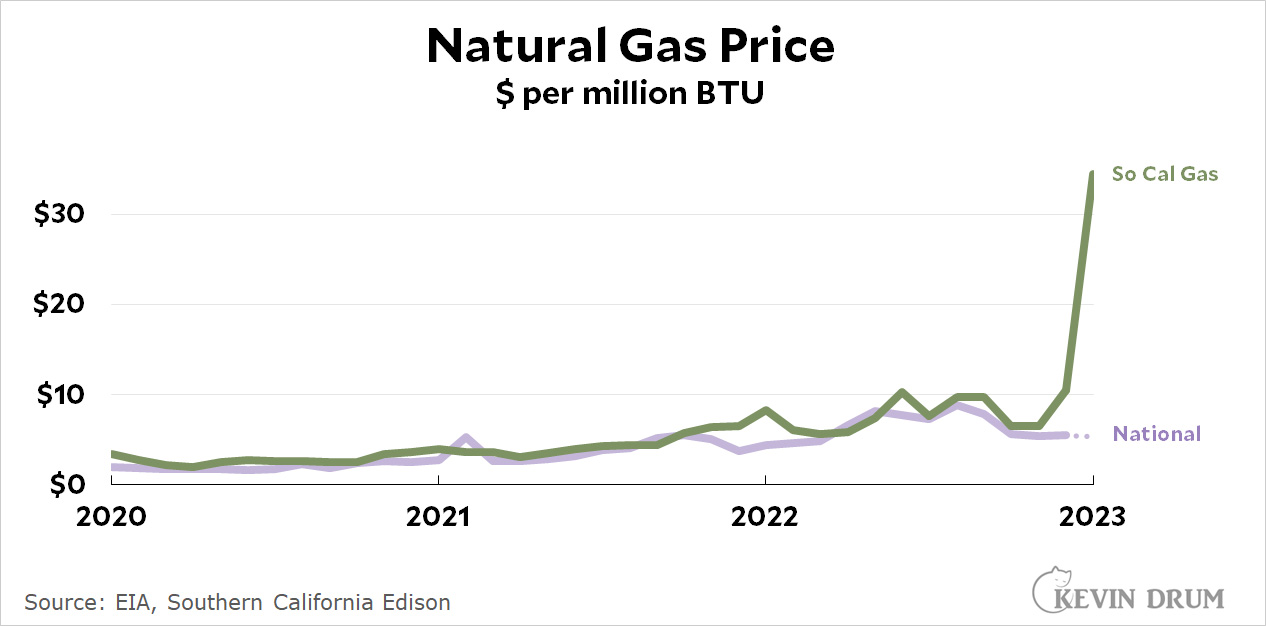

Two people in two days have told me that NextDoor is aflame with outrage about the price of natural gas. And that's hardly surprising: here in California gas bills for December ranged from double to triple the normal rate. People who normally have gas bills of $100 or so are reporting bills of $200-$500 depending on how much they use. Here's the chart I put up a few weeks ago:

This is an astonishing spike, and I spent some time today trying to figure out what caused it. The basic answer turns out to be simple: gas companies were predicting a warm, dry winter and instead got just the opposite. This has been one of our coldest winters of the past decade, and that drives up consumption and therefore prices.

This is an astonishing spike, and I spent some time today trying to figure out what caused it. The basic answer turns out to be simple: gas companies were predicting a warm, dry winter and instead got just the opposite. This has been one of our coldest winters of the past decade, and that drives up consumption and therefore prices.

