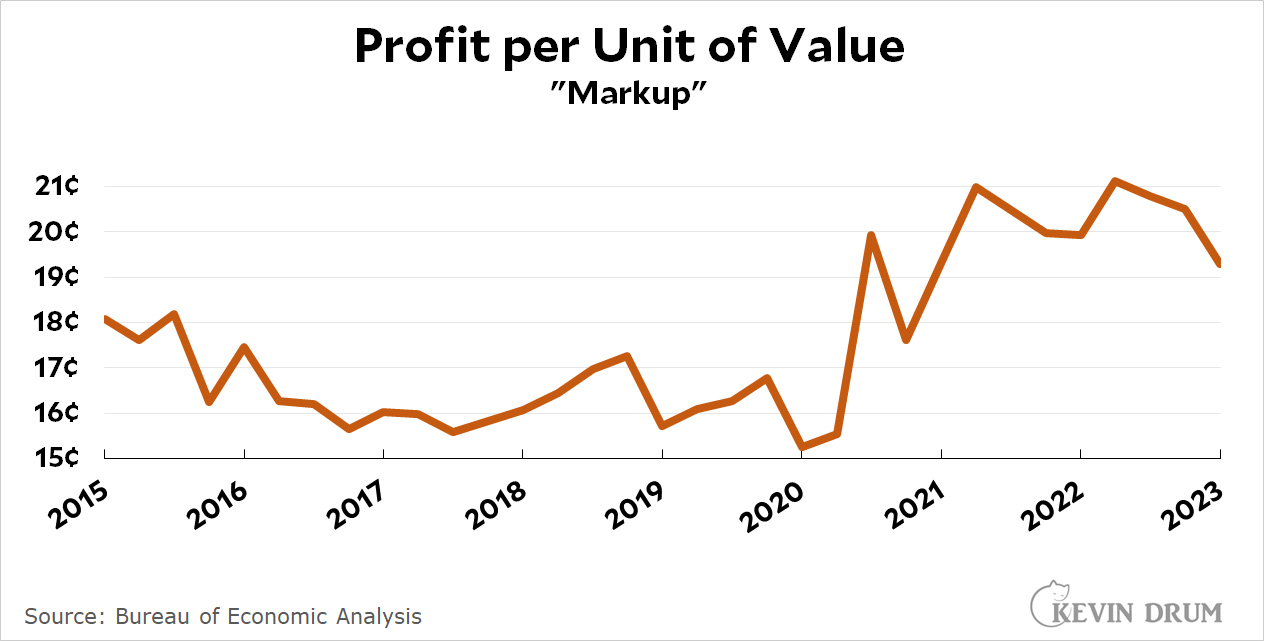

As we all know, corporations have raised prices substantially over the past couple of years, generating huge windfall profits. Is this "greedflation" the real cause of our recent bout of inflation?

In a nutshell, Eric Levitz says no. All that happened is that the pandemic caused supply shortages while government stimulus payments kept demand high, which caused prices to rise. Corporations then went along for the ride. I think this is broadly correct, but not entirely. After all, the evidence suggests corporations didn't just go along for the ride. They increased prices well beyond the rate of inflation. Was that related to lack of competition?

This raises an obvious problem: Corporate concentration has been transpiring over decades. In 2019, U.S. industries were roughly as concentrated as they were in 2022. Yet in the former year, inflation sat near 2 percent, a low level by historical standards. In the latter year, by contrast, prices rose by 6.5 percent. So why did corporate concentration yield historically low inflation throughout the 2010s, only to suddenly produce exceptionally high inflation following the pandemic?

Indeed. If they could get away with this, why wait for the pandemic?

It is unclear why corporations would feel compelled to wait for an “excuse” before seeking to maximize their profits....Generally speaking, companies do not feel compelled to provide an excuse for pursuing their mercenary interests....U.S. firms have been perfectly happy to offshore jobs to low-wage areas, even in the absence of an economic crisis that would serve to rationalize such profit-maximizing endeavors. Pharmaceutical firms, meanwhile, routinely price-gouged on life-saving medicines, even when inflation was near historic lows.

I think there's a straightforward answer to this question of timing. During periods of low inflation, price increases are conspicuous and consumers react to them. Big, flashy price increases run the risk of consumers abandoning your product and substituting something else.

But when the economy is chaotic and inflation is already high—and consumers are faced with endless news coverage of it—these constraints ease. If inflation is running at 8% and everyone is panicking, it's barely noticeable if a bag of Cheetos goes up 8% or 17%. It just seems like yet another wild price increase, like eggs or beef or used cars experienced for a while. At the same time, there's little risk of your prices being undercut, not because of corporate concentration but because everyone else is suffering supply shortages at the same time.

