media just live this moment. I think vox should fire all their staff. That would slow the economy.

I haven't drilled down into the numbers here, but I wonder if the negative growth number here represents actual contraction in the economy, or whether it's an accounting gimmick. We've been running unusually high trade deficits, for example, which pushes down GDP. Consumer spending remains robust. Jobs are solid. We're not in a recession. Yet.

Unsold inventory.

BTW, Ds now sporting big leads in generic ballot, meaning, it's starting to look like the midterms might turn out to be the opposite of what Republicans had hoped for.

Morning Consult now has D +8.

Maybe this is all part of the strategy to come on strong at the last quarter-mile section?