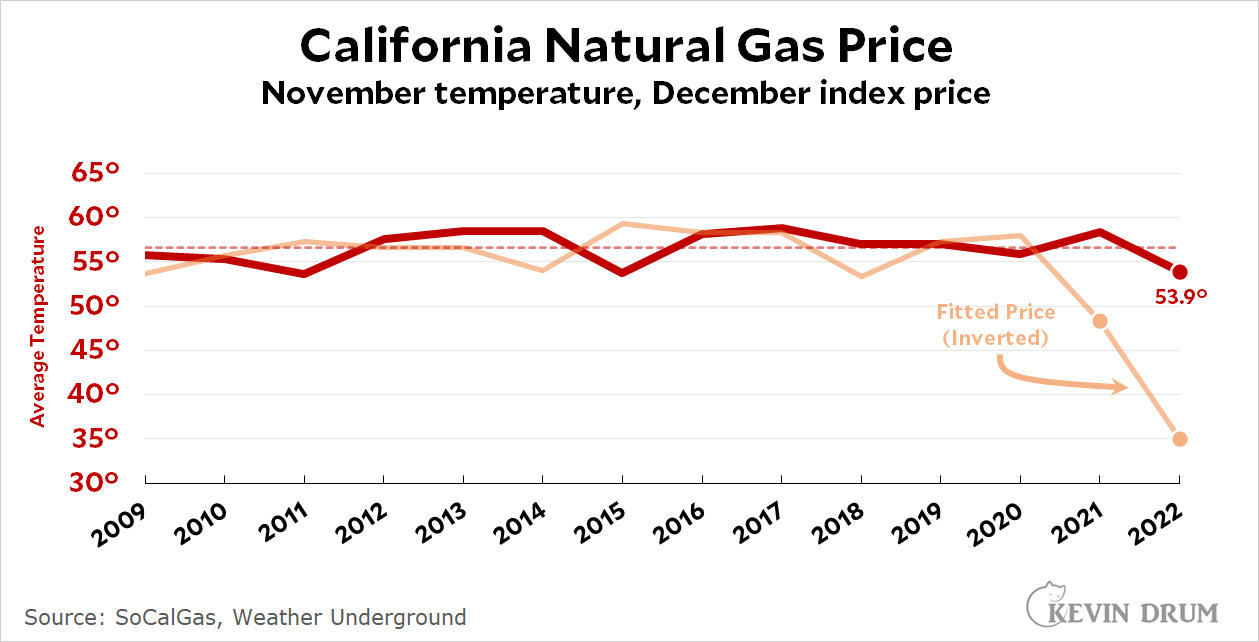

But that's not all. Here's a chart comparing temperature to gas prices in California:

The red line is the November temperature from 2009-22 (I used an average of Los Angeles and Sacramento). Lower temperatures mean higher prices, so I inverted the cost of gas and then scaled it to fit on the same chart. As you can see, price roughly follows temperature until 2021, when it suddenly diverged. Then in 2022 it diverged even more. What's going on?

The red line is the November temperature from 2009-22 (I used an average of Los Angeles and Sacramento). Lower temperatures mean higher prices, so I inverted the cost of gas and then scaled it to fit on the same chart. As you can see, price roughly follows temperature until 2021, when it suddenly diverged. Then in 2022 it diverged even more. What's going on?

Here's the way things work. Local utilities pay what's called an "index price for natural gas supplies:

There are dozens of liquidly traded, regional index points which represent the cost of gas delivered into different market areas....Weather conditions and available pipeline capacity often determine the volatility of an Index point. The monthly Index price is published the second business day of the month, after the decision of how much gas to flow has been determined.

Based on November temperatures, the index price for California started to soar. It was up 60% in December and then tripled in January. [But see the update at the bottom of the post.]

But why? We've had cold winters before, and the price of gas has increased only modestly. The answer is related to a seeming mystery: December prices were also well above average in 2021 even though winter was fairly warm that year. That doesn't make sense.

The problem was a pipeline from Texas that exploded in Coolidge, Arizona, earlier in the year and killed a person. The pipeline is operated by Kinder Morgan, and another one of their pipelines had exploded in Tucson in 2003. For this reason, the town of Coolidge was none too eager for the pipeline to reopen, and the NTSB was cautious too because they couldn't figure out what caused the explosion. This cut off one of California's sources of natural gas, which made it difficult to get enough supply during winter months.

In 2021 this caused a smallish upward blip in the index price. But in 2022, the pipeline outage combined with a cold winter to send prices skyrocketing. Kinder Morgan just recently applied for permission to reopen the pipeline, but the Pipeline and Hazardous Materials Safety Administration hasn't yet signed off on it. If all goes well, the pipeline will be back in service within a few months and this year's price spike won't happen again.

We hope.

POSTSCRIPT: But wait. Isn't it also true that we're exporting a lot of our natural gas to Europe this year? Isn't that contributing to lower supplies and higher prices here in the US?

Nope. Outside of the Pacific Coast natural gas prices are completely normal. In fact, an explosion at an LNG terminal in Quintana, Texas, cut off shipments of natural gas from Freeport and produced an enormous glut of natural gas. The glut is so big that prices of natural gas are negative down there: suppliers are willing to pay people to take gas off their hands because they don't have any place to store it anymore.

So we have a glut in Texas producing super low prices there, but no way to get that excess supply to California, where we need it. Welcome to modern life.

