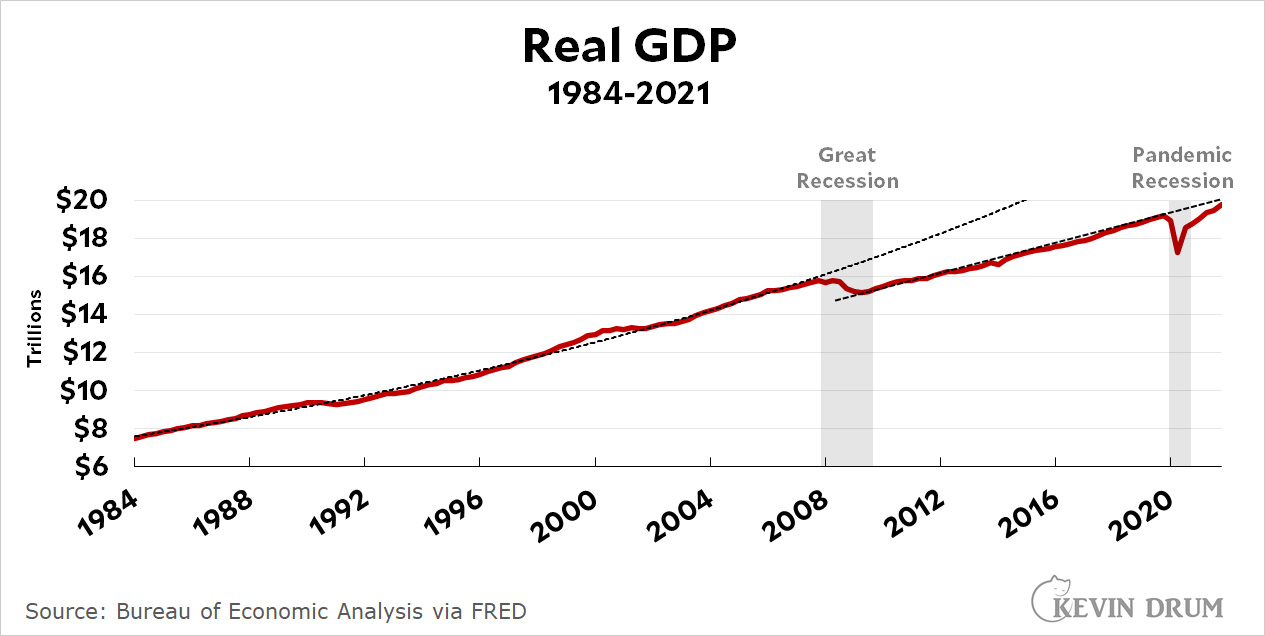

Here's another way of looking at the latest GDP numbers:

After the Great Recession of 2008-09, economic stimulus was weak and we never came close to getting back on our previous growth path.

After the Great Recession of 2008-09, economic stimulus was weak and we never came close to getting back on our previous growth path.

The pandemic recession was just the opposite. We poured stimulus money into the economy and we're now within a hair's breadth of getting back to our previous growth path.

This may end up costing us a year of moderately high inflation. Maybe. But even if it does, surely it was worth it?

I agree but Larry Summers does not.

He is right to that extent. Let's say the 2009 Stimulus was 4 trillion in transfers. About economy size adjustment to gdp at that time to 2020-21 transfers. The recovery would have been faster, but inflation would have soared in 2011. Faster recovery, no change in absolute growth rates and probably a faster business cycle.

The U.S. economy has been slowing since 1974 outside the mid-late capital spending boom of the 90's. Innovation in New modes of technology has slowed. The European, science driven boom is over. Real growth has slowed in response. The prophesy of 19th century socialist are coming true. All you have left is debt ponzi.

Decarbonization can be expected to produce an investment boom of unprecedented magnitude. It's already starting. Battery factories are springing up like weeds; companies like Tesla are growing with fantastic speed; wind farms and solar power projects are drawing more investment every year.

Yeah, no one is investing in AI nor Cloud Computing. And inflation always soars when you spend money while there are huge amounts of idle capacity lying around.

Nonsense, Mr Summer's position as I have read is that there is an overheating effect and inflation needs to be addressed (and that the "progressive Left obsession with yet more stiumlus is wrong). I do not recall reading anything saying he does not think the first round pandemic emergency repsonse was wrong, only that piling on more is incorrect.

