What is money? Don't feel bad if you can't answer since no one else can either. Roughly speaking, though, money is an accounting mechanism for keeping track of debt, with its value ultimately backed up by a central government's willingness to accept it for tax payments. Beyond that, there are several attributes that, while not absolutely necessary, are very handy for money to have:

- Hard to counterfeit.

- Stable in value.

- Light and easy to carry around.

- Widely accepted.

- 100% liquid.

There are others, but you get the idea. So is Bitcoin money? Not really. Mining doesn't represent debt of any kind, it's simply a mechanism that doles out coins on a semi-random algorithmic schedule. Nor do any governments accept it for payment of taxes. It's not stable, it's not widely accepted, and it's not especially liquid. On the bright side, it's hard to counterfeit and easy to carry around.

What else shares these attributes? Rare stamps and coins come close, though they're harder to carry around since they're physical objects. But that could be pretty easily solved by creating an index of stamp and coin values that act as the basis for a blockchain.

Alternately, it could be old masters. Or tulips. Or baseball cards.

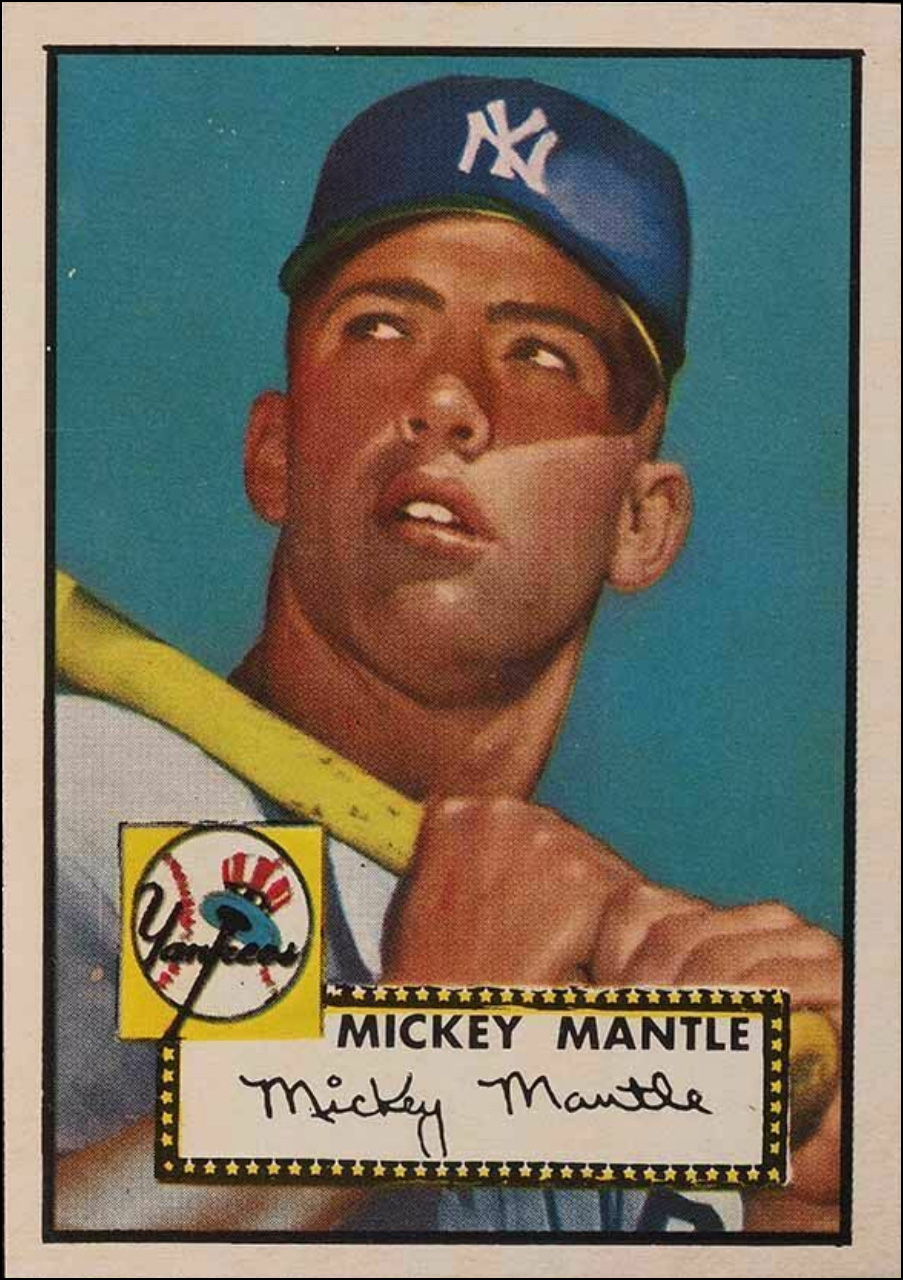

In other words, Bitcoin has few of the attributes of money but all the attributes of a collectible. And because it's the original cryptocurrency it's more sought after than, say, Ethereum, the way a 1952 Mickey Mantle is worth more than a 1951 Willie Mays. And both are more valuable than a Tom Egan rookie card, sort of the Dogecoin of baseball cards.

Bitcoin fans like to insist that it's money, but that's a serious category mistake that does nothing but cause confusion. As money, it has lots of drawbacks and solves very few problems that ordinary money doesn't already solve. Even its strongest selling point, absolute privacy, is mostly a lie, since nearly all Bitcoin is traded through central exchanges that are regulated by national governments. You don't have to use a central exchange if you have the technical chops to trade it yourself, but that's a pain in the ass and makes Bitcoin even less money-like than it already was.