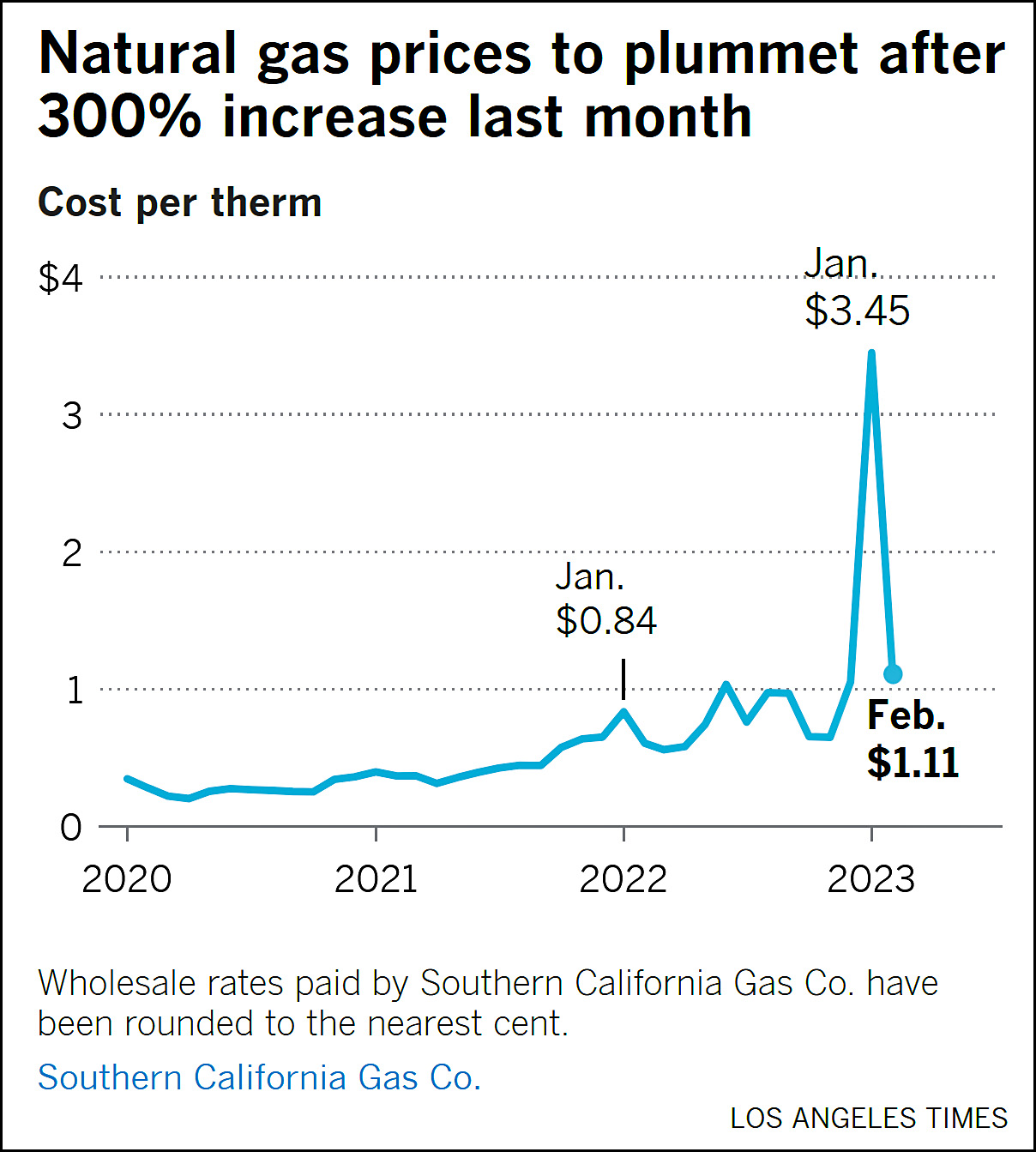

UPDATE: Good news! The LA Times reports that the index price for February has been published and the crisis is over:

That's still higher than normal, but it's not 3x higher than normal.

That's still higher than normal, but it's not 3x higher than normal.

Shirley California has local sources? https://www.eia.gov/dnav/ng/hist/na1160_sca_2a.htm California natural gas production going back to 1985. Part of why we depend on out of state sources.

Start making more money weekly. This is valuable part time work for everyone. The best part ,work from the comfort of your house and get paid from $10k-$20k each week . Start today and have your first cash at the end of this week. Visit this article

for more details.. https://createmaxwealth.blogspot.com

All according to plan...

not only on the Pacific coast. Natural gas prices in Colorado went from $3 per therm to $8, my monthly bill went from about $170 to well over $300. I wonder if we're also on that Coolidge pipeline ?