Ah, in fact noticed what you speak of in looking back. Comment withdrawn.

Hello, Larry!

The 21st century is a long way from Dick Morris's 3rd way!

Part of what your looking at is GDP from the duel bubbles. While the economy has slowed since 2008, much of it is demographics and contained lending by primary dealers.

What is the choice of weapons like in the bubbles' duel?

If jobs weren't as good but inflation was 0, they would still be screaming.

You can't expect to get back to the path of a previous expansion. CGP typically follows a sawtooth pattern. It expands for a while, then drops off sharply, then starts a new expansion. The long term pattern is in between the expansion and contraction trends.

The overall trend of a saw blade does not follow the ups and downs of the individual teeth.

While you can't get back to the actual path of the previous expansion, you can hope that the new expansion path is at least as steep, that is that it parallels the previous path. This was not the case for the trends that Kevin shows. If you go back before 1984, expansion paths were even steeper.

An expansion should surpass the overall trend eventually - I guess this is what Kevin is saying.

"This may end up costing us a year of moderately high inflation. Maybe. But even if it does, surely it was worth it?"

I am sold. But will you convince the multitudes that will line up to vote against 'the party that brought you inflation' in the midterms?

The problem is the relative number of people affected by inflation versus unemployment. Inflation affects everyone. Unemployment affects primarily the unemployed, a much smaller number. So the number of people that vote because of unemployment is much smaller than the number that vote because of inflation.

We're seeing a pattern somewhat similar to what we saw in the 80s, macro-wise: modest drop in real wages (a combination of pretty strong nominal wage growth + inflation) accompanied by an overall strong jobs picture. Both the 1984 and 1988 elections took place against such a backdrop, per Krugman. The incumbency party did well back then. But in 2022, the media seem determined to tell voters such an economic environment is disastrous for them.

Arguing counterfactuals is hard.

Arguing that we need a small amount of inflation so you have a job will sound like you are holding jobs hostage to inflation.

Long term growth--we need people to replace boomers...

I am of the opinion that it is the failure of the government to do in response to the Great Recession what it did in response to the Covid-19 pandemic is precisely what led to Trump getting elected.

Which was not especially something the R "establishment" - people like Mitch McConnell and Ted Cruz - wanted any more than Democrats wanted it.

I think the inadequate response to the Great Recession without a doubt contributed to the rather bad elections Democrats went through in 2010 and 2014. And yes, this situation likely helped to coursen our politics in the first half of the 2010s.

But the microrecession that plagued the upper Midwest in 2015-2016 wasn't directly related to the aftermath of the Great Recession, but rather to economic problems in China that had spillover effects. The GOP would likely have been favored no matter what in 2016 (parties very rarely win three consecutive presidential elections), but perhaps absent the above-mentioned "coursening," Cruz or Ryan or some other GOP worthy would have been the nominee.

Obviously particularly in taking comparative with economies that did not execute, initial response was quite correct and well merited.

The issue following being now overshoot and potential for getting into the early 1970s policy error of accelerating inflation expectations and overheating.

Inflation expectations aren’t what they used to be. Expectations alone could never cause inflation; the supposed mechanism was a combination of a) making major purchases sooner than later, to avoid further price increases, thus creating excess demand, and b) demanding higher wages/salaries to cover increased cost of living, directly increasing the labor-cost fraction of price. The decline of union membership over the decades has left fewer workers in a position to negotiate pay, and if you can’t expect higher pay, your ability to move large (either cash or credit) purchases forward is limited.

Left assertions as to why This Time It's Different are very nice, but the hand waiving to wish away the reality of excellerating inflation as inconveniently taking away their punch bowl for the party of pandemic-as-omni excuse for pet government spending programmes do not take away the reality of accleration of both observed inflation and expectations.

The mechanical ratchets of the 1970s certainly are no longer there, but such mechanical ratchets are not necessary, only sufficient conditions.

The punch bowl has already been taken away; economic-impact payments are off the table and the child tax credit enhancements and eviction moratoria have expired. And as I have stated multiple times, price rises caused by particular events eventually work their way through the economy, and prices stabilize at a new level. The only situation which calls for a strong response is an inflationary spiral, which happens if and only if there is a positive feedback mechanism. What is that mechanism today?

