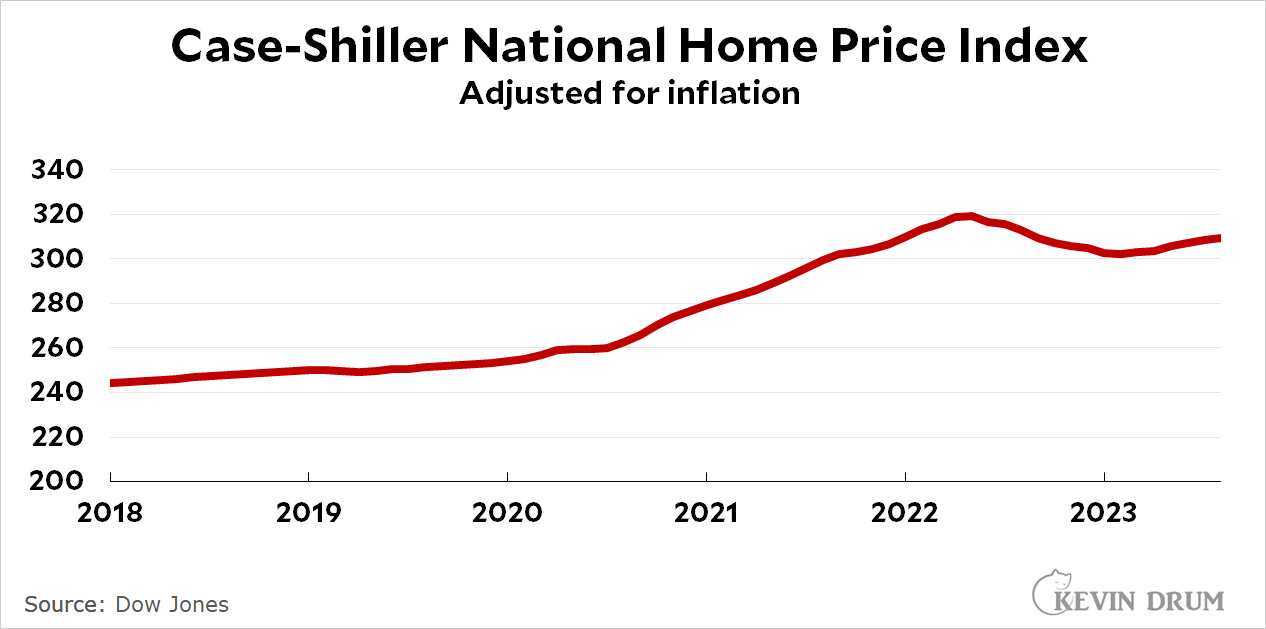

Home prices are high but they keep on rising anyway. In August they increased at an annualized rate of 3.3%:

We're still not quite back up to the 2022 peak, but we're getting there. Here's a longer term look:

We're still not quite back up to the 2022 peak, but we're getting there. Here's a longer term look:

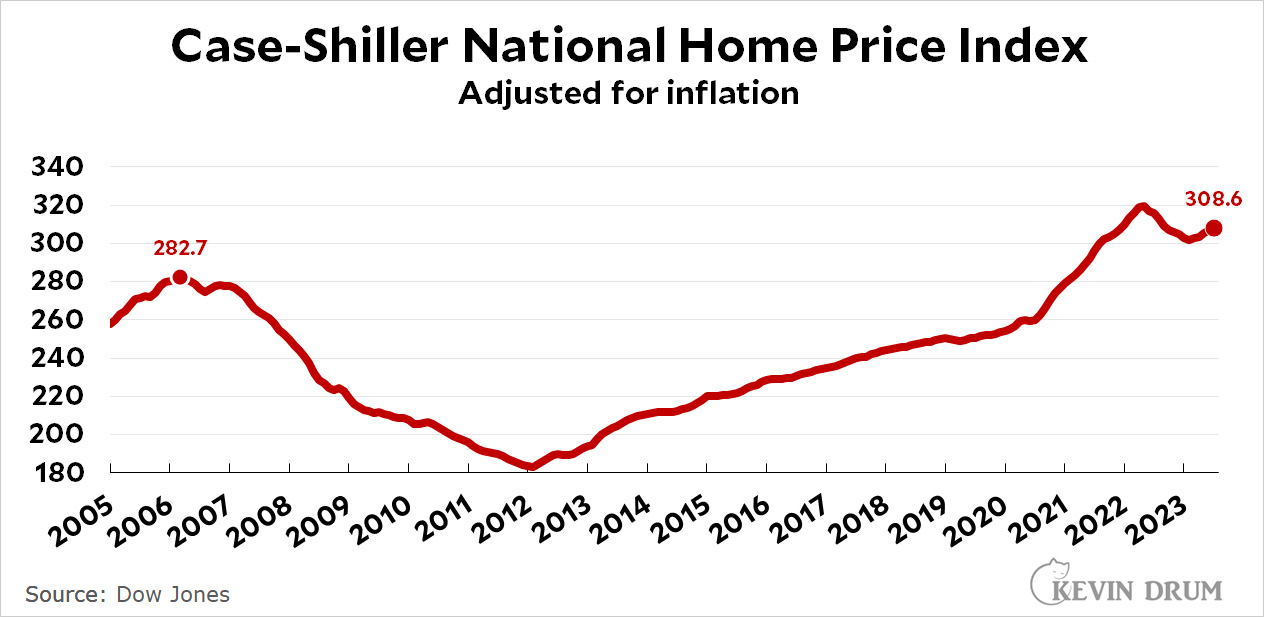

Prices have been above the peak of the early aughts housing boom for the past three years. They are now nearly 10% higher.