Why am I pointing this out? Because many rational people don't understand Bitcoin. It seems obviously ridiculous. But that's only if you continue to think of it as a new form of money. If, instead, you think of it as a collectible, it suddenly makes a lot more sense. After all, there are lots of rare things that are collectible and lots of rare things that aren't. It's pretty random, and different collectibles go in and out of style. Remember when Beanie Babies were hot? Or Pez dispensers? There's no why about collectibles. They're just reflections of weird human foibles.

Once you make this mental adjustment you will no longer be confused about Bitcoin. It's a collectible that's gotten a lot of hype. Maybe it will stay valuable, the way rare stamps and coins have stayed valuable for a long time, or maybe, like Beanie Babies, it won't. But whichever turns out to be the case, it means nothing profound about the future of money. Bitcoin is just another collectible that will go up and down at the whims of its fans. Capiche?

You’ve essentially described NFTs, which are pretty much cryptocurrency once people stopped pretending it could be a substitute for money. Anyone can make one so it’s not really money, and the value is determined solely by what others are willing to pay for it. Like other collectibles it’s also a great vehicle for money laundering. Who are you to say this digital token of my ass isn’t worth the totally legal $10M some shady international dealer paid me for it?

I was just thinking the same things as jesterb -- the thing that was supposed to be different about bitcoin and other virtual currencies was that they were backed by blockchain signatures that guaranteed their validity -- essentially NFTs attached to pretend money. NPR had a story this morning about how luxury goods manufacturers are toying with the idea of authenticating their products with NFTs. So now you know it's a real Hermes scarf or a real pair of Yeezy sneakers thanks to blockchain. Seems like a more rational use of the technology than pretend currencies, quite frankly.

Kevin left out the most damning bit of all -- that bitcoin/NFTs/etc. are, like gold-based currencies, are inherently deflationary and prone to wide swings in value over time. Relatively small amounts of time at that.

It's actually worse than that ScentofViolets - if you've ever watched vintage episodes of Antique Roadshow you see episodes from 10-20 year ago and see what a credentialed expert valued some collectable at that time. The vintage episodes overlay graphics that show you what the present day value of the item is estimated to be.