Kevin, please tell your friend Bob Somerby that someone is spamming his blog comments with fake quotes attributed to Digby, and simply the word Digby repeated over and over. It makes his comments unreadable. Since he lists no way to contact him and he purports to never read his comments, I do not know how to reach him to ask him to delete this annoying spam. Thanks for your help.

"Outside of the Pacific Coast natural gas prices are completely normal."

I dunno, Henry Hub prices still look higher than pretty much any point in the past 10 years.

https://www.eia.gov/dnav/ng/hist/rngwhhdm.htm

It's true that the U.S. market is _generally_ not that exposed to global gas prices, but that is less and less the case, and demand is short-term inelastic, so shortages bumping up against increases in demand deliver really high cost spikes. Yet another reason to electrify our infrastructure.

Looks like it is right in the trend line now.

Also, 300% is 4X

3x is 200%

Good call. One of my pet peeves when it comes to the abuse of words and numbers.

But wasn't Enron a reason to avoid reliance on electric? There are some things that will operate to cause price spikes in any market, such as deliberate shortages and gouging, and just-in-time allocation of resources (inadequate storage or inventory).

"But wasn't Enron a reason to avoid reliance on electric?"

Enron was a reason to avoid reliance on a poorly-deregulated electricity market (and you can get the same problems with a gas company having too much market share and ability to manipulate demand pricing). Fundamentally, the electric grid is far more robust and served by a greater variety of inputs than the gas pipeline network is. Especially for a mildly-temperatured state like California, electrifying everything is an aggregate cheaper and more effective solution.

1) It sounds like the utilities buy 100% of their supply on very short-term (monthly) contracts. Is this really the case? Are there really no suppliers willing to offer longer-term contracts at lower, more stable prices?

2) Great improvements in safety of the air transport system have been made over the decades. I have long thought that one important factor is that two independent agencies are involved: the NTSB investigates accidents and makes recommendations, the FAA regulates. It is a more transparent process: NTSB reports are public, facilitating better public input to rulemaking. I believe this is the model that should be followed for pipelines, chemical industries, refineries, etc.

"It sounds like the utilities buy 100% of their supply on very short-term (monthly) contracts. Is this really the case? Are there really no suppliers willing to offer longer-term contracts at lower, more stable prices?"

You can't store gas (at least, not in ways that aren't enormously expensive) and there are only so many pipelines, so it's very difficult to develop markets for long-term prices.

Electricity is even more difficult to store, but electric utilities manage to live with rates that regulators set, and leave in force for many months.

Electricity is difficult to store, but we don't have wellheads that produce electricity. We have power plants that produce electricity, and they can be turned on or off in response to demand, and their "fuel" (be that uranium, water behind a dam, or--ick--coal) can be stockpiled to varying degrees; sources like wind and solar are generally coincident with peak demand.

More importantly, the cost of electricity is not just the cost of fuel--much of that cost is things like the grid, the physical generating stations, the employees, etc. A far greater share of the price of gas is just the gas. This makes gas prices more prone to volatility than electricity prices.

"We have a glut in Texas producing super low prices there." Do we though? I live in the Texas panhandle and my NextDoor is also abuzz with anecdotes of gas bills suddenly tripling or quadrupling. My gas furnace was out of commission for about two weeks so I only saw about a 25 percent increase in my bill but that's still kind of impressive given that I barely used any gas that month. Electric bills are also reportedly tripling and quadrupling.

Ah, the gas in the PNW about doubled last bill. Almost blew my socks off as I really conserve. Can't win when they push up the price.

I'm in Virginia and Nextdoor here is buzzing about a spike in Natural Gas with the usual nutters blaming Joe Biden. My gas bill was $60 higher than last January but nearly same amount of therms used. So the gas spike wasn't just on the west coast.

It's everywhere. The past ten years of low gas prices were probably a historical aberation. Moreover, given that Germany&Co have (wisely! if finally) decided to wean themselves off of relying on a beligerant gangster-state as their prime source of gas, the US is increasing the amount of gas that we sell as LNG to Europe. This increasingly exposes the domestic US market to the far higher international prices for gas.

Which is ultimately a good thing, I suppose--low gas prices keep us hooked on using a fossil fuel that we absolutely must stop using as soon as possible.

Is there a time when NextDoor isn't aflame? It's Facebook for busybodies.

Do you have data for PG&E? I'm not finding a 3x price increase for natural gas from PG&E in my google search.