Yeah, the fact that Oil was a large part of the economy in the '70s and was being actively manipulated to keep prices high had nothing to do with inflation. It was all expectations.

Pathetic straw man drawing on Fallacy of Excluded Middle, although illustrative of why the hard Left should never be let near monetary policy.

As I am sure every reader here knows, exonomic expansion over the long term must be finite.

What few bother to consider is that even modest rates of real growth lead to per capita incomes that make the poorest of us wealthy by current standards (real wealth, not inflationary) in a few generations.

Since around 1970 wages have not kept up with GDP (or productivity) growth. In fact average production worker wages have barely kept up with inflation. In this time the very richest have grown much richer and inequality has increased. This has continued during the pandemic - for example profits have set records.

The price indexes don't necessarily capture improvements in goods, so there has been some improvement in actual living standards. But the growth in GDP has not trickled down for the last 50 years.

It was worth it. But now it’s time to stop buying so much junk and go out for dinner instead. I’m writing this sitting in a restaurant / sports bar with a couple hundred other people at 520 pm on a Thursday. I’m doing my part. Get out of the house and stop buying junk on Amazon!

Oh wait, another email from Macy’s with a sale on stuff. Let me check that out.

https://www.macys.com/shop/product/tools-of-the-trade-stainless-steel-13-pc.-cookware-set-created-for-macys?ID=2912733&CategoryID=26349

It’s on sale like 60% off! Deflation. It’s a buy.

A more plausible explanation is that a lot of the growth prior to the Great Recession was misdirected, due to economically unjustified investments which needed to be liquidated before growth could resume. In contrast, the pandemic was an entirely exogenous event which cause a temporary disruption before the economy returned to its previous point, without needing to reorient priorities or restructure inappropriate investments.

Most likely both stimulus, and the exogenous cause, played a role. There certainly was redirection of investment due to the pandemic - to plexiglas shields, ventilation systems, facilities for outdoor dining, infrastructure for remote work etc., which over the short term diverted investment from growing business to simply maintaining it, or some fraction of it. Some sectors have certainly not returned to pre-pandemic trend; the fact that the aggregate has so nearly done so, is evidence that government spending made up much of the difference.

Spot on. The Great Recession permanently destroyed GDP potential and triggered what I suspect was the true start of the Great Labor Force Exit as you can see here -- https://fred.stlouisfed.org/series/CIVPART -- but was exacerbated by the COVID Pandemic.

On a related subject, financial vulnerability may be rising fast -- https://morningconsult.com/2022/01/27/inflation-and-pay-losses-drive-financial-vulnerability/ -- and I think the culprit is the end of the CTC.

From Morning Consult:

So, that would be ‘since the month after every US adult received $1200 in economic impact payments’, then. Breaking a record that had stood for, um, 20 months.

insufficient savings to cover a month’s worth of basic expenses

Sadly, we run into those non-reality-based situations often in the popular financial media.

Consider, the statement assumes a no-income, no financial relief at all, and therefore disaster.

Well, sure - you could be laid off without notice and without severance pay, and you live in a part of the country where there isn't either public or any private aid, and you and yours neither have any friends or family to lend a hand.

And if you think that is a plausible scenario for 29% of Americans, then we have a lot more to worry about than we think.

Now if you want to talk about the old advice of having 6 months income, in cash, stashed away just in case, that faded away decades ago, for obvious reasons.

Those kinds of studies feel similar to the statements about what a large number of folk have insufficient savings for retirement which carefully avoid mentioning the Social Security income stream. Of course, the real goal is induce fear into people to save more - i.e contribute more to various investment vehicles, which results in higher profits...

Is it any surprise that a period where something close to a guaranteed basic income goes away, that a lot of people are freaked out that they can't cover their monthly expenses? Sure, it would have been a lot higher in 2009-2010, but the point of citing this poll is to highlight how the CTC operated like a GBI.

Agree, but Morning Consult wrote as though economic conditions are particularly bad at present; in fact, the baseline for the poll was uniquely benign, with direct cash payments and eviction moratoriums relieving pressure on family finances.

Even if there's a year of moderately high inflation, it needs to be put in context. The pandemic is drastically shifting around the way the economy works. The bottlenecks are in unusual places. In a "normal" recession, stimulating the economy wouldn't necessarily produce the same amount of inflation. The trick, of course, is to stimulate the economy by investing to remove the bottlenecks.