Prices have been above the peak of the early aughts housing boom for the past three years. They are now nearly 10% higher.

I don't believe this has really been covered anywhere, and I'm surprised the Biden campaign isn't making a bigger deal of it, but the administration has actually rolled out a fairly extensive list of policy actions to address the home shortage across the country. Were I advising the Biden campaign, I would tell them to start touting this regularly on the stump -- people need to know that he addressing this and contrast it with the Republican plan which is 1. nothing, as far as I can tell or 2. some ungoldy combination of using forced child labor, gutting the EPA and OSHA, or deregulating the mortgage market to allow churches to underwrite homeloans using a commitment to Jesus as down payment, and sell CDSs off them.

https://www.whitehouse.gov/briefing-room/statements-releases/2022/05/16/president-biden-announces-new-actions-to-ease-the-burden-of-housing-costs/

Yes, but volumes are very different. A more detailed analysis would be needed to see if this is because prices have stabilized or because the market mix is different.

I've posted this before, but I do strongly believe that corporate entities buying houses are distorting the market. Kevin and others say it is only a small percent, but that is enough to change what people ask for and what someone buying a house thinks they have to pay to get any house. I'd be happy to be proven wrong, but if a small number of the better homes in a neighborhood are bought at a high price, that would change the price all the houses in the neighborhood are sold at. Not sure how to prove or disprove that.

If corporate entities were buying increasing numbers of homes, then there would be a mismatch between the graphs for mortgage application rates and home purchase rates, as the distortion that is hypothesized by other folks is at the hands of large cash buyers.

To the extent that there is any effect from this, I haven't seen any evidence that it's a general trend in the market. I have seen some numbers in a local context for 2-3 places (PNW, NYC, and Florida), but there wasn't conclusive evidence that it was distorting the market in any material way.

And this is coming from someone who is pessimistic about contemporary homebuying prospects for the median household and adversarial to the housing-as-everyone's-nest-egg economy that we've had for the last 60 years (but which high finance has only been successfully parasitizing for the last couple of decades).

Of greater concern is the overall housing supply and collusion on rent pricing. Oh, and the Fed's insanity over raising rates too high.

I'm not sure I followed you. Kevin has posted how applications are way down and how new home sales are good. In any case, most homes are not bought by corporate entities. All they need to do to distort the market is pick the homes they want and pay top dollar for them. All the sellers see homes going for a lot. All the buyers see the best homes going quickly and for top dollar. So a small percentage of homes bought by groups that use a different revenue stream and have different motivations make prices rise even with high interest rates.

Like I say, I don't mind being proven wrong, but it still looks like a promising theory to me.

Applications are down because of other structural factors, mostly tied to the interest rate changes.

Firstly, when interest rates haven't changed a whole lot for a while, there will be a steady rate of people refinancing. When rates increase, and by a lot, nobody who has a lower rate mortgage (e.g., my ex with the 2021-era 2.75% severance package she bought me out of) wants to refinance to a higher rate (current rates are upper-7% or touching 8%). Basically no regular reason can financially justify making that change.

Second, people with lower mortgage rates do not want to buy a different home at a much higher mortgage rate, so there are fewer existing home sales. Fewer sales, fewer mortgage applications. That's also why home prices can still be going up: there's less velocity in the market, and sales are skewed more towards newer homes, which are more expensive for a number of reasons.

Unrelated to mortgage application rate, we underbuilt housing by many millions of homes between 2008 and 2021.

All of that also means that when homes do go up for sale, they still get snatched up and prices continue to increase, although not as quickly as they did when there was even more demand sloshing around in the market.

Shadowy big-capital buyers are not the reason for any of that.

as someone who was actively looking for a house late last year and early this year all I can say is inventory in my area is at an all-time low. Nice houses are being snapped up for cash in days or weeks. Unfortunately that has left folks trying to sell their POS home for more than it's worth keeping prices high. we found a house we really liked but since it was new construction it wouldn't be ready til summer 24. We passed and have now dropped out of looking.

Don't know where you live but in the Northern VA area the market is cooling a tad, a smidge maybe - super low inventory, well it's the time of year that it gets low but the POS homes are sitting unwanted on the market, the luxury homes are taking longer to sell but now a few of the homes that went on market in late September/October had to drop their prices from the initial you gotta be kidding amounts. I guess I'm going to find out the truth of the market as I put my parent's house on the market next month.

It is now clear that the housing boom of the 00's was not a bubble. Incompetent bank lending practices caused a crash, and it took a decade for the market to get back to where it was going before.

And in the meantime, we underbuilt housing by many millions of units and prices are set to skyrocket for years to come. Making lots of rich people even richer, and locking even more people out of the ability to build assets because our entire financial system is set up so that unless a regular person owns their home, they'll never have the modest wealth required to retire.

I know it's Kevin's religion to adjust everything for inflation, but when you're looking at the price of something that's a key component of inflation, it's sort of circular logic. If you adjust for inflation, there's been no inflation for the last 40 years. All you're saying is that housing is a smaller component of inflation than it was last month.

Not to mention that housing is somewhat underemphasized in inflation calculations!