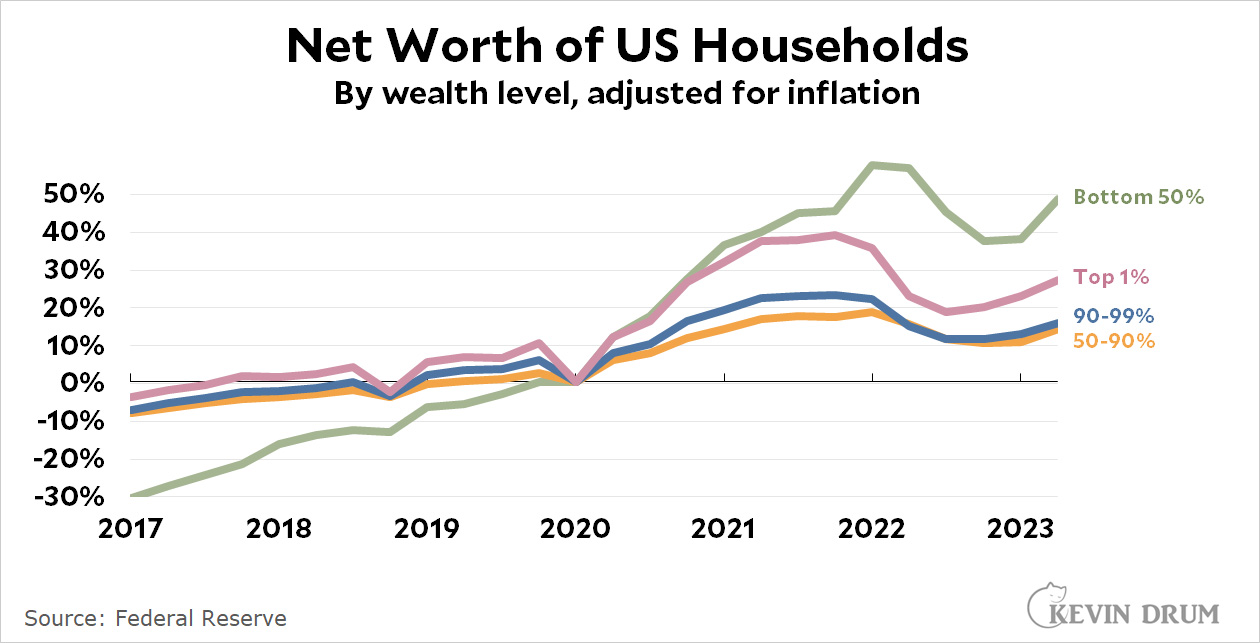

How are people feeling about their personal finances? Income is one way of looking at this, but balance sheets are another. That is, how much wealth do households have? Are their savings accounts flush? Are they relatively free of debt? Net worth is the simplest way of looking at this:

Since the start of the pandemic in 2020, net worth has increased at all economic levels. First, there was a big increase in 2020-21 thanks to pandemic benefits, which had a bigger impact on the poor than the rich. Then, starting in 2022, net worth fell. But in 2023 it started rising again.

Since the start of the pandemic in 2020, net worth has increased at all economic levels. First, there was a big increase in 2020-21 thanks to pandemic benefits, which had a bigger impact on the poor than the rich. Then, starting in 2022, net worth fell. But in 2023 it started rising again.

In other words, you can tell almost story you want here. The good news is that net worth is up since 2020. The bad news is that everyone started spending down their savings throughout 2022. But then there's more good news: that turned around and net worth rose in 2023 even though there were no new benefits and home prices were dropping.

Overall, should this make people happy or sour? I'd say happy, but it's sort of a toss-up. At the very least, though, you can say that household balance sheets are basically in good shape at all income levels and getting better. This shouldn't be causing a lot of angst about the economy.

That the bottom 50% are doing exceptionally well is certainly causing a lot of angst amongst the the people who play a big role in scripting the national narrative.

The same group who insists we need higher unemployment to benefit the lower class or lower taxes on hedge fund managers to incentivize the middle class or competion between workers in the US and devoloping world paired with protections for ownership and IP has been in a panic about the recent improving balance sheets and income of the middle and lower classes.

Having $1.50 instead of $1.00 is not really "doing pretty well." (I know the bottom 50% have more net worth than a dollar but I'm being extreme to illustrate the point.)

I don't disagree with you (more so with Kevin's title), it's more of a "things got better for them but still need to be even more better" situation.

Although I do think that the people who play a big role in scripting the national narrative frankly don't give a shit about whether the bottom 50% or doing well or not. It's about how they and their affluent friends are doing. Which is, of course, also pretty well - but it's never enough for those kinds of people.

I think the moral panic/hysteria they're having with regard to the working classes is more related to labor relations and power rather than with money itself. How dare people get uppity about having the right to live without financial duress??? Don't they know they should be grateful they even have a job at all?!

Things aren't so great for the 50th-90th percentiles, and those are the people who make up the bulk of voters and online commenters on political blogs.

With the stock market rebounding, that could change quite a bit. If the 401ks are up, people may feel richer, even without a ton of home equity growth.

Agree. Market up, interest rates coming down, and gas down should all slowly work into the opinions. Will have to fight the "everything is terrible" narrative, though.

Isn’t the base for the lowest 50% so small that doubling of their savings means they can last 2 nanoseconds without a paycheck instead of 1 nanosecond?

It's actually not as bad as I thought, but yes the principle is one I agree with and was initially going to respond about as well.

https://financebuzz.com/us-net-worth-statistics

Median net worth at the time of that report was $121,700 - so that's the dividing line. But if you go down to the 25th percentile, it's all the way down at $12,400. This makes sense, as well more than half of households (64%) own a home, so by definition the median is going to include people with at least one asset that's exploded in value in the last 5 years.

It would be better if we saw the net worth change for the bottom 40%, and preferably for the bottom 2 quintiles (0-20, 21-40). I'd put a healthy wager on the situation for the bottom 20% not improving all that much in actual dollar amounts. If you go from $2000 net worth to $3000 net worth, that's not all that helpful - maybe you can miss 1.5 paychecks instead of 1 paycheck before you're destitute, but you're still fucked.

Yeesh, how patronizing.

Maybe its too small for you to care about, but this is a big deal for many, many people.

Since this is more about net worth than income per se I'd have to say we're probably looking at the effect of rising home prices. While most of the bottom 50% are probably renters, a lot still do own modest homes, and particularly in places like CA and FL, those have gotten a lot more valuable over the past couple of years. A modest 3-bdr bungalow in Compton goes for around $600k nowadays.

Ding, ding, ding! The value of home prices in the lower priced tiers has risen much more rapidly than the mid-upper tiers. It's great on paper but doesn't do a whole lot to improve economic conditions in the short-term except in cases where long-term mortgage payments remain steady while wages increase.