So my take is simple: Our current round of inflation is fundamentally a result of pandemic shocks, but it's been made a little worse by greedflation. This stands in stark contrast to the usual bogeyman of labor costs, which have been rising at less than the rate of inflation. In other words, it's not that greedflation isn't real—it is—it's just that it's a modest part of the whole story. That's how companies are able to get away with it, after all.

In other words, pickpockets flourish in crowds, something like that? Maybe there's something to it; maybe famous pharma bro Martin Shkreli, to pick a name at random, wouldn't have been such a bright star if he'd waited a few years. Have to see the article to think about relative magnitudes of these phenomena. Thanks for the link.

I make 100 bucks per hours while I’m courageous to the most distant corners of the planet. Last week I worked on my PC in Rome, Monti Carlo at the long final in Paris. This week I’m back inside the USA. All I do fundamental errands from this one cool area see it. For more information,

Click on the link below… https://GetDreamJobs1.blogspot.com

"...They increased prices well beyond the rate of inflation. ..."

This doesn't make sense. The rate of inflation is the rate prices are increasing. So if some companies increased prices faster than inflation others increased them slower. Depending on where the supply demand imbalance was worst.

Inflation in the producer price index was over twice as high as inflation in the consumer price index:

https://fred.stlouisfed.org/graph/fredgraph.png?g=16Sdx

This does not mean that profits were not being made, but it suggests that the profits were made prior to where the producer prices were measured, and that retailers may have been squeezed (more detailed data would be needed to make this conclusion).

As PPI inflation has gone negative this is another indication that consumer inflation will be going down. The PPI may not have much of a contribution from shelter, which is important in the CPI.

Some pandemic psychology--with things uncertain, I valued having the security of the familiar much more. That made me less likely to switch purchases to a competing product or service. As companies realized that they increased thier prices.

I heard an interview with an economist (I think on Planet Money?) who went onto earnings calls for companies and recorded company after company saying they were using people's perceptions of inflation to crank up prices even more.

I may have read a transcription of the same interview.

I think this is a case in which you don't need data to reach a valid conclusion. A little knowledge of human nature coupled with the mechanics of capitalism explains it: People generally want more for themselves, and capitalism validates our greed.

the phrase greedflation is Lefty cant and really quite nonsensical.

Enterprises are made up of people who just like ordinary people see confusing signals and have no more real sense of what price increases are coming than anyone here.

It is entirely expected for enterrpsies of all sizes to try to anticipate and get ahead of expected own costs - inputs they buy, expected salary demands from staff, etc.

Because if you wait, and get surprised, you rapidly get into a cash flow crisis and Hello Bankruptcy.

Label this as "greed" is ideological cant.

Of course after two decades of flat pricing people will also push. This is why inflationary spikes are virtually universally hated, by operators, by salaried workers, by labour, etc.

People hate uncertainty and surprises.

To summarize:

- Leftys are bad.

- We should all expect companies to raise prices as much as possible.

- Therefore, we should not call it greed because we should expect it.

- Leftys are bad!

Well, part 3 makes no sense at all, but i undertand that parts 1 and 4 are the

central point while 2 and 3 are filler.

How many businesses operate that close to insolvency? Cash reserves were increasing leading up to the pandemic, then spiked upward. Seems many businesses were well-positioned to ride out increased costs due to supply disruptions for quite some time before having to raise prices.

You do know that real Brits don't really talk like Mary Poppins Dick Van Dyke, right?

Pretty sure no Potato chip Cos we’re gonna go belly up. Funny that this is where I noticed inflation at work. Used to pick up cheap chips for my co workers when I got lunch. One day I was like “are you kidding me?” So I lost the chips. Generally I do t eat them so I did not really care.

IOW, the narrative matters a lot.

And it does boil down to "greedflation", even if the term itself is ideologically tainted to some.

Kevin: focus on business to business sales more. It’s what you are missing, even though it is most of the cost of most things we buy as consumers.

Pre-COVID, it was extremely difficult to pass along price increases in a B2B setting. It was “cost down!!” all the time. When the pandemic hit, prices were destabilized and everyone had to accept substantial price increases from suppliers. Once the dam broke it was pretty easy to slip in excessive price increases and boost profits. Fortunately now that things are stabilized, “cost down!!” competition should blunt inflation.

When you were paying $5 for eggs last Christmas, it wasn’t a farmer ripping you off. It was the delivery company, the refrigerator company, the company that sold the pigment in the ink on the carton, etc.

Back in the day, an airline would announce a price increase on some routes that would happen in the future. Then wait. Competitors would follow with announcements of their price increases. Or not, then the original airline would take back their announcement.

Why didn't they raise prices before?

Well, they did, whenever they could craft a narrative. They may have a ton of power but they still require fig leaves.

Then the return to relatively normal times after vaccination was widespread (plus the fact that there were some kernels of truth in there, like supply really was constricted in some cases) provided the perfect cover for widespread price gouging.