So you see fine china was highly valued 20 years ago but nowadays folks can't give it away. OTOH Chinese antiques have skyrocketed in value as wealthy Chinese want to bring them back home to China. Louis Comfort Tiffany lamps used to fetch sky high prices 20 years ago but these days the prices have come back down to earth as they don't go with popular decorating trends for 2021.

So it's not even inflation, it's also the whims of the people who would purchase them!

The fern bar is coming back...drag those lamps out of your garage.

But Bennigan's won't be coming back...

Oh wait it is back. Maybe Mitchell is on to something?

Plus Stake and Ale! If you have your grandparent's fake suit of armor stored somewhere, or maybe those 3 crossed sword thingees they used to hang on walls in the 1960s...find those too!

KDrum did say "stable in value" as a attribute of money.

Bitcoin = virtual gold.

Seriously, best post on what money is. The stuff we call money is how we keep track of widely trusted debt, most relevantly of governments or banks. We use pieces of paper engraved in certain ways, and little pieces of gold or other metal stamped in certain ways. Today of course we mostly use computers to keep track of debt: most money now is electronic.

Perhaps this is a stretch, but your baseball card analogy could apply to stocks as well for the active traders who don't stick around for dividends. Once a corporation has received the cash from the public offering then they are out of the loop and the stock becomes a collectable. If I buy Ford stock from you then Ford makes nothing off the deal. Stock trading is simple speculation for the most part, just like you get with Bitcoin, Faberge eggs and baseball cards.

The one thing you can say about stock trading is that the Federal government will pour cash into the market (by giving corporations a buncha money for stock buybacks) to prop up the value, and they don't do that for Bitcoin or baseball cards.

This is one of the better analyses of Bitcoin that I have read.

This was meant for Kevin, not for gs. (Sorry, gs.)

I will go ahead and accept the compliment anyway.

My wife was asking me about Bitcoin last night and I struggled to explain it. I just gave her Kevin’s post and she now has a much better idea. So thanks Kevin!

I don't agree with this. People may treat stocks this way but the only reason a stock has a value is because it entitles the owner to a share of dividends. Most investors seem to forget this fact because so many of the most valuable companies out there don't pay dividends. But they should.

If people start thinking of equity stocks as like baseball cards our economy is in for a world of hurt.

My position is that equity stocks are not the economy, but people act as if they are synonymous. This is why the market's been repeated bailed out.

I wish I could say otherwise, but I'm afraid that's how the majority of people really do think of stock. They don't own much, but what they do own is aspirational at least as much as an investment. Hey, other people got rich on Google, why shouldn't I?

Only those who have made a serious time investment in understanding stocks and stock trading actually think of stocks the way you think they should.

I agree that people have been conditioned to believe (mistakenly, in my view) that the value of the stock market indices is synonymous with the U.S. economic health. It isn't.

Bitcoins and stock shares have different origins - bitcoin mining vs IPOs. Apart from that, there is little to distinguish them. They aren't money, as Kevin points out, but you can turn them into dollars. They are an intangible asset that people buy in the hopes that the value appreciates and sell when they think the value will drop or they need the cash.

Here is a question for you. Off and on, people say "Hey, we should privatize "social program of choice" by putting all the assets into an index fund." You know who says that? The people who are already invested in the stock market because they know that a flood of new cash increases buying pressure and raises the value of the stocks they already own. Here is my actual question: What if they said "Hey, we should privatize "social program of choice" by putting all the assets into Bitcoin." What's the difference, when it comes right down to it? Buying pressure increases the value of the tradable commodity and if you already own a buncha that commodity then your net worth will go up.

The problem - and it is a big problem - is that Americans have been brainwashed into thinking the U.S. economy is in trouble if the stock market drops, so they don't protest when a bunch of their tax money gets donated to stock buybacks in order to drive the market back up. Would you like to see your tax money used to prop up the value of Bitcoin or Faberge eggs or baseball cards? It's the same thing.

But stocks also represent fractional ownership of a company, of its real net asset value. So owning stock in a tech company that has never paid dividends, in the expectation that the price will increase, is reasonable as long as the company is growing its revenues, market penetration, intellectual property, or any tangible or intangible assets, presumably faster than it grows its debt..

