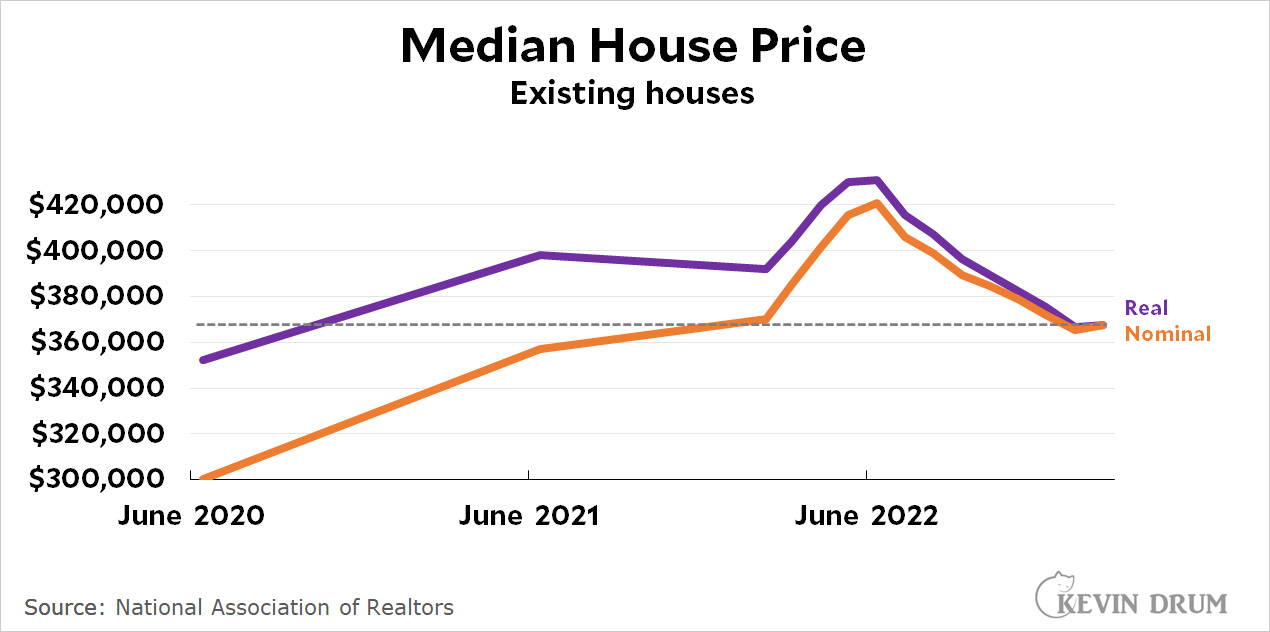

The Wall Street Journal says that in February home prices fell for the first time in 11 years. That's sort of true, but not really:

February was the first time in 11 years that home prices fell if you look at year-over-year figures and don't adjust for inflation. But if you just chart real home prices, they've been declining since last June. They're now down to the level of two years ago.

February was the first time in 11 years that home prices fell if you look at year-over-year figures and don't adjust for inflation. But if you just chart real home prices, they've been declining since last June. They're now down to the level of two years ago.

The really meaningful measure of any individual price is its relation to income, not to average prices. If the price of food, clothing, etc. goes up, raising the CPI, this doesn't make it any easier for individuals to buy a house. And wages have not been going up as much as prices.

This too, in addition to the comment below.

We also need to divorce the discussion of inflation from wages - I've noticed this a lot in posts here, but just because there is a measure of inflation it doesn't mean that wages have also gone up. Wages are only a (small, indirect) part of the measure. People seem to think of inflation in terms where a 2022 dollar buys exactly x% of what a 1982 dollar could buy, but that's not really how it works. Because workers don't less bargaining power, wages are constantly eroded by inflation and will never catch up. Only a portion of workers actually have the leverage to demand wages that keep up with inflation.

DO NOT adjust them for inflation.

They ARE inflation.

Housing prices have been declining since June.

But you need to look at them in nominal terms.

THIS THIS THIS.

It makes sense over the very long haul to adjust housing prices for inflation, in SOME circumstances. It would be silly to talk about 1960s or 1980s home prices, whereas it does make sense to talk about 1960s or 1980s real home prices because over that long of a timeframe, other trends are baked into the inflation measurement.

In the short term (say 10 to 15 years), housing cost inflation is the biggest single primary driver of inflation, so adjusting for inflation is just going to give you two lines that look like each other. And it's then stupid to try and use that to justify any point.

But have housing prices really dropped? What's the monthly mortgage for the next 30 years? Does that make up for the drop in the downpayment and taxes?