Semantics. What exactly does "fractional ownership" give you if you don't own enough shares to influence a board election?

Of the 2300 companies listed on the NYSW, only 671 pay dividends according to dividendhistory.org.

I am waiting to cash in my Welcome Back Kotter cards.

That being said, the only people I know who are into Bitcoin are those types that always follow some for of get-rich-quick scams. I've got a sister-in-law who let her BF charge $5K on one of her cards to "invest" in Bitcoin. The only party who saw return on that investment was the credit card company...

When did they buy it? $5k a year ago can be sold for $40k right now.

If "there's a sucker born every minute" back in the mid-1800s, when the population of the US was around 31 million, then there must be around 10 born every minute today.

I think 'money as debt' is an entirely false point of view.

I would have said that money is capacity of movement, a capacity socially assigned.

Debt is virtual money in that it represents the obligation of someone to make such an assignment to you in the future.

Cryptocurrency is actually exactly like debt in that it's only valuable in it's expectation of being at some point translated back into a governmental, socially assigned, currency.

It's the currency that should be hard to counterfeit, but it's value is like a charge given to it.

So, money works exactly like a kind of energy.

But, certainly the market for cryptocurrencies is a lot like the collectible market, just more imaginary.

If you consider debt to be potential energy or stored energy (with the amazing feature that it can be drawn down BEFORE it's stored, not just after), then you can make your energy analogy work fairly well.

Debt may represent an obligation, but energy has no obligations, just exists in potential or realized (e.g., kinetic, etc.) forms. Putting obligations in an energy model is just bad modelling. I may have limited knowledge of finance, but my specialty is modelling, so I claim local expertise in that. 🙂

That's why I called it virtual money, and why you can buy someone's debt like it's a commodity, but you can't actually buy someone's money.

I feel that there is another angle to Bitcoin, which is that it is a way to sell a "stick it to The Man" narrative to certain sorts of people. You know, those damn politicians are going to engage in crazy spending that will dilute and demean MY money. I don't want those politicians or bankers to have any say about my money.

So, instead they trust institutions that seem to me to be even shadier, and have no accountability whatsoever. The fantasy being that none is necessary, because Bitcoin is foolproof. I seriously doubt that the entire Bitcoin ecosystem is foolproof, even if the core technology is solid.

Yeah, accept bitcoin is the globalist man. Capitalism is the debt based system. You only own what the government bails out.

Wouldn't it have been easier to simply state that cryptocurrencies are commodities?

Aside from that, NFTs should be of concern, in that they represent a future where *everything* is authenticated and as such, traceable and controllable. If a centralized government requires the use of an official NFT, all will lose anonymity.

Like China's new digital currency

Well, the typical commodity is something like wheat, which has intrinsic value. Collectibles generally might be described as commodities without intrinsic value.

Might be good to mention the other part of "cryptocurrencies", which is the horrendous power cost they are inflicting, just when we were starting to figure out how to get our energy use under control.

(Ian Rennie) tweeted the other day "People used to describe blockchain as a solution looking for a problem. I disagree. It was a very efficient crowdsourced solution to the problem of not burning enough fossil fuels."

" And because it's the original cryptocurrency it's more sought after than, say, Ethereum, the way a 1952 Mickey Mantle is worth more than a 1951 Willie Mays."

Straight up racism.

Part of the confusion is that the term "cryptocurrencies" has been adopted to describe these silly things. They may be crypto but they are not currencies.

Just people trading commodities. Bitcoin is just another form of debt.

Debt means somebody owes something to someone else. If bitcoin is debt, then who, specifically,is the debtor and what, specifically, do they owe?

Hmm, I've always thought of money as an ageed upon way to demarcate value.

I have always been pro bitcoin but I have always thought of it as collectable money. It's an investment. I think Bitcoin is here to stay because it's been around longer than most fads but I don't think it will ever totally collapse in value.

Also I'm gonna buy $5 of Dogecoin for the memes and maybe one day I can unload it for a ton more. Who knows! But I think $5 is acceptable cost to amuse myself.

Why is a 1952 Mickey Mantle card worth more than a 1951 Willie Mays card?

yeah, I thought glided over that one a little too easily. People have been talking about this for a long time, see e.g. https://www.chicagotribune.com/news/ct-xpm-1989-07-02-8902140463-story.html

The issue is not black-and-white, but it is black/white to a large extent. It isn't about rarity.

'Try some Moneyness: http://jpkoning.blogspot.com

This rather misses the point.

I mean, it is a fine way to distinguish Bitcoin (et al) from money, and as others noted, Kevin is actually closer to describing NFTs.

But it entirely misses several important things, including why people do actually use them.

And that is pent up desire for unobserved commerce. Drugs, yes, but more generally, tax avoidance. The original pitch from the Cypherpunks, the community from which Bitcoin emerged, was explicitly an anarcho-capitalist attack on the capability of nation-states to collect tax.

So that's what bitcoin is, at root: an attempt to subvert the modern nation state.

It would work if most goods were purchasable in crypto-currencies. But I can't go into any supermarket around here in WA and buy shit with Bitcoin. My car dealer did not offer a bitcoin option on our last purchase in 2019 either. Despite a breathless and brainless article in the Seattle Times about someone buying a house with Bitcoin - that didn't actually happen - the buyer had to convert the bitcoin to US currency, get that in a bank, and get through a lot of paperwork to prove provenance of the funds before they would be accepted by the mortgage company.

And as a long time SW engineer, anything that uses anonymity AND strict passwords will result in a lot of people losing access to their "funds". As has already happened. And even exchanges who claim good security turn out to be susceptible to cracking and looting.

Problem with anarcho capitalism is it doesn't exist. They are creations of said nation state as is capitalism. When all money and property are worthless, tribal attitudes prevail.

Bitcoin may not be money, but, because it's electronic, people can use it for many of the things they use money for much more easily than they can do so with baseball cards or Ming vases. So, it's a collectible that readily serves as a proxy for money, whether Kevin or anybody else likes it or not.

(I'm vaguely fearful of Bitcoin myself, and would like to see governments conspire to kill it, but maybe I'm wrong to feel that way, and maybe that's not possible in any event; certainly my impression is that Beijing is a fan of Bitcoin because of the belief it might help undermine the primacy of the dollar).

Bitcoin is like boxes of rare baseball cards that consume gigawatts of electricity to make and store. I wouldn't have a problem with it as a fad if it weren't contributing to to destruction of the planet as we know it for no particularly good reason. (And don't give me the BS about how most bitcoin mining is done in places with hydro or geothermal power.With modern grids that electricity could be sent elsewhere to replace fossil fuel electricity. heck, you could use it to make hydrogen even without a grid)

THAT

Pingback: === popurls.com === popular today

Plus Stake and Ale! If you have your grandparent's fake suit of armor stored somewhere, or maybe those 3 crossed sword thingees they used to hang on walls in the 1960s...find those too!

And both of them produce more global warming than is prevented by all the solar panels in the world, combined.

No wait- that's just Bitcoin.

Bitcoin is literally a small number of greedheads converting our livable climate into cash for themselves.

Henry Plainview likes the taste of this milkshake.

Pingback: Weekend link dump for April 25 – Off the Kuff

Pingback: Column: Coinbase introduced bitcoin to Wall Road. That doesn’t make crypto legit - OrbMena News

Pingback: Hiltzik: Bitcoin is no good as a currency - Daily Business News

Pingback: Hiltzik: Bitcoin is no good as a currency - KANE NEWS NETWORK

Pingback: Hiltzik: Bitcoin is no great as a currency - Costaalegreresto

Pingback: Hiltzik: Bitcoin isn't any good as a currency | Crypto Market Watch

Pingback: Hiltzik: Bitcoin is no good as a currency - Cryptocoinsider